ArcelorMittal reports another huge loss (JSE: ACL)

It’s better than the prior year, but that’s not saying much

ArcelorMittal’s share price is R1.35. For the year ended December 2025, the company has flagged a headline loss per share of between R2.68 and R3.18. Sure, that’s better than the loss of R4.58 in the prior year, but you can see where this is heading.

It’s not often that you’ll see a company trading on a Price/Earnings multiple of worse than -1. Although valuation techniques get very murky in these extreme examples of value destruction (it becomes about liquidation value rather than going concern value), the simplistic view is that this multiple implies that the company would be worthless within the next 12 months if losses continue at the current rate.

Results will come out on 5th February. The company will need to convince the market that it isn’t going to fall right off a cliff in 2026. It’s certainly teetering on the edge.

Gemfields released some key metrics for the year ended December 2025 (JSE: GML)

Avoiding the use of comparative numbers doesn’t mean that people won’t go digging for them

You can learn something from the omissions in a SENS announcement, not just the inclusions. When a company doesn’t disclose comparative numbers, it can be because they don’t have a great story to tell and would prefer mainstream media to gloss right over it.

Gemfields at least gives a link to an Excel doc that has their comparative numbers, but they still aren’t making it easy for casual observers to get a flavour of the performance. I will say this: they are at least consistent in terms of not disclosing any comparative numbers whatsoever, so at least they aren’t just cherry-picking the (few) good ones and ignoring the rest.

Sadly, positive narratives have been hard to come by for the company. Gemfields could only manage auction revenues of $128.5 million for the year to December 2025. A quick dig through the 2024 annual report reveals that revenue was $212.8 million in that year and $262 million in 2023, so the trajectory is very ugly.

The share price has lost over two-thirds of its value in the past three years, so this isn’t a huge shock if you’ve been following the company.

The net debt position as at December 2025 was $39.2 million (before auction receivables of $20.5 million). That’s a lot better than when it was out of control at the end of 2024 ($80.4 million before receivables of $33.9 million). The Gemfields balance sheet had to be bailed out by brave shareholders, as the company’s capex programme proved to be too aggressive and got them into serious trouble.

Is there any other good news? Yes, there are thankfully some highlights.

The second processing plant at Montepuez Ruby Mining is expected to be commissioned “imminently” after being delivered materially on budget. The first rubies from this plant should go on auction this month.

At Kagem, the emeralds business, premium recoveries have met expectations. This is a good time to remind you that precious stones like these come out of the ground in all shapes and sizes, so Gemfields is never quite sure what they will find. When a whopper of a thing is discovered, it gets a name and a story and ideally a premium price when sold!

Through the use of night shifts at Kagem in this period, they made good progress in processing the stockpiles.

Gemfields has been through the most, and so has the balance sheet. I hope 2026 will be a better year for them. It must be tough to see the success in areas like gold and PGMs, while emeralds and rubies are left for dead. On the plus side, at least they aren’t mining diamonds!

Impala Platinum can be grateful for PGM prices (JSE: IMP)

Production has been pretty flat and unit costs increased 11% per ounce

When you see major one-day moves in mining stocks, you have to be careful in how you interpret them. Impala Platinum closed 13.3% lower on the day of release of a production update, but this is correlation rather than causation (despite the production update being less than inspiring).

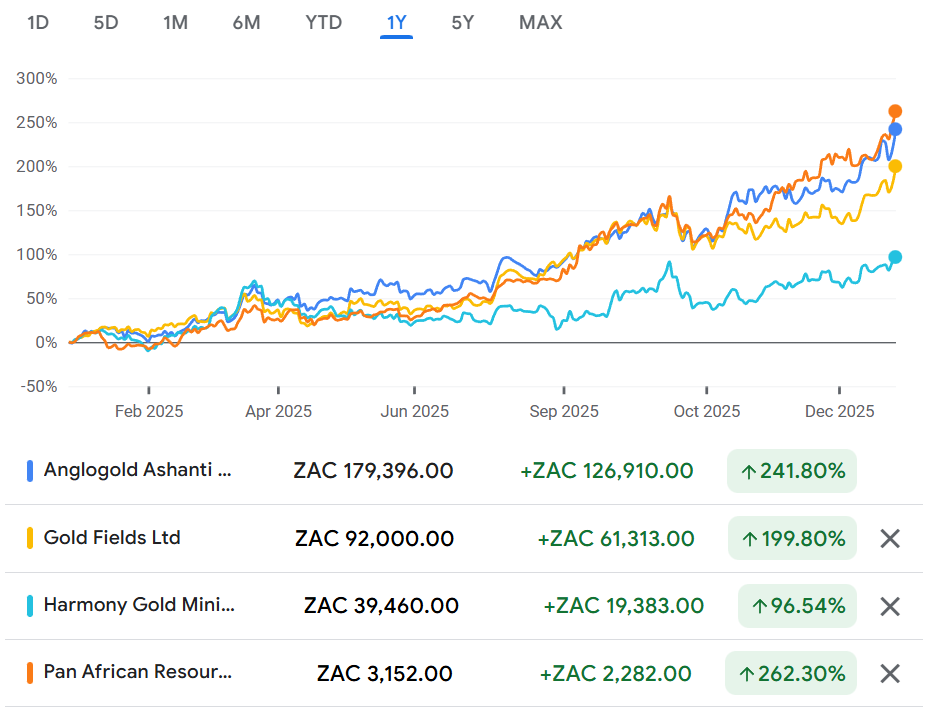

The quickest way to check this is to just look at how the sector peers performed. Sure enough, it was a bloodbath across the gold and PGM names, with the Resource 10 index dropping 10.4% on the day. This is because of movement in the commodity prices, not because of Impala Platinum’s production update. I must remind you that the Resource 10 is up 129% over 12 months and Impala Platinum has tripled over that period (up 208%)!

Moving on to the production update itself, there isn’t much growth here to take advantage of the higher prices. For the six months ended December 2025, they grew group 6E production by just 1%. This is in line with guidance, but is ultimately a flat performance that has relied on the PGM price upswing to deliver earnings growth. An increase of just 0.3% in 6E sales volumes drives this point home.

Sales revenue jumped by 39.5% to R33,250 per 6E ounce sold, while group unit costs per 6E ounce increased by 11% to R23,200. When detailed earnings are released on 5 March, there will be a good story to tell in terms of margins and headline earnings.

In further good news for free cash flow, group capital expenditure came in at R2.9 billion vs. R3.9 billion in the comparable period. This is due to lower capital expenditure at Zimplats as projects neared completion.

It’s just a pity that more PGMs aren’t coming out of the ground at the moment to take advantage of these prices! The great irony is that if production did rapidly increase in response to high prices, then the prices would likely drop anyway due to the supply/demand balance changing in the market. Such is life in PGMs.

Uitkomst remains a problem at MC Mining (JSE: MCZ)

They need to deliver the Makhado Project without any hiccups

MC Mining has released a quarterly report. We may as well deal with Uitkomst Colliery first, as this is the big headache.

Despite a turnaround plan being in place and delivering some cost savings, production has gone the wrong way at Uitkomst. Run-of-mine coal production fell 30% sequentially and 40% year-on-year. Production yields weren’t the problem, so this means that they just weren’t processing enough material.

Sales at Uitkomst were down 34% year-on-year for high-grade coal. There were no sales of lower-grade coal. To make it worse, prices for thermal coal weakened further in the quarter.

Concerningly, cash on the balance sheet was just $2.9 million as at the end of the quarter. That’s a lot less than $13.2 million at the end of the prior quarter!

Luckily, Uitkomst isn’t the exciting asset here. Kinetic Development Group is working towards a controlling stake in the company for one big reason: the Makhado Project. This will be South Africa’s largest hard coking coal producer.

At Makhado, hot commissioning activities for the coal handling and preparation plant are scheduled to begin by March 2026. They are also making a lot of progress on other major workstreams, ranging from steelworks through to overhead power transmission lines. Project expenditure is within the budgeted estimates.

They cannot afford to slip up in the delivery of Makhado, that’s for sure.

Ninety One completes the acquisition of Sanlam Investment Management’s SA business (JSE: N91 | JSE: NY1 | JSE: SLM)

A new era has dawned

Sanlam does many things, but sitting still isn’t one of them. The financial services giant is never far from the action, with interesting transactions concluded on a regular basis. As internal corporate finance teams go, this must be one of the better ones to work for!

You might recall that at the end of 2024 (yes, that long ago), we found out that Ninety One and Sanlam would be putting in place a long-term active asset management relationship. This makes sense for all involved, as it gives further scale to the operations and allows Sanlam to focus elsewhere (including on its excellent passive investment management business, Satrix).

This is a highly regulated space, so transactions take time to be completed. After a long road, the companies have announced that Ninety One has finalised the acquisition of the South African component of the deal. This triggers the 15-year strategic relationship between the groups.

To pay for the acquisition, Ninety One is issuing shares to the various Sanlam entities that held the Sanlam Investment Management business. This means that Sanlam shareholders will retain look-through exposure to the combined business and gain exposure to the broader Ninety One story.

If you feel like you’ve read something similar to this before, it’s because the UK component of the deal was completed in June 2025. The South African component took longer and is now complete.

Orion Minerals is getting closer to finalising the Glencore deal (JSE: ORN | JSE: GLN)

In the meantime, work continues at both major projects

The Orion Minerals share price has done some crazy things. It has literally doubled year-to-date (yes, that means in January alone) and strongly rewarded those who saw the opportunity to add this asset to their portfolio.

2026 is the year that should see Orion transition from an exploration company to a mining company. This is why much of the focus is on finalising the terms of an offtake and financing deal with Glencore to the value of between $200 million and $250 million.

Orion has two base metal production hubs in South Africa: the Prieska Copper Zinc Mine (PCZM) and the Okiep Copper Project (OCP). You’ll notice that the magic word (“copper”) is in both of those project names. Given all the focus on copper among the mining giants, this is a great time to be on the cusp of producing the stuff. It also makes Orion a really interesting acquisition target.

The Glencore funding is earmarked for work at PCZM. If they can get it finalised, then work on the uppers can begin at PCZM. The due diligence has made significant progress and investors will be hoping for a positive outcome that could give even more momentum to the share price.

Although the near-term excitement is around PCZM, they are also working on optimising the OCP project. Moving forward with both projects is important in justifying what is now a R3.4 billion market cap!

To give you an idea of how much value sits in the ground vs. the bank account, the cash on hand at the end of the quarter was A$5.74 million. That’s less than 2% of the market cap.

Nibbles:

- Director dealings:

- A director of Santova (JSE: SNV) exercised share options worth R277k based on the strike price. The value is R644k based on the current share price. The announcement doesn’t note a sale to cover the tax, but such a sale may still come. If it doesn’t, then that would count as a buy in my books.

- Southern Palladium (JSE: SDL) added its quarterly report to the mix. They are still early in their journey, so the quarterly report is shorter than some of the sector peers (and thus sits in the Nibbles). The company raised A$20 million in the quarter from institutional and large investors, giving it all the funding needed to complete the Definitive Feasibility Study workstream at Bengwenyama. This is the key milestone as they work towards receipt of the mining right and a Final Investment Decision (an official term). It doesn’t hurt that PGMs have gone through the roof. Get this: in the past year, the share price is up 678%! Maximum risk means maximum reward.

- With Libstar (JSE: LBR) currently trading under cautionary based on engagements with potential acquirers of all the shares in issue, we’ve seen an interesting shift on the shareholder register. Cearus Holdco has sold a 6.56% stake to Allan Gray, taking the latter’s stake to 14.1865%. I noticed this post by Anthony Clark (@smalltalkdaily) that describes Cearus as “allied” to major shareholder Actis.

- ISA Holdings (JSE: ISA) renewed the cautionary announcement related to the receipt of a non-binding expression of interest related to the acquisition of a controlling stake in ISA. Note the careful use of “controlling” here, rather than “all” the shares. Although this would likely mean a mandatory offer to all shareholders, that’s very different to a scheme of arrangement where it’s an all-or-nothing approach. But here’s the most important thing: there is still no guarantee of this progressing to a firm intention to make an offer. Hence the need for caution!

- AB InBev (JSE: ANH) has completed the previously announced acquisition of the 49.9% minority stake in its US-based metal container plants from various institutional investors. A meaty number changed hands for this: $2.9 billion!

- A rather odd SENS announcement came out on Thursday. I had hoped that further clarity would emerge, but all I’ve really seen is speculation. Nedbank (JSE: NED) announced that Standard Bank (JSE: SBK) now has a 5.57% stake in the green bank. Tempting as it may be to think of a merger, it is extremely unlikely that regulators would allow it. I’ve heard a plausible theory that the stake is held in Liberty’s investment funds, which could then be seen as Standard Bank Group. Time will tell.

- Famous Brands (JSE: FBR) has decided to repurchase up to 5% of the company’s issued share capital. The programme will commence on 1 February 2026 and run until 31 May 2026. With the stock trading on a P/E of just over 10x, the board is sending a message that the shares are undervalued. The market didn’t ignore this, with Famous Brands up 5.5% on the day. The share price is down 6.5% over 12 months, having largely been ignored by the market despite the rally in local stocks.

- Another local stock that is still in the “cheap” bucket is iOCO (JSE: IOC). They’ve already been busy with repurchases for a while, acquiring R9.6 million worth of shares during January at an average price of R4.42 per share. Since August 2026, they’ve repurchased shares worth R26.5 million at an average price of R4.09 per share. The current share price is R4.48.

- Europa Metals (JSE: EUZ) has been trying to get a deal done with Marula Mining. As Europa is currently a cash shell, this would’ve injected much-needed operating assets into the structure. Alas, the deal is not going to proceed, which means that the company has been a cash shell for too long and thus the listing on AIM (the London Stock Exchange’s development market) will be cancelled. The company is confirming what this means for the JSE listing, but we can probably guess the outcome here.

- Zeda (JSE: ZZD) has moved its AGM from 11 February to 27 February based on nominations received from major shareholders for the appointment of directors to the board. An amended notice of the AGM has been published. I don’t usually make reference to AGM notices, but an amended notice like this is worth highlighting.

- Wesizwe Platinum (JSE: WEZ) is suspended from trading. They need to get the financials for the six months to June 2025 published, followed by financials for the year ended December 2025. They expect the interims to be out by 15 March 2026 (on an unreviewed basis) and the full-year results to be released by 30 April 2026.

- African Dawn Capital (JSE: ADW) is suspended from trading. They are trying to finalise the February 2025 financials. They expect to release those annual financial statements by mid-February 2026, with interims for the six months to August 2025 expected to go out by the end of February 2026.

- The timetable for the planned delisting of Sail Mining Group (JSE: SGP) is being revised due to certain regulatory approvals remaining outstanding. It’s not unusual for transaction timetables to be pushed out for this reason.