Listen to the show using this podcast player:

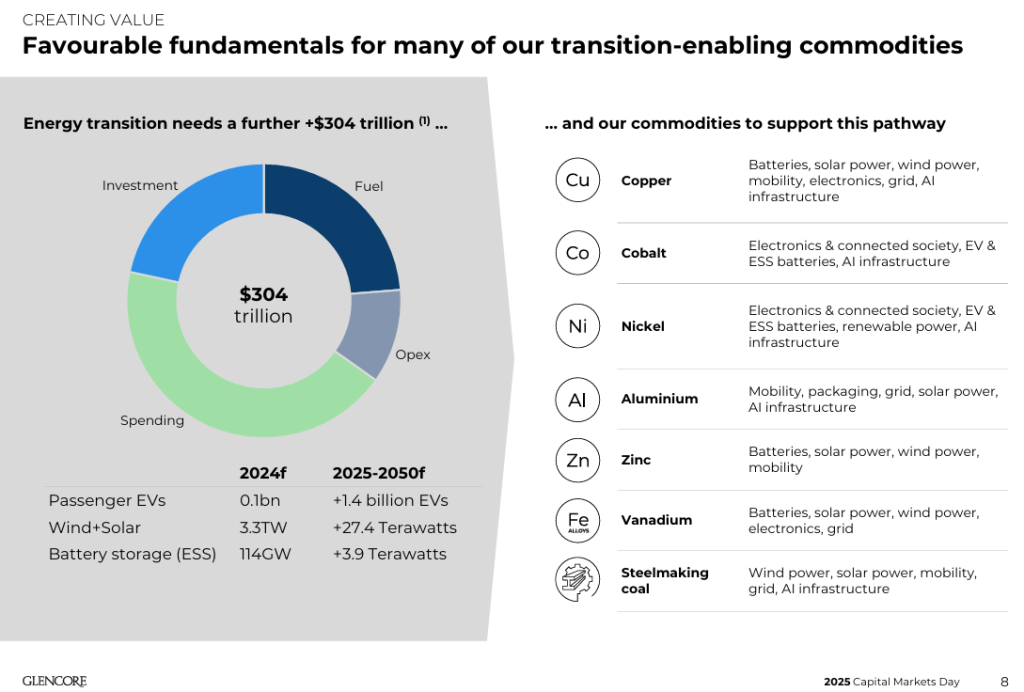

Sirius Real Estate is a great example of a JSE-listed property fund that gives local investors a chance to participate in offshore markets. With a strategy focused on the UK and Germany, Sirius follows an “always-on” mentality to the opportunities in those markets.

Whether following megatrends like defence spending and the further industrialisation of the German economy, or being open to opportunistic plays in business parks that offer attractive upside opportunities, Sirius is never too far away from a deal.

To understand more about the strategy of the fund and how they win in these markets, I was joined by a full house of CEO Andrew Coombs, CFO Chris Bowman and CIO Tariq Khader. Get ready to learn all about Sirius and the opportunities for this fund.

This podcast has been sponsored by Sirius Real Estate. As always, I was given an opportunity to dig into the strategy and ask my own questions in my quest to learn more. You must always do your own research and speak to a financial advisor before making any decision to invest. This podcast should not be seen as an investment recommendation or an endorsement.

Full Transcript:

The Finance Ghost: Welcome to this episode of Ghost Stories. I’m your host, the Finance Ghost. I’m so excited to be doing this because I get to speak to the management team of such an interesting real estate fund on the JSE.

They are very well known for their active management approach, for doing lots of deals. For finding stuff that has some really good tenants, as well as some fixer-upper type elements to it. So, they don’t just sit back and own the properties and wait to see what happens. They actually go out there and really improve them, and follow a very focused strategy in the UK and Germany. So that is, of course, Sirius Real Estate.

If you’ve been following property funds on the JSE, you’ll know the name. You’ll probably know a little bit about their strategy. And today we have, essentially, a full house – Andrew Coombs, the CEO, Chris Bowman, the CFO, and Tariq Khader, the CIO. Really cool to have all of you here with us.

Andrew, I’m just going to jump in and start with you. Let’s begin with an overview of why the UK and Germany are your markets of focus for Sirius. Because that literally is where you spend your time making acquisitions – and to the extent that you sell properties as well, that’s where the portfolio sits, basically. Why do you believe that Sirius can – and does – win in these regions?

Andrew Coombs: Well, thank you very much. There are a few reasons. Firstly, it wins because it’s a very well-run, extremely well-disciplined organisation of over 500 people in 150 locations across two countries, those countries being the UK and Germany.

And of course, what we do is we specialise in the ownership and operation of industrial parks.

Typically, what you’ll find us ‘owning’ in Germany is a park consisting of a dozen or 15 buildings all on the same park. Some of those buildings might be warehouses, some of them might have offices above them, factories, basements – a whole range of categories of space that we run and operate on those industrial estates.

And if you think about the UK, it’s an interesting story because in the UK there is an undersupply, comparative to demand, of industrial property. And the demand for that property has increased, all the more so since Brexit. Why? Because lots of things that used to be imported from Europe without any trade friction used to come into the UK. Now, a lot more of those things are assembled and distributed from within the UK, because of the Europe-UK trade friction in that post-Brexit world.

So what we’ve got is increasing demand, and actually, the supply is not even stable. Because it isn’t really economical for people to build more of this stuff. And what’s happening with things like the environmental rulings that are coming in is these old industrial brick buildings are very often being torn down. So, you’ve got a perfect storm here. A situation whereby the demand is increasing, and the supply is actually shortening.

And in addition to that, in the post-Brexit world, the UK is decoupling from the European cycle.

You’re seeing it with interest rates. Interest rates in the UK are higher than they are in Germany. So, German interest rates have probably bottomed out now. UK interest rates are still coming down. You’re seeing it with inflation. Inflation in Europe is much lower than inflation in the UK, and less sticky.

So, you’re seeing a real decoupling of the economies, which makes it all the more interesting to Sirius. Because if I turn to Germany, the story is different. And the story is different inasmuch as we are involved in two really countercyclical markets. In Germany, unlike the UK, there is an oversupply of industrial property. And actually, whilst demand is increasing, the demand is still not sufficient to fill more than 90% of the industrial space within the market.

But our platform and our ability to know and understand well the local markets that we operate in, in and around the seven major cities in Germany, mean that we can mitigate the risk of vacancy. In fact, what we can do with our platform is we can divide our property up into different products, some of them much higher yielding than traditional conventional products that you would find in industrial property.

And by doing that, we are in a position where, because of the oversupply, we can buy the property at a discount. Not just a discount to replacement cost, but a discount to the secondary use cost that that property would command, for example, in the UK market.

We can get that discount because of the oversupply, but then we can mitigate the risk of the oversupply using our platform to put high-yielding products into the parks and get the best of both worlds: a low entry point, and the ability to manage a much higher, much more sustainable, much more interesting yield.

So this is two different stories. In one market, undersupply, overdemand. In the other market, it’s all about being able to access the property at highly discounted rates and then use your platform to be able to run the property as a premium.

And we really love the countercyclical nature of the way in which the two economies have decoupled, because what that means is that if I look back over the last 18 months, we’ve invested over 200 million into the UK market and probably something slightly less into Germany.

But if we look now, as we see the UK get more difficult and the tailwinds gather in Germany, we will be pivoting towards more investment in that German market. And the fact that we have two countercyclical markets means that we have an always-on mentality in terms of our ability to be able to deploy capital into markets to get return.

The Finance Ghost: Thank you, that is super insightful and genuinely very interesting. Here in South Africa, you don’t realise – this decoupling, you’re seeing it every day. Obviously, we know about Brexit and what’s happening, more or less, but to actually hear it explained like that is so interesting.

Because the UK and Germany really do give you diversification, then. It’s not just to say, “Oh, it’s a European fund.” These are two different places, at the end of the day. They are two really different places, and they’ve got two completely different supply-and-demand situations, as you said; macroeconomic situations.

I love that ‘always-on mentality’. So that keeps guys like Tariq nice and busy – and I look forward to hearing from him later, definitely. But Andrew, I want to ask you one other question, and that is around specifically the defence strategy in Germany.

So I did actually notice in your announcement that came out very recently (it was literally a couple of days ago), you did talk about that focus in the near term on German acquisitions now. But something else you’re doing in Germany is this defence strategy. And obviously, that’s a nice big macro theme around Europe at the moment – thanks to the geopolitical environment, and the Trump administration, and, essentially, this rearmament of Europe and all the stuff that people have been talking about for the past year. So, you’ve made some hires. You’ve recently closed a deal. It’s all very interesting.

I think let’s talk through that a little bit because, even sitting here in South Africa, I’ve been wondering. What is it about these properties that makes them so specialised for defence applications? And what does that strategy look like in Germany?

Andrew Coombs: I believe that we are about to enter a defence supercycle in Germany. And please excuse me, I’m going to go back a little bit. I’m going to go back to 2021, the end of Chancellor Merkel’s grip on German (and arguably European) politics.

And it’s something we watched very carefully at Sirius. We said this is going to be a time of very large-scale change. In the same way as the end of the Thatcher era in the UK led to political and economic change, we always saw the Merkel era coming to an end as being a point where things change fundamentally in Germany.

And I take you back to something that Merkel said as late as September ’21, when she said that Germany cannot defend its borders. She said it very publicly, and you could have been forgiven for believing she said it to pacify Putin. Because Merkel, who comes from a family that originally grew up in the West and defected to the East – very unusual for people to have defected that way, when the wall was up – Merkel understood the mentality of Putin, and she was pacifying him when she said that Germany cannot defend its borders.

Of course, at that time, you had two gas pipelines (one up and running), and you had economic dependability between Germany and also, Russia. Well, look, those days have passed, and we now have a chancellor called Merz.

Merz is the first chancellor since German unification who has seen military service. He was an artillery officer in the ’70s. His defence minister and deputy is a gentleman by the name of Pistorius. Pistorius, although he’s been in politics for nearly two decades, has always focused on defence; he’s always been a defence specialist. And Merz is very clear – not only does Germany need to defend its borders, but Germany needs to become the backbone of European defence.

Now, if you just consider that position between September ’21 and today, that is a huge shift in terms of the national attitude where a subject like defence is concerned. And of course, what we’ve seen in the intervening period is Russia invading part of Ukraine. And people say to me things like, “Yeah, yeah, but if there’s peace, all of this will drop away.” Unfortunately, I don’t believe that is the case.

I do not believe that if there is a cessation of violence in Ukraine tomorrow, that Merz will adopt Merkel’s previous position of we have no intention of defending our borders. I think the cat is out of the bag now. And I would love to believe that there’s going to be a cessation of violence in Ukraine, but whether there is or there isn’t, Germany will now continue to invest in its defence. We have entered a new era, whatever happens in Ukraine.

And that new era is supported by the lifting of the debt brake. Meaning that not only do we have normal defence spending of 3% GDP in Germany, but what we also have, from the last government, is a €100 billion fund, which is halfway through being spent on defence.

And then, in addition to that, following the lifting of the debt brake, we have a further €400 billion that is to be spent on defence. That’s over half a trillion of fiscal stimulus going back into the German economy to focus on defence. That is absolutely huge. It’s like nothing that Germany has seen in modern-day history, either economically or from a defence perspective.

Now, what can you point to that’s specific? What can you do to come out of those big headline numbers and say, “Yeah, yeah, but what’s really happening?” Well, something that’s really happening is that the German army has announced the formation of five new brigades. That’s 40,000 soldiers.

You probably saw earlier this week that France is contemplating returning to limited levels of conscription. Out of the five new brigades, one of the brigades – the Lithuanian brigade, the 45th Brigade – is already up and running and based in Lithuania. First time German troops have been permanently based outside of their own borders since the Second World War.

To support those brigades, the German government has issued orders of €7.7 billion. The main beneficiary of those orders is Rheinmetall. €7.7 billion of orders, on armoured fighting vehicles and associated needs around logistics.

Everything from the trailers that transport the armoured fighting vehicles (there’s a mass world shortage of those, even the Americans haven’t got enough tank transporter trailers). Everything to do with the tracks on the fighting vehicles, to the armour, to the laser rangefinders. All of these sit within the €7.7 billion order that is already issued.

And what that means is there are thousands of companies now in Germany looking to increase their production of everything associated with those fighting vehicles and those five new brigades.

And what you will see, if you look carefully, in the manufacturing figures in Germany, you will see that they have dipped slightly recently. Don’t be misled by that. That is the factories that used to produce cars, the factories that used to produce other things, that are now stopping production because they’re being converted over to the elements involved in that €7.7 billion government order.

That is not speculation. It has been issued. The money is there, it’s being passed to suppliers. The production lines will begin in the next two to three quarters. And that will need to be underpinned by industrial property.

For every €10 that is spent per year, you are going to need about €1 of rents to underpin the space that the production of the orders associated with that €7.7 billion goes into. And those are not going to be offices, those are not going to be houses, they’re not going to be retail. They are going to be factories and industrial sites that produce things for the defence industry. And that is why Sirius is so well placed in Germany at the beginning of what I believe will be a defence supercycle.

The Finance Ghost: Yeah. So, if you look at the Rheinmetall share price – I checked now while you were talking – 149% year-to-date. That tells you something about the amount of spend going into the space, and certainly the market’s understanding of that and the positive sentiment towards it. So thank you, that makes a lot of sense.

And so, just to confirm, it really is just a case of tons of new industrial space required, as opposed to overly-specialised manufacturing space for the defence industry. It sounds like there’s just this high-level demand, right, that’s going to filter down now?

Andrew Coombs: Absolutely.

The Finance Ghost: So, we’ve heard a lot now about the macro story. We’ve heard all about the German defence story and some really compelling arguments to be made there. I think we’re going to move across now to Chris. That is, the CFO of Sirius. Chris, thank you for your time today. Really good to have you here.

The question that I’d like to pose to you is mainly around capital deployment. And of course, we see a lot of capital raises from Sirius, pretty much on an ongoing basis. Andrew spoke earlier to the ‘always-on mentality’, and to do ‘always on’ in property, you’ve got to have ongoing access to capital. You’ve got to raise the stuff, and you’ve got to deploy it.

And of course, if you take too long to deploy it, then you end up with a cash-drag problem. And if you deploy too quickly out of desperation, then you end up with really bad deals. So that’s what you guys need to do, of course – is try and balance this off.

And perhaps, Chris, you can just talk us through this prioritisation and how you actually do this in terms of managing the risk of cash drag versus the risk of poor transactions?

Chris Bowman: Yeah, sure, good question. Look, I think – like lots of other facets of the business at Sirius – when it comes to raising capital, first and foremost, we are disciplined. We only raise capital when we have a really compelling acquisition pipeline to actually go and put that capital into, to ultimately create accretion for shareholders in the earnings and the FFO, which is all about the core sort of principle of Sirius: driving shareholder value.

So yes, we have raised capital a number of times and, most recently, twice in the last two years. But that’s always been off the back of having a really compelling pipeline. And I think your question expands there as to, “Okay, how do we then maintain discipline about putting that capital to work?”

Well, yeah, there are times when things change. For instance, we last raised capital in the summer of 2024, and later that year, there was a lot of upheaval politically, both in Germany (the German government changed) and obviously with the US elections. Then, we remained disciplined in that environment. And we did, we took a little bit longer to deploy capital than we had expected, but at the same time, we have the flexibility within the capital structure to be able to tweak our dividend payout to protect shareholders from that cash drag.

And ultimately, what have we done? Well, as you’ve heard from Andrew and as you’ll hear from Tariq shortly as well, we’ve now deployed €370 million into acquisitions just in the last eight months.

So, we’ve demonstrated we’ve got the capability to put really significant amounts of capital into a really exciting pipeline and portfolio of opportunities, which will drive value for shareholders in future years. So, I guess I come back to discipline, and very much discipline about creating long-term value.

The Finance Ghost: Yeah, I love that. And the discipline is in the raise as much as it is in anything else. You only raise when you need to. I think that’s a really good insight for listeners and investors to take from this. And of course, you’ve got to be disciplined in the acquisitions as well.

So, Tariq, this is where we can bring you in as the CIO, because the acquisition strategy at Sirius is always super interesting. I must say, I really enjoy reading the Sirius deal announcements. They seem to have quite a common flavour in terms of how you guys do things. I always seem to notice a big anchor tenant, and then there’s some vacancy rate to work with. There are some shorter-dated leases to work with. So, just really interesting stuff coming through there. And in the disclosure by Sirius, you even split the assets into what you call ‘value-add’ and ‘mature’, which I think speaks directly to where they are in their life cycle.

So, I’m going to open the floor to you now. Just walk us through some of the approaches that you take to these properties, and why you believe Sirius has had so much success in this area of actively managing these properties and then getting these outsized returns as a result.

Tariq Khader: Yeah, look, I’m really pleased you’ve mentioned that value-add/mature split that we disclosed, because I think that is probably the one slide in the presentation that we typically turn to, to illustrate the Sirius business model.

And it’s really a simple business model on paper. You take value-add assets, you transform them into mature assets, recycle the cash, and then reinvest in value-add assets. But how you go about that transformation, I think, is part of what we’ve built is a platform that has the capability to transform these assets.

And what we like to do is one-third of our portfolio at the moment is in this ‘mature’ bucket. So these are assets which have been through this transformation process. And these are assets which have strong cash flows (where we’re enjoying that benefit, of having stable cash flows), or assets which are being held for recycling.

But the really interesting part is that two-thirds of the portfolio which is in that ‘value-add’ bucket, because here typically these assets have high vacancy. Where we need to either put our sales and marketing function to drive leads inquiries and sales conversions, or we need to invest modest amounts of capex – low-value capex, typically in the region of €100 per square meter – to invest in these, to generate returns in excess of 30% ROI to drive occupancy and rate across these sites.

And right now, the two-thirds probably has about 300,000 square meters of opportunity for us to kind of work through. And that’s typically about a three-year runway that we’ve got there.

But how do we tie that into acquisitions?

We’re always looking for assets which have challenges for other property companies that we see as opportunities, that we know our platform has the capability to address. Now we can’t address every problem that everyone else has, but we have a specific set of criteria that we’re looking out for.

Like you’ve mentioned, vacancy is one of them. We’re not afraid of vacancy. We recently acquired an asset in Klipphausen, which is in Dresden. We knew the anchor tenant was leaving in six months, vacating the whole site. Within 12 months, we’ve managed to fill that entire site, and now it’s fully let. So we knew a lot about the area, we knew the capability of our platform, so we were confident in being able to fill that space.

We also like assets where there is very poor service charge recovery, because we have an in-house team and we have an in-house service charge process where we’re able to recover 90% of our operating costs at just over 80% occupancy. So, we have built up a way and a methodology that we’re able to optimise service charge recovery.

And lastly, what we typically love to find is spaces where other operators deem to be structural void – basements which have never been used; loft spaces; areas above factories. This is the gold dust for the Sirius model, because we love to just invest small amounts of money.

And this is where we generate those high-yielding spaces where we’re able to use targeted capex investment (again, low-value capex) to create new types of products – such as self-storage, work boxes, other flexible products – where we’re able to drive the rates up on space which we’ve essentially got for free, because it was structural void.

That’s where a lot of our returns and yield come from – through that transformation process. So, hopefully that gives you a bit of a flavour as to our acquisition approach and what we look for.

The Finance Ghost: No, it does, absolutely. It’s super interesting. And it must be quite a lot of fun, I would think, actually. As opposed to buying something that’s a yield on something that works already and you’re just managing the life of the lease. This does sound a little bit more juicy, for sure.

And I guess another source of fun for you (and sometimes it’s not fun, I’m sure. Sometimes it’s a headache, but that’s how running a business works), is that you’ve got this mix of large tenants and SMEs in your tenant base.

And I’m sure both types of tenants will have pros and cons. You’ve already talked to it there. When you sometimes have a large tenant with lumpy occupancy movements, that can create a risk which can also be someone else’s opportunity – like yours, for example. It depends on your ability to actually fill the space.

So maybe you can just walk us through, from a Sirius perspective, how you think about the mix between large and small tenants. Do you always look to have a little bit of both, or what is the approach?

Tariq Khader: I think that’s correct. We’d love to have a mix of anchor tenants on site. I think that is key for us. Stable income – a good, strong kind of anchor tenant, or a couple of anchor tenants who provide a large chunk of income. We also like to create these flexible products or high-yielding products, and these are typically where we have a high number of customers.

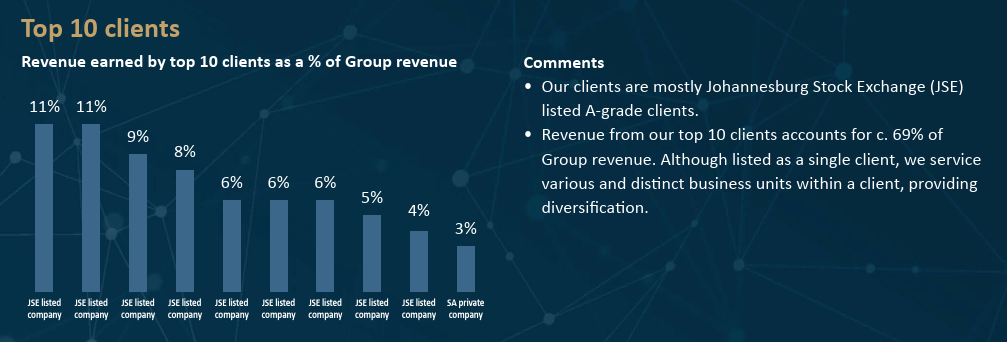

And then you’ve got the gap in between, which is the core SME market. This probably makes up about 50% of our portfolio. So, when you look at Sirius in total, you’ve probably got 40% of our customers are these anchor tenants. You’ve probably got 10% of our customer base, which are these small, flexible customers, high-yielding end. And you’ve got the core business, which is kind of that 50% SME market that we look after.

So, I think what we look to do is be a bit more flexible and adaptable. We know the anchor tenant market – that’s long, stable income; strong balance sheets; can weather the storms going through the economy. You’ve got that SME market with not as well-established companies; their balance sheets aren’t as strong. A couple of move-outs in there, you have to then go and get it.

And then you’ve got these flexible customers, where you’re turning them in and out as they leave. They don’t create too much risk because they’re so small, but you can really keep moving the price and the yield on those assets.

But our approach isn’t fixed. If we get a lot of movement in that core SME market, we can create more of that flexible space to drive the yield. Or if we’re seeing that core SME market become very strong, we can flex the smart space down and have more of that space. So, our approach is adaptable, and there are pros and cons to each. But I think being flexible allows us to kind of take advantage of all the upside there.

And lastly, I would say we have over 10,000 customers across Germany and the UK. I think having the right process and systems to be able to efficiently manage a large number of customers in a low-touch way is super important. And that’s part of what we’ve built up over the last 15 or so years, is to be able to manage that volume of customers without it kind of dragging down operations.

The Finance Ghost: Yeah. So it really is all about just looking for that yield uplift as often as you can, managing the risk, etcetera. It’s pretty much as I expected it to be, but it’s also just nice to hear about what life is really like on the ground with this stuff.

Keeps you busy, definitely. That’s what I’m hearing here, above all else. Which is not a surprise, because Sirius keeps everyone busy with the number of deals that you guys do, that’s for sure.

So we’ve heard from Chris, we’ve heard from Tariq about capital deployment and the types of properties that are being acquired. Andrew, we heard from you earlier about the macroeconomics and some of the mega trends like defence.

Let’s talk now about the regional focus, because this is something that always comes out in your announcements when you talk about new acquisitions. You tend to talk about the proximity of the properties, and I’ve always been curious about what these synergies actually are.

So maybe you could walk us through the practical stuff (of when the properties are closer together, what the benefit of that is), but also the platforms that you’ve built in these markets?

Andrew Coombs: Yes, certainly. So, look, I sort of think about the origination of the customer. The first and most basic thing we do is we capture demand, and we disintermediate agents and third parties from that process.

So, we don’t want to be talking to someone who’s saying, “You’re one of 10 people in a beauty parade. What can you do for us?” We want to be talking to a potential tenant and saying to them, “Look, we’ve got enough options for you to be so busy considering our options, you don’t want or need to look at anything else.” And in those options, we want to differentiate ourselves by adding points of value that other people don’t or can’t add.

And that can be all sorts of things. That can be as simple as a dedicated parking space, or catering in your offices during the day, or dedicated bandwidth that can be operated on a burstable level. So, you don’t need 10 Mbps 20 days a month, you just need 10 Mbps on the last day of the month, but 1 Mbps for the rest of the time. So we charge you 1 Mbps for 19 days, and you burst to 10 Mbps for the 20th, and nobody else can offer you that.

But we’re looking at being able to have a direct conversation with a prospective tenant to be able to show them real value, so that what we can do is we can sell our estate at a sensible price – a price that gives them good value, but a price that also gives us a good enough return so that we can invest in the space that they spend time in.

Then once they’re in our estate, because our properties are manned (which is, you know, unusual for industrial properties), we can say, “Look, we can focus on running the property so you can run your business.” So, we make sure that the heating is working, the snow’s removed, the wastewater’s taken out, the security on the site is right. We see you every day because we are there.

What makes that different from everyone else is we’re not an absent landlord that you have to find when something goes wrong. We’re proactive. We’re there every day, and we’re there to make sure the property runs so you can focus on your business.

And then, of course, we want to understand not just you, but your customer, because we don’t just want to be a supplier. We want to be someone who adds value to your business. So we don’t want to wait for you to say, “Our customers come and visit us, and they need a meeting room with these facilities.” We want to be able to get there before you and make those recommendations.

Then when something like Covid hits, we want to be in contact with you – as we were. We’d spotted the risk with Merkel stepping down, and we’d already effectively hedged our gas pricing. So, we were able to supply our customers in manufacturing with gas at pre-war prices all the way through the first two years of the Ukraine conflict.

That really just illustrates that point of us understanding your business well enough to understand the kind of risks that we can insulate you from in order to become your partner, rather than just your supplier.

And then of course, when the time comes for you to either expand, we want to be able to provide you that space, or if it’s leave, we would like to provide you with follow-out-the-door services. Things like virtual offices, where we can forward post, so people can still see you as being based in a location, even though you might have moved to a second city. And we will aim to try and maintain a relationship with you after you have left because we believe, in many cases, there are businesses that, from time to time, will need our services in the evolution of their business.

We think that makes us very, very different from your average property company that says, “There’s a contract, we provide the property, there are the keys, give us the money every month. We’ll see you at the end of the lease term.”

The Finance Ghost: So Chris, let’s bring it back to you then. And we did speak a little bit earlier about your capital raising technique there, of raising with discipline. And when you’ve got a strong pipeline, that’s obviously very much on the equity side.

From a debt perspective, I mean, the nature of debt is that it keeps maturing over time. So, you’ve got to manage that maturation as you go. And you’ve also got to then manage a debt-to-equity ratio when you’re raising equity, to make sure that you’re getting the right return on equity.

So, it’s a very interesting space. You are definitely the right person to ask this question to. Could you just walk us through the Sirius debt strategy and how you look to optimise your cost of debt versus your balance sheet flexibility?

Chris Bowman: Yeah, sure. Obviously, you’re absolutely right. The debt strategy is critical to the overall Sirius story. It’s an area which real estate companies can get into trouble with if they’re overly aggressive. And certainly from our perspective, we focus on being conservative with our debt strategy, and we focus on having a long-term approach as well in there.

At a high level, we have just over €1 billion of debt, which sits alongside the €1.5 billion of equity that we have listed in the stock market. So, we commit to keeping a loan-to-value below 40% despite the fact that our portfolio is actually relatively high-yielding.

So on other metrics, such as net debt-to-EBITDA, we’re north of 6x on net debt-to-EBITDA, which is really healthy. So we are very, very conservatively funded, from a balance sheet perspective, in terms of the income and our abilities continue to service that. There are no concerns at all there.

That debt stack of just over €1 billion, we then take that and we look at it and we say, “Okay, we want to have a mix of optionality and sources of debt, and we also want to have a mix of term of debt, and we also want to have a mix of both fixed and floating interest rates within there, and different levels of flexibility as well within different types.”

So at a high level, we have core debt. We have three bonds outstanding, which are listed institutional rated by credit rating agency, Fitch, at investment-grade-level bonds. They are traded in the markets; they’re owned by institutional investors. And most recently, we issued a bond in January this year for €350 million. We had over €2 billion of demand for that bond, so we’ve got fantastic support from the institutional bond markets to support Sirius.

That bond essentially replaces or refinances a bond which comes due in June ’26. So there is no upcoming refinancing on the horizon until November ’28, so we’ve got a very long runway in terms of refinancing window.

And again, that comes back to the conservatism. We went out and refinanced that early. We got great support for that. And we have a building relationship and an ever-improving cost of debt in the bond market. Our 2032 bond, for instance, has over six years left to maturity, trades in the market below 4% yield-to-maturity.

And then, alongside those bonds, we have strong relationships with some of the specialist real estate bank lenders, particularly in Germany. So, we have just under €250 million outstanding with Berlin Hyp and Deutsche PBB.

We also have lending in our JV with AXA. We run a JV on some mature assets with AXA. We have a lending relationship there with Helaba for €150 million. All of those really strong, long-term lending, that secured lending on our balance sheet, is out to 2030.

And then alongside that, I put in place a revolving credit facility (which, in simple terms, is really just an overdraft, so that’s real flexibility) for €150 million earlier this year. That is undrawn at the moment, so that is very much flexible. That’s got a five-year term, and that’s priced around 3.5% interest rate as well.

Net net, our real cost of debt today is somewhere between 3.5% and 4%. We still have one sort of super low-cost bond – the 2028 bond, which is at 1.75% – we need to refinance. But we have to take a journey from a current average cost of debt of 2.5% up to 3.5% to 4% over the coming years. But we can do that while still continuing to grow earnings and FFO. We’ve absolutely got the top-line growth to be more than capable of doing that.

The Finance Ghost: That ‘always-on’ mentality again, right? It’s not just ‘always-on’ in terms of looking at the macro and everything else; it’s ‘always-on’ in managing the debt. So, maybe that’s the key principle to actually take out of this thing.

So, Chris, I’m going to stick with you here because, as we bring this home, I’m keen to understand a little bit more about the growth outlook. And I’m going to ask Andrew just now about the dividend, which I know is a topic he’s passionate about. But first, I’m asking you about the growth outlook.

You recently said to the market that the full year’s pretty much in line with management expectations. Now obviously, you can’t disclose anything on this podcast that isn’t already out there in the market, but perhaps you could just take listeners through some of the key drivers of the outlook and what gives you confidence, at the moment, in the numbers that you have put out there?

Chris Bowman: Yeah, absolutely. So you’re right, we’ve made that statement – and we make that statement, in terms of ‘in line with expectations’ – very much from a position of confidence. And that’s in line with expectations for this year and, as well, for next year looking forwards.

Now I think, with Sirius, you get growth and you get income. So obviously Andrew will touch on the dividend, but we’re very much focused on growth as well. Because we want to provide that growth in terms of total return to shareholders, but also to be able to pay a growing dividend.

So what gives us confidence? We have organic growth. So this is our 12th year in a row now that we are on track to achieve more than 5%, like-for-like rent roll growth. So, that is in an environment where, in Germany, inflation is around 2%, and in the UK, it’s around 3.5%.

So, we have consistently more than beaten inflation in the markets in which we operate, and we continue to do that with the strength of our platform and our capital allocation. You’ve heard about acquisitions – we haven’t touched on capex, but that’s key for us as well – but also just the underlying strength of our platforms regionally. That underpins that organic growth.

And then on top of that organic growth, we have the acquisition-led growth. Which, again, you’ve heard about how we’ve put €370 million to work in the market this year on acquisitions. You don’t see the full effect of all of that income that’s associated with those acquisitions this year, because a lot of those acquisitions have just happened in months 4, 5, 6, 7, so really, the full effect comes through next year.

So, we sit here today, very confident in terms of the outlook for rent roll growth. We have to work hard for that, but we continue to be confident of achieving that – particularly in Germany, with the tailwinds that Andrew’s touched on earlier, but then into future years as well. The combination of that organic growth and that acquisition-led growth gives us great confidence.

The Finance Ghost: So just to bring it home in this podcast, we know from Sirius’s recent reporting that you’ve essentially baked in around €20 million’s worth of net operating income (NOI) from your recent acquisitions. So, that‘s obviously a nice boost to the numbers coming in the year ahead – and in the years ahead, for that matter.

But what does that mean for the dividend, Andrew, which is obviously a big focus for any investor in the space? Obviously, to the extent you can talk about it, it’s just good to give investors an understanding of what they can expect and hope for, in terms of the dividend policy going forward and the sort of numbers you’ve got on your mind.

Andrew Coombs: Well, look, the dividend’s really close to my heart. It’s close to my heart because I know people in South Africa can invest for dividends, but it’s close to my heart because, in terms of my shareholding, the dividend pays me more than my salary. So, I’m fairly well aligned, where that is concerned.

And as you know, it’s Sirius. We always pay a very well-covered dividend, never less than 1.3x. We are now into the 13th year of paying a progressive dividend. And of course, the €370 million of acquisitions that we have now made in this financial year have already generated a forward run rate into next year of €20 million of NOI, but we’re not stopping there. We’re only halfway through the year.

We will acquire more than €400 million of new property this year, which is more than the company has ever done before. And we will have baked into next year’s numbers well in excess of €20 million of additional net operating income and FFO that will contribute to the full-year effect next year.

And that will mean that our dividend will continue to grow as it has for the last 13 years. It means it will continue to be extremely well covered, and it means that we will continue on our journey towards something they call in the UK ‘dividend aristocracy’.

Apparently, if you can deliver, for 25 years, a constantly increasing dividend, that is dividend aristocracy. Well, we are now about to cross the halfway mark in our journey to dividend aristocracy.

The Finance Ghost: Very impressive goal, indeed. Thank you. It’s a really nice way to just cap it off, talking about dividend aristocracy. And yes, you’re quite right. Many investors in the property space are firmly looking at the dividend. Although certainly from a South African perspective, they like the offshore elements as well. And there are some really good stories there that have been highlighted by not just you, but also the team.

So, Andrew, Chris, Tariq. Thank you so much for your time today. Really appreciated having you on the podcast and just bringing this additional layer of detail to the Ghost Mail audience about Sirius Real Estate. And this really has been an excellent resource for anyone looking to do deeper research into Sirius.

And of course, this is a listed company on the JSE. You can go and check it out, you can go and find all of the investor relations publications. Go and do the work, do the research, obviously. This is just part of your research process.

But Andrew, Chris, Tariq – thank you so much for your time. This has been really great. Enjoy the end of the year, and I hope to do another one of these with you.

Andrew Coombs: Thanks very much, indeed.

Chris Bowman: Thank you.

Tariq Khader: Thank you very much.