Wall Street’s forecasts for Kroger’s first-quarter profit and same-store sales were surpassed due to consistent demand for basics and lowering supply chain expenses.

Refinitiv IBES statistics show that Kroger’s first quarter net sales climbed by 1.3% yearly to $45.17 billion, although they fell short of analysts’ forecasts of $45.24 billion.

The first quarter performance of Kroger Company (The) (ISIN: US5010441013) was strong due to the application of its “Leading with Fresh and Accelerating with Digital” strategy. As more consumers experience the effects of inflation and economic uncertainty, Kroger has increased its reach to customer homes by delivering fresher items at reasonable prices with tailored rewards.

The “Leading With Fresh” campaign now recognises 1,738 stores, and Kroger accelerated their Fresh Produce Initiative. This led to higher sales without fuel in some locations. By extending Alternative Farming offers to 1,094 merchants, it successfully linked more communities to locally produced fresh goods.

Due to its delivery solutions, which include Kroger Boost and Customer Fulfilment Centres, delivery sales have climbed 30% over the previous year. Kroger also developed a connected TV relationship between Disney and Kroger Precision Marketing in order to increase its digital reach. According to the group, the number of households with digital involvement increased by 13% over the previous year.

Technical

- The share price has consistently trended lower and now converged with the 100-day moving average after falling 25% from its peak last year. In 2023, a rectangle pattern developed as the share price consolidated, and bears could not push it below the support level set during the consolidation period. At $43.00 and $50.50 per share, respectively, support and resistance were identified.

- A Doji candle developed during the week of the company’s earnings, indicating market indecision in the wake of the earnings report at the 61.80% Fibonacci Retracement Golden Ratio. Given that positive momentum favours the move higher, the $50.50 per share level may be in play if bulls prevail in the current battle.

- In contrast, if bears prevail, the share price could decline. Long-term investors may become more interested at the support level of $43.00 per share. If downside volumes start to decline as the share price gets closer to its support level, it could be a sign that the downside momentum is waning and a turnaround is about to happen.

Fundamental

- Sales for the corporation increased to $45.2 billion in the first quarter from $44.6 billion in the same period last year. When fuel purchases are not included, sales rose 3.5% over the same period the previous year. Due to its efforts to source some products closer to its distribution hubs and reduce supply chain costs, Kroger’s gross margins climbed 21 basis points to 22.3% from a drop a year earlier.

- The improvement in the gross margin rate was principally brought on by the success of Kroger’s Brands, sourcing benefits, decreased supply chain expenses, and the effects of a terminated contract with Express Scripts. Increased promotional price investments have largely offset this improvement. Additionally, it profited from consumers picking its store-brand products over more pricey national brands, particularly higher-income shoppers looking for less expensive alternatives amid continuous inflation.

- Given the increased levels of liquidity, Kroger’s net total debt to adjusted EBITDA ratio declined from 1.68 to 1.34 from a year earlier, showing a reasonably healthy balance sheet. There has been a $1,460M decrease in total net debt during the last four quarters. The company’s net total debt to adjusted EBITDA ratio should fall between 2.30 and 2.50 as per its guidance.

- After taking into consideration the effect of Express Scripts, it is anticipated that sales without fuel will have an underlying growth of 2.5% to 3.5%. Adjusted Free Cash Flow is predicted to rise to$2.5 to $2.7 billion.

- After discounting for future cash flows, a fair value of $49.00 per share was derived.

- Over five years, Kroger has outperformed the S&P 500 stock market as a whole. Compared to the S&P500, Kroger saw a return of 98.02%. Despite the stock price’s positive correlation with the index and notable outperformance, the market has generally favoured it.

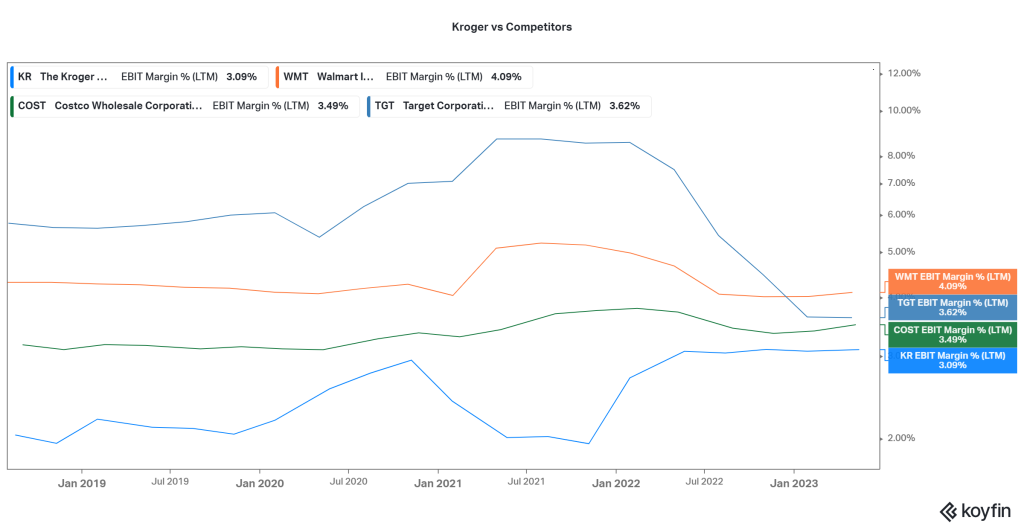

- With an operational income per unit of sales of 3.09%, Kroger has the lowest operating income among its main rivals. It still lies within the sector range, nevertheless, and has improved since 2021, whereas the profitability of its rival declined.

Summary

Given the sector’s steady demand for vital goods, the consumer staples market is one that can often survive economic setbacks. After a year of tightening, consumers can see the light at the end of the tunnel as interest rates are about to peak following the Federal Reserve’s pause.

The medium to long-term outlook most likely shows a softer climate that encourages consumer expenditure. As the existing economic restrictive policy loosens, the share price could converge with its $49.00 per share fair value.

Sources: Kroger Company (The), Reuters, Nasdaq, TradingView, Koyfin