Attacq’s narrative sounds positive

This is one of the few property companies I hold in my portfolio

Attacq is a solid company in my view, despite the unnecessary renaming of types of properties. Shopping centres are “retail-experience hubs” and good ol’ offices are “collaboration hubs” – each to their own, I guess.

I’m invested in the numbers, not the names. Although load shedding is definitely a concern in this space as running backup power isn’t cheap, the good news is that turnover and footcount over the festive season both showed strong growth vs. the prior year.

Mall of Africa reported particularly great results, with turnover in November and December up 17.6% and 19.1% respectively. Footcount is also higher, up 10.8% and 15.5% for those two months. Those looking for clues about performance in different retail categories over the festive trading period will enjoy this paragraph from the Attacq announcement:

Vacancies at Lynnwood Bridge “collaboration hug” are down to 2.6% and there seems to be progress with leasing vacant space at Waterfall City. There does seem to be a general return to office environments, which is definitely good news for the property industry overall. The problems are still there in lower grade office properties or in areas that are hopelessly oversupplied, like Sandton.

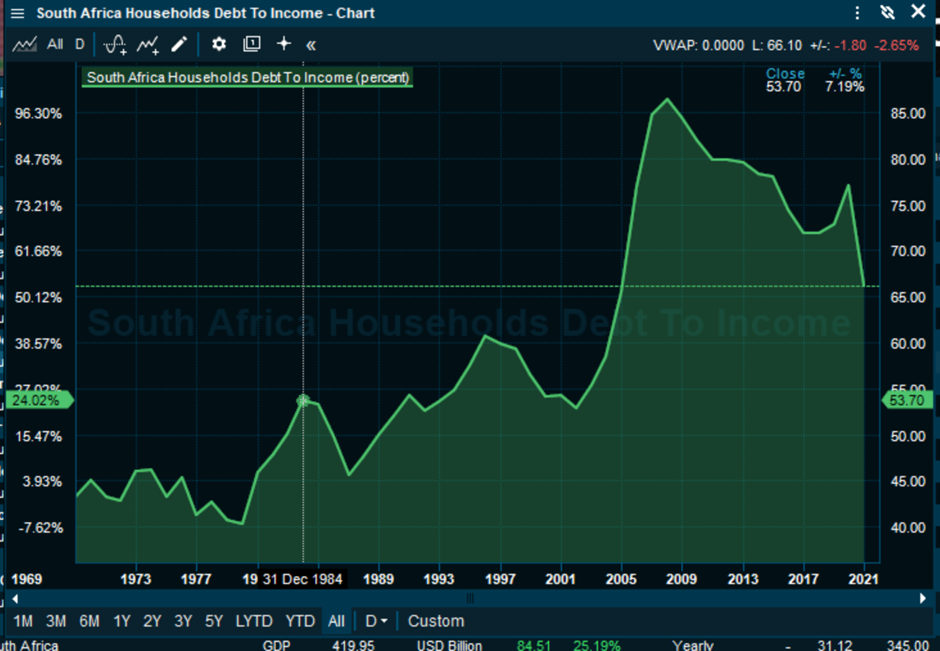

Looking at the balance sheet, Attacq has successfully refinanced R1 billion of term loan facilities, taking the weighted average cost of debt on the facilities down by 64 basis points. The weighted average term to maturity on the refinanced facilities has increased from 1.5 years to 3.2 years.

It all looks pretty good to me, though I remain nervous about the impact of load shedding on profitability. The share price is up 22% over six months but has been range-trading since early December.

Fortress loses REIT status

It’s debatable whether this will be a positive or negative outcome

For the first time on the JSE, a listed property company has officially lost REIT status. After several attempts to restructure the dual-share classes failed, there was no way for Fortress to meet the distribution requirements to retain REIT status.

So, what does this mean?

From 1st February, Fortress will lose REIT status. It will remain a listed property company with two classes of shares. The rights attached to the shares wont change. The only difference is that the tax burden now sits with the company, not with its shareholders.

This is bad news for exempt investors, like pension funds. By now, they should’ve gotten off the share register anyway. If they didn’t, then you can expect to see some painful selling. There will also be asset managers out there who are only allowed to hold REITs, so the loss of that status is a forced sell.

Keep a close eye on SENS updates. For example, Coronation has sold some shares and now holds 18.92% of the Fortress A shares, which is still a big number. Speculative traders will be watching Fortress closely, hoping to take advantage of a bit of chaos on the register.

Is there a silver lining here? Well, maintaining REIT status puts the company on a cash flow treadmill that forces most profits to be paid out as a distribution. With the loss of that status, Fortress has far more balance sheet flexibility. The question is whether they will take advantage of that.

Karooooo releases third quarter results

With record net subscriber additions, things are finally looking up

Covid caused a lot of disruptions for Cartrack, Karooooo’s major underlying business. The global expansion plan was hit by travel restrictions, especially in Asia. The excuses eventually wore thin and the share price fell as low as R320 in mid-2022. A significant recovery to R412 has been staged since then, with the stock incredibly range-bound between R400 and R450.

Lack of liquidity is part of the problem, with a significant bid-offer spread that makes it hard to take advantage of that range.

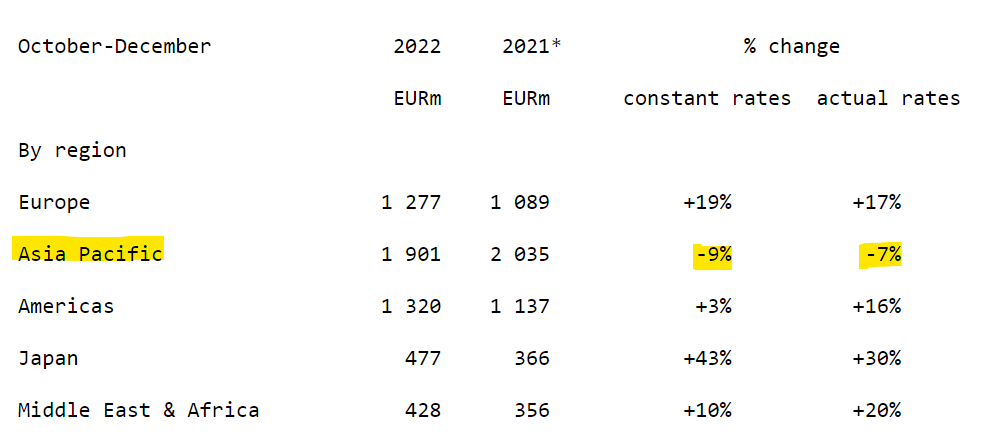

With third quarter results now available, investors have fresh information to work through. The key statistic is that net subscriber additions for the quarter were record-breaking, coming in at 78,593. The total subscriber base is now nearly 1.68 million, up 14% year-on-year.

Subscription revenue increased 16% as reported and 15% on a constant currency basis. Total revenue was up 29% as reported and 28% on a constant currency basis, so you can see the impact of Carzuka and Picup (with the latter renamed Karooooo Logistics) on the growth numbers, as they aren’t subscription businesses.

Karooooo Logistics is at least profitable, with adjusted EBITDA of R2.6 million. That’s not a typo – it’s a very small business.

Carzuka is still incinerating cash, with adjusted EBITDA of -R14.6 million. Losses in startups are nothing new. I’m just not convinced of a strategy of mixing a low margin dealership business with a high margin subscription business.

Speaking of cash, Karooooo generated record free cash flow for the nine months ended November of R434 million, up from R306 million the year prior.

Has Mr Price lost its relevance with customers?

Fashion is intensely difficult and competition has heated up in this market

I’m not sure if you’ve Cotton On yet, but there are a lot of very good clothing retailers in our market. The international players entered our market with a vengeance, forcing Woolworths to focus and almost putting Edcon out of its misery entirely. Mr Price faces an onslaught in this space. If I look at the positioning of the likes of The Foschini Group vs. Mr Price, I struggle to see how Mr Price is staying relevant with customers.

The share price is down well over 20% in the past year and has lost 36% in the past five years. This excludes dividends, of course.

Mr Price seems to be focused on acquisitions rather than its core business, having gone on a buying spree that included Yuppiechef, Power Fashion and most recently Studio 88. Based on my glances through the shop windows, Studio 88 seems to give Mr Price a fighting chance in a market that TFG is currently dominating.

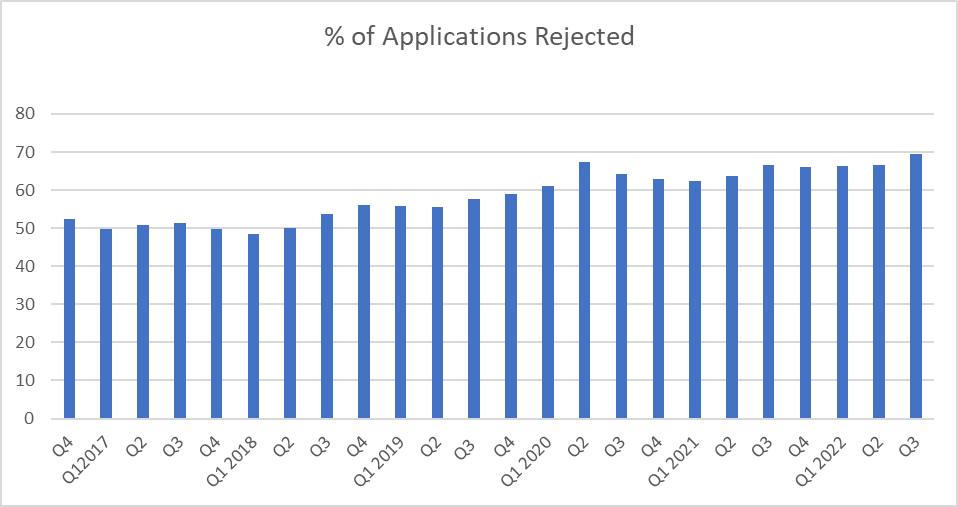

Despite the trading update for the 13 weeks to 31 December 2022 proudly declaring this a record quarter for Mr Price in terms of sales growth, the market thankfully isn’t that stupid. The share price fell more than 7%, which makes sense if you bother to read past the first paragraph.

After such large acquisitions, of course it’s a record quarter. If you include the revenue you acquired, it’s not hard to look much bigger than you used to be. Sadly, if you exclude Studio 88, the growth rate is a paltry 1.2%. With selling price inflation of 6.2%, this means that volumes plummeted.

Here’s a metric that makes it look even worse: cash sales grew by just 0.6%.

We don’t have numbers yet for net profit, but you can rest assured that they will be poor. Gross margin was lower and load shedding drove significant backup power costs at store level. The stores are seeing the action, with online sales down 6.1% if you exclude Studio 88.

Instead of focusing on what is broken, the group just keeps expanding. Excluding Studio 88, weighted average trading space increased by 5.4%.

Are there any silver linings here? Well, Power Fashion and Yuppiechef both achieved double digit sales growth. This suggests that Mr Price is doing a decent job on acquisitions and a poor job in the core business.

Maybe the retailer should take a leaf out of Woolworths’ book and focus on fixing the value proposition instead of rolling out lots of new stores?

- Director dealings:

- The CEO of Spear REIT has bought shares worth R15.3k

- An associate of a director of Huge Group has bought shares worth R15k

- Reinet always reports the net asset value (NAV) of the underlying fund and then reports the NAV of the listed company that is invested in the fund. Though the percentage movements aren’t usually identical, the fund movement is a strong clue as to the movement in the company. From September to December 2022, the NAV increased by 6.5%, so that was a strong quarter.