MultiChoice Group (MCG, or the group), Africa’s leading entertainment company, executed well on its operational objectives during the six months ended 30 September 2023 (1H FY24).

Note: this article has been provided by MultiChoice and does not reflect any views or editorial content by The Finance Ghost

Building on its track record of investing in technology to be ahead of the curve, and to accommodate shifts in consumer video consumption trends to support future growth, the group continued to transition strategically with an increased investment in Showmax, ahead of an exciting re-launch in the second half of this financial year.

“We remain focused on developing our leading entertainment platform that caters for consumer needs across sub-Saharan Africa, on leveraging our footprint to build a differentiated ecosystem and on developing additional revenue streams,” says Calvo Mawela, Chief Executive Officer.

The overall excitement around three world cups, culminating in the Springboks emerging victorious as back-to-back Rugby World Cup champions, supported subscriber activity. A highlight of the interim period was the South African Premium customer base, which grew 5%, a positive trend for the first time in many years.

Although profitability came under pressure due to ongoing power interruptions, cost of living pressures and sharp depreciation in local currencies against the US dollar, the impact was mitigated by a change in focus towards subscriber retention, an improved customer mix, as well as ongoing pricing and cost saving disciplines to protect the resilience of the business. As a result, the group maintained a positive trading profit margin of 3% in the Rest of Africa (a ZAR2.2bn organic improvement YoY) and delivered a 31% trading margin in South Africa.

Salient points for the 1H FY24 period included:

- Group revenue: ZAR28.3bn, down 1% (up 4% organic) due to weaker local currencies and consumer pressure, offset by conversion benefits of a weaker ZAR on the group’s USD reporting segments and inflationary-led price increases in the majority of the group’s markets.

- Subscription revenues: 3% higher on an organic basis, attributed to strong growth in Rest of Africa (+14%) and Showmax (+25%), offset by pressure in the South African business (-4%).

- Group trading profit: increased 18% on an organic and like-for-like basis (excluding the additional investment in Showmax), reducing to a 10% improvement once the investment in Showmax is considered. On a reported basis, trading profit was 18% lower at ZAR5.0bn, impacted by foreign exchange headwinds of ZAR1.7bn, Showmax trading losses of ZAR0.8bn and a lower contribution from South Africa. Focus on cost optimisation delivered ZAR0.5bn in cost savings.

- Total content costs: up 10% (+ 4% organic), driven by ongoing investment in local content (+16% YoY) and several World Cups hosted in the first half of the year.

- Core headline earnings: ZAR1.9bn, down 5%, impacted by the same drivers weighing on trading profit, with some offset from realised gains on forward exchange contracts and lower tax and minorities in South Africa.

- Adjusted core headline earnings (incorporating the impact of losses incurred on cash remittances in markets such as Nigeria): increased 25% to ZAR1.5bn, resulting from lower losses on cash remittances as the gap between the official and parallel naira rates narrowed following the material depreciation in the official naira rate during the period.

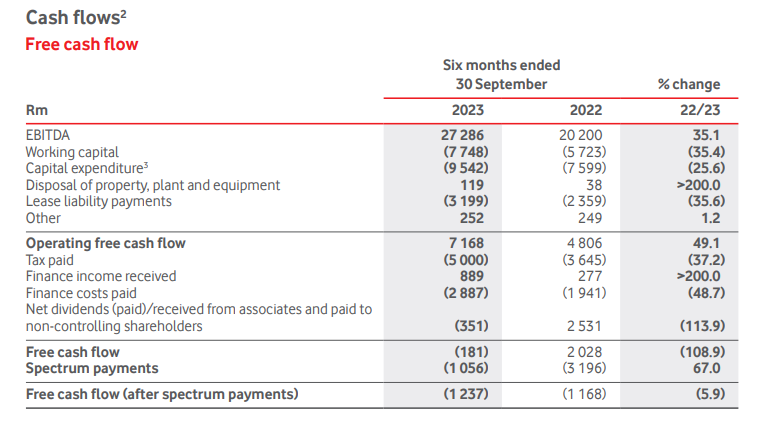

- Free cash flow: ZAR1.1bn, impacted by the increased investment in Showmax and a lower contribution from the South African business.

- Retained cash and cash equivalents of ZAR5.6bn and access to ZAR9.0bn in undrawn facilities; financial debt stable at ZAR8.1bn with Net debt:EBITDA of 1.30x.

The group continued to deliver compelling local content and enable its audiences to access internationally renowned entertainment shows. Playing a vital role in supporting and developing the continent’s wider video entertainment industry, it has increased its spending on local content by 16% YoY, taking its local content library to almost 80,000 hours. Going forward, the group plans to enhance the monetisation of each hour of content produced by leveraging both its linear and streaming platforms.

Several new titles were launched to maintain strong momentum in leading local language programming. In addition to the successful debut of Shaka iLembe on Mzansi Magic; Gqeberha: The Empire replaced The Queen in its time slot; and Umkhoka: The Curse continued to grow in viewership and social media engagement during the period. M-Net launched the higher-end series 1802: Love Defies Time on 1Magic. kykNET introduced a new medical procedural drama, Hartklop, and a new cooking reality show, Kokkedoor: Vuur & Vlam, both of which commanded strong audience share. Big Brother Naija entered itseighth season, delivering record advertising revenues in local currency.

Following on from the success of the FIFA World Cup in FY23, SuperSport yet again demonstrated its ability to deliver an exceptional sport offering, successfully broadcasting three World Cup events in the period – the FIFA Women’s World Cup, the Netball World Cup and the Rugby World Cup – followed by the Cricket World Cup, which aired post period-end.

As part of its broader “Here for Her” campaign, SuperSport provided a world-first all-female broadcasting crew to produce the Netball World Cup in Cape Town, which was shortlisted at the Sports Business Awards for “Best Sporting Event of 2023”.

Beyond World Cup coverage, SuperSport’s broadcast of the Comrades Marathon in June 2023 was the biggest production in SuperSport’s history. The group continued telling the best of local sport stories and is proud of its latest documentary series, Pulse of a Nation, which documents the history of football in South Africa. SuperSport also secured several rights in its portfolio to provide viewers with a wide variety of choice.

MultiChoice also remains committed to making school sport accessible to all levels of society through its SuperSport Schools platform, which grew its user base by 69% over the last six months, providing a valuable stage for identifying the next generation of South Africa’s sporting stars.

Operational performance review

South Africa

- The challenging consumer environment persisted into 1H FY24. Loadshedding remained the most immediate challenge in terms of subscriber activity, with the number of active days per subscriber declining by 5% due to a significant increase in both frequency and intensity of loadshedding, especially in Q1 of the reporting period. Premium and Compact bases showed improved stability compared to the latter part of FY23.

- The group reported a 5% decline in 90-day active customers to 8.6m (3% of which can be attributed to the decision to end the short-term campaigns implemented in the prior year to support customers during loadshedding), with active customers amounting to 7.8m. More stable trends in the mid- and upper segments of the customer base, along with inflation- linked average price increases of around 4%, helped limit the decline in monthly average revenue per user (ARPU) to 2%.

- Various initiatives were implemented to protect the economics of the segment and to help offset macro and consumer challenges weighing on the performance of the business into the second half, a period which is typically affected by the seasonally higher cost of the football in decoder subsidies through increased device pricing in our linear business and the relaunch of DStv Stream, which has more than tripled its subscribers since March 2023, albeit off a low base. Encouragingly, over 90% of DStv Stream subscribers added in the period are new subscribers to DStv, who find the connected product without hardware installation more appealing. The pricing and value proposition of the DStv Business Play packages were also recalibrated which led to a 37% increase in month-on-month revenues for this segment in September 2023.

- Revenues declined by 3% to ZAR16.5bn, impacted by a 4% decline in subscription revenues and a reduction in decoder revenues due to the shift in strategy, offset by 31% growth in insurance premiums and a doubling of DStv Internet revenues. The segment delivered a trading margin of 31%, with Showmax now reported as a separate trading segment. In absolute terms, the lower revenues and negative operating leverage resulted in trading profit trending 17% lower to ZAR5.2bn, impacted by the ongoing investment in local content and sport, partially offset by cost saving initiatives and reduced decoder subsidies.

Rest of Africa (RoA)

- After adding 1.4m new subscribers in FY23, subscriber growth in the Rest of Africa was more subdued in 1H FY24. This was due to the impact of inflationary pressures in key markets like Nigeria, and similar trends to previous periods which followed a FIFA World Cup or northern hemisphere football off-season. A total of 0.1m subscribers were added to end the period at 13.0m 90-day active subscribers. The active subscriber base was broadly stable at 8.9m subscribers and subscription revenues grew 14% organically.

- Revenue of ZAR10.5bn was flat (+13% organic) with a weaker ZAR against the USD on conversion, offsetting the impact of weaker local currencies relative to the USD. The RoA segment delivered a trading profit of ZAR330m (+ZAR2.2bn YoY on an organic basis) which was underpinned by specific cost interventions around decoder subsidies and content costs.

- Weaker currencies remained a significant impediment to improvements in profitability, with average first half exchanges falling sharply against the USD. The sharp fall of the naira resulted in a large proportion of the previously recognised losses incurred on cash remittances now being recorded in trading profit. The net effect of these forex movements was a negative ZAR1.6bn impact on the segment’s trading profit for the period.

Showmax

- The Showmax partnership with Comcast (owners of NBCUniversal, Sky and Peacock) was concluded on 4 April 2023 and significant progress has been made in preparing for launch later in this financial year. This service, which is set to benefit from rising connectivity and smart device uptake that enhances accessibility and scalability, will enable MultiChoice to double its customer base and deliver an additional USD1bn revenue in the medium term.

- Showmax (now reported separately from the South African segment) saw its active subscriber base increase by 13% YoY, resulting in revenues growing 46% (+45% organic) to ZAR0.6bn. As the group continues to support the existing business and invest behind the new platform, operating costs increased in the short term, resulting in trading losses increasing by ZAR0.5bn to ZAR0.8bn.

Technology segment

- Irdeto’s external business delivered 17% topline growth (+4% organic) due to the weaker ZAR against the USD, market share gains in its core media security business and the provision of its managed services. Irdeto’s connected industries initiatives continue to build momentum, most notably in the Keystone product line where Irdeto secured additional customer wins in the construction equipment space.

- Trading profit was affected by once-off restructuring activities in the core media security business as the business adapts to the changing media landscape, and increased by a modest 1% on an organic basis.

- On a standalone basis, Irdeto generated revenues of USD98m (ZAR1.8bn), down 7%. Trading profit of USD15m (ZAR0.3bn) was lower than the prior period as a result of the non- recurring benefit from elevated FIFA World Cup orders in the prior year, as well as the restructuring costs.

KingMakers

- KingMakers continued to deliver strong underlying operating momentum despite the impact of the weaker naira and challenging macro environment in Nigeria. The business delivered organic revenue growth of 22%, led by strong growth in its online sportsbook which saw active users increase 17% and its revenue contribution grow by 40% YoY. The weaker naira resulted in reported revenues increasing only 2% to USD95m (ZAR1.8bn). KingMakers reported USD10m in EBITDA and narrowed its loss after tax to USD8.6m (ZAR0.2bn) for the first six months to June 2023.

- The core development focus for KingMakers was preparations for the soft launch of SuperSportBet in South Africa on 9 November this year. The expertise of the KingMakers team combined with the strength of the SuperSportBet brand and exclusive partnerships uniquely positions the group to leverage the opportunity for future revenue and gain market share in this large and growing addressable market.

- KingMakers is focused on optimising the profitability of its agency business and growing its higher-margin online business that, together with the opportunity presented by the new South African business, will support its path to sustainable profitability.

- The product and market expansion plans are fully funded with KingMakers having USD134m (ZAR2.5bn) of cash at period end (being June 2023).

Moment (Fintech)

- The Moment joint venture made significant progress in integrating with group core payments infrastructure and remains on track to commercialise its local services in 2H FY24.

- In addition, Moment prioritised payment service integrations for the Showmax business to support the streaming platform’s launch in 2H FY24. The platform is set to deliver returns equal to the initial investment within a 20-month timeframe and will become increasingly important to the success of the group’s ecosystem in future, providing simplicity to customer payment options, more integrated rewards platforms and B2B revenue opportunities.

Future Prospects

“MultiChoice has a compelling growth strategy in place, which is partly driven by the opportunity to capture sustainable long-term growth through our targeted investment in streaming and partly by the need to absorb increased external economic pressure on the business and its consumers in the short-term. Our priority is to navigate both sets of demands to ensure the group operates sustainably through the current economic cycle and long into the future, while delivering attractive shareholder returns.” says Mawela.

The focus remains on driving further efficiencies in operating expenditure, as well as working capital and capex decisions, to ensure consistent and optimal returns on all capital deployed. At the same time, the group continues to seek ways to support or improve the economics of the business through pricing decisions, optimising customer mix and content monetisation, as well as calibrating decoder subsidies according to the macro-economic backdrop.

The group is also carefully investing behind nascent or future business lines, taking into

account the strategic importance and prospects of success.

“The second half of FY24 will be an important period in our journey to expand our ecosystem beyond Africa’s leading linear pay-TV operator into a broader ecosystem of interactive entertainment and consumer services to enable us to double our customer base to 50 million over the next five years. The relaunch of Showmax, combined with KingMakers’ entry into the South African market with SuperSportBet, and Moment’s platform launch are all important milestones as we accelerate growth and drive additional scale, creating a ‘world of more’ for customers and additional value for shareholders.” Mawela concluded.

THE FULL RESULTS SUITE CAN BE VIEWED HERE >

VIEW THE RESULTS ANNOUNCEMENT BELOW

MultiChoice-Reviewed-Interim-Results-Announcement