Many wrongs make a right(s) offer

EOH says there is “significant interest” in its rights offer – but it is fully underwritten anyway!

A rights offer of R500 million by EOH isn’t fresh news. In fact, shareholders approved it back in December, with the circular due to be released on 23 January.

This was inevitable. I’ve been writing about it since I walked away from this punt at over R7 per share. EOH closed at R3.32 on Tuesday, so I’m very glad I did. It took too long to sell the underlying businesses, the prices weren’t high enough and the interest burden in the background was simply too large.

The good news is that EOH has managed to achieve a fully underwritten rights offer through a combination of boutique asset managers and investors. This doesn’t come for free, with underwriting fees of either 1.5% or 2% due to the underwriters (depending on which one you look at).

In a pre-close update for the six months ending January, the group paints a bleak picture of operating conditions in South Africa. Still, EOH believes that things will be better this year, with revenue and EBITDA for the five months ended December looking promising.

Debt at the end of July 2022 of R1.3 billion has been reduced to R1.2 billion, but it doesn’t help when interest rates have gone up and the financing cost has remained the same. This is why I felt that a rights offer was inevitable, as there is just way too much debt here. For reference, EOH’s market cap is less than half the current debt level!

Assuming the rights issue goes ahead without any problems, Standard Bank has agreed to refinance the debt in a way that EOH believes will be sustainable.

I guess that time will tell. I struggle to find anything to get excited about with EOH.

Kibo looks to synthetic oil

If they get it right, this is a new revenue stream and potentially a less risky project

Kibo Energy owns 65% of Sustineri Energy, a business that hopes to produce electricity from syngas. I’m no engineer, but “produce electricity” is a statement that I can get behind right now.

There’s an interesting change of plan here, which the company is calling an “optimisation improvement decision” – a term that made full use of the corporate thesaurus.

By focusing on producing synthetic oil instead of electricity in phase 1, Kibo believes that the project can be de-risked and made more attractive to funders. They are currently busy with a comprehensive integration study that will look at financial viability among other factors, so we don’t even know yet if this will work.

Honestly, if this gets us closer to generating electricity from waste, then I’m all for it.

Ninety One’s AUM is flat for the quarter

It’s not easy managing money in a rough market

In the asset management industry, fees are earned based on assets under management (AUM). They take the form of fixed fees and performance fees, which means that asset management firms are highly exposed to broader asset values in the market.

This would be called a “high beta” industry, as the share prices are strongly correlated with the broader market index.

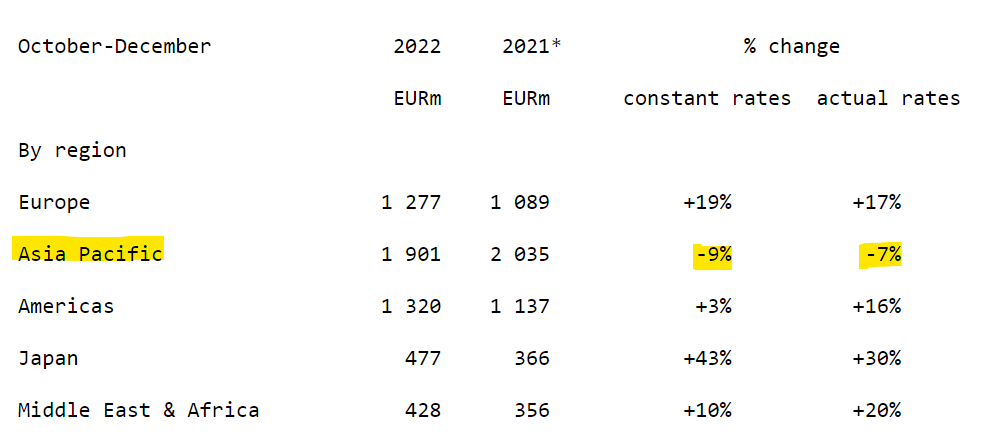

With that bit of finance nerdiness out of the way, I can report that Ninety One’s AUM as at the end of December was £132.4 billion, down approximately 6.5% year-on-year. Importantly, it’s very similar to the number reported at the end of September, so AUM was flat over the quarter.

There are only two drivers of AUM: (1) asset values in the underlying portfolio and (2) net client flows. The Ninety One quarterly update doesn’t give an indication of the drivers of the AUM movement over the period, but it’s worth keeping this in mind.

Property values don’t always go up during inflation

It’s all about the market yields vs. rental levels

Property is often put forward as a great inflation hedge. The theory is that rentals should increase, thereby protecting investors.

Here’s what they don’t tell you: property values often go down during periods of inflation, as the yield demanded by investors also goes up. Value has an inverse relationship with yield, so a higher yield = a lower value on the property.

If the net operating income increases by enough to offset this issue, then it is true that investors will receive a higher dividend and will see the value of capital protected, as the rental growth can offset the yield pressure.

If net operating income doesn’t increase sufficiently, because of say economic challenges during inflation that make it hard to demand endlessly higher rentals, then the inflation hedge thesis takes a knock.

Schroder European Real Estate Investment Trust is a perfect example, with the property portfolio valuation as at 31 December taking a knock over the quarter of 3.3%. The company attributes this to “25 basis points of outward yield movement,” which in English means that yields are higher (now at 6.6% on the portfolio) and hence values are down.

100% of the portfolio leases are subject to indexation, which (once again) in English means that rentals will increase with inflation. The company believes that this will mitigate further value declines.

The latest loan-to-value for Schroder is 32% based on gross asset value and 22% net of cash.

Wholesale changes at Spar

After a disastrous few months, the management team is out

The governance at Spar has a smell that would embarrass the fish section after Stage 6 load shedding on a boiling hot summer’s day. Change is finally upon us, with big news at board level.

Graham O’Conner is retiring at the AGM and will not make himself available for re-election. That’s the right choice, as I somehow doubt that the vote would’ve gone in his favour based on current investor sentiment.

CEO Brett Botten is also on his way out after less than two years in the job.

There are also changes in independent directors, including the appointment of Pedro da Silva. If that name sounds familiar, it’s because he ran Pick n Pay South Africa for a short time. Dr Shirley Zinn has also joined the board, bringing loads of experience from other listed boards. Dr Phumla Mnganga is stepping down as an independent director after 17 years.

Little Bites:

- Director dealings:

- An entity related to Adv JD Wiese (Christo Wiese’s son) has acquired preference shares in Invicta to the value of R2.98 million

- Delta Property Fund just can’t catch a break. After announcing the sale of a property in Kimberly in December for R22.1 million, the deal has fallen through as the purchaser couldn’t put the money together. Back to the drawing board they go.