Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Grindrod achieved a strong increase in HEPS (JSE: GND)

Whichever way you cut it, 2023 was a happy time for Grindrod

Grindrod closed 6% higher after releasing a trading statement that has great news for the year ended December 2023. There are a bunch of metrics, including total operations, continuing operations and core operations.

If you know a bit about Grindrod, the different metrics make sense. Total operations include Grindrod Bank which was disposed of in November 2022, so I would ignore that. Core operations include only the Port and Terminals, Logistics and Group segments, so that’s the best indication of how things are going with an increase of between 27% and 30%.

And in case you’re only prepared to work off HEPS from continuing operations, that’s up by between 33% and 39%.

Higher finance costs ruin the party for Motus (JSE: MTH)

You can never ignore the impact of the balance sheet

Motus is a great lesson in how the income statement and the balance sheet interact. Despite revenue being up 11%, HEPS has fallen 27%.

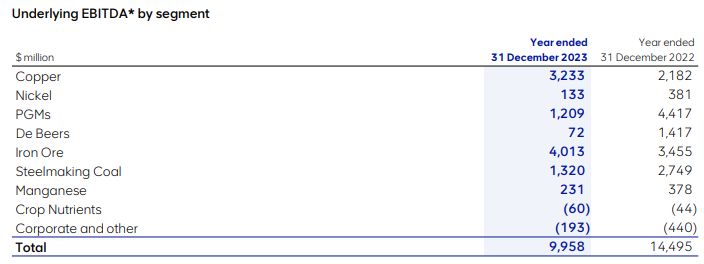

EBITDA stands for Earnings Before Interest, Tax, Depreciation and Amortisation. In other words, this captures profitability before the impact of the balance sheet (both in terms of fixed assets and how they are funded), as well as tax obviously. That part is less interesting.

With revenue up 11% and EBITDA up 13%, the group did well in terms of how costs were managed relative to revenue growth. Sadly, it uses a lot of working capital to have cars on the floor for sale, so everything below EBITDA is where it goes badly wrong. Not only did the cost of funding go up, but net debt to EBITDA jumped from 1.6x to 2.1x. Net finance costs jumped by R639 million to R1.1 billion.

Return on invested capital has fallen from 17.4% to 11.8%.

The South African business contributed 55% to revenue and 66% to EBITDA in this period. It was 65% and 77% respectively in the base period, so the poor state of the South African economy is leading to Motus being less exposed in relative terms over time. It’s also not surprising to see that bolt-on acquisitions in this period were in the UK and Australia rather than South Africa.

We can look at the stats to see why. Industry car sales in South Africa were down 3.5% for the six months to 31 December 2023. Motus has 18.1% market share in the local market. Looking ahead, naamsa is forecasting growth of around 5% in car sales for the 2024 calendar year. Clearly, naamsa isn’t reading enough company updates showing how tough it is for consumers. I struggle to see how this will be achieved.

In contrast, the UK showed new vehicle sales growth of 18.3% for the six months to December 2023. The problem is that used vehicle prices fell significantly in October and November 2023, leading to write-downs in inventory at Motus (and every other car dealer). Interestingly, 70% of Motus’ dealerships in that market are in the van and commercial business.

In Australia, 2023 was a record year for vehicle sales, with the market up 16.8% for the six months to 31 December 2023.

It’s very important to note that Motus generates higher revenue from parts sales (R2.7 billion) than new car sales (R2.2 billion) and parts sales carry a higher margin, so the sheer number of cars on the road is arguably more important than new car sales.

Still, the balance sheet pressures aren’t likely to reduce materially in the near-term, as they cannot execute a “quick and rapid” de-stocking because of commitments made to OEMs. In other words, OEMs don’t allow dealerships to cause damage to customers by selling remaining stock at a discount. Where possible, Motus will obviously try and unlock cash to reduce debt.

Rainbows and sweet sugar at RCL Foods (JSE: RCL)

Earnings growth is a lot higher than the initial trading statement suggested

When RCL Foods released a trading statement in February 2024, the guidance was that HEPS from total operations would be at least 30% higher for the six months ended December 2023. In a further trading statement, the company has delivered the excellent news that the increase will be between 31% and 45.9%.

The improvement has largely come from the Rainbow and Sugar business units, with detailed results due for release on 4th March.

Redefine releases a pre-close presentation (JSE: RDF)

This includes stats as at December 2023

With the closed period about to start on 1 March in relation to the six months to end February, Redefine released a detailed pre-close presentation that you’ll find here.

Aside from the usual stuff dealing with the strategy, it shows that occupancy dipped from 93% at the end of September (the full year) to 92.7% at the end of December. Renewal reversions did improve though, from -6.7% to -2.9%.

The office portfolio is an ongoing headache, with vacancies up from 11.4% to 12.1% and reversions worsening from -12.1% to -13.4%. The biggest problem is lower grade offices, with Secondary Grade reporting a 26% vacancy vs. Premium Grade at 6%.

The industrial portfolio saw vacancies increase from 4.8% to 5.0%, but reversions are positive at +4.8% vs. +2.1% for FY23.

In EPP, the portfolio in Poland, vacancies are pretty steady at 1.5% and reversions swung beautifully from -7.2% to +2.8%. The logistics portfolio in Poland has seen vacancies of 7.8% (up from 7.5%) and renewals up 4% vs. 6% in FY23.

The loan-to-value is expected to be 42.8% for the half-year, dropping to 42.0% by the end of the year. The target range is 38% to 41%.

SARS is shaking the tree in a big way at Sasfin (JSE: SFN)

This tax claim is over 7.5x the size of Sasfin’s market cap!

This update certainly set Twitter / X abuzz when it was announced on SENS, with SARS putting in a truly eyewatering claim of R4.87 billion related to the receiver’s inability to collect income tax, VAT and penalties allegedly owed by former foreign exchange clients of the bank.

This harks back to the syndicate that was using former employees of the bank to expatriate money.

Sasfin believes that the claim has a “very remote likelihood of success” and makes reference to a legal opinion obtained from top lawyers at ENS and endorsed by a senior counsel. This is going to be a huge overhang for an already battered share price, as it will take years until this is eventually dealt with in court.

Super Group also got hit hard by financing costs (JSE: SPG)

The banks are smiling here, even if shareholders aren’t

Super Group’s results were expected by the market as the group previously released a detailed trading statement. Although revenue was up 11.9% in the six months ended December, EBITDA was only up by 5.1% (so that’s a sign of operating margin pressures) and HEPS fell by 16.2% (a sign that finance costs went through the roof).

It’s worth noting that the revenue growth was boosted by acquisitions, so 11.9% isn’t an indication of organic growth.

The biggest part of the business on the revenue line is Dealerships, generating just under R14 billion of the group’s R33 billion in revenue. Next up is Supply Chain Africa at R9.3 billion, followed by Fleet Solutions with R7 billion and Supply Chain Europe at nearly R3 billion.

It’s a totally different story at profit before tax level, with structurally different margins across the segments and financing costs that hurt the businesses that are more working capital intensive. For example, Dealerships SA generated profit before tax of R125.5 million and Dealerships UK was just R13.2 million, which is a combined contribution of under 10% of group profit before tax. Remember, these segments were around 42% of group revenue! The Dealerships UK business was way off the comparable period profit of R91 million, having suffered the same inventory write-down problems that Motus also highlighted in that market.

Still, it could be worse. If you want to depress yourself, you could look at Supply Chain Europe which swung from a profit before tax of R38.3 million to a loss before tax of R132.2 million. Ouch.

Little Bites:

- Coronation (JSE: CML) has announced an odd-lot offer that has two strange things about it. The first is that the entire amount is a dividend, which makes it sound like individual shareholders would pay 20% tax on the entire amount received, which is more punitive than paying CGT on it. I don’t know why the company would take this route. Secondly, Coronation is trying to make allowance for opportunistic buying of odd-lots ahead of the offer, noting that they reserve the right not to make payment to shareholders that seem to have bought purely for the offer. In practice, I have no idea how they will get that right without prejudicing shareholders. Odd-lot holders (fewer than 100 shares) will be deemed to sell the shares unless they choose otherwise. Holders of 200 to 500 shares will be allowed to accept a specific offer on the same terms i.e. the default isn’t to sell.

- Quantum Foods (JSE: QFH) announced the retirement of CEO Hendrik Lourens, effective 1 April 2024. Adel van der Merwe moves into the role, having been in the eggs business since 2016 and holding previous roles at Pioneer Foods.

- Salungano Group (JSE: SLG) announced that Keaton Mining has launched an application to be put under business rescue. This is after trying to reach a compromise with creditors, which was a positive process save for one creditor who elected to proceed with a provisional liquidation application instead. This company holds the operations at the Vanggatfontein Colliery in Mpumalanga and doesn’t have anything to do with the main revenue-generating operations at Moabsvelden Colliery.

- The CEO of Datatec (JSE: DTC) entered into an equity funding arrangement that includes a put and call option structure (collectively a collar) with a put strike price of R40.40 and call strike price of R63.78. Expiry is between 30 October 2026 and 31 August 2027. The share price is R40.25. This hedges against downside risk and gives up a portion of potential upside.

- MiX Telematics (JSE: MIX) has obtained Competition Commission approval for the proposed merger with PowerFleet. Although the approval comes with conditions (as usual), they are acceptable to the parties involved.

- If you are a shareholder in NEPI Rockcastle (JSE: NRP), look out for a circular dealing with the dividend for the year and whether you want it as a capital reduction (the default option) or a taxable dividend.

- Zeder’s (JSE: ZED) special distribution has received SARB approval and will be paid on 18 March.

- Adcorp (JSE: ADR) shareholders have approved the odd-lot offer. At a share price of around R3.85, baskets of 100 shares aren’t exactly worth much.