Heriot REIT is keeping it in the family (JSE: HET)

Heriot is selling assets to its controlling shareholder and using the proceeds to reduce debt

The first transaction saw Heriot REIT sell R8.8 million worth of shares in listed property group Safari Investments to Heriot Investments (the controlling shareholder of Heriot REIT). This was executed on 30 June.

The second transaction is the disposal of Hagley (owner of a property in the Western Cape) for R40.3 million, also to Heriot Investments. This property carries development risk and so the listed company is moving that risk to its controlling shareholder. Importantly, the listed group has the option to acquire Hagley’s equity at a price equal to the current selling price plus additional development costs, less liabilities. This means that if Heriot REIT and its shareholders really want that property back, it will be possible for a period of time.

The proceeds of both disposals will be used to reduce debt at Heriot REIT.

Hudaco suffers margin contraction (JSE: HDC)

Not every industrials group can enjoy positive operating leverage in this environment

For the six months ended May, Hudaco increased turnover by 12% and operating profit by only 3%. HEPS was up by 8% and so was the interim dividend.

Nobody is going to cry into their soup over 8% growth in the dividend, but it’s a pity that operating margin contracted from 12% to 10.9%. Also keep an eye on the balance sheet, where borrowings rose by around 27% in response to working capital pressure and greater investment in inventories.

In the consumer-related products segment (which has twelve different businesses contributing 53% of group sales and 59% of operating profit), sales were up 13.2% and operating profit fell by 2.8%. This segment faced the worst of the margin pressure, with operating margin of 13.1%.

The engineering consumables segment (47% of sales and 41% of operating profit) grew sales by 11.8% and operating profit by 4.3%. Operating margin was 10.1%.

The major acquisition currently underway is the Brigit group of companies, operating in the fire safety space. The initial payment is R143 million and the maximum price is R315 million based on a two-year earn-out structure. They’ve paid a meaty multiple for this business, but the earn-out does give some protection.

Hudaco is also very critical of government in the prospects section, although it sounds like sensible people wrote the announcement rather than the wild tirade at Argent Industrial. Unlike Argent, Hudaco is still investing in the South African economy.

Implats: finally, the love for RB Plats is unconditional (JSE: IMP | JSE: RBP)

This love story had more twists and turns than a Shakespearean classic

After a tale of courtship and no shortage of bitterness in the rivalry with Northam Platinum, we have finally reached an outcome where the Impala Platinum offer to Royal Bafokeng Platinum shareholders has met all required conditions.

I think we are all pretty happy to see the end of SENS announcements extending the long stop date. Long, indeed.

The last date to trade the Royal Bafokeng Platinum shares in order to participate in the offer is 18 July.

MC Mining has good news for shareholders (JSE: MCZ)

The Life of Mine and coal reserve estimates for Makhado have improved

In junior mining, it’s all about projections for a specific mine and how successfully funding can be raised. The happy news for shareholders of MC Mining is that key estimates have been revised upwards.

At the Makhado Project, mine life is up 27% vs. previous estimates and the annual mine production rate is estimated to be 25% higher, which would help bring the mine down the cost curve (i.e. make it more efficient and more profitable). However, the time to first production has increased from 12 months to 18 months, with the payback period (3.5 years from date of construction) unchanged because of the improved characteristics of the site.

The project is believed to offer a post-tax return of 37%.

MC Mining owns 67.3% of the Makhado Project.

Nampak is one step closer to a rights offer (JSE: NPK)

A 250-for-1 share consolidation is seen as an important first step

It tells you something about the future pricing of the rights offer that Nampak is worried about a share price of 75 cents per share and what that might mean for the offer. To create more room for the pricing to play out, a 250-for-1 share consolidation has been almost unanimously approved by shareholders.

This literally means that every 250 shares in issue will become 1 share. In other words, the price should end up roughly 250 times higher because the number of shares in issue will change. The market cap (price multiplied by shares in issue) theoretically isn’t affected.

Nictus is a good reminder of furniture retail economics (JSE: NCS)

Only the insurance segment was profitable this year

Nictus is surely the smallest listed company that is a genuine operating entity that makes an effort to report decently to shareholders. Despite a market cap of R30 million, this little group conducts itself properly.

In the year ended March, revenue only increased by 4.1% but HEPS was up by 66%. The dividend increased by a similar percentage to 5 cents per share.

Looking at the segments, furniture retail made a loss of R0.9 million off revenue of R37 million. The insurance segment did far better, with profit of R5.2 million off revenue of just R9.8 million.

The shares don’t trade very often, with the last trade at 55 cents and a bid-offer spread wide enough to fit an entire furniture store into it.

PBT Group is coming under margin pressure (JSE: PBG)

In a consulting business, margins are very important to watch

When you are selling time, there are only two ways to increase margin: charge more per hour or improve the utilisation rate of staff. And of course, that has to happen without the added value being paid to staff to retain them.

It’s not easy. Globally, businesses like Accenture manage to get it right. PBT Group has done exceptionally well over the past few years, but the results for the year ended March 2023 show that these pressures eventually come through the system.

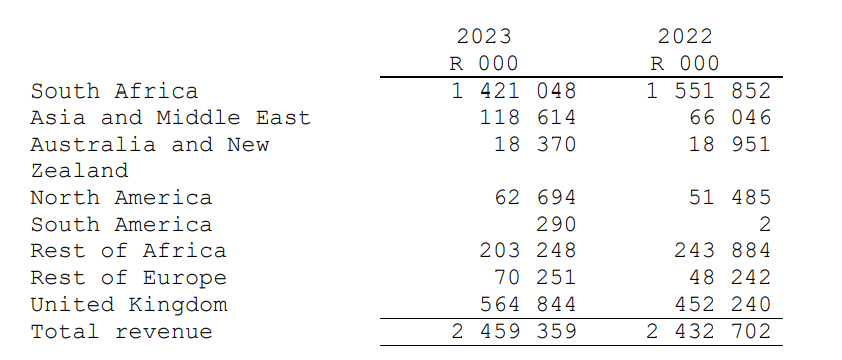

Organic revenue growth of 11.8% is very strong after an excellent FY22, but EBITDA only grew by 2.5%. HEPS actually fell by 6.3%, or 0.9% on a normalised basis.

In South Africa, revenue was up 13.5% and EBITDA was 8.3% higher, with margin pressure attributed to cancellation of two large-scale projects and general cost pressures. The successful redeployment of staff does say something for the resilience and adaptability of the business model.

The European and UK business is only 3% of group revenue. It delivered 15.3% revenue growth and EBITDA growth of only 1.3%, with sales team incentives paid for the first time in this financial year. The goal here is to sell services in euros and pounds while providing that service with a rand cost base. It’s not hard to see why that is lucrative.

Australia is a problem, as is so often the case for South African companies. Revenue fell by 15.3% and EBITDA swung horribly from positive R5.3 million to negative R3.3 million. This is small in the context of group EBITDA of R142 million, but it’s big enough to have ruined the group year-on-year growth rate.

Overall, this environment is going to be tougher for PBT than over the past couple of years. Clients are pushing back against pricing increases and staff are demanding increasingly higher remuneration packages, so margins get squeezed in the middle.

The company has declared a gross dividend of 16.50 cents and a capital reduction distribution of 16.50 cents.

You can engage directly with the management team by registering for the next Unlock the Stock event on 13 July. Find the link here>>>

Primeserv achieves solid dividend growth (JSE: PMV)

Modest revenue growth of just 4% wasn’t the star of this show

Although Primeserv could only grow its revenue by 4% for the year ended March, there were significant non-recurring costs in the base year and this meant a 27% increase in operating profit. HEPS increased by 28% to 23.42 cents, so the current share price of R1.30 is a Price/Earnings multiple of 5.6x.

The dividend increased by 20%. It helps that the group is ungeared, as debt in this environment is where dividends go to die. Instead, shareholders get to enjoy the spoils here.

RMB Holdings: updating its “orderly monetisation” (JSE: RMH)

Following the disposal of Atterbury Europe, the biggest component of value is Atterbury

RMB Holdings has nothing to do with investments in FirstRand or RMB anymore. All that is left in this legacy structure is property assets, which will be wound down on an orderly basis. In other words, shareholders should at some point be repaid all the value in the company. These things are easier said than done.

The disposal of Atterbury Europe to Brightbridge Real Estate was concluded in September 2022. There was also a large special dividend in October, with these events being the main reason why the net asset value (NAV) per share has fallen by 64% to 100.3 cents.

The current share price is 49 cents, so there is a sizable discount to NAV.

The relationship with Atterbury is a little awkward at the moment. There is a facility in place with RMB (the bank – which RMB Holdings no longer has a stake in) and if Atterbury feels that it doesn’t have sufficient cash resources to repay the debt, it can elect to issue ordinary shares instead. This would presumably dilute the RMB Holdings stake. Atterbury wants to take that route and RMB Holdings wants to avoid it, with the parties going through arbitration.

The other legal distraction is a s164 dissenting shareholder fight, with a group of shareholders with 1.3% of the company’s share capital demanding to be paid out at fair value. The use of s164 remains contentious in South Africa, with several examples of what can best be described as an opportunistic use of the legislation to unlock profits.

Finally, RMH is going to change its year-end to September. Atterbury’s year-end in June and this allows RMH to use the Atterbury year-end financials in the preparation of its own results.

SA Corporate Real Estate expects earnings to fall (JSE: SAC)

A pre-close update suggests a 12% to 14% drop vs. H1 of last year

In a pre-close update for the interim 2023 period, SA Corporate Real Estate flagged modest growth across most of the portfolio and a nasty further drop in the office portfolio.

In the retail portfolio, vacancies are down but so is the retention rate. Reversions have gone negative again, reflecting pressure in this sector. The group expects a return to positive reversions by the end of the year.

The industrial portfolio is small but working well, with steady occupancy and positive reversions.

The same certainly can’t be said for the office portfolio, where vacancy rates are up and reversions are still negative at -3.7%. The only good news is that the reversion is far less negative than it was in the prior financial year.

In the residential portfolio, the group is managing to put through 3% increases on rentals.

In Zambia, vacancies have dropped and reversions are positive 3%.

The loan-to-value ratio is around 37%, down from 38.1% at the end of 2022.

Strategically, the group is in the process of trying to acquire all the shares in Indluplace, which would create a much larger residential property platform overall.

Little Bites

- Altron (JSE: AEL) has finalised the disposal of the ATM Hardware and Support business in Altron Managed Solutions to NCR. The purchaser needed to finalise a VAT registration with SARS as the final step in the transaction.

- In case you wondered what happened to Conduit Capital (JSE: CND), the group is still dealing with the liquidation of Constantia Insurance Company Limited. As this represents 94.4% of group revenue, this has clearly made it difficult to audit the group financials. Nonetheless, they are expected to be released during August 2023. As part of this, the group is changing its accounting policy to apply investment entity rules.

- Salungano Group (JSE: SLG) has added its name to the list of companies that can’t release results within three months of period end. Results for the year ended March will only be released by the end of July due to delays in finalisation of the audit, specifically relating to funding refinancing agreements.

- You can also add Acsion Limited (JSE: ACS) to that list of companies that can’t cope properly with being listed, with results due on 7 July. The year ended was February, so this is quite late now. No reason is given for the delay.

- The underwriters for the Choppies (JSE: CHP) rights offer have taken up a big chunk of shares, as only 51.36% of the total shares to be issued were subscribed for by existing Choppies shareholders. This includes excess applications. Ivygrove subscribed for 37.65% of the offer and Export Marketing for 11%.

- The unbundling of AYO Technology (JSE: AYO) by African Equity Empowerment Investments (JSE: AEE) has been approved by the AEEI shareholders. Separately, AYO renewed its cautionary announcement related to engagement with the JSE regarding implementation of the settlement agreement with the PIC.

- Encha Properties has made it through almost 4 million of the intended sale of 5.5 million to 6 million Vukile Property (JSE: VKE) shares as part of a loan arrangement with Investec bank.

- In a rather offensive abuse of my brand colour, I found out on Friday that Steinhoff (JSE: SNH) referred to the WHOA Restructuring Plan as Project Purple. Not all purple things are good for you, I’ll tell you that much.