Things are picking up at Cashbuild (JSE: CSB)

Bit by bit, sales growth is increasing

Life is tough at Cashbuild. The SARB loves nothing more than high interest rates, so we live in a country where consumers prefer sports betting to investing in physical assets like property (at every income level). They just have to keep grinding away at Cashbuild, with the great hope being that SARB will finally deliver some meaningful interest rate relief.

In the quarter ended September 2025, Cashbuild’s group revenue increased by 6%. In Cashbuild South Africa, existing stores were up 5% and new stores contributed 2%, so the growth in the local business was 7%.

This may not sound like much, but it’s a bit better than what the company has been able to manage over the past year or so. Importantly, volumes are the biggest driver of growth here, as selling price inflation was just 1.4%.

Sadly, P&L Hardware continues to fall, with existing stores suffering a turnover decline of 11%. This segment is only 6% of group sales, but that’s enough for the poor performance in this segment to continue to be annoying.

Onwards and upwards – ever so slowly!

A slight quarter-on-quarter uptick at DRDGOLD (JSE: DRD)

Cost pressures are evident, but are mainly due to timing

DRDGOLD released an operating update for the quarter ended September 2025. All the comparisons are made to the quarter ended June 2025, so this is a sequential quarter-on-quarter view rather than the typical year-on-year approach that would use the September 2024 period as a base.

In other words, don’t be shocked by relatively small movements, as these would annualise into bigger moves.

Gold production was up 2% and gold sales were up 1%. They achieved a better yield on the ore that was milled (i.e. more gold per tonne milled), which is why cash operating costs were up 8% per tonne milled and only 3% per kg of gold.

Adjusted EBITDA was only up by 1% though, with cost pressures leading to this modest growth rate. Annual labour increases were felt in this quarter and they also had to deal with winter electricity tariffs applicable in July and August (vs. only June in the previous quarter). When a business has seasonal factors, using quarter-on-quarter numbers can lead to distortions like these.

Cash and cash equivalents fell by R257.1 million to R1.05 billion. This is because of the dividend and the capex during the quarter. Importantly, the company remains debt free.

Thanks to the leveraged exposure to the gold price (in the form of plenty of operating leverage in this model), DRDGOLD is up a whopping 233% year-to-date!

Gemfields has suffered a very concerning security incident in Mozambique (JSE: GML)

Lives were lost at the mine gate

The risk factors at Gemfields seem to be through the roof right now. The company recently noted the illegal mining issues at the Montepuez Ruby Mining (MRM) facility and how this has delayed the next auction. Things are clearly getting much worse, with 40 illegal miners having marched on the mine gate and attacked Mozambican police officers. Two officers (including a commander) lost their lives.

Sure, no employees or contractors were hurt, but this is clearly an escalation in violence and risk. The company has been given information that this attack may be linked to an investigation by immigration authorities of illegal immigrants in a local village, which also led to loss of life.

Getting rubies out the ground at a profit is hard enough. Doing it under armed guard (which seems to be buckling under the pressure) makes it even worse. I worry about how this security incident is being downplayed in the market, with the share price closing just 1.5% lower in response to this news.

A truly wild day for the Labat Africa share price (JSE: LAB)

At one point in morning trade, it was up 230%!

Labat Africa is a small cap that really captured the imagination of the market on Thursday. There are normally fewer than half a million shares changing hands each day. Thanks to the release of a trading statement, over 18 million shares traded!

After a chaotic trading day, the share price eventually settled 50% higher. This was driven by the trading statement for the year ended May 2025 (yes, very late) that noted a jump in HEPS of a casual 436%. If you’re going to be late, you may as well make an entrance!

In this swing from profits to losses, the HEPS was 13.28 cents for the period. The share price was trading at 6 cents at the start of the day and ended on 9 cents, so it’s trading on a P/E of less than 1x!

The net asset value (NAV) per share is expected to be 21.87 cents, so the share price is also a significant discount to NAV. There’s a whole lot going on at Labat, so treat it as a speculative punt and do your research very carefully here if you are tempted.

Premier proposes a share-for-share acquisition of RFG (JSE: PMR | JSE: RFG)

As usual in these deals, the market sold Premier and bought RFG

It feels like we’ve seen some exciting deals on the local market this year, and now we have another example. Premier Group – the very successful FMCG business that was unleashed by Brait (JSE: BAT) – is looking to acquire sector peer RFG Holdings in a share-for-share deal that would lead to current RFG shareholders having a 22.5% stake in the combined group.

This exchange ratio is calculated based on a price of R22 per RFG share (vs. the prior day’s closing price around R16) and R154 per Premier share (in line with the prior day’s closing price).

What is the rationale for the deal?

Well, if we start with an understanding of Premier, we are looking at a company that has 28% market share in the formal bread market, 38% of the wheat market, 15% of the sugar confectionery market and 22% of the feminine care market in South Africa. It exports 14 brands in its portfolio to 41 countries worldwide. Recent performance has been very strong, with the benefit of operating leverage coming through in the baking business. It’s therefore likely that RFG shareholders would be quite happy to be involved in the merged group, as Premier is a successful story.

Over at RFG, the focus is mainly on key fresh and long-life categories. Recent performance has been difficult, with a number of market factors that can influence the pricing of key products both locally and abroad. There is minimal product overlap with Premier and the operations are (and would remain) distinct. On the one hand, that’s good news for the likelihood of a successful Competition Commission process and the culture of RFG being retained, with Premier seeing this deal as a way to expand and diversify the group. But on the other, this calls into question why it actually makes sense for the groups to belong together and why Premier should be paying a 37.5% premium to the 30-day VWAP of RFG.

It’s worth noting that a typical control premium is around 20% – 25%, so part of the premium is justified purely by Premier taking control of RFG. I think there’s also an element of opportunistic dealmaking at play here, as the RFG Holdings share price was depressed and Premier has been riding high:

The deal is being structured as a scheme of arrangement in which 1 new Premier share would be issued for every 7 RFG shares. Fractional entitlements would be settled in cash. This means that arbitrage traders will keep an eye on the share prices and see if there are any profits to be made based on the exchange ratio, although there’s obviously loads of deal implementation risk at this stage as shareholders still need to vote on the transaction and regulators will need to approve it. There are also a number of material adverse change provisions, which would give the parties a way out if something goes badly wrong at either company.

There are dividends to consider, with RFG entitled to pay a dividend for the 12 months to September 2025 and Premier entitled to pay a dividend for the six months to September 2025.

A break fee of 1% of the deal value would be payable by RFG to Premier in certain circumstances, but this excludes a situation in which RFG’s board recommends a superior proposal. This deal is wide open to a bidding war, so one wonders if we might see a competing proposal emerge.

In that context, it’s important to note that holders of 49.5% of RFG shares have given irrevocable undertakings to accept the offer, including Capitalworks with its 44.5% holding. There are non-binding letters of support from holders of a further 28.3% of shares. Those holders are mainly large institutions and they are clearly keeping their options open in case a better deal arrives.

The scheme circular is expected to be distributed on or about 11 November 2025.

PSG Financial Services’ advice-led model continues to do so well (JSE: KST)

Distribution power is king

When it comes to financial products (and especially in the investment space), it’s really hard to differentiate based on investment performance. As we know, only a handful of active managers reliably beat the market index over the long term. This means that distribution is where the real moat lies, with advisors out there structuring portfolios on behalf of clients and helping to attract flows.

PSG Financial Services is evidence of this, with the results for the six months to August 2025 reflecting a 19% increase in total assets under management. There’s an 18% increase at PSG Wealth (the advice business) and a 21% increase at PSG Asset Management. Thanks to a really good year in the markets, performance fees were 7.3% of headline earnings (up from 6% in the prior year).

PSG Insure also contributed positively, with gross written premium up 6%.

With underlying growth drivers of that nature, it’s little surprise that recurring HEPS increased by 21%. But here’s the interesting thing: despite having a modest growth rate, PSG Insure posted the best recurring headline earnings growth of 26%! The insurance sector really has had an amazing year.

Part of the jump in earnings is the approach taken by the company to managing its margins and investing in efficient growth. Technology and infrastructure spend was up 15%, while fixed remuneration was up just 5%. It’s a good time to be a data centre and not such a good time to be a young professional in the market, although full credit must go to PSG for their graduate programme and their initiatives like Think Big South Africa. The company does the right thing for shareholders and also does the right thing for the country.

Return on equity was a juicy 28.6%, up from 26.2% in the prior period. Just to cap off the good news for investors, the dividend per share was up 18%.

This is an impressive performance that explains why the share price is up 24% year-to-date. Interestingly, the share price dipped 2.6% on the day of results. Some profit-taking after a strong run isn’t uncommon.

Sanlam’s capital markets day details the next era of growth (JSE: SLM)

There’s always something interesting to learn from these events

Sanlam hosted a capital markets day and made all the presentations available here. This gives you an opportunity to really dig in if you’re interested in how the company will drive growth in years to come.

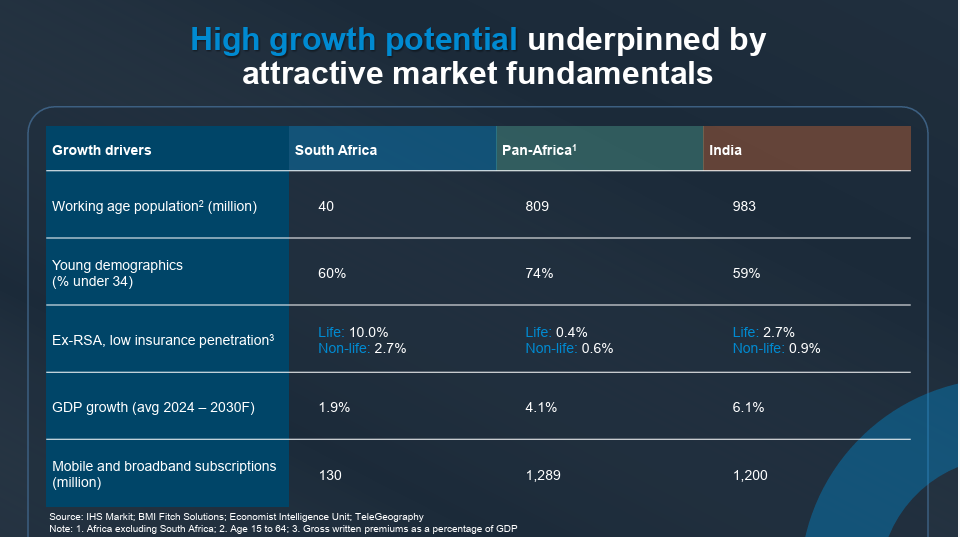

Remember, Sanlam is not shy to do deals. The company tends to make big moves both locally and internationally, with a focus on high growth emerging markets like India and the rest of Africa.

This comes through in the slide deck, like in this slide which shows the ex-South Africa growth opportunity across GDP and financial product penetration:

The group is looking to grow operating profit by more than 600 basis points above South African inflation. That’s significant real growth! In terms of returns to shareholders, they aim to grow the dividend at a rate 400 basis points about South African inflation. They also aim to keep return on equity above 20%.

How will they do it? Aside from organic growth, there are substantial growth drivers in the business that have been unlocked through recent transactions. For example, the growth runway in Africa for SanlamAllianz is exciting. In India, the ShriramOne app is is a “one-stop financial hub” that looks like an interesting strategy. Sanlam is also looking to ramp up its specialist insurance capability via the Lloyd’s transaction. There’s work to be done in some cases to get these deals across the line and to integrate them into the operations, but this is nothing new to Sanlam.

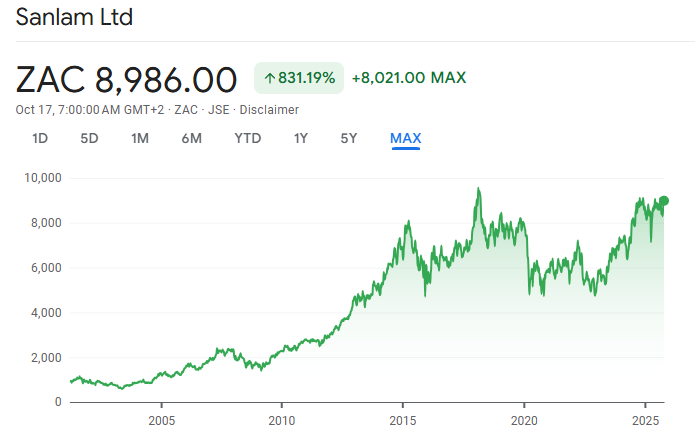

There’s plenty to dig your teeth into in the slides. As a final comment, this chart shows the recovery from the COVID lows and the base for further growth:

Unsurprisingly, the market threw money at Vukile Property Fund (JSE: VKE)

The property sector is hot and Vukile is one of the brightest flames

On Wednesday, Vukile announced a plan to raise around R2 billion through an accelerated bookbuild process. As usual, it didn’t take them long. Also as usual, institutional investors jumped at the opportunity to get their hands on more shares in Vukile at a discount.

In the end, Vukile upsized the raise and placed shares worth R2.65 billion, or 10% of the company’s market cap. In percentage terms, that’s a capital raise that was 32.5% larger than planned!

The property sector has come so far since the pandemic. I’m not ready to reduce exposure just yet, as we are still in a situation where only the best funds are raising money. When the more marginal players start to achieve oversubscribed bookbuilds, it’s time to take my money elsewhere.

In terms of pricing, the shares will be issued at R21.30 per share, which is a 4.3% discount to the 10-day VWAP. This of course is the challenge for retail investors in this sector: our phones don’t ring with the opportunity to buy the shares at a 4.3% discount. Instead, we just get diluted over time, with the hope being that the fund puts the capital to good use and keeps generating strong returns.

Nibbles:

- Director dealings:

- Ex-CEO and outgoing director Jan Potgieter has sold more shares in Italtile (JSE: ITE), this time to the value of over R8 million.

- I was slightly off on the estimated pricing at which the underwriters have bought the ASP Isotopes (JSE: ASP) shares as part of that capital raise, as it seems that I misunderstood the option granted to the underwriters. A subsequent announcement by the company has confirmed that the price is $11.65 per share (for both the initial issue to the underwriters and the option). The underwriters will obviously try to offload them at a profit.

- Southern Palladium (JSE: SDL) has requested a trading halt in Australia based on a pending announcement of a capital raise. This is how the listed environment in Australia works. We don’t have this rule in South Africa, so we end up in the odd situation where the company’s shares are suspended from trading in Australia but not in South Africa. The halt will be in place until the company makes the announcement about the capital raise or until the commencement of trading on Monday 20th October, whichever happens first.

- Mantengu Mining (JSE: MTU) announced that Magen Naidoo, currently the CFO, will be appointed as the Deputy CEO as well. The drama around the company continues, with the company noting that this appointment is because of the death threats that have been received by CEO Mike Miller.

- Shuka Minerals (JSE: SKA) is still holding its breath for the funding that is expected to be received from Gathoni Muchai Investments (GMI) for the acquisition of Leopard Exploration and Mining. There’s a $1.35 million cash consideration due to the sellers. The amount has been delayed yet again, with promises now made that the money will clear next week.

- Kibo Energy (JSE: KBO) announced that the company has received an initial advance of funding under the convertible loan note issued to an institutional investor. This is to help the company with the process of acquiring Carbon Resilience Pte Limited, a utility-scale industrial decarbonisation and renewable energy company focused on Australia. The balance of the funds under the convertible loan note is expected to be received by 29th October. This capital is purely to fund the process of the deal, not the deal itself.

- Universal Partners (JSE: UPL) will issue shares worth roughly R1.25 million to Argo Investment Managers in part settlement of the carry fee that is payable after the disposal of the company’s investment in YASA Limited. This represents less than 0.1% of shares in issue.

- Here’s something for those keeping an eye on Mondi (JSE: MNP): the company has announced the launch of a €550 million Eurobond with a 5-year term and a coupon of 3.375%. They will use this to refinance existing debt, including the €600 million notes due April 2026 that they are currently busy with a tender offer for.

Note: Ghost Bites is my journal of each day’s notable news on SENS. It reflects my own opinions and analysis and should only be one part of your research process. Nothing you read here is financial advice. E&OE. Disclaimer.