Sea Harvest financials for the six months ended June 2025

“Today we earn over half our revenue offshore, and, with all processing done in South Africa, retain a strong pricing influence that underpins our resilience as a Rand-hedge and a local and global player”

Felix Ratheb – Chief Executive Officer

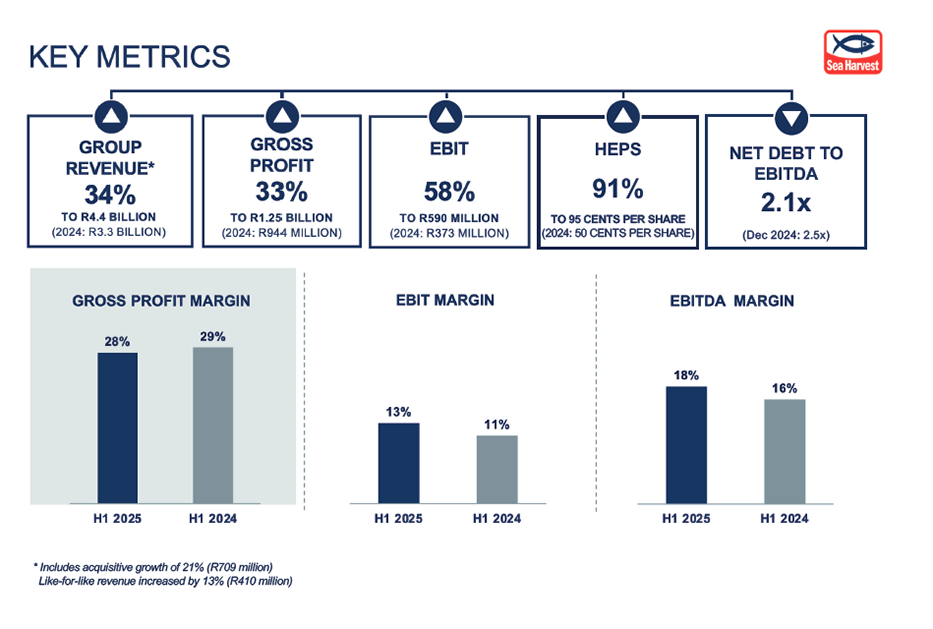

Sea Harvest is geared for success

Sea Harvest Group’s 2025 interim results, which it released on Monday, September 01, 2025, represent a pleasing turnaround in the company’s performance, compared to the same period in 2024. Revenue increased by 34% to R4.4 billion (2024: R3.3 billion) and headline earnings per share (HEPS) increased by 91% to 95 cents (2024: 50 cents). Earnings before income and tax (EBIT) increased by 58% to R590 million (2024: R373 million), at an EBIT margin of 13% (2024: 11%). Although the results are primarily attributable to higher catch rates and significantly improved pricing in its core hake business, it is also due to strategic moves that saw strict cost control across all businesses and volume efficiencies across the Group.

Shredding the Gnar

The results prove once again that Sea Harvest certainly knows how to “shred the gnar” in the boardroom – to use an analogy from surfing, a sport that the Group has supported through its corporate social investment (CSI) since it was officially recognised as a new sporting code for the Olympics ahead of the Tokyo 2020 Games. “Shredding” refers to confident and stylish manoeuvres executed by highly skilled surfers, while “gnar” refers to rough waves that would most likely wipe out less skilled surfers. Sea Harvest entered its 61st year in existence in 2025, not only proving its staying power but growing in this time from a small fishing business on the Cape west coast to a leading, vertically integrated, diversified fishing business that sells to more than 30 countries around the world.

The Group has a workforce of more than 5,000 people with 99% of its employees in South Africa. Its asset base includes a total of 61 factory freezer trawlers, fresh fish and purse sein vessels; eight processing operations; eight aquaculture farms and processing operations; eight factory shops; and engineering capabilities that repair its own- and third-party vessels. The Group’s deep-sea hake, pelagic, prawn, and aquaculture businesses are located, inter alia, in the port towns of Cape Town, Saldanha Bay, St Helena Bay and Mossel Bay, as well as Hermanus, Buffeljags, Kleinzee, and Ladismith in South Africa, and in Shark Bay, Exmouth, Port Samson and Fremantle in Western Australia.

A Strong Investment Case

Since listing on the Johannesburg Stock Exchange in 2017, Sea Harvest’s investment case has held strong allowing it to deliver on its growth and expansion strategy. What sets Sea Harvest apart is that the fishing industry, its key focus, has high barriers to entry with positive dynamics that drive premium pricing. Sea Harvest is the largest hake company globally and is the market and brand leader in volume and value within seafood in South Africa. It has world-class production facilities with an experienced and established management team. Furthermore, the Group has enjoyed long relationships with a diverse international customer base generating hard currency earnings.

Chief Executive Officer (CEO), Felix Ratheb, says, “When we listed, we fixed our sight on being a leading, responsible, global business that remains true to our purpose of creating jobs, improving food security and achieving broader economic impact. Our strategy in pursuit of this vision, which was to secure volumes, enhance margins and grow through acquisitions, has built a substantial, diversified seafood group. Today we earn over half our revenue offshore, and, with all processing done in South Africa, retain a strong pricing influence that underpins our resilience as a Rand-hedge and a local and global player.”

Tightening the Net

According to Ratheb, the Group approached 2025 with a sharpened focus on earnings growth and shareholder returns and kicked off the year by refining its strategy around three priorities. “For the next three years, our goal is to drive efficiency and profitability in our South African fishing business, restructure underperforming segments, and reduce debt,” he says. The subtle reversal manoeuvre delivered efficiency gains in the hake business during the reporting period, which were not only achieved by good cost control but also by the addition of four new trawlers and better vessel utilisation to boost landed volumes by 15%. In the six months to 30 June 2025, the Group’s net debt to EBITDA ratio improved to 2.1 times (30 June 2024: 2.7 times).

A firm hake biomass drove the improved catch rates, while the pricing increases were made possible by robust demand for wild-caught fish across all markets. The inclusion of the pelagic business for the full six-month period, which delivered a solid performance with higher processed volumes and improved fish oil yields, resulted in revenue of R879 million, and EBIT of R144 million at a 16% EBIT margin. Overall, revenue for the fishing segment rose 19% to R2.1 billion, with EBIT nearly doubling to R429 million, and the EBIT margin expanding to 21%. This means that the segment accounts for 64% of total revenue and 90% of EBIT for the reporting period.

In the Group’s dairy business, Ladismith Cheese’s new sliced cheese line and roller dryer powder plant increased operating capacity after being fully commissioned during the reporting period, while solar investments delivered strong returns. This, supported by higher milk flows and stable pricing, increased revenue by 24% to R975 million, with EBIT up 73% to R61 million. The Australian business increased revenue by 7% to R455 million, supported by higher prawn prices and strong engineering division performance, with EBIT recovering to a positive R0.3 million from a R15 million loss in 2024. Despite the aquaculture segment remaining under pressure due to weak demand and lower selling prices in Hong Kong and China, revenue increased by 63% to R167 million with the inclusion of Aqunion. The segment recorded an Operating Profit of R8 million.

Looking forward

Ratheb states that the Group is well positioned for future growth. “We will continue to strengthen our South African hake and small pelagic businesses by driving efficiency and profitability. Although a very small part of our business, our abalone and Australian operations are being restructured to prepare for long-term recovery as market fundamentals improve. We are also committed to reducing debt by 50% over the next three years through stronger cash flow, disciplined investment, and selective disposals to support increased dividends for shareholders in the future,” concludes Ratheb.

The Sea Harvest Group is a leading vertically integrated seafood, agri-processing and branded fast-moving consumer goods (FMCG) business with a global footprint. Sea Harvest was established in 1964 and has developed a strong reputation and solid long-term relationships with its geographically diverse international customer base.

The Group harvests wild-caught seafood off the coasts of South Africa and Australia and processes the catch into a variety of chilled and frozen premium seafood products including fish oil and fishmeal. Through Sea Harvest Aquaculture, they farm abalone. Their varied wild-caught and farmed products are then packed and marketed to a local and international customer base. Their agri-processing business produces value-added dairy products, such as cheese, butter and powders, for the South African retail and food service markets. Their convenience foods business produces premium convenience foods for the retail and food service markets in Southern Africa.

VIEW THE FULL RESULTS HERE >>>

Note: Sea Harvest values the Ghost Mail audience and the company has placed its earnings here accordingly. This article reflects the views of the company. For the views of The Finance Ghost, refer to the section in Ghost Bites dealing with these results.