If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

All scheme conditions for Walmart’s buyout of Massmart have been met. The delisting is expected on 22 November. You can get all the details at this link>>>

Gold Fields is in a bidding war for Yamana Gold

The irony is that the share price rallied on news of the deal being at risk

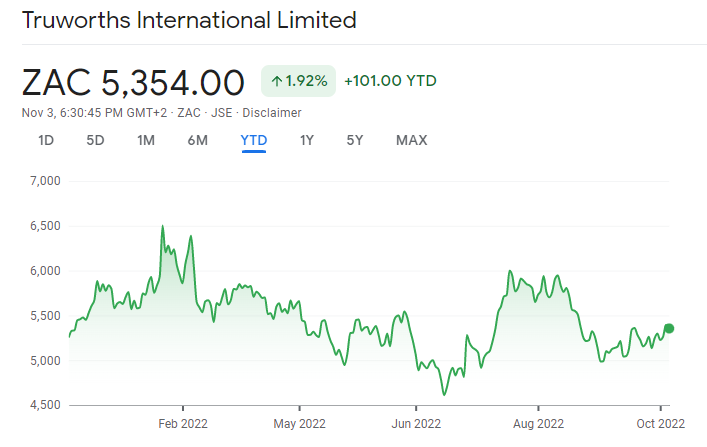

If we base our analysis on the share price action above all else, then the market has never liked Gold Fields’ attempted merger with Yamana Gold. Gold Fields loves Yamana’s assets and believes that they represent an opportunity to acquire quality assets at a good price. Shareholders seem to be nervous of the deal, which has put the Gold Fields share price under a lot of pressure.

Gold Fields seems to be right about the appeal of the Yamana assets, as there’s now a bidding war on the table.

Yamana announced a joint offer from Pan American and Agnico. The board has designated it as a superior proposal. The offer is part-cash, part-shares in both companies and values a Yamana share at around $5.06 per share.

Gold Fields now holds a matching right, which means the company can choose to increase its offer and convince Yamana’s board that it is back to being the best offer. The Gold Fields offer is an all-share merger in which 0.6 Gold Fields shares would be issued for each Yamana share. At current pricing, that’s around $5.13 per Yamana share.

The offer prices aren’t terribly different and will change daily based on the behaviour in each offeror’s share price. I suspect that the Yamana board likes the cash underpin to the Pan American and Agnico joint offer and has given this significant weight in its assessment of which offer is superior.

At this stage, Gold Fields has given its opinion that the complementary nature of the assets would create a merged group that is more valuable to the Yamana shareholders than the competing offer. The Yamana board clearly feels otherwise.

Yamana shareholders are due to meet on 21 November to consider the Gold Fields offer. Of course, the board believing that the Gold Fields offer is inferior doesn’t mean that the shareholders will take that view as well.

A rally of over 11% in the Gold Fields share price tells you that the market would be quite happy to see the Yamana deal fall over. This calls into question whether Gold Fields has much of a mandate from shareholders to increase the offer and match the competing bid.

The greatest irony of all is that the Gold Fields rally in response to the deal being at risk has actually made the Gold Fields offer more attractive to Yamana shareholders! All-share mergers are complicated beasts.

To add to the noise, there is a termination fee of $300 million payable to Gold Fields in certain situations. There are many pages of legal documents that would govern whether a termination fee applies in this case, including non-solicitation provisions. If this offer genuinely came out of the blue, then I doubt it would be payable.

This is a developing story.

MC Mining has raised A$40 million through a rights issue

The underwriters are getting a significant allocation

A successful rights issue takes the company a step closer to financing the flagship Makhado project. This would position MC Mining as the only large scale producer of Hard Coking Coal in the South African market.

Of the 200 million shares issued under the rights issue, applications were received for 107.6 million. The underwriters (Senosi Group Investment Holdings and Dendocept and its associates) picked up the rest. This is a perfect example of the importance of having anchor shareholders.

The share price has almost tripled this year, though the chart is even more volatile than the Proteas in a World Cup:

MTN grows revenue and margins

The African subsidiaries are pulling the margin higher

With 285 million customers in 19 markets, MTN has incredible reach. This goes far beyond selling people the ability to make a phone call, with a major focus on digital services that are enabled by smartphones.

After covering the results from the African subsidiaries in Ghost Bites, we now take a look at the group results for the nine months ended September.

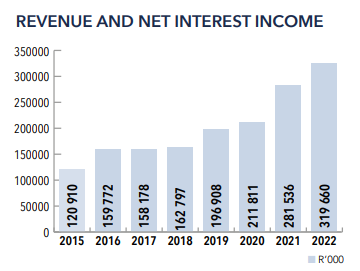

Group revenue increased by 14.3% and with voice revenue only up by 2.7%, it’s obvious why the group has turned its focus to other sources of revenue. Data revenue increased by 33.2% and fintech revenue was 12.9% higher.

Thanks to the African subsidiaries, group EBITDA margin was 30 basis points higher at 45.3%. South Africa actually fell by 210 basis points from 41.6% to 39.5%. To give that more context, MTN Nigeria’s margin increased from 52.6% to 53.6%.

There are headwinds of course, like sim registration rules in certain markets, general macroeconomic pressures on consumers and the introduction of taxes on electronic transactions in places like Ghana.

The market tends to put a much lower value on the African subsidiaries vs. MTN South Africa, as the risks are higher and it becomes difficult to upstream the cash to the holding company because of the limited availability of dollars. No cash was upstreamed from Nigeria during the third quarter. A payment post period-end took the year-to-date total from Nigeria to R6 billion.

A feature of the MTN story at the moment is high capex, as the network infrastructure is rolled out in key markets. Capex for the past nine months was a meaty R23.8 billion.

The balance sheet is always a focus area for investors. Group leverage of 0.5x and holding company leverage of 0.8x are well within targets.

As a reminder, MTN was recently in talks with Telkom about a potential acquisition. Discussions were terminated as the parties couldn’t reach an agreement.

The group’s medium-term guidance is unchanged, so the investment thesis is well intact. The share price is down 23% this year and I believe there is value to be found at this level.

Little Bites

- Director dealings:

- The CEO of Altron has bought shares in the company worth R547k

- A prescribed officer of ADvTECH has sold shares in the company worth R900k

- An associate of a director of Huge Group has entered into a very small CFD trade on the company’s shares

- The CEO of Fortress REIT has acquired Fortress A shares worth R204k and Fortress B shares worth R86.4k

- It may just be a timing thing in terms of announcements, but it looks like three Santova directors exercised share options worth over R1.3 million and didn’t sell any shares to cover the tax.

- Exemplar REIT has a portfolio of 23 retail properties and has released interim results for the six months ended August. The fund is focused on rural and township retail. The interim dividend per share has increased by 51.5% and the net asset value per share is up by 15.92% year-on-year. The stock is extremely illiquid.

- African Equity Empowerment Investments (AEEI) has entered into a small related party transaction with Sekunjalo Investment Holdings to sell shares in Sygnia to Sekunjalo. The price is 90% of the 30-day VWAP leading up to 30 September, with an adjustment mechanism in case the price moves by more than 10%. The stake is 1.188 million shares and Sygnia’s average weekly volume over the past three months is around 111k shares. To try and sell a stake of that size on the market would put pressure on the price, hence the discount to VWAP. Merchantec has been appointed as independent expert and will need to provide a fairness opinion here. The purpose of the transaction is to provide liquidity to AEEI.

- Buffalo Coal has announced a rights offering at a price of 13.396 ZAR cents per share. Even if the full amount is raised, the company won’t have sufficient working capital for its obligations over the next twelve months. The proceeds will be used to settle indebtedness to Investec. The offering circular is denoted in Canadian Dollars because of the listing in Canada. The offer plans to raise C$4.16 million and the company will still have a working capital deficiency of C$38.4 million.

- Old Mutual has announced that the retail offer application window for the Bula Tsela B-BBEE transaction closed on 24 October. Shares are expected to be issued to successful applications on or around 25 November. The retail shares will be issued at a subscription price of R10.22 per share.

- Impala Platinum has acquired another 0.05% in Royal Bafokeng Platinum, taking the total stake to 40.71%. The approval from the Competition Tribunal is still outstanding.

- AngloGold Ashanti has announced that the acquisition of Coeur Sterling has satisfied all the conditions precedent and has now closed. This was a cash deal of $150 million that strengthens AngloGold’s plans in the Beatty district in Nevada, USA.

- In case you’ve forgotten about it, Alviva has renewed its cautionary announcement relating to ongoing discussions regarding the expression of interest received by an investment consortium. Shareholders have to be patient for more details here.