The English High Court has weighed in on BHP’s Fundão disaster in Brazil (JSE: BHG)

There are still many years to go in court

The horrific Fundão disaster in 2015 is one of the biggest environmental disasters in the history of Brazil. And aside from all the toxic waste, online reports note that 19 lives were lost.

The families of the victims will live with that pain forever. As for BHP and Vale, joint venture partners in Samarco, they are living with it in court a decade later. It seems as though they still aren’t done with the legal stuff, as the English High Court has now thrown its weight behind the claims.

Despite BHP arguing that the court action in England was duplicative of the remediation and compensation that already occurred in Brazil, the English High Court found that BHP is liable as a polluter under Brazilian environmental law and the Brazilian civil code, rather than under Brazilian corporate law.

Look, I’m no lawyer and this is clearly highly technical stuff. Essentially, there are trials scheduled for 2026 – 2027 that will establish whether the losses claimed by the claimants were caused by the dam failure. There might need to be a third stage of the trial in 2028 (or later) based on individual claimants.

Interestingly, of the 610,000 people who were already compensated in Brazil, 240,000 of them are also in the UK claimant group and they have provided releases for related claims. The English High Court has upheld the validity of those releases.

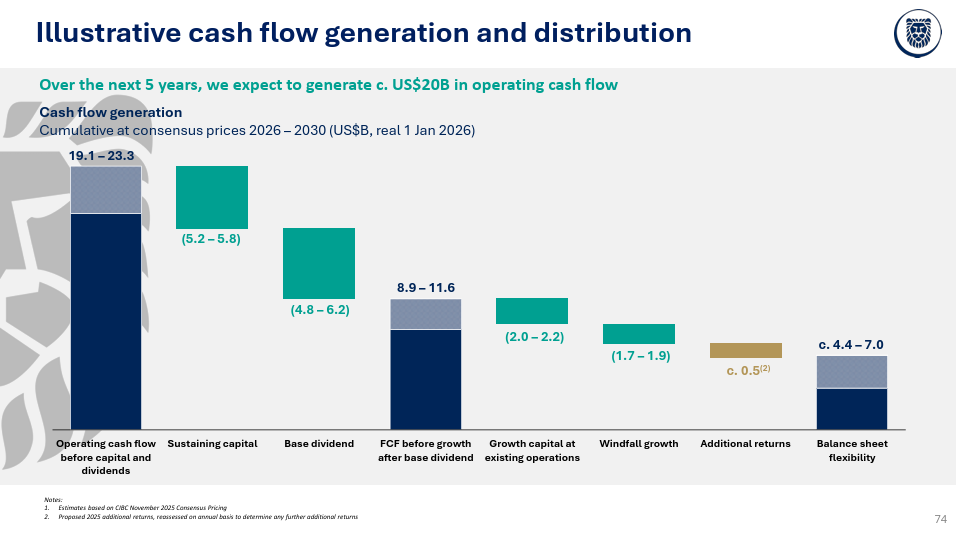

BHP notes that cash outflows related to Samarco are still expected to be $2.2 billion in FY26 and $0.5 billion in FY27. The provision on the balance sheet was $5.8 billion as at June 2025 and has now decreased to $5.5 billion. But by BHP’s own admission, material changes to this provision are possible based on how the court action moves forward.

Purely wearing a financial hat for a moment, the market hates anything that looks like a share price overhang. With a market cap of nearly R2.4 trillion though, this provision isn’t exactly going to sink the company.

CMH gets ready to repurchase up to 15% of its shares in issue (JSE: CMH)

This is a strong positive signal from management

Although there has been a significant change in the market share across leading automotive brands in South Africa, groups like CMH have managed to position themselves for a successful response to the shift towards new Chinese and Indian vehicles. In fact, the prevalence of these affordable vehicles in local showrooms is why new car sales look so good!

This has given management the confidence to move forward with a massive share repurchase of up to 15% of shares in issue. This deals with the excess cash on the balance sheet and sends a message to the market that the directors think the shares are attractive at their current price.

Due to liquidity constraints on the local market and a wish to avoid reducing the free float, the share repurchase is being structured as an offer to all shareholders on a voluntary pro-rata basis. Up to 15% of each shareholder’s shares can be sold to the company for R35.50 per share. The current share price is just over R37, so this offer is likely to only appeal to large institutional holders who struggle to monetise their stakes due to lack of liquidity in the market.

Here’s the really interesting thing: no over-elections will be allowed, which simply means that shareholders cannot sell more than 15% of their shares back to the company at this price. In other words, we don’t know what the final percentage of total shares in issue will be, but in all likelihood it will be significantly less than 15% as not every shareholder will accept the offer (partially or in full).

Don’t let the big drop in HEPS at Goldrush fool you – the operating performance is actually flat (JSE: GRSP)

The base period included a huge accounting distortion that removes comparability

I’m very grateful that we have HEPS as a performance measure in South Africa, although I noted some very concerning recent commentary from the JSE around potentially dropping it. I know that people from the JSE read Ghost Bites, so my message here is clear: please don’t do that! HEPS is a wonderful thing.

But even HEPS doesn’t capture all of the potential accounting distortions that can make one period less comparable to another. Goldrush is a prime example, as a change in accounting policy from investment holding company to consolidated accounts led to a huge unwind in the deferred tax provision in the prior period. This boosted prior period HEPS by 107.9 cents per share to 113.77 cents.

If we strip that out, we are left with 5.87 cents in HEPS. This means that HEPS for the six months to September of 7.13 cents reflects growth of over 21%, instead of a decline of 94%!

You’ll note that I described the earnings as “flat” though, so how does that align with a 21% increase in HEPS? The answer lies in operating profit, which increased by less than 0.2%. The boost to HEPS came from an increase in interest income and a dip in finance expenses, along with a decrease in the weighted average number of shares in issue.

If we dig into the business, the Bingo division was good for 5% growth in gross gaming revenue. With online gaming being a disruptive force in the industry, the group is implementing cost reductions to allow for the uninspiring growth in in-person gaming. Interestingly, despite Limited Payout Machines increasing revenue by just 4% vs. a 10% increase in the number of active machines, the group is happy to keep rolling these machines out. Ultimately, it all comes down to return on capital and where they can find efficient growth.

Sports betting stores seem to be bearing the brunt of online gaming, with existing retail stores suffering an 11% decline in revenue. Conversely, gross gaming revenue in the online business was up 23%. This comes at the cost of marketing spend in this hugely competitive environment. Interestingly, Goldrush notes that current regulations are due a refresh in response to how this industry has developed.

In case you’re wondering, Goldrush has provided funding of R92 million to Sizekhaya, the consortium that won the National Lottery licence. They expect to achieve sign-off on the operations and tech well ahead of the 1 June 2026 start date. This funding is being capitalised at the moment, not expensed. There are two court challenges in progress at the moment in relation to the award of this licence.

This is an interesting time for the company. There’s plenty to keep them busy, ranging from online gaming (both an opportunity and a threat) through to the National Lottery.

KAP is selling Unitrans Africa as part of the group turnaround strategy (JSE: KAP)

They simply cannot afford to own underperforming businesses

KAP has had a terrible time recently, with the share price down more than 60% over three years. With Frans Olivier stepping up from CFO to CEO, they will be keen to take the necessary actions to stem the bleeding and get the share price on a positive trajectory.

One such example is the sale of Unitrans Swazi Holdings to Freight-X, the company’s existing partner based in Eswatini. Unitrans is getting out of almost everything in that country, retaining exposure to only their agricultural operations.

The price is R138 million plus various vehicles and balance sheet adjustments. Based on 30 June numbers, it would come to around R214 million. The majority of the purchase price would be settled immediately, with around R41 million being due 95 days after the effective date.

The loss after tax in this business for the year to June 2025 was R1 million, so KAP is doing the right thing by unlocking proceeds that Unitrans can then use to fund capex related to the replacement of existing assets. There’s a nasty knock to the income statement on the way out though, as the net assets were carried at R253 million. This means a loss on disposal of around R39 million based on the latest estimated value of the deal.

The old adage in finance is that your first loss is your best loss. In other words: get out of something early and just take the pain before it gets any worse. Given the broader pressures on KAP, this deal seems sensible to me.

Labat Africa bounces between buyers of their cannabis assets (JSE: LAB)

It seems that “buy low, sell high” is harder than it looks

I have to get those cannabis puns in while I can, as Labat Africa won’t hold these assets for much longer. The Labat Healthcare segment was initially planned to be sold to All Trading, a related party, but that deal fell through in October. Then, a company named 64P Investments appeared and entered into a binding agreement for those assets.

“Binding” seems to mean different things to different people, as 64P Investments has subsequently withdrawn from the deal and it has been terminated. This left Labat Africa without a buyer once more, so they went back to All Trading and knocked on their door.

In the third attempt to sell this thing, the price is R23 million and it would be settled through partial settlement of existing loan amounts due to the related parties. This price is in line with the terms that were agreed with 64P Investments. Amazingly, the profit for the business was R17.5 million and independent valuations previously indicated a value of R15 million to R17 million. You won’t often see a P/E multiple below 1x!

Ultimately, shareholders are just looking for a deal that gets these assets off the balance sheet. Labat has made acquisitions in the IT space and is a completely different company these days, so the sooner this distraction is over, the better.

As this is a related party transaction that is material in size to the company, a shareholder vote will be required. An independent expert has been appointed to provide an opinion and a circular will be sent out as soon as possible.

Richemont accelerated in the second quarter (JSE: CFR)

The share price reflects the much stronger recent performance

Richemont’s share price has been on a charge recently, pushing towards the 52-week high. The share price is up roughly 30% from the lows in August, driven by a much stronger performance in the three months to September (the second quarter of the year). It’s incredible to see a company of this size bounce around like this:

To be fair, it’s been quite the year, with extreme global trade disruptions and nobody being sure what the impact might be on consumers. In the results for the six months to September, Richemont has sent a clear message that people are still buying luxury products – and at an accelerating rate.

Sales growth was 10% in constant rates and 5% in actual rates, with relative euro strength blunting the reported growth. Operating profit was up 24% in constant rates, so there’s a lovely margin expansion story here.

Jewellery Maisons led the way, with sales up 14% in constant rates. 17% growth in the second quarter reflects the acceleration that the market is excited about. This segment runs at 32.8% operating margin and the group margin is much lower at 22.2%, so brace yourself for what is coming next to make those numbers possible.

Specialist Watchmakers experienced a drop in sales of 2% for the period, although they were at least up 3% in the second quarter. Operating margin was just 3.2%, which is why the group margin is so much lower than the jewellery business. Although the Swiss watches are being affected by tariffs, it seems as though the Americas were still the best source of growth for this business. Soft demand in China was a problem.

As for the “Other” bucket, sales were up 2% for the six months and 6% in the second quarter, but it still reported an operating loss.

Diluted HEPS increased by around 5.2%, so it’s not exactly a strong growth story. The market was just happy to see improvement in the trajectory, even if there’s a very long way to go in the Specialist Watchmakers business in particular.

Nibbles:

- Director dealings:

- The CEO of Old Mutual (JSE: OMU), Jurie Strydom, bought shares worth R10 million. Separately, the company announced that a share plan with a capped value of R300 million is being put in place for Strydom. Alignment doesn’t get much better than this: the vesting of shares is based entirely on share price appreciation!

- An associate of the CFO of 4Sight Holdings (JSE: 4SI) bought shares worth R334k.

- An associate of the CEO of Grand Parade Investments (JSE: GPI) bought shares worth R67k.

- Supermarket Income REIT (JSE: SRI) announced the acquisition of a portfolio of 20 Carrefour supermarkets in France through a sale and leaseback transaction. The total price is €123 million at an attractive net initial yield of 6.6%. As a sign of the times for retailers (and their landlords), these properties have an omnichannel focus and thus affordable average rents as they aren’t necessarily in prime locations in terms of footfall. This takes the REIT’s total Carrefour exposure to 46 stores, or 10% of the gross asset value.

- Cilo Cybin (JSE: CCC) announced that for the six months to September 2025, the headline loss per share will be between 138.30 cents and 138.48 cents vs. HEPS of 0.87 cents in the comparable period. This is because of the significant once-off expenses related to the acquisition of Cilo Cybin Pharmaceutical that was effective only at the end of September 2025.

- Eastern Platinum (JSE: EPS) has very limited liquidity in its stock, so the results for the third quarter of 2025 will only get a passing mention down here. Revenue for the quarter was up 24.5% year-on-year, but for the nine months they are down 13.6%. Despite the higher revenue for the quarter, they still incurred a mine operating loss of $0.2 million. The year-to-date numbers look terrible on that metric, with an operating loss of $4.6 million vs. operating income of $8.7 million in the comparable period. The reason is that the company ceased the chrome retreatment operations and focused instead on underground operations at the Crocodile River Mine. The future of the business lies in PGM concentrate sales to Impala Platinum (JSE: IMP).

- Rex Trueform (JSE: RTO) and African and Overseas Enterprises (JSE: AOO) announced that the profit warranty related to the 51.02% investment in Byte Orbit has fallen away by mutual agreement with the sellers of the shares. The parties attribute this to a change in the commercial basis of the investment that makes the profit warranty no longer applicable.