Fairvest releases its first results since the Arrowhead merger

Comparability is very limited here, so we focus on other metrics

With the merger between Arrowhead Properties and Fairvest Property concluded, the merger was accounted for as a reverse acquisition. This means that the financials are a continuation of “Old Fairvest” and cover a 15-month reporting period from 1 July to 30 September. To make it even trickier, Arrowhead has only been consolidated since January.

This makes comparability of the numbers practically impossible. The most we can look at is specific metrics in the business.

For example, a loan-to-value ratio of 38.1% is well in line with what you want to see in a REIT. Vacancies are down to 5.9% and tenant retention is 87.4%.

The pay-out ratio is 100%, so there are no issues here in passing profits onto shareholders as a REIT should. With two classes of shares, it’s notable that the distribution for the B share exceeded guidance by 4.4%.

The net asset value per A share is R13.1878 and for the B share is R5.1901. The shares are trading at R13.90 and R3.37 respectively, so the A shares are above NAV and the B shares are at a discount. Dual-share structures can get complicated, as we’ve seen in the huge problems at Fortress which is on the verge of losing REIT status.

Before investing, you would need to do detailed research into the differences between the share classes.

Mahube Infrastructure achieves modest growth in NAV

This renewables group has investments in two wind farms and three solar PV farms

Those interested in renewable energy should do more research on Mahube Infrastructure, as pure-play renewable investments are hard to come by. Although dividend income in the six months to August decreased sharply by 65.6%, this is mainly because the subsidiary company needed to redeem preference shares rather than pay ordinary dividends.

The tangible net asset value increased by just 2% to R11.18 per share, but at least that’s a move in the right direction. A dividend of 45 cents per share has been declared.

At a closing share price of R6.43, this puts the company on a discount to NAV of 42%. The interim dividend yield alone is nearly 7%. I would be nervous annualising this given the unpredictable nature of the underlying portfolio.

PBT Group hasn’t escaped the pressures of inflation

Although margins are under pressure, the technology group is still moving forward

PBT Group is one of those companies that is annoyingly good at gaining ground and then staying there. I keep waiting for the share price to drop so I can make up for previous mistakes in missing the opportunity and it simply doesn’t happen.

In the six months to September, results were pleasing on the top line, but the margin growth that is plaguing so many companies at the moment was clearly visible. Organic revenue growth was 14.5% and EBITDA inched higher by 3.2%.

The pressure on EBITDA was mostly from the international segments, where EBITDA decreased year-on-year despite an 18% increase in revenue. In South Africa (92% of group revenue), revenue increased by 16% and EBITDA was up by 10%. This means that both regions experienced margin pressure, with the situation particularly difficult in the UK and Europe.

Some of the margin pressure came from increased incentives paid to the sales team in June based on the success of the prior financial year. These are annual incentives that won’t repeat in the second half, as they are paid once per year based on the previous year’s performance. The point is that there’s a mismatch in timing between the revenue and the related incentives.

Given the prevailing market conditions, it’s likely that there are pressures beyond just the incentives. Nevertheless, the company is hinting at an improved margin performance going forward.

A quick look at the balance sheet would raise some concerns around accounts receivable, with R136.9 million in debtors at the end of the period in the South African segment. A disappointing cash conversion performance isn’t what investors want to see in this environment. In very good news, the situation has normalised after the end of the reporting period, with R115.3 million of the debtor balance collected. Investors will breathe a collective sigh of relief.

A feature of this result is the progress made on the strategy of selling non-core assets and returning the proceeds to shareholders. Net proceeds from non-core assets were R20.9 million. The group chipped in from the reserves and paid a special distribution of R31.8 million to shareholders in addition to executing R7.3 million worth of share repurchases.

There should be more to come, with R187.1 million in non-core assets still on the balance sheet at the end of September.

In the meantime, the board has declared an interim distribution of 25 cents per share.

Santam is set to change its operating model from January

Net underwriting margin and return on capital targets are still valid

Santam has provided an update to the market on its performance for the 10 months ended October.

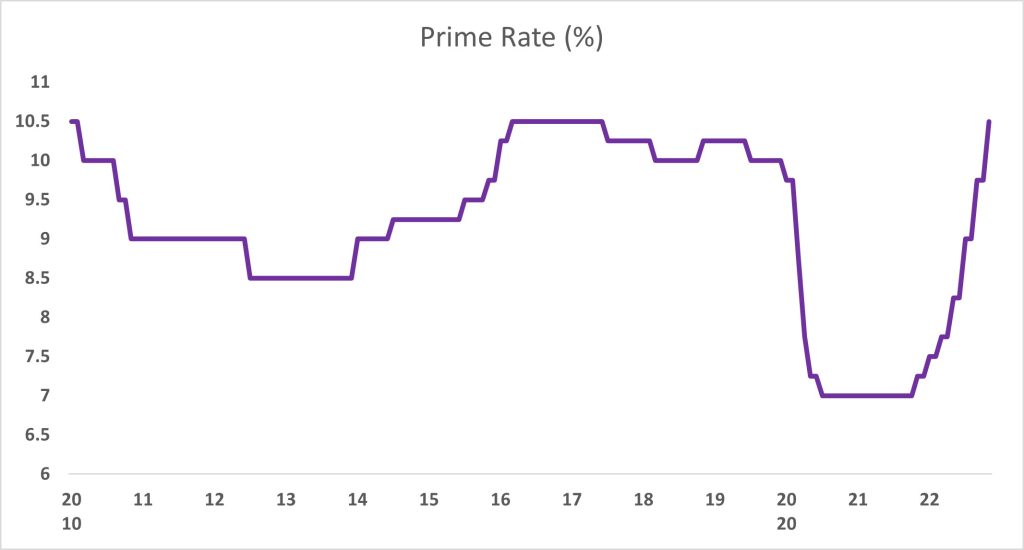

In conventional insurance, gross written premium growth was 8%, proving that any reputational damage during the pandemic has been successfully managed by the group. Due to numerous weather-related disasters in South Africa and high claims inflation (an inflationary increase in premiums lags the increase in underlying costs), the net underwriting margin is below the bottom end of the target range of 5% to 10%. Steps have been put in place to amend this situation heading into 2023.

The investment return on insurance funds has been volatile as one might expect, with improved performance since June as Santam put steps in place to steady the ship. With such a strong recent rally in the local market, the company would’ve been better off without the zero-cost collar to hedge performance. Hindsight is always perfect, of course.

Looking at the Sanlam Emerging Market partner business, investors are reminded that Santam entered into an agreement in May to sell its 10% interest in the SAN joint venture to Allianz Europe. Regulatory approvals are expected to be obtained by mid-2023.

In India, Shriram General Insurance suffered lower sales, but an improved claims experience and higher investment returns on insurance funds took the net performance into the green.

Santam is making operational changes with effect from 1 January, with the biggest change being to the multi-channel business that will be restructured into three business units to focus on distribution channels.

The company has reiterated the targets of a net underwriting margin of 5% to 10% and a return on capital target of 24%. A target isn’t the same as guidance.

Little Bites:

- Director dealings:

- A non-executive director of KAP Industrial has bought shares worth nearly R100k

- The former CEO of Cashbuild has sold shares and now owns 4.48% of shares in issue

- A director of a major subsidiary of Santova has sold shares worth R373k

- The family trust of a director of Curro has sold shares worth nearly R8.1 million

- A long-standing director of Invicta has bought R414k worth of the company’s preference shares

- In very good news for Stefanutti Stocks (with a 13% jump in the share price in response), a dispute related to a project in Zambia has attracted an arbitration award in favour of the 50-50 joint venture that Stefanutti Stocks was part of for the contract. The award is for 510 million Zambian Kwacha, which just so happens to be worth 510 million Randelas as well! Although this is a final arbitration award and the decision is final, there is a risk of the award being set aside on procedural grounds. Still, the market clearly likes this and with good reason.

- Anyone who followed the Ascendis Health battle in recent times will remember shareholder activist Harry Smit. At the AGM of the company, his re-election as a non-executive director was voted down. Smit’s journey as a director of Ascendis has come to an end.

- PGM and chrome business Tharisa has extended its fixed income note offer to raise $50 million for the Karo Platinum Project. To accommodate institutional investors in the final approval process, the deadline has been kicked out by a week and a half and the offer closes on 9 December.

- AYO Technology released results for the year ended August. Revenue increased by 3% and the headline loss improved by 10% to 60.25 cents. This group never lets a loss get in the way of a good dividend, declared a dividend of 60 cents per share (up 100% vs. the prior period). You can go do some digging for yourself on why that might be the case.

- At an extraordinary general meeting, shareholders of Gemfields approved a general share buyback programme of up to $10 million. With all the hassles in Mozambique, this is an encouraging show of faith by the board and the shareholders in the balance sheet.

- After a mandatory offer made by GMB Liquidity Corporate to the shareholders of Grand Parade Investments, GMB now holds a stake of 48.97% in the company excluding treasury shares. It’s worth noting that Value Capital Partners (VCP) has disposed of shares in the company worth nearly R205 million, which means VCP no longer holds any shares in the company.

- If for some reason you want to see the sheer extent of paperwork that goes into a merger on the London Stock Exchange, you can find all the documents (including the newly released supplementary prospectus) for the Capital & Counties / Shaftesbury merger at this link.

- Property development and holding company Acsion Limited renewed its cautionary announcement related to a potential delisting and cash offer. No indicative value of the offer is given in the announcement. The company also released results that indicated a 34% increase in revenue and a 72% increase in HEPS. Net asset value per share has grown by 13% and the loan-to-value is only 7.3%, which tells you that this is a developer rather than a REIT that has much higher gearing and focuses on rental properties. With a net asset value per share of R22.8006 and a share price of just R6.17, the discount to NAV is huge.

- Europa Metals has announced a 19% increase to the indicated mineral resource and a 14% increase in grade following a successful 2022 drilling campaign. This compares “very favourably” with the company’s mineral resource estimate announced in October 2021.

- African Dawn Capital has released results for the six months ended August. Revenue increased by 17.6% to R7.3 million and the loss is also R7.3 million, an unusual set of numbers for several reasons. This obscure (and tiny) company was also loss-making in the comparable period.

- There’s been a change in approach in Chrometco’s business rescue process, with the practitioner deciding to proceed with the accelerated sales process rather than the restart of the underground mining operation.

- Sable Exploration and Mining released a trading statement for the six months ended August. The headline loss per share is expected to be between 50 cents and 61 cents, which is between 38% and 68% worse than the comparable period’s loss of 36.30 cents per share.