2025’s African mergers and acquisitions have been shaped by shifting global trade dynamics, as geopolitical uncertainty, evolving US policy, growing regional integration, and a fast-moving digital economy continue to redefine investment behaviour. On the global stage, US President Donald Trump’s tariff-driven agenda has not only reshaped international alliances, but has also sharpened focus on the African Continental Free Trade Area (AfCFTA) – set to become the world’s largest free-trade bloc.

DealMakers’ analysis of the first nine months of 2025 shows that one-third of cross-border transactions undertaken by South African-domiciled, exchange-listed companies involved other African countries, underscoring the growing significance of intracontinental dealmaking.

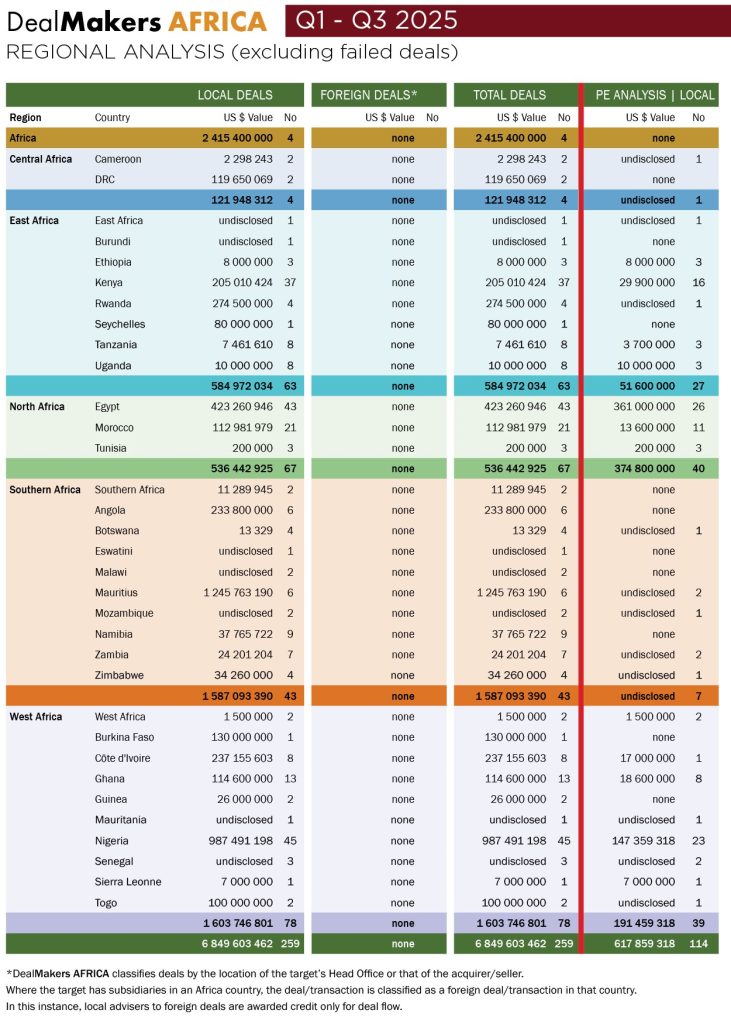

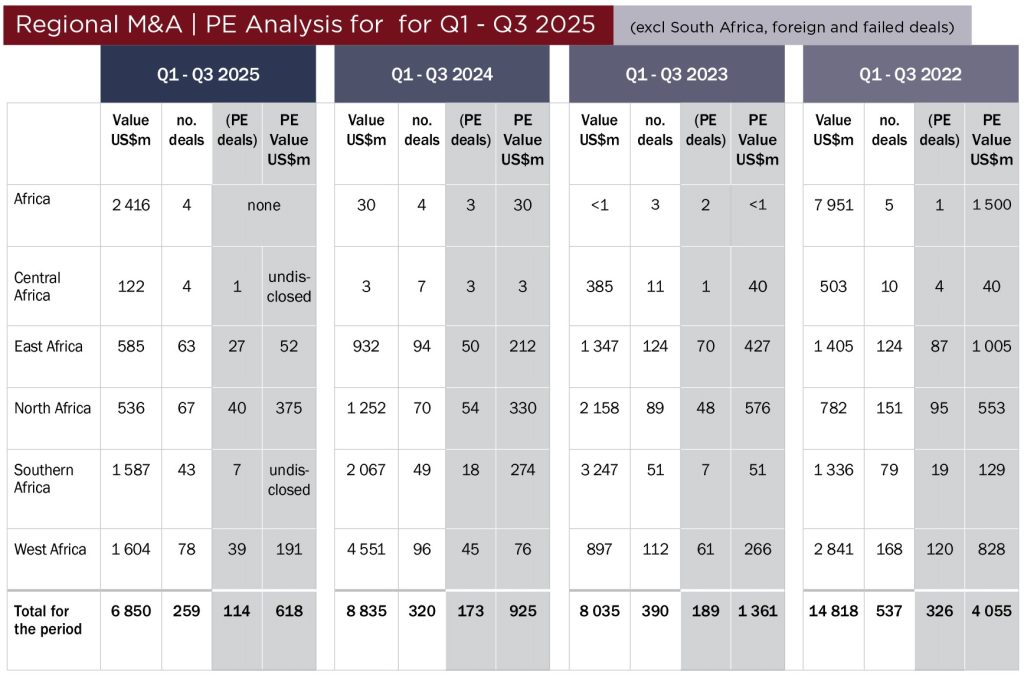

Across the continent (excluding South Africa), overall deal activity continued its downward trend. Deal value declined a further 6% year-on-year to US$6,85 billion, following a 10% drop in 2024. The number of deals fell to 259, from 282 in the prior period. West Africa, and particularly Nigeria, led activity with 78 deals (Nigeria accounting for 45), followed by North Africa with 67 (43 for Egypt) and East Africa with 63 (37 in Kenya).

General Corporate Finance (GCF) activity mirrored this moderation. For the first nine months of the year, DealMakers Africa recorded 64 transactions (excluding bonds) valued at $2,2 billion, compared with 88 transactions valued at $10,4 billion in 2024. Among the standout transactions was Sun King’s $156 million securitisation, the largest and first majority commercial-bank-backed transaction of its kind in sub-Saharan Africa outside South Africa.

Despite these headwinds, Africa’s structural strengths continue to attract investment. The continent is home to some of the world’s fastest-growing economies, and boasts the fastest-growing working-age population, coupled with rapid digital adoption. Together, these trends present significant opportunity, particularly for private equity investors backing technology scale-ups in an era of tightening global liquidity.

Private equity is no longer viewed as an unconventional funding route, but rather as an increasingly reliable engine for scale, consolidation and long-term value creation, and a pivotal driver of M&A. Still, the sector has not been immune to global pressures, regional risks, and shifts in investor strategy. Private equity deals for the period totalled 114, just one-third of 2022 levels, reflecting the impact of constrained capital and elevated risk premiums.

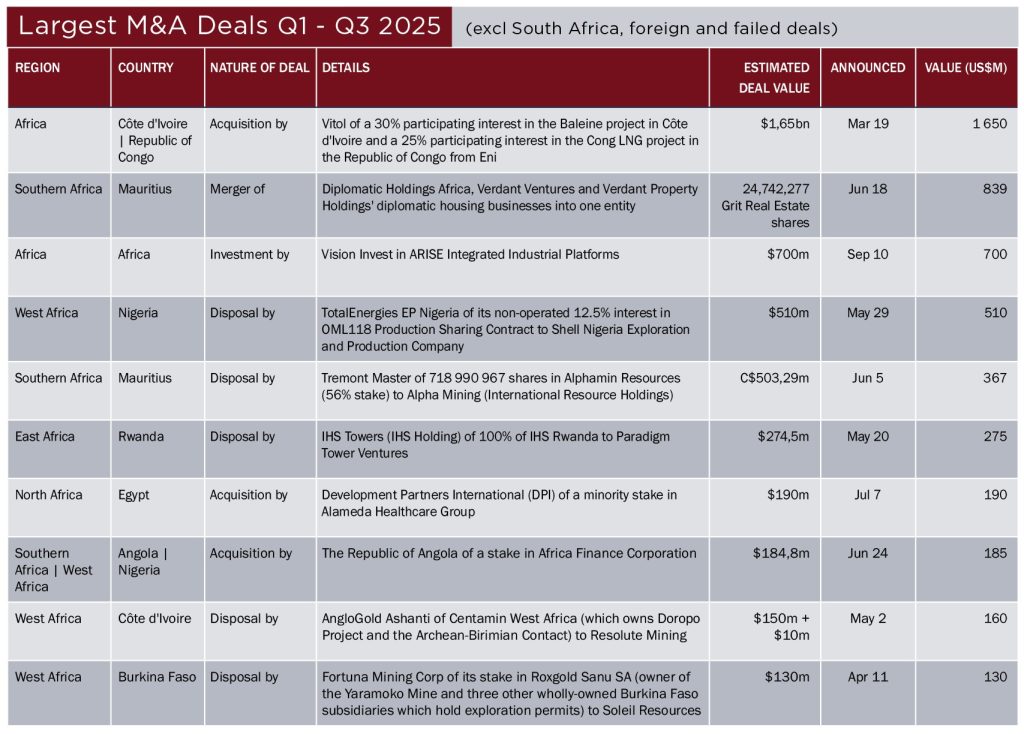

Among the top transactions for the year, four mining deals featured in the 10 largest by value. Leading the list was Vitol’s $1,65 billion acquisition from Eni of a 30% participating interest in the Baleine project in Côte d’Ivoire, and a 25% stake in the Congo LNG project in the Republic of Congo.

The latest magazine can be accessed and downloaded from the DealMakers AFRICA website

DealMakers AFRICA is a quarterly M&A publication

www.dealmakersafrica.com