STADIO Holdings is enjoying excellent support in the market for its strategy, evidenced by a strong share price performance in a year when the shine has come off many SA Inc. stocks.

This begs the question: how are they getting it right?

CEO Chris Vorster and CFO Ishak Kula joined me on this podcast to talk about not just the recent performance, but also the major growth drivers that underpin the medium-term targets. The discussion includes insights into:

- STADIO’s core DNA and the principles that guide the business.

- The importance of communication with the market, including on financial targets.

- Key focus areas of institutional investors based on discussions at recent roadshows and conferences.

- Developments in the underlying business in areas like the Durbanville Campus and AFDA.

- The broader strategy around the road to being recognised as a university.

- The value of AI in the business and other shared services.

- The medium-term goals for student growth, margins and return on equity.

My thanks to STADIO for valuing the Ghost Mail audience and recognising the importance of sharing this level of insight with the retail investor base.

Please note that this podcast is brought to you by STADIO Holdings. The goal is to give you further insights into the strategy and business model based on recent company announcements. I crafted the questions myself, without any influence from the business. Please note that as always, nothing new here is financial advice and you should not interpret this podcast as an endorsement of the company. Instead use it as part of your broader research process in your portfolio and be sure to refer to STADIO’s announcements and reports for more information.

Listen to the podcast here:

Transcript:

The Finance Ghost: Welcome to this episode of the Ghost Stories Podcast. I always get really excited to speak to management teams of listed companies who value the platform and who want to bring their insights to this podcast and come and talk to us about their results. So much of this stuff tends to happen at conferences and we’ve seen some of that recently, obviously, and that’s a really important way to speak to institutional investors, roadshows, all of the rest. It’s lovely to see management teams taking the opportunity to actually come and speak to a retail investor audience.

So, we are here today with STADIO. That is CEO Chris Vorster and CFO Ishak Kula. Thank you so much for joining me on this podcast, for coming back after we did one about six months ago, more or less, your last set of numbers. It’s lovely to get to follow through and just that consistency of messaging, I guess. And when we last spoke in April, you were trading at around R7 a share. STADIO is now at over R10 a share. So that’s a nice chart to go and print out on your wall! The share price when I looked, was up almost 50% year to date and let’s not forget this has been against the backdrop of the shine very much coming off the GNU exuberance. There’s been a lot of broader noise in the education sector. Not all of which is relevant to you, of course, with the STADIO model, but all of those VAT changes, obviously the developments at Curro as the entity STADIO used to be part of many years ago, and a geopolitical hornet’s nest of note, globally. So what a year and here you are almost 50% up!

So Chris, Ishak, thank you so much and I’m sure you had a grand old time telling the story at the conference this past week because that’s a nice story to tell.

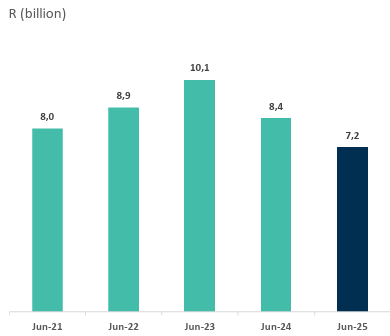

Chris Vorster: Yes, good morning Ghost and from our side again, thank you so much for the opportunity to come and share the STADIO story with you again. Definitely as you indicated, it’s been quite a good year again for us at STADIO. I mentioned at one of the conferences that the STADIO train is well on track and it’s full steam running ahead, delivering another solid set of interim results for the first 6 months ending the end of June.

The question that one might ask oneself is why do we see such great interest coming from investors at this point in time? And I think the open and transparent communication that we had from day one, I think must play an effect. We try to communicate both our strategy and purpose very clearly to investors and I think over time we’ve managed to do so, really focusing on the three things, what we call our DNA. But the three things that we based all our decisions on in the business is the WWS, standing for Widening access, giving more people opportunity to access quality higher education, which is important. Then really inviting industry (World of Work) into our institutions and align with it that makes sure you stay relevant as an institution, that your graduates are also employable because they actually have the skills that are needed by these employers that need to employ them. And then Supporting our students to be successful with their studies There’s no sense in just giving everybody access, but they then all fall away over the three-year period of a degree programme. So it’s really making sure that you give them the necessary support to be successful in their study. That I think was critical for our business.

And then also to really make sure that you communicate your targets clearly to the investor community – we’ve always given feedback on how we track on our pre-listing statement. We’ve ticked all the boxes so far, which I think gives them a lot of surety. And then also communicate our next targets and every time we have the opportunity to then engage is we give them feedback on how we’re progressing towards that. And then lastly, I think also from an investor’s point of view, a lot of our investors are actually supporting us that it’s not just an investment opportunity, but it is also an investment to the betterment of the country, which I think carries a lot of weight. One can see the role and the effect of a STADIO and what it can have in the future on our country if we roll out quality education, people that are employable, it will make a huge difference to the country. So I think those are the things that excites us as an institution. But I think our investors are also appreciating.

The Finance Ghost: Absolutely. Chris, you’ve touched on a lot there and I think an important concept that comes through – and sometimes people forget this – is that the share price performance is actually just the end result of a lot of good business decisions and strategies and how you actually run the business. I think anyone who’s been in the market for any length of time knows that the share price itself is an unpredictable thing. Lots of external factors. You can’t control that. It’s obviously lovely when it looks the way it does. Some years might be flat through no fault of your own but you’ve gotta just keep doing the right stuff at company level.

So thank you for touching on I think some of the core DNA at STADIO and just some of the – I agree with you – I think consistency of communication with the market is a huge part of giving investors comfort over what they are actually buying. Ishak I’m going to bring you in here because I’m sure at the conference you were asked lots of interesting financial questions and I’m sure the two of you were asked lots of interesting questions – I kind of want to tap into some of the top of mind stuff before we dig into some of the questions that I’ve got around the company specifically. So what were some of the major things that you found came up in the roadshow discussions on the numbers, but also not necessarily on the numbers? There might be some stuff that Chris wants to add, but Ishak let’s bring you in here.

Ishak Kula: Ghost, good morning, thank you for hosting us. Really good to be here. I think invariably, looking at the track record Ghost, one of the questions I think Chris and I always get is well, how big is this runway, right? How long does it last? And we answer it by saying, well, how long is a piece of string? No, I’m just kidding.

I think strategically, the business has been positioned looking at our growth pillars to invest in a number of new programmes that have been enrolled in the business and institution, particularly in STADIO Higher Education over the last number of years. And we believe that the growth that we’ve seen in the last two years in particular, that those programmes Ghost, still have a lot of runway before they reach maturity. So on the backdrop of that, we believe there’s a lot of growth still to come and therefore our investor community can certainly look forward to, I think some continued strength, particularly in the growth story of STADIO Higher Education. I think that’s the one big theme that’s always come through.

If we look at the broader education landscape, coupled with what I’ve just said, public universities continue to limit the intake. There’s a ceiling to their ability to take in new students, and no doubt we continue to be the beneficiaries of that. And in saying that, of course, it needs to be backed by good quality product. There’s no good just having the infrastructure and the capability, but you need to make sure that you deliver it at both the right price point, as well as with good quality and we believe the institution has put a lot of hard work into those elements to be able to capture a broader market opportunity because we continue to be well priced and to deliver a good product.

So that’s thematically, I think one of the key things that came out in the discussions and while we continue to believe that the institution is well positioned for growth going forward.

Chris Vorster: Let me add to what Ishak said. I think firstly, the STADIO story is very well received. We get very good vibes back from the investor community, but it’s always the question, so what’s new for next year? What are those growth indicators? What can we expect to see coming from STADIO in 2026?

So maybe if I add and trying not to repeat what Ishak said, obviously for us 2026 is a big year, especially in the STADIO Higher Education and AFDA brand.

STADIO Higher Education, it’s the opening of our big and long-awaited Durbanville Campus, which would be a comprehensive campus – will host seven of our faculties and will open with we anticipate more than 1,000 students, so that that is a big thing in our world for next year, really creating a lot of excitement.

And then for me also personally, is to see new life in the AFDA brand again after it has been showing very muted and low growth over the last few years. Next year we will see the opening of Hatfield, there in Pretoria campus for AFDA and we think that is also a development that can shift the needle in that AFDA business. Eight new programmes coming for 2026, again giving a lot of runway. We start new programmes with only a first-year intake and then after three years, you would really see the impact of those new programs that you launch as they then get filled in the 2nd and the 3rd year. So it becomes quite exponential going forward.

Another exciting thing to mention, in 2026 we will offer 100 accredited programmes in the group. So that was the magic number to get to offer potential students, 100 different accredited programmes to register.

And then more exciting news, we’ve secured property for expansion also in the Eastern Cape area where we will look at renovating the current building that’s there during the ‘26 academic year, to open aggressively then in the Eastern Cape also in 2027.

I think those are the big things that we shared with investors regarding the ‘26 academic year.

The Finance Ghost: That is very interesting. The Eastern Cape does not come up too often as a growth prospect in South Africa, so that’s quite cool to see. I guess that goes to one of the Ws that you mentioned early on about Widening access. So that’s a very interesting strategy that you’re following there, quite keen to see how that plays out.

It sounds to me like a lot of the questions that came from the roadshow were the sort of things that typically get asked to a business that’s just doing really well. How long can you keep growing for? How long can this carry on for? These are nice questions to be asked. It’s definitely not a case of how do you survive or how do you catch your competitor? Or some of the things that businesses get asked when they’re really on the back foot – I think at the moment STADIO is firmly on the front foot, so well done for that.

And you’ve also raised the point there on that Durbanville campus and all the different faculties. I did notice in your earnings presentation that pretty much all your campuses now are what you refer to as multi-school campuses. That is something we talked about earlier this year, which is a little bit around the student experience, getting closer to the sort of traditional university experience versus being maybe a niche college which I think is interesting because that’s a very clever way to compete with the public universities over time. I studied at Wits, so that’s the experience that I had was the public university with all its pros and cons, great experience overall. But yeah, as you say, there are not enough universities in South Africa and you’ve got this kind of growth runway. And the closer you can get to that kind of experience, I think the better.

You’ve made a recent executive appointments in that space as well. Maybe let’s talk a little bit about that and your journey to being that sort of university competitor in the traditional sense. Give us the latest there.

Chris Vorster: Yes, definitely. We took the very bold decision back in 2020 actually, to move away from your typical traditional private higher education institution operating from an office block somewhere in town and the central CBD areas, to say, let’s position ourselves to be an alternative for a typical but small public university and that then led to the big Centurion campus in Gauteng. And also then now for the one in Durbanville, but also we expanded in Durban where we also have a footprint, making sure that we can offer that holistic offering for students. When we acquired the brands, a lot of the brands that we’ve acquired back in 2018, 2017, were all the single faculty institutions. So typically you will see at one of our buildings back then, we will offer for example only education. So that limits you as a business tremendously in the sense that you don’t have a bouquet of product to offer and by bringing more product to those campuses, you obviously then open yourself up for exponential, faster growth. So we’ve done all of that, and also built on our faculty range, our programme range, making sure that we cover the full NQF meaning from bridging higher certificate programs all the way up to PhD.

In the variety of faculties, we’ve really expanded on our community engagement activities as well as in research and building research capacity. So you can see that we are already acting as a university. We are putting all the structures in place to become a university. And we took a further step to really go and appoint a leader in the current public university space. Somebody that really understands the university dynamics, the landscape, not just locally but also internationally and that led to the appointment of Dr. Stan du Plessis, the former COO of Stellenbosch University. Stan is settling in very nicely here at STADIO. We are very, very excited. He will then lead our biggest institution, which is STADIO Higher Education, the one that we are positioning to become the university and to compete with your big publics. Stan comes with all that experience, all the contacts nationally and internationally.

So yes, we’re very, very excited in that appointment and then we believe, when legislation makes it possible for us to apply for university status with our current academic leadership and with the addition of Stan, we would be in a very good position to qualify for university status.

Ishak Kula: Chris, if I may just add to that. Ghost, I think to your question to comments just around the student experience, I can attest it being new in Higher Education, Chris, and that bold decision we took to continue to invest in a bit of contact learning.

Ghost to when I joined in January ‘24, we went to our Centurion campus – life was busy but not quite this busy, right? So you sit back and you think, wow, we’re not quite there with student experience, right, if you had to be honest. But I can tell you – what a dramatically different picture in ‘25 we’ve seen obviously on the back of really good growth in the contact learning space, unbelievable student life coming to that campus and Centurion in particular. So I think that’s what also makes us tremendously excited and hence the strategy to put down these comprehensive multi-school, multi-faculty campuses, it brings the business to life.

Really exciting, we also moved our school of fashion students from Randburg and Hatfield to that Centurion campus. And it’s amazing to see the different dynamic between the different students also playing a role and therefore I think just linked to that growth story, Ghost, that’s why we’re so excited about our Durbanville campus. We bring a lot of product, we’re excited about the number of students hopefully we can have in our first year to really make a big difference in in the Western Cape as well.

The Finance Ghost: Yeah, that’s fantastic. I mean, that student life is a big part of the appeal. Try not to put any of the sports clubs underneath the exam venue like I suffered through at Wits. I will never forget writing a financial accounting paper while listening to 99 Red Balloons on repeat downstairs and a whole bunch of people having a billion times more fun than I was having in that FinAcc paper. But anyway, that’s my pro tip for the day.

Maybe moving on from the campus-level life and hopefully the lack of red balloons, or at least in the wrong place, and looking a little bit at the head office and the shared services and some of the opportunities you’ve then got to actually drive efficiencies through the business, no surprise to see that AI did come up in the presentation. I think that’s basically a prerequisite right now – although I’ve got to say I’m starting to use AI more and more in my research process, I think at this point if you’re really hitting your head against AI and saying no, I’m not touching this thing, I think you are missing the boat quite substantially, I’ll be honest. So I’m glad to see that it is something you are looking at as well.

How do you balance that technology opportunity against that in-person experience? I guess that’s one part of the question, that’s maybe your customer-facing piece. But then just also further back, what kind of layer of shared services can you deliver across all these different campuses because that’s got to be part of the investment case here as well, I would think?

Chris Vorster: On the shared services side I think there’s still a lot to do. But if one looks over what we’ve achieved since 2020, a great lot of efficiencies are starting to show how we use shared services more productively. But there is still a lot of runway for us there and that also led to the appointment of a dedicated focused CIO to look at all our business processes, to look at all our touch points with students and how we can use technology to enhance and improve the experience. So I’m very happy that we will now have dedicated focus on that and we should even see more efficiencies coming through down the line.

AI. also, we’re one of only a few institutions in the country that really embraced it and we went so far to incorporate it in our teaching and learning offering, so it’s part of the curriculum. We made it part of our assessments, meaning some of the assessments learners are actually allowed to use AI, obviously not in all the assessment tasks, but we feel that if you’re going to send out a graduate not fluent in using AI, it’s actually not good enough. One must produce and make your students are aware of all the tools out there and making them more efficient, so we definitely embrace that. There’s still a lot of talk and debate on the ethical side of it and how to do it to still support the whole learning process, but I think we’re one of the leaders in this regard, our academic leadership being involved and invited, not just locally but also internationally to share best practice and also to share our experiences. So, we’re very excited in this space. I think that’s the way to go, actually, if you look at AI is to embrace it and to get your learners up to speed in using it.

The Finance Ghost: I always think it’s like a calculator, none of us are running around trying to use an abacus. It’s a completely ridiculous concept we all using calculators. We’re all using Excel. Could technically do the hard yards, but why? And I think that’s where AI is such a good tool. And while we were talking now when you were talking about the university thing, I like to test Copilot and see how often it gets it right. So I just asked it: does legislation allow for STADIO to be a university? And it’s just a perfect answer – currently registered with the Department of Higher Education and Training. There are accreditations, but South African legislation does not currently allow private institutions to call themselves universities. And STADIO said that once legislation changes, you’ll apply for private university status. Perfect answer, pretty much, out of Copilot. That’s pretty good. I think this tool is there and it’s good to see that you’re embracing it.

It’s not perfect, AI definitely is not perfect. I’ve had some howlers returned to me by Google. One of my favourite things to ask Google actually is, who is the Finance Ghost? I do it like once a week for an absolute laugh and it gives me a different answer every week and it does it with so much conviction. This week it pointed out that it was Neil Schreuder who works at Shoprite. He’s like their Head of Innovation and it was convinced, like flat out, The Finance Ghost is Neil Schreuder. Bang. Not even guessing. So yes, AI’s gotta be treated with caution, but I think that there’s a great opportunity there and it’s nice to see that you are using it and obviously the shared services layer coming through over time as well is very valuable.

I think that maybe let’s look at some of the drivers of the numbers in the business and I think this is important to help investors understand what it is that they’re actually looking at, at the end of the day. So the nice thing in tertiary education is that unlike in primary and secondary education, student numbers do not seem to be a big challenge for you. The birth rate issue that is plaguing primary schools at the moment is many, many, many years away for STADIO, and I think there’s a lot of good reasons why it would still be OK even then. We don’t need to try and forecast what happens 20 years from now. It’s hard enough to forecast a few years ahead. And at the moment it looks like student number growth is pretty good. I think I saw a forecast or a goal I guess of 8% annual growth over the next few years. You can just confirm that for us. And then maybe in light of student numbers as the top of the funnel and the ultimate driver of revenue, what are some of the other things that you think about? What are some of the levers that you can pull when you’re actually trying to get revenue right? Pricing, managing volumes, I guess, maybe revenue mix? Ishak probably one for you to take us through how it all filters down into profits for shareholders at the end of the day.

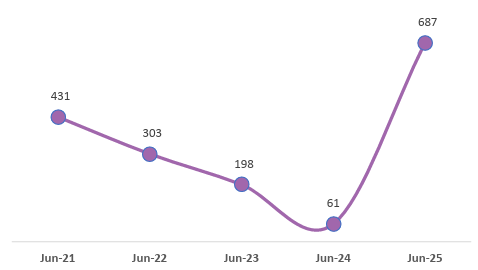

Ishak Kula: Yeah, correct Ghost. I think you set the scene quite nicely. Maybe just as a backdrop, remembering that our strategic and stated objective is to have 80% of our students in the distance learning mode of delivery over time and 20% in the contact learning mode of delivery. At the half year, we were about 14% in the contact learning mode of delivery and 86% in a distance learning mode of delivery. And correct, your 8% annual growth rate is correct. We currently at the end of August – we were close to the 54,000 / 55,000 thousand student mark. Our stated objective was always to reach 56,000 students at the end of 2026. So we believe that is on track, with getting to 80,000 students by 2030. So there’s a long road for us and lots of hardwork and lots of plans going into making that happen.

Ghost, correct, if we think of our student intake, I think we’ve been fortunate with good student intake, which ultimately drives the revenue number. But on one of our strategic levers that we pull, definitely the fact that we are heavy distance learning, right, and in the distance learning mode of delivery, we generally have higher operating leverage, where in contact learning you have a sort of stepped-fixed-cost-base model. The beauty of, I think, where we are as an institution so to speak, in this J-Curve, is that in the contact learning mode of delivery because of the fact that we’ve put down so much infrastructure already, we’ve got ample capacity to grow into that sphere, which means a lot of upfront costs have already been deployed. And therefore, although there will still be some costs to come, the beauty is as we see good growth in contact learning, we believe that can open up margins quite nicely in the contact learning mode.

In the distance learning mode of delivery, again there you don’t have incremental costs when you sign up new students, but of course you need to make sure you support your students well in the distance learning mode of delivery. But certainly you have high operating leverage and therefore when we think of price point particularly and price increases in line with our stated objective of widening access, we want to keep our price increases as low as we practically can so that we open up the opportunity for people out there whilst allowing us to reinvest in our margins. And I think that’s a big lever that we have as an institution. And doing that sensibly, given where we are from a growth perspective is quite crucial and features heavily in our strategy going forward.

The Finance Ghost : Yeah, I think what’s super interesting with STADIO, I was thinking about it now while you were talking, you’ve got one piece of the business that is almost Netflix-platform economics. You have to go and create content and then the users will come. You can sell that piece of content, that course, a zillion times or 10 times – you had to spend the same amount to actually put that course together. That’s obviously the J-Curve that you’re talking to there. If anyone is not too familiar with how the J-Curve works, go and actually do the research on that. Just keep the letter J in mind. And you’re very much on the right track. It’s that sort of downward slope that is the initial difficult high investment phase. And then that up to the moon as they like to say in the pandemic, when the markets were going crazy. To the moon it goes, hopefully, when you get lots and lots of students coming through the door and then those profits really just start to drop to the bottom line.

And then your more in-person, university model is almost airline economics. It’s quite high fixed costs, but once you’ve covered them then the incremental value of additional students is fantastic. That extra person being there is just almost all profits, which is very much airline economics.

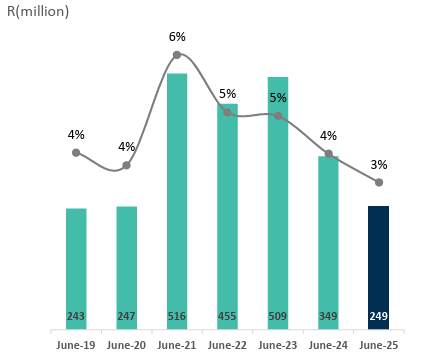

So it’s a lovely combination. And I think it sounds like it’s pretty promising for margins. That’s been part of the story over the past few years. There’s actually a great chart in your investor presentation that shows that revenue is up 104% since 2020, core headline earnings up 209% since 2020. So that’s just leverage coming through, that’s just leverage in the model. You could probably give that to one of your finance lecturers as a case study for leverage and efficiency, so well done.

It sounds like some of that trend around margins could well continue. I mean, do you have an idea in mind in terms of margin expansion targets or a steady-state margin? Is there any more information you can share or that you’d be allowed to share around can people just expect this margin story to continue that expansion?

Chris Vorster: So Ghost, we communicated I think a couple of years ago already that we believe a sustainable good margin for a business of this size and also wanting to produce a quality product at an affordable price would be from 30% EBITDA margins and a little bit upwards from there. We are super excited that we’ve reached that milestone now in this first half of 2025, which we’re very excited about. So there’s definitely potential to grow. But as Ishak indicated, as your numbers increase, there are costs in supporting learners to be successful with their studies. We must just always keep that in mind.

Ishak Kula: Chris, I think you’ve said it well, Ghost, we see an opportunity for enhancement, but in saying that we want to keep our product’s stated objective at a very affordable price, right? So, we definitely see ourselves reinvesting some of that almost operating leverage through giving up some price increases, certainly where it makes sense to do so, and therefore you can definitely see it accreting north of the 30%, would probably be what I say. But it’s kind of how steep is that curve and how quickly do we move? And that’s part of the strategy we as an organisation think about quite long and hard. But for now, I think the 30.6% we achieved at the half year, certainly the stated objective we achieved and very proud of.

The Finance Ghost: Alright, thanks. That is additional useful information on the business, appreciate that. And it certainly seems like there’s some good reasons to believe that margins can keep expanding, but there are practical ceilings to these things as you’ve correctly pointed out there, people should always keep that in mind as well. I think maybe just to understand the business a little bit better for investors looking at it, just in terms of seasonality inside STADIO, that basically means when you’re looking at the interim results versus the final results, just to help investors, is there something they should be careful of from a seasonality perspective? What should they look out for as they look to understand the numbers?

Ishak Kula: Yeah, Ghost, thank you. Most certainly. I think we always caution our investor base to remember that semester 2 is not semester 1, multiplied by 2 right for the full year, because our business is staggered across both the contact learning mode of delivery and distance learning mode of delivery. Your contact learners enrol for the full year. Your distance learners you re-register for semester 2. That’s the one reason you can’t expect it to be semester 1 multiplied by 2. And then the other reason is many people take up studies in semester 1, right? So we see many of our students that enrol in semester 1 and given the flexibility of our offering that has been positioned this way, many of them would take a break, right, in semester 2 or even, let’s say if they’ve taken 3 or 4 modules in semester 1, they only take 1 in semester 2 and that is allowing them to balance their own personal lives, both from a finance perspective and workload perspective. I always say that’s quite an important factor in our business and has been the same in the past.

The Finance Ghost: I think there’s also a great message in there just around the importance of what you do, because I think it’s an incredibly privileged position for the few who finish high school and they go straight to university and they can have the four-year student life and it’s all lekker and they come out with a great qualification and off they go. There’s a very tiny percentage of people who are so lucky to be able to do that.

For a lot of people, they don’t have the funds, they don’t have the ability to do that, they have to go and start working and then they have to try and you know – those who want to try and better themselves and study while working and families, I have mad respect for people who push themselves forward like that. What you’re saying there makes sense. Life gets in the way. Sometimes people can only do it for half a year. They’ve gotta wait till they have the funds for the next one, etc.

I guess there’s also just natural drop off. It’s “new year, new me” – I’m gonna register for something. And by the time we get to June, July, there’s no more “new year new me” anymore, I’m tired. It’s the same problem they have at gyms, except that gym I think it starts from February, so that’s good to understand about the seasonality. Thank you.

I think maybe let’s bring it home. Just looking out to, I guess 2030, you’ve got a targeted return on equity you’d like to get up to around 20%. I’m sure you’d like to get higher, but it’s good to have realistic target. The overall message I’m hearing is things are good, margins look promising, you are investing in the core business. There’s some really exciting stuff coming. The mix in the business looks good. I guess the final question from a capital allocation perspective is then what is the sort of the latest thinking on your on your capital investment programme and is there any updated thinking on that ROE? Or is it very much still the case of by 2030, you reckon that 20% could be the target.

Ishak Kula: Ghost, thank you. If we look at the capital allocation strategy, it remains the same. We believe that we’re still in a high growth phase and we’ll continue to invest into major capital projects that are sensible to us, that will support the growth of which one is Durbanville as we are all aware. Ghost, you would see we communicated that we actually accelerated the building there. We’re going to be spending and bringing forward the initial planned phase two earlier, that was much planned much later. We’ve moved that forward. So we’re going to be spending a total capex number there of about R325 million. We expect that entire project, including phase two to be concluded in Q3 2026. So that’s our big capital project there.

And quite excitingly, there’s other capital projects that’s in the pipeline where we’ve seen really good growth. I think Chris alluded to earlier around the Eastern Cape, we see good opportunity there to invest a bit more, and although we won’t own that campus, it will be a lease. We’ll still invest heavily there to make that a bespoke offering that lives our brand. So you can certainly continue to see in the short- to medium-term the continued capital allocation around perhaps infrastructure and technology which is our big opportunities there.

But balancing that with our shareholders return, which was a stated objective we believe at 20% that we communicated in ROE, remains intact. As an institution, we believe we’ll achieve that in the next five years.

The Finance Ghost: Yeah, fantastic. I guess just on a personal note, I always love seeing South African companies doing things in South Africa, growing in a piece of the market that they understand, not getting distracted by weird stuff, not trying to blame the macro for all the reasons why they can’t do stuff. And yes, I think there have been some very helpful tailwinds for you in terms of the business model, but I also think you’ve risen to the opportunity those tailwinds bring and that’s a big part of it. So well done, it’s just been nice to see another set of solid numbers, clearly a positive story coming through.

I guess as we bring this to a close, Chris, any final words from you in terms of a final message maybe that you want to leave with investors listening to this podcast?

Chris Vorster: Yes, thank you Ghost. We’ve positioned the business very well. I think where we are currently, we’re in a solid position, and that gives us the opportunity to really look at exciting growth opportunities. Let me say we’re not going to hastily just run into new markets and new ventures, but I think we’ve reached the point where we can see a gear shift coming in ‘26 going forward for the institution based on how we positioned the business up to now. We really have an opportunity to look at accelerated growth going forward beyond ’26 / ‘27.

The Finance Ghost: Yeah. Fantastic. Congratulations, Chris, Ishak thank you for your time. I hope we’ll do another one of these, maybe your next set of numbers? It’ll be great to keep tracking how STADIO is doing. But thank you so much, and particularly for just giving your time to the Ghost Mail audience, the investor base there, I know they really appreciate it, so do I.

And yeah, just all the best. You’ve got a very busy, very, very busy few months ahead, some exciting stuff coming next year, all the best for that.

Chris Vorster: Thank you very much.

Ishak Kula: Thank you.