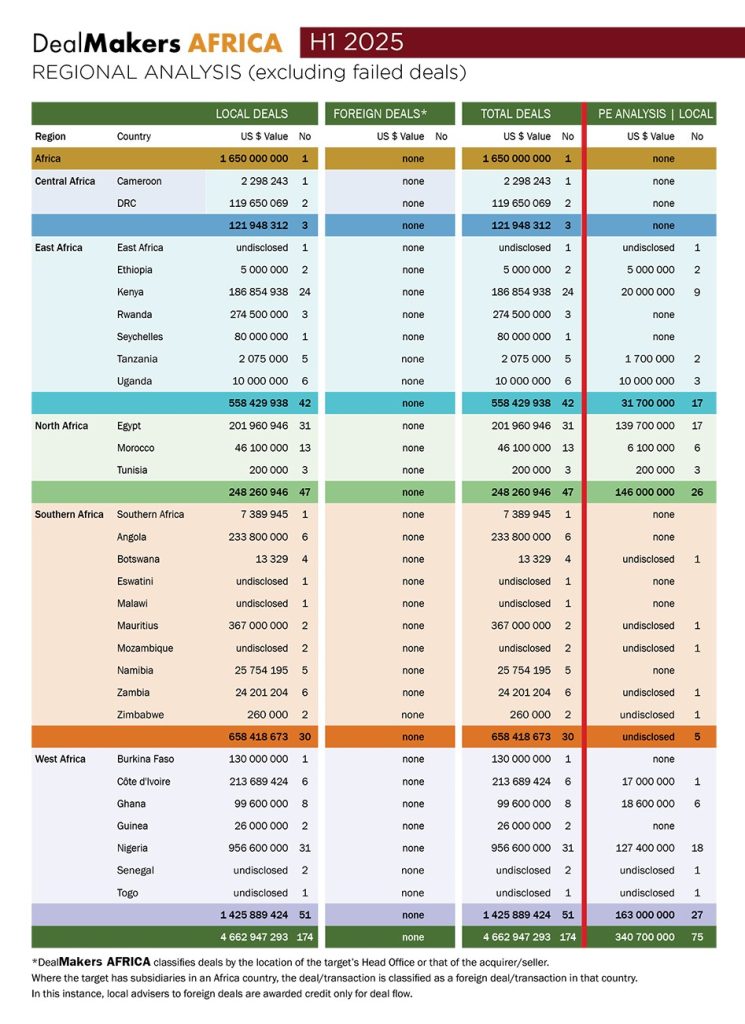

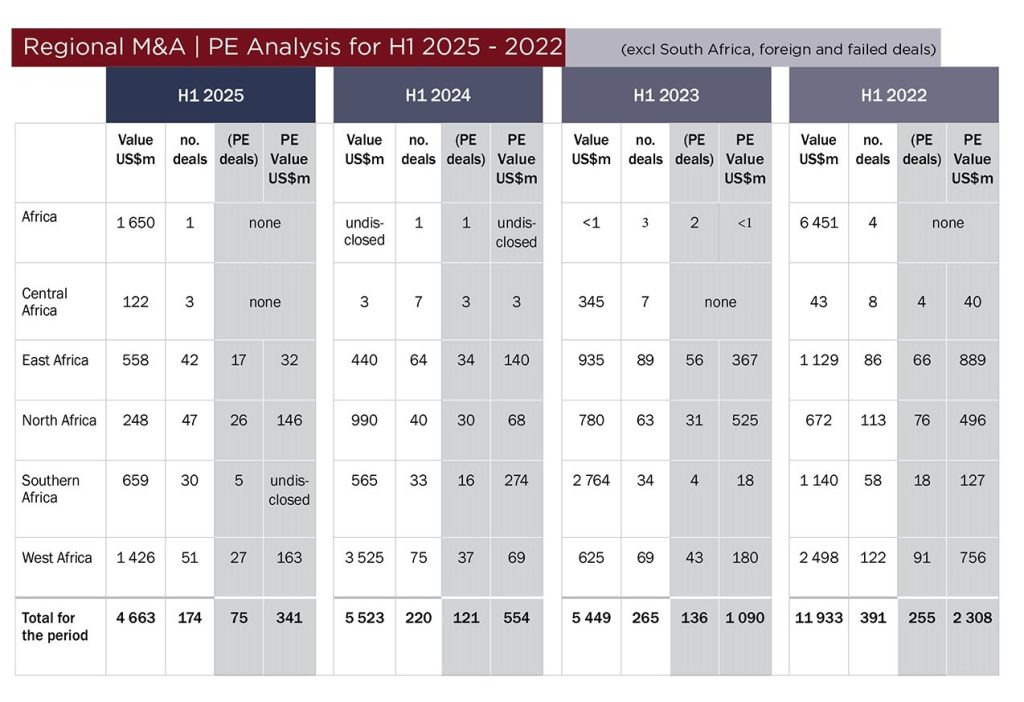

The total value of M&A deals captured for the continent during H1 2025 (excluding South Africa) was a mere US$4,66 billion, down 16% year-on-year, and 61% off the levels seen in H1 2022.

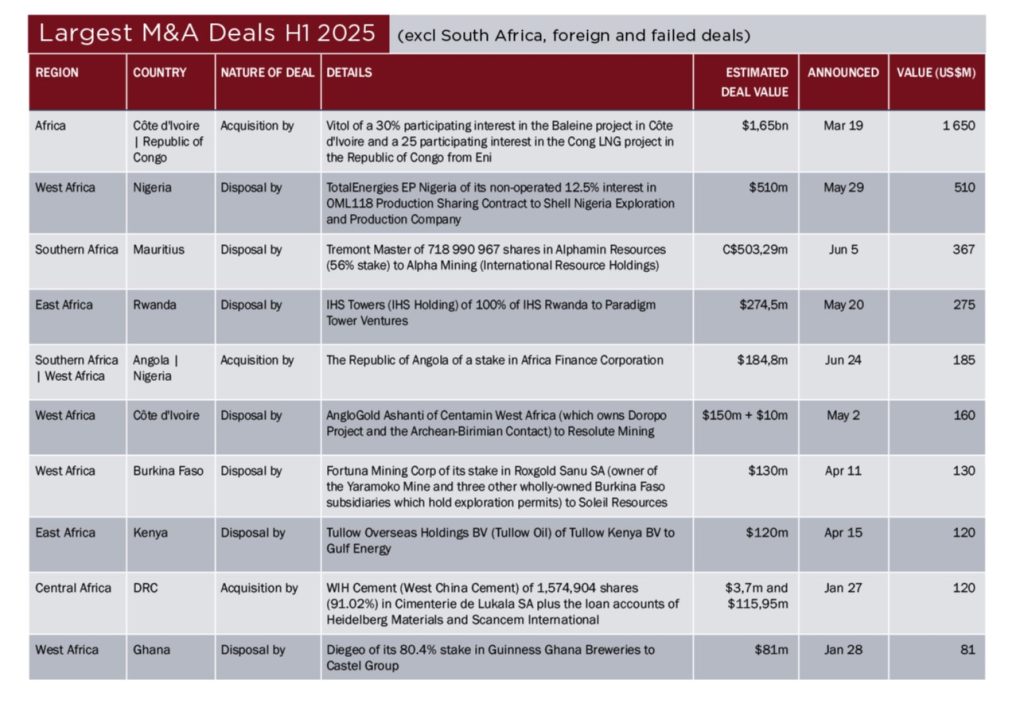

Deal volumes echoed this decline – down 21% on 2024 deal flow, and 68% off levels registered in 2022. Two deals in the energy sector topped the deal table by value for the period at $2,16 billion – almost half the total deal value for H1.

Analysis of private equity investment in Africa over the past four years mirrors this steady decline, amid challenges brought about by a mix of global macro pressures, regional risks, and shifts in investor strategy.

While not unique to Africa, rising global interest rates, a strong US dollar and geopolitical uncertainty have seen international investors retreat to safer, higher-yielding markets. For Africa, where private equity funds remain heavily reliant on offshore capital, this has translated into weaker fundraising and a more selective deployment of capital.

Currency volatility, energy insecurity, and political uncertainty in key economies such as Nigeria have added to the caution. African institutional capital remains underdeveloped, with African GPs heavily reliant of foreign backers. Subdued IPO markets, together with limited trade buyer activity, continue to constrain exit opportunities – a critical factor in investor appetite.

Added to this has been the correction in technology and fintech valuations; these sectors were central to the surge in 2022. The shift in global sentiment and a redirecting of attention to more defensive opportunities in healthcare, agriculture, food value chains and logistics has cooled valuations and deal appetite, reflected in the lower deal volume.

However, on a positive note, the long-term story remains intact, and the cycle will turn. Africa’s demographic dividend, rapid urbanisation, and the pressing need for investment in energy transition, infrastructure and healthcare continue to underpin opportunity. All that is needed is patient capital, and Africa’s fundamentals will ensure it remains firmly on the radar, with the current environment presenting entry points at more attractive valuations.

The latest magazine can be accessed and downloaded from the DealMakers AFRICA website

DealMakers AFRICA is a quarterly M&A publication

www.dealmakersafrica.com