This week, Chris Gilmour turns his gaze to the strength of the dollar and the significant issues in Europe and the UK.

During the past few months, as US inflation and interest rates have risen, the US dollar has become the safe haven of choice for most global speculators. And that trend is likely to continue for the foreseeable future due to TINA (There Is No Alternative).

But this is playing havoc with currency markets and US exporters. Anyone who has US dollar-denominated debt is really struggling now, with some emerging economics with that exposure facing a debt crisis.

So, how long will that last and when the US dollar eventually weakens, where will be the best places to invest?

Typically, at this point in a currency cycle, US dollar strength would have subsided by now and speculators would already be piling into other currencies. There are two main reasons why that hasn’t happened.

Firstly, the US economy (while in the grips of high inflation) is still perceived as being relatively strong, even although it is technically in recession. This is because its unemployment rate is still very low and the number of job vacancies remains very high. US inflation has been less affected by energy price increases than many other economies such as the UK and Europe, thanks mainly to its reliance on internally-generated energy supplies, including cheap gas from fracking sources.

Secondly, but related to the first factor, is that the US is not nearly as badly affected as Europe and many other parts of the world by the war in Ukraine. European energy has been choked by Russia cutting off its natural gas supplies via the Nord Stream pipeline under the Baltic and this situation is likely to persist for as long as Russia maintains its illegal war in Ukraine.

Load shedding: a proudly South African export?

So looking more closely at Europe, one sees that its manufacturing base is in danger of being strangled due to lack of energy. As cheap Russian gas supplies are switched off, many European governments are desperately scurrying around attempting to revive old mothballed fossil-fuel power plants or nuclear plants and nationalising utility companies to prevent them going bankrupt.

There is talk in Europe of the distinct likelihood of their version of “load shedding” and already certain regions and municipalities have ordered the banning of street and office lights at night to conserve power. And the start of winter proper is still a few weeks away and will last, effectively, until well into January and perhaps into February.

Heavy industries in Europe would be worst hit, such as steel and glass making for example and in a worst-case scenario, they would have to close, with a concomitant rise in unemployment and danger of prolonged recession. So, no joy in Europe for the time being.

And then there’s the UK.

Reeling under the backwash from an incredibly ill-conceived mini-budget of two weeks ago, the UK economy is likely to endure a 5-quarter recession, according to the Bank of England. And that forecast was made before new Chancellor of the Exchequer Kwasi Kwarteng delivered his now infamous budget speech on Friday September 23. Liz Truss’s new administration has already had to make an incredibly embarrassing U-turn on tax cuts for the wealthy, designed to “trickle down” and kick-start the moribund UK economy.

The other parts of the mini-budget are still in place, with their energy price caps for example, but any good that may accrue to consumers because of that will likely be more than nullified by the impending massive rises in interest rates and specifically in mortgage rates. A typical two-year fixed mortgage rate in the UK is now more expensive than at any time since the Global Financial Crisis of 2008, at just over 6%. It’s entirely possible that Liz Truss will lead the Conservative Party into the next UK general election in 2024 with the UK still in recession. That would most likely result in the Labour Party winning a majority in the House of Commons, a move that would likely not be welcomed by financial markets.

And to rub salt into the wound, the UK’s National Grid warned the Brits on October 6 about the possibility of rolling blackouts during peak hours in January if gas supplies become even tighter than they are now.

The troubles in the UK didn’t happen overnight

Britain’s problem isn’t just a momentary thing, caused by Truss and Kwarteng’s lack of judgement. It goes far deeper than that. For 150 years until the end of the second world war, Britain ruled the greatest empire the world has ever seen and it was also the world’s biggest trading empire.

But that all changed post-1945, when Britain found itself having to pay back crippling war debts to the new masters of the universe (the USA) and reluctantly had to acknowledge that it was no longer the world’s biggest economy. It went steadily downhill from there, even though prime minister Harold MacMillan in the 1950s told the Brits that they’d “never had it so good”. The country got a second stab at greatness when it joined the European Economic Community (now the EU) in 1973, but foolishly in my honest opinion, left it with the Brexit Leave vote in 2016. That move has further reduced London to a position of lesser importance in global financial markets and has made life more difficult for British traders in all goods.

Meanwhile, other competing financial markets such as Dubai have taken away a lot of London’s lustre. Already, Euronext Paris has overtaken the London Stock Exchange in terms of total market capitalisation.

Bottom line, what has happened in the past five years since Brexit is that the world has finally spoken, metaphorically, about what Britain really is post Brexit: a middle-power in the world. Of course the Brits hate this, as many of them still yearn for the grand old days of empire, not realising they are long gone and not returning. So unless the Truss administration can manage to work out some kind of really elegant trade and other deals with its largest trading partner the EU, it is probably destined to continue its dismal decline. The pound sterling will, in all likelihood, reach parity with the US dollar in the next few days and weeks, unless Truss and Kwarteng can pull some kind of rabbit out of the hat. But this seems unlikely.

We can never ignore China (and India?)

So if neither the EU nor the UK are looking attractive, what about China?

Well, for as long as it fails to get on top of the coronavirus pandemic and get its house in order with respect to dodgy real estate loans, the Chinese economy will remain unattractive. Because it has failed demonstrably to transform from being an export-led industrial base into a consumer economy, it will be highly vulnerable to the impact of global recession. That’s before one factors in the Chinese demographic time bomb that the country can do little or nothing about!

The World Bank is currently forecasting Chinese GDP growth of less than 3% this year. While that is going to be considerably better than most developed countries, it’s nowhere near where China needs to be at this point in time.

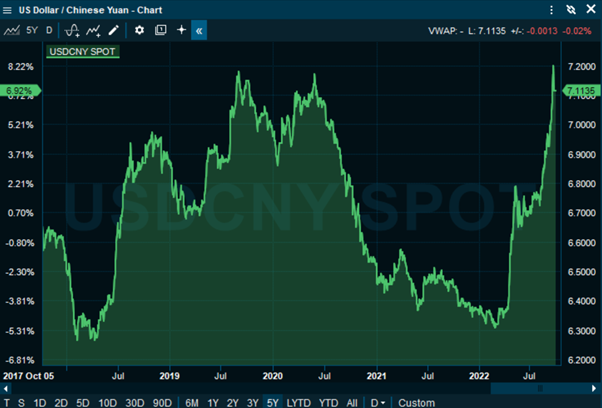

The Chinese yuan has weakened considerably vs the US dollar this year, despite Beijing’s best efforts to shore it up. Having said that, the fact that the People’s Bank of China keeps on cutting interest rates during a time when just about all other countries are increasing rates makes it a lot easier for currency speculators to bet against the yuan.

Although this really just leaves India as the only large economy that may buck the global trend to an extent, the World Bank and other bodies have recently slashed their GDP forecasts to 5.7% for India for 2022. However, it should be remembered that India is largely a domestic demand-driven economy, based on consumption, so is far more insulated from the impact of a global recession than China for example. It may be worth having a look at the iShares MSCI India ETF, which gives broad exposure to Indian equities.

The trend (as usual) is your friend

The answer for most people appears to be that the trend is your friend, for the time being. The US dollar is likely to remain strong, at least while the US Federal Reserve is in tightening mode. The Fed has recently come in for some criticism for allowing rates to rise so rapidly but chair Jerome Powell and his FOMC appear to be sticking to their guns on this one.

Only if and when it becomes clearer that the US economy is headed for a deep recession will Powell and his advisors likely take their foot off the interest rate pedal.

So, get used to the harsh effects of a sustainably strong US dollar.

For equity research on South African retail and other stocks, go to www.gilmour-research.co.za.