Understanding fair value beyond mark-to-market in low liquidity environments

In South Africa’s financial ecosystem, the concept of “fair value” arises frequently, particularly when discussing corporate bonds. Yet, for many investors, the differences between fair value and mark-to-market pricing, and why this might matter, can be misunderstood. At Intengo, we believe that a more nuanced understanding of these valuation methods will transform our local fixed income market into one which is more transparent, equitable, and efficient.

The bond valuation conundrum: Fair value vs mark-to-market

In its simplest terms, fair value is a theoretical assessment of a bond’s worth, rooted in the bond’s fundamental characteristics, such as the issuer’s credit risk and prevailing financial conditions. By contrast, mark-to-market pricing reflects the latest transaction price in the open market and, by extension, the immediate dynamics of supply and demand. Both measures are valuable but serve distinct purposes.

Mark-to-market prices are shaped by real-time market activity and, in liquid markets, can offer an accurate, up-to-date assessment of what you might receive if you sold an asset today. However, in markets where trading is thin, including much of the local corporate bond space, such prices can be misleading. A single, urgent seller or a temporary lack of buyers can drive prices far from what an objective assessment might suggest. In these environments, mark-to-market pricing is less a reflection of the bond’s intrinsic value, and more a signal of recent market pressures.

Fair value, by contrast, should be insulated from the “noise” of short-term market moves.

Why the distinction matters

The divergence between fair value and mark-to-market is not just an academic matter; it has real-world consequences for investors, asset managers, pension funds, and ultimately, the individuals whose savings and retirement incomes depend on accurate valuations.

For the institutional investors, the need to sell bonds occasionally can become problematic. When a bond must be sold in an illiquid market, there is a risk that it will trade well below its fair value, eroding client savings at a critical point. Conversely, if valuations are based solely on mark-to-market prices, there is a risk of misrepresenting assets’ worth on balance sheets.

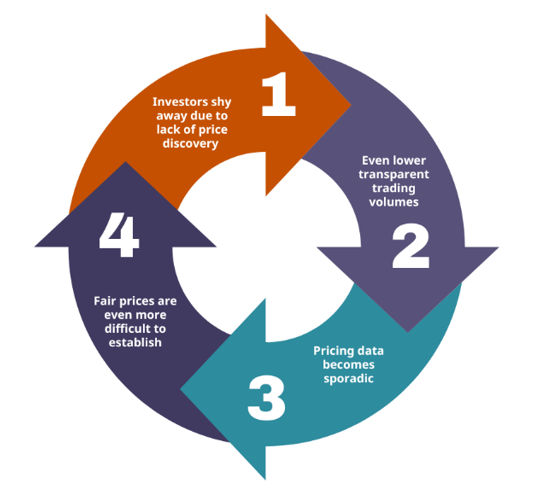

This challenge is further amplified by a feedback loop: investors shy away from corporate bonds due to liquidity risk, leading to even lower trading volumes, which in turn exacerbates the difficulty of establishing fair prices.

In such a context, an independent and robust mechanism for valuing corporate bonds, and one that separates fundamental worth from transient market volatility, is vital.

Why not just use mark-to-market?

It’s often argued that bonds should be valued at the price at which they could be sold immediately in the market. However, this logic breaks down in a market where bonds are seldom traded, and the buy-to-hold mentality prevails among investors. In such environments, the most recent trade may be entirely unrepresentative of what a bond is truly worth due to its age (or staleness). The most recent trade may also not be immediately available, as the intra-day trading activity of the major exchanges is only published at end of day.

Moreover, urgent sellers and limited buyers amplify the volatility of mark-to-market prices. A fair value estimate, rooted in a more comprehensive methodology, provides a steadier and more accurate benchmark for both buyers and sellers.

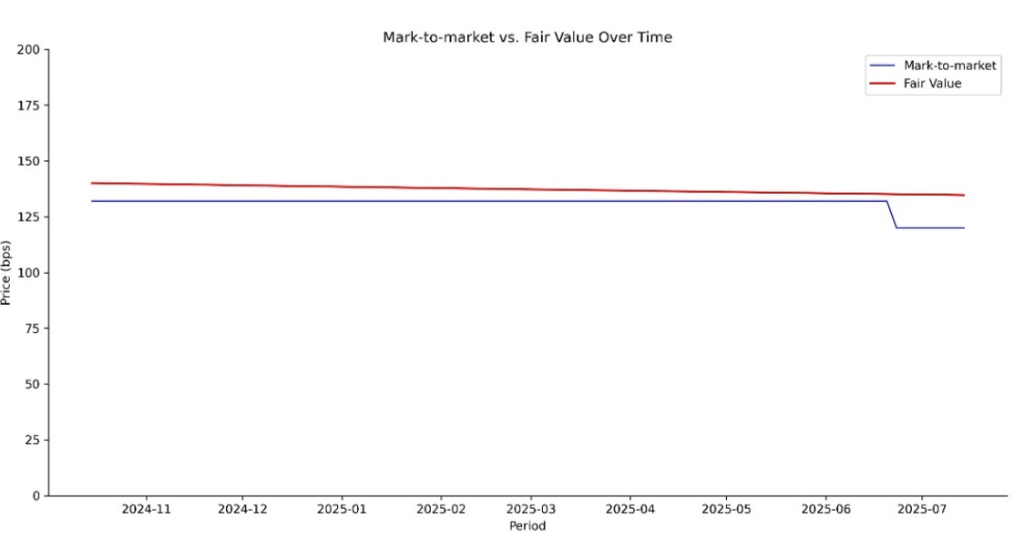

Chart 1: A real example of the fair value of a listed bond compared to its daily publish mark-to-market (expressed in bps as the applicable credit risk spread for the bond.

Addressing the data scarcity challenge

Our earlier piece on the nuances of the South African listed debt market highlighted how we have a buy-to-hold fixed income market. This is the key reason for why we have a data scarcity challenge in our market, making it difficult to rely solely on transaction data for accurate valuations.

Intengo finds itself in a unique position in the market as it collects auction bid-level data alongside all secondary market trading data. This information is anonymised, to protect the user, and then forms the backbone of our independent fair value curves. By pooling market insights in this way, we are building pricing curves that are genuinely reflective of market sentiment, rather than being skewed by isolated trades or the needs of individual issuers. This is a game changer for a market which has, for so long, only been able to rely on limited publicly available information.

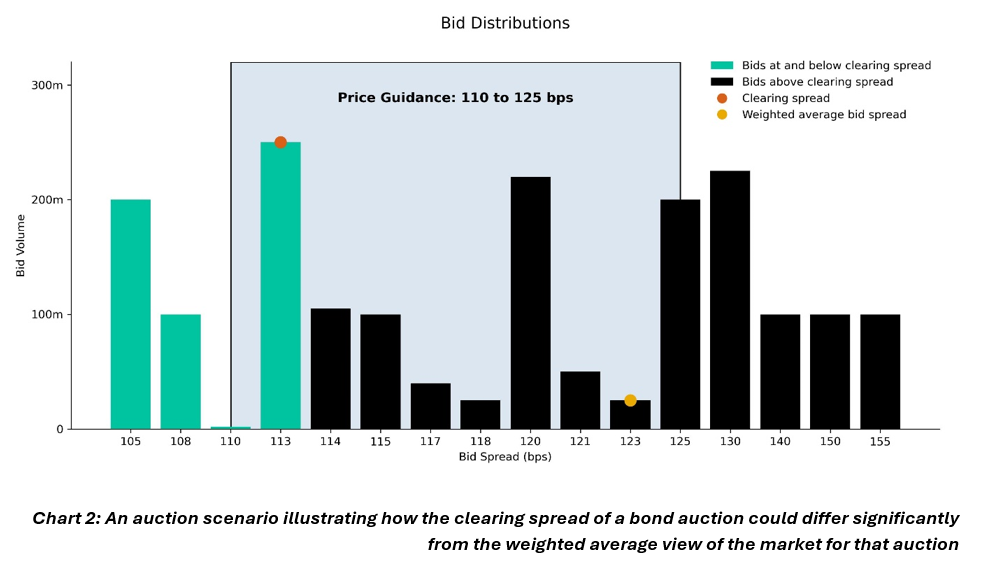

The graph below shows how the weighted average spread of the bids in a particular auction can be significantly higher than the clearing spread. The listed bond would have one data point, its clearing spread, but our models use all 16 bid levels. This approach means our models incorporate significantly more inputs than a model using only clearing spread data.

Chart 2: An auction scenario illustrating how the clearing spread of a bond auction could differ significantly from the weighted average view of the market for that auction.

How Intengo approaches fair value

Our view is that fair value is best determined through a collaborative, data-driven process that draws on a wide spectrum of market metrics, rather than being beholden to the latest sale price.

Here’s how we realise this in practice:

- Objective assessment: We start by questioning how we can strip away the influence of short-term market sentiment and focus on long-term value drivers.

- Market participant collaboration: We believe the best fair value estimates come from the expert credit teams within our local institutional investor base. Aggregating the collective intelligence of these professionals creates a market consensus view we can use in our modelling.

- Credit spread curves: By combining all the data sources available to us, together with the derived consensus view from each bond auction, we model credit spread curves that reflect the market’s aggregated view.

This methodology stands in contrast to a simplistic reliance on the clearing spread of a new bond issue (i.e. the price at which a new bond is sold to the market) or the last traded price of a bond at the end of a day. While these levels are public and easily accessible, they are not immune to distortion: for instance, corporate treasurers have an incentive to minimise borrowing costs. Their ability to tailor their demand for funding at a given time can thus influence the ultimate clearing spread downwards. As an aside, many institutions feel this option to downsize is not something that issuers should be able to execute, for this reason. We can explore this theme, and possible alternatives, in a future article.

The Intengo difference: Transparency and market integrity

At Intengo, our mission is to enhance transparency, price discovery, and fairness in the South African fixed income market. By developing and disseminating fair value curves built on aggregate market intelligence and robust modelling, we empower market participants to negotiate with confidence, make more informed investment decisions, and ultimately deliver better outcomes for their clients.

Our research confirms that fair value curves, modelled in an environment where demand is outstripping supply, tend to sit above those constructed solely from primary market clearing spreads. This reflects the reality that issuers’ funding needs can depress clearing spreads, making them less reliable as standalone proxies for fair value. By adjusting for these nuances, our approach gets closer to the true economic value of corporate bonds, benefiting all fixed income participants collectively.

Conclusion: A better way forward

The arrival of a robust and reliable fair value estimate marks an exciting development for our market, offering participants a clearer, more data-driven perspective on bond valuations. This advancement empowers all stakeholders with greater confidence and transparency.

At the same time, it’s important to recognise that mark-to-market values continue to have their place, particularly when liquidity and recent trades provide meaningful signals. We can embrace both approaches. We use fair value for a more comprehensive, consensus-driven view, and mark-to-market when market conditions are suitable.

This approach enhances resilience, adaptability, and positions our local market well for continued growth and efficient trading.

To find out more about how Intengo is addressing these issues, please visit www.intengomarket.com or connect with Ian Norden on LinkedIn. You can also contact Intengo Market here.

Get more insights by listening to Episode 60 of Ghost Stories, in which Ian Norden went into more details on the structure of the debt market and the role played by Intengo: