Emerging market exposure, with managed risk: making Chinese investment and diversification work for investors.

Despite its heft, as the world’s second-largest economy, China (or large parts of it) is still classified as an emerging market (EM). With its patchwork of developed and emerging conditions and stellar tech credentials, China presents a characterisation challenge for investors with a low(er) price tag, and thus a potential value investing and mean reversion opportunity. By balancing risk with risk mitigation tools and capital protection, structured products linked to a broad index like the CSI 300 could offer both a protected pathway into the Chinese opportunity and strategic portfolio diversification.

Highs and lows – and managing them

The overarching story of EMs has long been ‘higher growth potential with higher volatility and risk’. Unlike the established behemoths, EMs tend to be zippier, offering growing (and younger) populations, rapid urbanisation, and infrastructure spending to match. Thriving EMs can also demonstrate an extension of the middle class (with consumption in step) and leapfrogging, especially in technology. On the other hand, EMs are associated with risks, including regulation failures, political instability, and currency volatility.

In sum, there’s amplification of both risk and reward potential. To manage this, investors often look to alternatives like index trackers (with built-in diversification), direct investment into specific outliers, actively managed mutual funds, and structured products.

Custom built

Structured products, as it says ‘on the tin’, are investment products structured (or built) to meet specific purposes, including growth or risk management. They do this by linking a traditional security (the reference asset) with a derivative component. Unlike an ETF, an investor isn’t buying the underlying equity itself but rather access to an outcome (return) that incorporates the performance of the reference assets.

Structured products have become mainstream since their initial introduction. Moreover, when they incorporate capital protection, they provide relative stability in times or markets with heightened volatility and uncertainty. Knowing your principal investment is protected1 at maturity makes this asset class a great way to gain that desired EM exposure in the medium-term, turning the rollercoaster into more of a Sunday drive.

The Chinese opportunity

Investec has recently launched two structured products that offer exposure to China, an EM that could present a compelling opportunity over the next few years. If we round up the ‘usual suspects’ in terms of fundamentals, we find in China: GDP growth at 5.2% for the April-July quarter (Reuters); exports up 5.8% YoY in H125 (CNBC); and a general gross government debt-to-GDP ratio (96.3%) considerably lower than the US’s (122.5%) (IMF). The much-discussed housing downturn continues, but 2025 home prices and sales are falling slower, and rental yields and affordability have improved. Additionally, China leads global manufacturing, accounting for between a fifth and a third of the world’s total (estimates vary) (UN Statistics Division and Centre for Economic Policy Research).

Tech advancement remains strong, particularly in the spheres of artificial intelligence (AI), electric vehicles, robotics, and renewable energy. In fact, China is emerging as a global disruptor. For example, DeepSeek caused major ripples in January when it demonstrated Western-peer-rivalling performance at a Western-peer-demolishing cost of development. It was certainly a dramatic demonstration of Chinese tech’s ability to innovate and leapfrog, establishing China as the definitive second centre of the AI universe. Tech is front and centre for the country’s long-term development strategy, especially as these capabilities feed into its manufacturing aspirations.

So why is China not consistently the belle of the investing ball? The dual blows of Covid-19 lockdowns and property market concerns have certainly contributed, and many analysts are still looking for more stimulus measures from Beijing. Fears of the impact of a trade war with Trump’s US continue to play a role, despite China’s confidence that policy, interest rate cuts, and targeted public investment are sufficient bulwarks against the threat.

Value and diversification

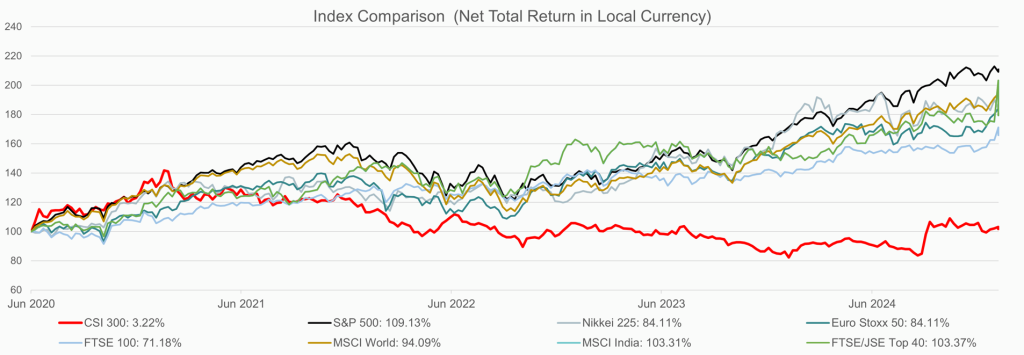

The Shanghai Shenzhen CSI 300 (CSI 300) – which includes the 300 largest and most liquid stocks on the Shanghai and Shenzhen stock exchanges – decreased by 31% since its high on 10 February 2021 to 16 July 2025.

Given the above, the CSI 300 seems to offer a decent entry point compared to global peers. Certain valuation metrics also appear relatively favourable such as a forward price-earnings ratio of 13.8 for the CSI 300 vs. 23.5 for the S&P 500.

Moreover, structured products with CSI 300 as the reference asset may offer a strategy for portfolio diversification. The correlation between major developed market indices tends to be relatively high such as 0.81 for the S&P 500 to the Euro Stoxx 50, and 0.75 for the S&P 500 to the FTSE 100. However, the correlation of the CSI 300 to the above indices is lower at 0.33 (S&P 500), 0.29 (Euro Stoxx 50), and 0.26 (FTSE 100).

About the latest Investec Structured Products:

Investec’s new structured products are linked to the CSI 300 index and have a 3.5-year term to maturity:

- The Investec ZAR CSI 300 Digital Plus provides a return of 30%2 in Rand if the growth of the index at maturity is greater than or equal to 0%, plus any index growth above 30% (uncapped return potential). If the CSI 300 growth is negative at maturity, investors receive 100%1 of their initial investment back.

- The Investec USD CSI 300 Geared Growth offers 190%2 participation in the growth of the CSI 300 index up to a maximum product return of 76% in USD. If the index return is negative at maturity, the product offers 100% capital protection1 in USD provided the index return is not less than -40%.

Learn more here.

Application closing date: 13 August 2025

- Ensure you understand the terms of the product as fully described in the term sheet, including the caveats to principal protection, which include being subject to credit risk. T&Cs apply.

- Indicative, to be determined on trade date.

Disclaimer available here.