Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

AYO Technology reports much larger losses (JSE: AYO)

This is despite a significant increase in revenue

AYO Technology has released results for the year ended August 2023. Revenue is up 28% thanks to increased revenue in the managed services and unified communications divisions, like Sizwe IT Group. Group gross profit margin fell from 22% to 16% though, so that ate up the benefit. It sounds like margin mix is a major driver here.

Most of the segments are actually profitable, except Managed Services which somehow manages to lose R719 million off revenue of R1.6 billion. Incredible.

Still one of my absolute favourite things about AYO Technology is that they invest some of their excess funds in the stock market. Nevermind returning it to shareholders so they can do it themselves; AYO Technology is quite happy to act like your asset manager and take risk with your capital. Whether or not they make good returns really isn’t the point here. I cannot think of another example where I’ve seen this in a public company when it comes to treasury management.

The headline loss per share deteriorated from -60.25 cents last year to -176.46 cents. Considering they still paid a dividend of 60 cents last year, things must be really bad for the dividend to have gone to zero.

British American Tobacco is pushing harder on non-combustibles (JSE: BTI)

When the entire business model is in flux, why do investors see this as a defensive stock?

I have a fairly unusual view on British American Tobacco, in that I don’t see it as a defensive stock. I simply see it as a company in structural decline, which means dividends probably won’t make up for capital losses. I wrote on this topic just two months ago in Financial Mail and my bearishness turned out to be correct.

On Wednesday, the share price closed 10% lower based on a business update. That dividend doesn’t look so good anymore, does it?

The problem here is that the company needs to push harder to get people off old-school cigarettes and onto non-combustibles which are supposedly healthier. Regulators aren’t overly pleased with those products either, so my suspicion is that British American Tobacco needs to create scale a lot faster in order to make it harder for regulators to take action. This is firmly a “lesser of two evils” product range.

They are talking about “Building a Smokeless World”, which is a stretch even for an ESG team that has managed to make the website look like they sell baby unicorns rather than cigarettes. It’s not exactly a “smokeless” world that we are talking about here, as the plan is for 50% revenue from non-combustibles by 2035.

In an effort to allay some of the fears of investors, the news is that New Categories as a segment will be breakeven in 2023, two years ahead of target. Currently, 10% of the world’s 1 billion smokers use New Category products.

In recognising a massive impairment of £25 billion that is mainly in recently acquired US combustibles brands, the company tries hard to make it sound like this is on purpose because of the push into non-combustibles. They also note macroeconomic challenges in that part of the world, which I suspect is the bigger story.

I am not a smoker, so I don’t pretend to understand the nuances across Vapour, Modern Oral and Heated Products as alternatives to traditional cigarettes. British American Tobacco is particularly strong in Vapour, with decent market share in Modern Oral and Heated Products as well. Heated Products don’t seem to be doing well overall, with growth decelerating.

The bull case here is that British American Tobacco is a cash cow, delivering close to 100% operating cashflow conversion. They have quite a bit of debt though, which isn’t helping things at the moment. Investors believe that the pricing power (through addiction of its customers; let’s not beat around the bush here) is enough to keep the cash dividends growing.

Guidance for full year 2023 is organic constant currency revenue growth at the low end of the 3% to 5% range. EPS growth is mid-single digits.

In a high yield world with businesses that are paying good dividends without all the concerns around long-term prospects, I continue to scratch my head at why anyone owns this stock. Heck, I even made a meme for fun:

Rubies are red; their profits are green (JSE: GML)

Gemfields is enjoying ongoing strong pricing

At a time when diamond prices are under the kind of pressure that makes those stones in the first place, rubies are doing really well. This is good news for Gemfields, which has a 75% stake in Montepuez Ruby Mining Limitada in Mozambique.

The final auction of 2023 has capped off the second highest year of auction revenue in Gemfields’ history. It’s fascinating to look at the pricing at these five auctions (per carat):

- Dec’21 – $132.47

- Jun’22 – $246.69

- Dec’22 – $154.84

- Jun’23 – $265.99

- Dec’23 – $290.02

As you can see, gemstone prices are volatile and they aren’t always comparable because of varying quality. There’s also a specific lot that has skewed the June and December 2023 auction numbers. Still, the overall message is one of success and the share price jumped 13% in response.

A weird day of news at Metair (JSE: MTA)

This is the definition of a mixed bag

It’s really not nice to read that Sjoerd Douwenga is stepping down as CEO of Metair for health reasons. He’s a youngster (certainly by CEO standards) and this is most unfortunate news, especially after less than a year in the job. I hope he will be alright.

He’s going to formally step down from 31 January and will be around until the end of March to help with handover. A successor hasn’t been named.

The other bad news is that Rombat (the battery subsidiary in Romania) has received a nasty letter from the European Commission. The letter expresses concerns that manufacturers (including Rombat) may have potentially violated EU anti-trust rules between 2004 and 2017. No further disclosure is possible at this stage and the company has two months to respond. This is only the first step in the dance and is very far from any kind of definitive ruling.

The good news in the announcement relates to Hesto Harnesses, which is a supplier to Ford in South Africa. Ford’s volumes are in line with expectations (no surprise there based on the quality of the new models in my view) and commercial negotiations are making progress. Ford shifted the goal posts during the product design phase and caused much financial pain for Metair’s business. A commercial price adjustment and cash compensation is being negotiated, which would significantly improve the remaining economic profit over the remaining model life.

So, as usual, Metair seems to have mostly bad luck. I genuinely struggle to think of an unluckier company, if you look back over the past couple of years.

Nedbank gets a major boost from Ecobank (JSE: NED)

Africa has been a significant help to local banking groups this year

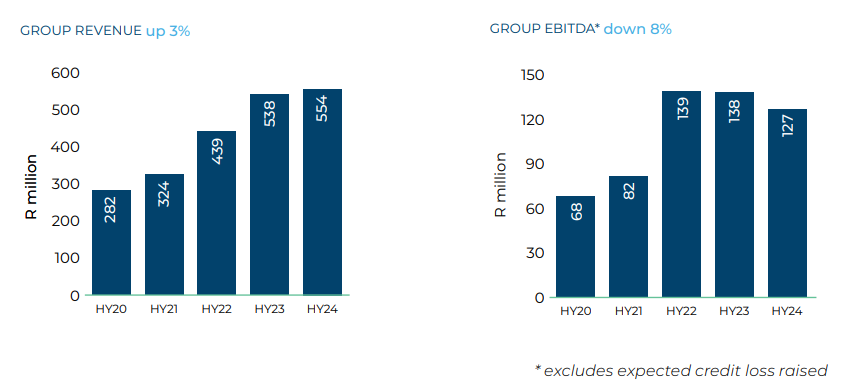

Nedbank has released a pre-close update dealing with the 10 months to October 2023. It starts off with a reminder that economic growth in South Africa is a huge and worsening headache, with the 2023 GDP growth forecast at just 0.5% (vs. 1.9% in 2022). They do at least anticipate a downward trend in inflation and hopefully a dip in interest rates.

They don’t bluntly say it, but a low growth environment with falling rates isn’t fantastic for banks.

Performance for the 10 months to October is mostly in line with the FY23 guidance given in the interim results.

Net interest income is up by more than mid-teens, with net interest margin consistent with the interim period at 418 basis points. Growth in loans and advances is still decent, but slower than in the interim period. They should end with mid-teen growth for the full year.

Importantly, the credit loss ratio is lower than 121 basis points in the interim period but above the through-the-cycle target range of 60 to 100 basis points. Retail and business banking is where the problem lies, with the other clusters within target ranges.

Non-interest revenue growth is below mid-single digits, with a slowdown in client activity and delays in closure of some renewable energy deals. Insurance income also fell. Guidance for mid-single digits for the full year remains in place, with downside risk.

The positive news is in the Ecobank investment, with Nedbank’s associate income up by a rather delicious 80%. This includes a substantial reversal of an impairment estimate related to Ghanaian sovereign debt.

Expense growth is mid-to-upper single digits, which means that the JAWS ratio should be positive for the full year.

The CET1 capital adequacy ratio is solid, which supports ongoing dividend payments at the top end of the payout ratio.

Return on equity is higher than the 14.2% reported in the interim period, as the group moves closer to the target of 15%.

Rebosis releases a business rescue quarterly update (JSE: REB | JSE: REA)

Although there is a “reasonable prospect” of rescuing the business, how much of it will be left?

I must be honest: as business rescues go, a property fund is surely one of the simpler ones. You basically keep selling properties until you’ve gotten the creditors and overall levels of debt under control. If there is any equity value in there, it takes a lot of digging to find it.

In its obligatory quarterly update, Rebosis reminded the market of sales achieved before 31 August 2023 of R7.6 billion. It’s been pretty slow going since then, with sales of only R160 million.

And of course, being property transfers, these sales take a while to go through.

The business rescue practitioners have managed to preserve the employment of around 75% of affected employees. This has been achieved through engagement with the buyers of the properties.

Schroder Real Estate signs off on a tough year for the NAV (JSE: SCD)

When rates go up, property values come down

Schroder Real Estate has released results for the year ended September 2023. They reflect a difficult year that saw the NAV per share drop by 8.9%, with asset valuations coming under fire in an environment of higher yields and geopolitical risks.

Looking at earnings tells a different story, with earnings up 31% thanks to rental growth and acquisitions, along with a low average interest cost of 2.9% that is 100% hedged against rate movements.

The loan to value ratio is also quite low at 24%, with many funds operating at well over 30%.

If we’ve now seen the top of the rate cycle, the next year should be a lot easier for the group. The company has announced a dividend of 1.48 euro cents per share, payable in January 2024.

Texton: another local stock I won’t touch (JSE: TEX)

The capital allocation strategy is terrible for minority shareholders

When a company raises capital on the markets, the immediate things to look out for are (1) the price of the capital raise vs. what the directors told you the group is worth, and (2) what the proceeds will be used for.

Sometimes, only one of those things is problematic. Occasionally, you get a proper mess that is cause for concern on both metrics.

Texton trades at a large discount to net asset value (NAV) per share, like so many property funds. Where a company like Calgro M3 has done a great job with share buybacks far below NAV (and just look at the effect on the share price), Texton has instead been on an empire-building mission by clutching onto the capital for dear life. Instead of large buybacks, the fund has invested in offshore funds.

It’s very hard to understand why any investor wants to own something with a costly structure and a strategy of redeploying capital into the hands of other investment managers overseas.

It’s going to be even harder to understand that decision after this rights offer at R2.20, when the NAV per share is 619.37 cents. The capital raise is at a 10% discount to 30-day VWAP and a vast discount to NAV per share. That is a big red cross against the first metric given above. As for the second metric I put forward, the capital will be used to reduce debt (they could’ve done that before), support capital projects (ditto) and, wait for it, further fund the group’s capital allocation towards the offshore deployment strategy. I can only interpret this as Texton wanting you to give them money to invest on your behalf in more offshore funds.

The rights offer is non-renounceable and will not allow for excess applications, so there’s another tick in the box for hurting minority shareholders. And best of all, there are underwriters for the portion of the R85 million offer that hasn’t already been committed to, with a 1% fee paid to the underwriters. Those underwriters are Oak Tech Properties and Rex Trueform Group.

This ticks basically every box for hurting minority shareholders and treating them poorly. Texton will never, ever see my money.

Tharisa can’t escape the PGM downturn (JSE: THA)

Earnings for the year ended September 2023 have dipped considerably

In case you’ve been under a rock this year, the platinum sector has been getting hammered. Tharisa enjoys a buffer from its chrome operations, but it still can’t escape the broader pressure of much lower commodity prices.

The group has done what it can in terms of using operational flexibility, like adjusting the timeline for the Karo Platinum project to adjust for weak PGM prices.

In a trading statement dealing with the year ended September 2023, Tharisa noted a drop of between 30.7% and 33.1% in HEPS. This puts HEPS at between 27.5 and 28.5 US cents. The share price closed 2.4% lower at R14.

There’s a sting in the Tongaat Hulett business rescue tail (JSE: TON)

Two new court applications have thrown the whole thing into uncertainty

When I open a court affidavit and see that it is 430 pages long, then my first thought goes to what shiny new cars the lawyers will be buying at the end of this process. Rest assured, the biggest winners of all in these situations are the attorneys and advocates.

In addition to the separate attempts by RCL Foods and the South African Sugar Association to stop the plans in their current form, Tongaat Hulett faced another setback in the form of a rather juicy judgement dealing with the statutory obligations of companies in business rescue. I wish I had the time to read all 74 pages properly, but I enjoyed skimming them. Long story short, the judge didn’t grant an order that allows Tongaat Hulett to avoid settling an industry levy.

So, not only is that a big knock to the financial situation of Tongaat Hulett, but there is now a court process underway that could cause further delays and/or the current plans being declared unlawful. Part of the problem as I understand it is that the levies haven’t been built into the plans, so RCL Foods and the South African Sugar Association want that rectified. You may recall that RCL Foods suffered financial loss as they needed to pay up the additional levies to the association as a result of Tongaat’s non-payment.

This is likely to impact the final distribution of proceeds, assuming one or both of the current deals can go ahead.

The soap opera continues.

Little Bites:

- Director dealings:

- The CEO of Omnia (JSE: OMN) received a large vesting of shares and only sold enough to cover the tax. When just the taxable portion was R12.9 million, the remaining amount is a large enough temptation that this counts as a meaningful positive signal on the share in my books.

- The CEO of Invicta (JSE: IVT) and Dr Christo Wiese seem to be joined at the hip. They each bought shares worth a total of nearly R265k and in two very similarly sized tranches.

- Various associates of the CEO of Spear REIT (JSE: SEA) transacted in shares, with a net sale of around R34k across the associates.

- Back in August 2023, Aspen (JSE: APN) announced an agreement with Eli Lilly to distribute and promote Lilly’s products in South African and other Sub-Saharan African countries. All conditions precedent have been fulfilled and it will come into force on 1 January 2024.

- Southern Palladium (JSE: SDL) released the results of metallurgical test work from the UG2 Reef. It indicates potential 4E PGM recovery rates of 85%. A new Mineral Resource update is due for release shortly. The scoping study for the Bengwenyama project is due for release in January 2024.

- Calgro M3 (JSE: CGR) has been busy with its share repurchase scheme that has been a wonderful driver of recent share price performance. Used properly, share repurchases are excellent. From 8 August to 4 December, the company repurchased 3.02% of issued shares (calculated based on the date of the AGM in June), with an average price of R3.95 per share. The current price is R4.20.

- MTN (JSE: MTN) announced that group COO Jens Schulte-Bockum will vacate this role when his fixed-term contract ends in March 2024. He will be replaced by Selorm Adadevoh, an internal promotion. Adadevoh’s current role is as CEO of MTN Ghana, with Stephen Blewet now appointed to that role as another internal promotion.

- The CEO of Brikor (JSE: BIK) has sold shares worth R18 million under the mandatory offer.

- Oando Plc (JSE: OAO) is currently involved in a court petition that has been adjourned pending the company filing its scheme of arrangement document.