Local banks have been one of the best sectors that you could’ve chosen this year. Only Capitec has been a disappointment, coming off an incredibly high valuation. The other four large banks have all posted great returns, especially measured against the the broader market.

What is it about this environment that is driving strong returns for banks?

The latest update in the banking sector is a trading statement from FirstRand, one of the best financial institutions in the country.

The update relates to the year ending June 2022, so FirstRand is feeling confident enough to comment on a period that only ends a month from now. This positive messaging is why the share price closed 4.7% higher on Friday.

JSE rules require companies to release a trading statement when there is a reasonable degree of certainty that earnings will differ by at least 20% to the comparable period. It’s quite rare to see a company release a trading statement before the period has ended.

Importantly, all that FirstRand has confirmed at this time is that earnings will be at least 20% higher, so that’s the bare minimum under JSE rules. This makes it plausible (and perhaps even likely) that the end result will be even better.

The market clings onto every word in these types of announcements, looking for clues in the commentary as to the drivers of performance.

FirstRand notes that “the credit cycle in South Africa is incrementally gaining impetus” – a sentence that appears to have been designed to deliberately confuse almost anyone reading it. If you understand banking, you’ll know that this talks to the overall credit environment, which is a function of demand for credit and customer affordability that keeps credit losses at reasonable levels.

The update confirms that impairments are reducing and non-performing loan (NPL) “formation” is in line with expectations. Remember, when a bank lends money, it knows that a percentage of those loans will end up in trouble. This is a cost of doing business for a bank.

The perfect scenario for banks is one in which people want credit, they can afford it and rates are going up as this makes the credit more expensive. This environment drives growth in loans and advances and improvements in the net interest margin, a combination that turbocharges banking earnings.

Nedbank’s update last week gave the impression of strong growth in consumer credit and subdued demand for credit from corporate clients i.e. large companies. This is particularly interesting considering the pressure that corporate balance sheets are being put under by working capital stresses and inflation. In contrast, the FirstRand update noted that corporate activity is “showing stronger momentum” – a more positive narrative.

The FirstRand update gives a passing mention to the UK business, where “advances growth has continued” as demand for credit picks up. I’m more focused on the South African environment.

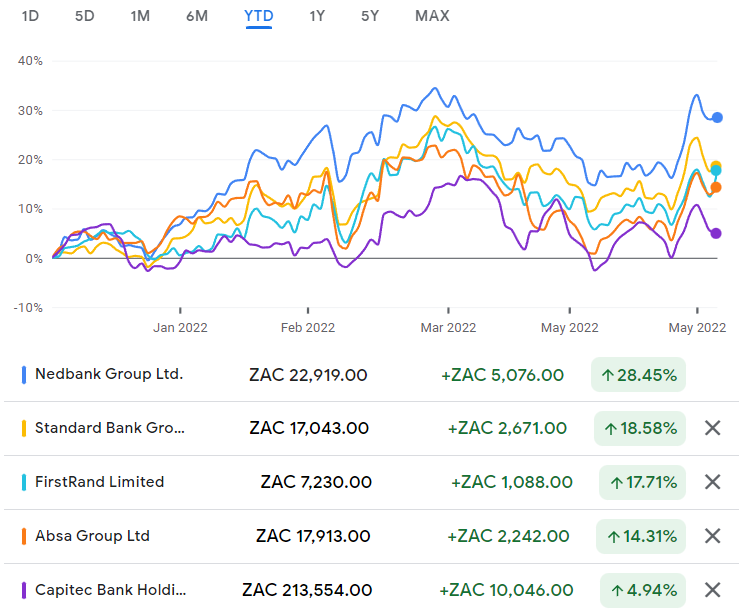

The chart below shows the year-to-date performance for the five largest banks, clearly demonstrating the momentum in this sector:

Nedbank is the star of the show here, which may come as a surprise to you. This is a wonderful lesson in buying the cheaper companies in a particular investment theme, especially where relative valuations have deviated over time.

This is also why Capitec has lagged peers this year, as it was trading on the highest valuation multiples coming into 2022.

Will the momentum continue? It’s impossible to say for sure, of course. Something heavily in the banks’ favour is that rates are rising off a low base, which means every increase has a significant positive impact on earnings. When rates get too high, an increase can have a negative impact because of credit losses. For now, things in the sector are shining bright green.