Martin Slabbert of Prime Kapital has strong views on the Hyprop offer to MAS shareholders. As a follow-up to the press release dealing with his concerns around the deal, he joined The Finance Ghost on this podcast to dig deeper into key concepts including:

- The backstory to the relationship between Prime Kapital and MAS;

- His views on why Hyprop has put in this offer;

- The conditional nature of the Hyprop bid and the risks that he believes that this introduces;

- The highly unusual structuring of the deal in terms of how long the offer is open for;

- The nature of an irrevocable undertaking; and

- What the future might look like if this deal goes ahead.

Important disclosure: Prime Kapital has paid a market-related fee for the production and placement of this podcast. The views shared by each of Martin Slabbert and The Finance Ghost in this podcast reflect their opinions on the topics covered herein and should not be seen as financial advice. As noted in the podcast, The Finance Ghost currently holds a position in Hyprop. As always, do your own research in forming a view on this transaction.

Listen to the podcast here:

Transcript:

Introduction and disclosure: This episode of the Ghost Stories podcast was recorded on 23rd July, which is in the middle of the week during which the Hyprop offer to shareholders of MAS is open for acceptance. This podcast features Martin Slabbert of Prime Kapital. Martin approached me because, as a follow-up to the letter to shareholders that was published in Ghost Mail, he wanted to make sure that further insights could be delivered to the Ghost Mail audience. Hence, we agreed to do this conversation.

It mostly features Martin’s views on the offer, so please do see it in that light. And where I feel that it’s appropriate. I’ve added in some of my views as well, mainly around the structuring of the offer.

Full disclosure, as I give again in the podcast, I am actually a Hyprop shareholder, so ironically I’m probably better off if MAS shareholders do accept the offer. However, in the interest of balance, of course, even when it doesn’t necessarily go in line with my own portfolio, I’m ensuring that these views are available to you and that I’m also not shy to hold an opinion when it doesn’t necessarily go in line with what is in my portfolio.

With that disclosure out the way, please remember that nothing you hear on the show is financial advice. It is in fact the opinions of someone who has a strong vested interest in the transaction in the form of Martin. So please do see it in that light and ensure that you consult with your financial advisor as part of making any decisions.

The Finance Ghost: Welcome to this episode of the Ghost Stories podcast. We come to you in a very busy time around a company on the JSE that I’ve got to say doesn’t usually find its way into the headlines, certainly not nearly as much as it is at the moment – and that is MAS Real Estate.

Today I’m speaking to Martin Slabbert from Prime Kapital and obviously that’s – well, Prime Kapital is a name that I think the market is starting to really get to know. Martin. I’m not sure how many people know you, but they’ll get to know you through this podcast.

So welcome to it, in a very busy week in which Hyprop has made a voluntary offer to MAS shareholders with a very, very tight timeline. Hence why we’re doing this on a very tight timeline because you wanted to make sure that this gets out there while that offer is still open.

And just to maybe get some disclosure out the way before we start this – so the horse I have in this race ironically is I’m actually a Hyprop shareholder. I have been for a while, I’ve mentioned that in Ghost Mail several times, but my self-appointed mandate and what I do in Ghost Mail is to really help people in the market try and understand more about what’s going on out there. I really do focus on balanced views and sometimes those views goes go against something that I might have in my portfolio, a legacy holding, whatever the case may be. I’ve made it clear in Ghost Bites that as much as I’m a Hyprop shareholder and actually it would be lovely for me if everyone at MAS ran off and accepted the offer that Hyprop has put in, I’ve also looked at it and I’m not thrilled personally about some of the terms that I’ve seen there.

Martin, you have much stronger views than not being thrilled, some of which came through in the letter that you sent to MAS shareholders which was published on Ghost Mail earlier this week. Again, I think you value the Ghost Mail audience and you wanted to make sure that they get to see this stuff. So with that long intro out of the way, Martin, welcome to the show. Thank you for doing this, for valuing the Ghost Mail audience, for wanting to take them your views and I certainly look forward to digging into this with you.

Martin Slabbert: Good morning. Thank you. Ghost. We don’t usually, or I don’t usually do this type of thing, but given the circumstances, I think it’s very important to reach some of the retail investors which are not often – are difficult to reach when one speaks shareholder to shareholder.

The Finance Ghost: Yeah, absolutely. Well, thank you for doing that. I always want the retail investors to be given a chance. That’s kind of the whole point of my business. So I love seeing that kind of stuff.

So let’s dive into it. Let’s get some backstory here because as I said at the beginning, MAS is not a name that finds its way into the headlines very often. It’s kind of a slightly obscure property fund on the JSE. It’s actually quite sizable, but because their portfolio is so far away, everything is in Central and Eastern Europe, it’s not a commonly thought of name. Most retail investors, if you say oh property, they’ll spit out the usual suspects in terms of the big names on the JSE. MAS is not usually one of them.

So what’s exploded onto the scene now is this corporate activity around MAS, these potential deals around that asset. And that’s why we’re here today. I want to understand from your perspective and for the listeners to understand: how did we actually get here in terms of your relationship with MAS, why Prime Kapital even wants to do a deal here. What is the backstory? What brought us here?

Martin Slabbert: Thank you, Ghost. Yes, we probably need to go back quite a bit to provide proper background. Victor Semionov and I, we’re the co-founders of a company that was called NEPI, it’s nowadays known as NEPI Rockcastle. We left the business in 2015 and founded Prime Kapital as an equity partnership with a number of investment and development professionals co-investing with us. They’re all partners and investors. Soon after we founded Prime Kapital, we formed a relationship with MAS, which became known in MAS’ disclosures as the Development Joint Venture.

The Development Joint Venture is actually a company called PKM Development in which both Prime Kapital and MAS are invested. Both Prime Kapital and MAS own ordinary shares in the company which we take up took up for cash and Prime Kapital has the controlling stake in the company. And then MAS undertook to contribute some preference share capital as well.

So we are managing PKM Developments under separate governance with a view to maximize return for shareholders of this company. And since 2016, PKM Developments spent just over R17 billion on property development, all of it very successfully. So during this time period, over the last eight years, whilst we spent R17 billion on property development, PKM Developments also acquired some MAS shares in the market, mainly in two tranches or in two time periods. And the total amount that was invested is around R2.4 billion. So I think it’s important to note that this is not our primary business. We’ve done about seven times as much business in development as what we’ve done in terms of MAS purchases.

The first of these MAS acquisitions, which account for about half of PKM Developments holding in MAS, was acquired during COVID when MAS’ share price was severely depressed.

Then we stayed out of the market until 2024 when again when two things happened. One is that MAS’ share price was again depressed, this time because of some difficulties in the sub-investment grade European bond market, where MAS has some bond issues. And it suspended its dividend because it’s building up liquidity to repay that bond early next year, which it made made very good progress on incidentally. And there was also at the same time an opportunity because Attacq wanted to offload its stake. So we agreed with Attacq to acquire their stake and then we bought some additional shares and that accounts for the second half of the shares (more or less) that PKM Developments holds in MAS. So today PKM Developments holds about 22% of MAS as a result of these share purchases in two time frames.

Now if some of your listeners didn’t know. It’s very interesting to note that at the time when we formed our relationship with MAS in 2016, Attacq actually held about 40% of the shares in MAS. It was a much smaller company at the time, about €400 million market capitalisation. And the CEO of Attacq at the time is the CEO of Hyprop today. And the CEO of Hyprop today, which was the CEO of Attacq at the time, was a prominent non-executive director on the board of directors of MAS at the time when this relationship was formed. So that’s just some interesting – some background.

So I think it’s important to mention a few things that for background as well. The blended return that MAS earned from its investment in PKM Developments since 2016 to December 24 was almost 14% per annum in euros. So that’s an enormous return. It was very successful from a return perspective for MAS.

And since MAS became a company that’s focused on Central and Eastern Europe from 2019 onwards, MAS’ total return per share, in euros, is about 60%. So whilst most companies listed on the JSE and I’m referring you to property companies – including Hyprop, which you invested in – over that time frame, actually delivered negative euro returns per share. But MAS’ total returns per share is about 60% in euro terms. So those are very strong returns and unfortunately those are not reflected in its share price and it is most likely because MAS has suspended its dividend payments in 2023.

So, I’ve talked about the shareholders of PKM Developments in MAS, which adds up to around 22%. There’s another 13% which is held by the partners in Prime Kapital’s families. So our family interests combined account for another 13%. And these were shares that were acquired over the years in MAS long after we formed the relationship in 2016. But a substantial amount of shares were acquired in MAS by the family interests and I think it’s important for shareholders to realise that 13% of the company is held directly by our family interests.

My family interests account for about 50 million shares, or about 7% of MAS, so we are very strongly aligned with other shareholders in MAS and it’s very much in our interest to make sure that MAS in the long run maximises value on a per-share basis. So we are long term investors, all of us. We’re not focused on the short-term and although the share price is depressed at the moment, we very much focused on the long-term. And given that our shareholdings in PKM Developments and our direct shareholdings are lumped together, we are in a situation or in a position where we’re not permitted to acquire further shares in the open market. We hold about 35% shareholders jointly. And this is really where the idea came from to launch a voluntary bid to acquire shares from other shareholders.

We think that the share price is very attractive. We thought it was for some time now, and we would like to buy more shares, but we’re not permitted to do so unless we launch an offer that’s available to all shareholders.

That being said, it has become apparent to us that there are some shareholders who are very uncomfortable with us becoming a majority shareholder. MAS doesn’t have a controlling shareholder today. We combined hold 35% and then the PIC has about 15%, and then it becomes smaller. And there are lots of retail investors as well.

So we have been in discussions with shareholders to try and make them comfortable. And we actually said to shareholders, I think, which is quite unique in these circumstances, that they should tell us what it is that they would like to add to our offer that would make them comfortable. What minority protection that they think would make them comfortable, they should propose to us and we’ll add it to our offer so that they don’t have to have the fear that our intentions are to squeeze minorities once we get into a majority position.

In this regard, for example, we offered to shareholders that we will include a term in our offer that prevents us from acquiring further shares outside of this process. So if we get to 50%, we need to stop buying at that point. We also offered to put in place fairly strict dividend policies and other forms of share capital returns to shareholders, such as share buybacks.

Those types of actions, we think, illustrate that our intentions are, in the end, to make the 13% of the company we hold directly as valuable as possible.

We’ve also indicated that we will make available about €110 million in cash to fund the cash portion of our voluntary bid. And we are in the process of putting in place substantially more liquidity, more than double that. So there is a possibility that we could increase our cash offer. We could more than double it, potentially.

That being said, we are in discussions with shareholders and if shareholders are so uncomfortable with the idea of us being a majority shareholder, we would also consider withdrawing from the bid and rather distributing this cash to MAS and to Prime Kapital, which would place MAS in a position to resume dividend payments in September of this year.

The Finance Ghost: Martin, thanks. There’s a lot of detail there which is great and super helpful. So if anyone wondered if MAS is a shortening of Martin Slabbert, it’s not. I think we can confirm that, it’s just a happy coincidence.

More importantly, there’s been a lot of interesting stuff that’s happened along the way here. And you talk to that depressed price at times, in the MAS share price. I’ve written about that many times and for those who maybe haven’t followed the story that closely, it is all about that journey to bond redemptions and managing the balance sheet. And what I always thought was that it’s quite a conservative view from management around what could happen. I think that a lot of JSE management teams are a little bit more cavalier about this stuff and it’s like, well, you know, we’ll deal with it when we get there – we’ll do a rights offer if we need to and we’ll fix the balance sheet. I mean, how many of those have we seen on the JSE, which is very destructive behaviour? Whereas I think that the MAS board took a route of saying, well, you know, let’s rather do the early warning. And I know they were quite surprised by just how negative the response was on the JSE to the dividend going away in favour of more of a NAV-focused balance sheet management strategy. And I think that was a hard lesson they learned around just how many institutional investors on the JSE care really about the dividend and not necessarily about much else. So it’s been an interesting journey for MAS.

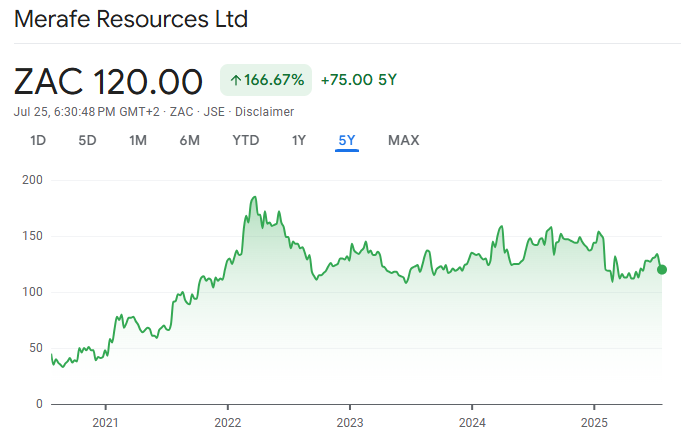

You referenced the total return there on Hyprop. I actually checked on my app now, so I think my timing was quite lucky. I’m up quite nicely. And that’s the point is that sometimes market timing is lucky. And it feels like some of the deal activity we’re seeing at the moment around MAS is maybe a little bit of an attempt at some lucky market timing, some opportune deal making, which is certainly part of how M&A works. Let’s not kid ourselves – opportunistic plays are a big part of it.

It sounds like you’re quite a long-term holder in MAS. It sounds like you see yourself as aligned with – maybe not the short-term strategy, or in terms of some of the stuff that’s been done, if I think through some of the comms that came out around wanting to call a shareholder meeting to get a shareholder vote etc. and we’ll get to that – but I’m going to ask you outright in terms – and mainly because you’ve been quite outspoken about what you see as this Hyprop offer – so from your perspective, what do you think their rationale is? Because obviously their official story is we like the assets, it’s in the CEE region, so Central and Eastern Europe, we’ve got some stuff there already, it aligns with what we want to do, etc.

From my perspective, my opinion is it does look quite opportunistic in terms of the price they put on the table. And personally, again my view, I think that giving people a week to accept an offer speaks to opportunistic behaviour rather than saying hey, let’s go along for a long-term ride. I’m still not sure why they’ve gone that route and I don’t particularly like it. It’s just my opinion. But I’m going to ask you the question now around why do you think Hyprop wants to do this deal?

Martin Slabbert: Well, I think the answer lies in the pricing and the offer structure. So let me talk about the pricing first. The price at which Hyprop is proposing to acquire what I said is options from shareholders over a controlling shareholding in MAS is at approximately R18 per share. Shareholders should not be hoodwinked into thinking that it’s R24 per share. The way Hyprop structured the option is to be partly cash and partly in equity. The cash part is at R24 per share, which then looks very attractive since the share price, the share was trading at around R23.50 when that offer was made.

But the cash portion is capped. And if you actually calculate the total amount of the price that would be paid if they exercise the option, if all shareholders accept, that accounts for about 5% of the total shares in issue in MAS. So really the price is in the exchange rate, because what Hyprop is really offering is to exchange potentially Hyprop shares in exchange for MAS shares. And if you do that calculation, you get about R18 per share. And there are a few interesting details there. They say that MAS is not permitted to pay a dividend, but Hyprop will pay a dividend before it issue shares if it completes this transaction. So that also impacts the pricing.

We think that if you look at MAS today, you could take the NAV of the company and divide it more or less in two equal parts. The first part would be its investment in PKM Developments and the second part, roughly equally to the same value, would be the investment of MAS in direct assets, net of its debt. So at R18 per share, Hyprop is essentially valuing the investment in PKM Developments at zero. It’s only paying for the direct investments net of debt.

So given that, I think the offer pricing is highly opportunistic. That combined with the structure and the short time frame and the fact that Hyprop is actually not making an offer which is binding from the perspective of somebody that would accept the offer.

The Finance Ghost: So let’s talk about some of that conditionality, because you’ve raised the point there around the offer is not necessarily binding. And you know, it’s quite interesting because one of the conditions really sticks out. So the backstory to this is that a group of institutional shareholders, I think they were pretty much all South African from memory, have essentially sent a rather pointed set of questions to the board of MAS around historical disclosure, primarily around the joint venture agreement that Prime Kapital sits on the other side of.

Now, disclosure to the market is the responsibility of the board of directors of MAS, so I’m not sure how much you can or even want to comment on that – probably not much, but I mean if you want to, then go ahead. But I think what’s more interesting is the fact that one of the conditions in the Hyprop offer is to say they want to be put on a similar level of knowledge of the relationship to you. Now what makes that even more interesting is that MAS has recently disclosed a legal summary prepared by well-known attorneys that basically deals with a lot of the detail of the joint venture. I mean I’ve read that document, it’s multiple pages, it goes into plenty of detail, it’s not just a little one pager. So basically what Hyprop is implying here is that there are still significant disclosure gaps. I mean that’s how I read what they’ve said in the context of what is out there. Now, again, if you want to comment on the historical disclosure you can. I doubt you want to. But perhaps more importantly, you can probably comment on your views on Hyprop’s requirement to get this additional disclosure. And obviously this is feeding into why you in your opinion see this as an option, and I think you called it the “Hyprop Free Option” in your letter, which was a rather colourful description. So I’ll let you give some more information there on your views.

Martin Slabbert: Yeah. About the disclosure, let me just – I don’t want to talk about it much because it is indeed the responsibility of MAS as to how they disclose and what they disclose. But I would like to just say this. The CEO Of Hyprop, as I mentioned before, was a prominent non-executive of MAS when the agreements in question were entered to in the first place and he was perfectly happy with the disclosures that MAS adopted at the time.

Those disclosures have been simply rolled forward by the board since 2016 to very recently. So in fact, the current board members, I don’t think any of them were board members at the time when MAS originally decided what the appropriate disclosure is around these agreements.

The second thing is that if you do go to MAS’ website and you download the summary of the agreements there, you would note that it’s very comprehensive. What those summaries actually confirm is that they isn’t any price sensitive information that hasn’t been disclosed by MAS prior to actually disclosing the summaries of the agreements. So there really isn’t anything that Hyprop could be seeking to know that is not really known to it and to the rest of the market.

So what we think Hyprop is really doing, potentially cynically, is to ask for something that they know that MAS’ board can’t give to them, then to use that to cast the board in a poor light, stating that something that sounds very innocent and appropriate, that all parties should have similar levels of information, that the board doesn’t want to comply with that and that the board is somehow trying to prevent Hyprop from making an acquisition to the benefit of MAS’ shareholders, as it’s been painted in some quarters of the press at a very opportunistic price.

The Finance Ghost: Thank you. That is very interesting and I guess much of this will come out over time I suppose as the board has to respond to some of those disclosure requests from shareholders. I noted that MAS has now sent out the notice for the next extraordinary general meeting. It’s incredible that I can say “next extraordinary general meeting” – again, this is a company that historically has kind of just gotten on with it in owning Eastern European property and now they’re having an extraordinary general meeting a month at the moment. So it is rather interesting. This is life in the listed space.

Something else that was rather interesting – and I must say again I was quite surprised by Hyprop’s approach here – because they raised money, I think it was last month and they did it on this view to the market that they might make an offer for MAS. And they went and raised, I think it was just over R800 million from memory. And they had no problems raising it because there are lots of South African institutional investors with very, very deep pockets who are always looking to support accelerated bookbuilds in REITs like Hyprop. So they had no problem raising that basically in the space of a day. And they sat on the money for several weeks and then they came out with this offer, but it has an acceptance period of essentially just a few days, which is extremely unusual. Generally, offers will stay open for weeks and weeks and conditions will need to be sorted out over that period and then they can be accepted, etc. So, this is an extremely unusual deal structure from a JSE perspective. And I know that some of that has to actually just do with jurisdiction and regulations and where MAS is domiciled and maybe you can speak to that a little bit as well. But it also almost feels like maybe in the background, Hyprop spoke to some institutional investors in the meantime and said, you know, this thing’s coming, what do you think?

Which is not to imply that anything wrong has happened here, because canvassing your major investors before the time, making them insiders and then them not trading on that knowledge is market practice in corporate finance. That’s a very normal thing to do. It’s unfortunately just one of the structural differences between big instos and retail shareholders. And again, just to be clear, the balancing factor here is that once an institution or anyone is made an insider on a share, if they trade on that knowledge, on that inside information, then they’ve broken the law. So that’s kind of the saving grace here is that they then agree, okay, we’re insiders now, we’re under NDA, we won’t trade.

I’m not saying that’s what happened, but it is odd to me that Hyprop would have a one-week period to accept the offer. That’s just a bit of a surprise. And I imagine you were quite surprised by that as well?

Martin Slabbert: Yes, there’s quite a bit that I would like, or could speak to – it is a very unusual offer structure. We’ve made some commentary in our letter to shareholders about that. I could briefly summarise that again.

The offer is very unusual. It would be unusual anywhere in the world, including in Malta and in South Africa. And it’s not something we would have dreamt of trying to do. And there are a few reasons for this.

The first thing is that there are loads of conditions in this offer which is under the control of Hyprop and it includes the possibility for Hyprop to amend its offer up or down subsequent to acceptance of offers by MAS shareholders, which is highly unusual. In other words, you accept the offer, but then Hyprop could still actually change the pricing. Hyprop also retains the right to extend the time frame for as many times as it wants to. So, if you accept the offer, in very simple terms, you are then prevented as a shareholder from trading in your shares. You are prevented from accepting any other offer because you are prevented from trading in your shares. Hyprop could keep you out of the market for as long as they want. Hyprop could change the terms of the offer at any point in time. And Hyprop could also, in the end, decide not to follow through with the transaction because one of the conditions that is under its control hasn’t been met. This is called in law and in economics – it is an option. It is not an offer to purchase shares.

It’s also in contravention of the JSE’s listing requirements, which include the offer timetable rules, which we understand any offer should be subject to, including one that we should make, one which determines that offers need to remain open for 12 days after they became unconditional. It would be the same under Maltese law. In our view, this is quite a dangerous strategy that Hyprop is taking, and especially if you contextualise this with some of the institutional shareholders overlapping MAS and Hyprop, because we’re not sure that Hyprop is seeking here to make an offer, get options over a controlling portion of the shares and then avoid a mandatory offer to other shareholders. And it’s asking MAS board to confirm that it wouldn’t have to make a mandatory offer. Which makes you wonder what the real reason is for the request to place additional directors on the board by some of the shareholders that signed the notice to call the EGM that’s been called to add four additional directors to the board.

And why am I saying this? Well, we’ve been analysing the trading patterns and the shareholding of the institutions that signed the letter, in combination with another large South African institutional shareholder. They all seem to hold higher or more valuable stakes in Hyprop as compared to their shareholdings in MAS. So they have overlapping shareholding and they seem to be weighted towards Hyprop. So, the only shareholders that could potentially benefit from a transaction which is at a price which favours Hyprop would be shareholders that are overweight HyProp. And our view is that that shouldn’t come at the cost of shoulders that are not invested in High Prop, which is the vast majority of the shareholders in MAS.

The Finance Ghost: Yeah, lots of really interesting moving parts here. I think let’s move on to the irrevocable undertakings because these are actually quite serious things. And generally speaking, again, in typical corporate finance transactions, an offeror or potential offeror or whatever the case may be, will approach insiders, will approach one or two major institutions for an irrevocable undertaking to say, look, we want to do this deal, we want to bring this to market. It’s going to fail unless we get like major support from one or two key people. Will you give us an irrevocable to support the deal? And again, to reiterate what I said earlier, this typically makes them an insider. They sign an NDA, they agree not to trade. That’s how this works.

And the point of an irrevocable undertaking is it’s irrevocable, which means that I say to you, I’m definitely going to do this and that’s it – my understanding is that this is basically a legally binding situation. I’m going to agree to accept your offer. That’s how this is.

Now, normally you would give an irrevocable subject to only customary conditions like a regulatory approval, etc. etc. – stuff that you can understand (1) needs to happen and (2) is outside of the control of the company to a large extent. But this Hyprop offer has conditions that are still very much in Hyprop’s control, all that kind of loose wording around they want to be put on the same level from an information perspective and then they still want to be able to choose what they do, etc. So it’s an unusual situation, again.

And I just want to touch on the irrevocable perspective or rather the irrevocables point. What is the legal position that is actually faced by someone here who says yes to the offer? Because I know you’ve raised it in your letter where you’ve said, look, if you say yes to this thing, you could potentially sit in a situation where you are stuck for several months waiting for the conditions to be fulfilled. Walk us through how these irrevocables work?

Martin Slabbert: That is correct. If you accept the offer by Friday, then there’s no guarantee that Hyprop will follow through and acquire the share because of the conditionalities, many of which are within Hyprop’s control. Hyprop could also then amend its timetable by giving notice to you. And Hyprop could also amend the terms of its offer by giving notice to you.

But you, as a shareholder that accepted the offer, remain irrevocably committed to sell to Hyprop up until the moment when Hyprop releases you from this commitment, which they don’t have to do for months to come. So it really puts a shareholder in a very disadvantageous position.

Usually, irrevocable undertakings are given by large institutions and for shorter time frames. They are very loathed to provide irrevocable undertakings. So it seems to us that what Hyprop is doing here is dressing up what we call an option agreement or an irrevocable undertaking which is one-sided, which is detrimental to the provider, dressing this up as an offer to acquire shares at R24 a share, whereas in fact it’s an undertaking to sell shares in exchange for Hyprop shares at R18 a share if Hyprop should choose to exercise their option to acquire at the dates in the future on terms that Hyprop may still determine. So it is indeed very unusual and it’s not market practice and it’s not something that we would have dared to attempt ourselves.

The Finance Ghost: I think let’s move on to the structure of I guess both potential offers on the table, one of which is from your side and may happen, may not happen. I keep calling the Hyprop one a potential offer because it’s still conditional, so it is technically a potential offer, that’s not wrong. And I guess the one common theme is that cash is always king. I always write about this whenever there are deals on the markets. I mean there’s another example right now playing out right now with Assura and Primary Health Properties where there’s a cash deal on one side, shares on the other for a merger. People like cash. Now interestingly, the board in that case has backed the share offer and it doesn’t look like they’re getting the acceptances from the market that they thought. Who knows what happens there, it’s outside the scope of this discussion.

I guess the point I just want to make is in M&A, cash is always king, always and cash is a bit thin on the ground in terms of an outright cash deal to buy the whole of MAS because it’s actually quite big, as much as it’s not necessarily a name that comes through very often on the JSE, this is a large fund.

There’s a cash element in the Hyprop offer which we’ve talked about. There’s a cash element in the original offer that you put through or at least indicative offer which is larger than what Hyprop is putting on the table, is my understanding. But either way, shareholders in MAS are being asked to effectively swap their exposure in MAS for some other kind of equity exposure. Now in the case of Hyprop, it’s for a known quantity, which is the Hyprop shares. In the case of the Prime Kapital offer, it would be for an inward listed preference share. And in case anyone is listening to this and thinking oh the Ghost has a one-sided view here, it’s not true. As usual, I have a balanced view and when this came out I wrote in Ghost Bites, I’m sure you would have read it, Martin, that I have a bit of a dim view on the liquidity of that instrument. I feel like it’s something that would be inward listed and would probably not trade, unfortunately – South African liquidity is not good. So maybe the thesis here is that it’s a long-term holding kind of instrument, but at least there is some liquidity in MAS, so people are effectively giving up liquidity if they go that route. And that’s obviously one thing we need to touch on here.

But I guess the overall point is why is the status quo so broken? That’s the thing I look at. It feels like there’s an offer here, there’s an offer there – why do MAS shareholders need to do anything at all? And this kind of brings us back to the shareholder vote that you called for the extraordinary general meeting. A vote on a value unlock. It doesn’t really look to me as though other shareholders formed an orderly queue to say yes, we love this idea. It didn’t seem to get great support.

And I’m going to kind of open the floor to you for a few minutes as we start to bring this to a close. Just to walk us through why you think that inward listed instrument is potentially a good idea? Bearing in mind it’s not actually a formal offer right now, is my understanding, this is something that might happen. And also why do MAS shareholders need to feel the need to do anything at all? Why can’t this thing just carry on?

Martin Slabbert: Thank you. That’s a mouthful. I’ll. I’ll address it point by point. Let me start with your first statement, or the last statement – why do MAS shareholders do anything at all? You’re right, MAS shareholders don’t have to do anything at all. And in fact under our proposed offer structure, they don’t have to take up any of the offers either.

So what we have proposed to say to shareholders, that we will make available some cash – what we’ve put forward to date is €110 million, which will cover about 17% of shareholders’ holding if everybody would accept, except of course ourselves. We could increase that substantially. We haven’t taken that decision yet.

And we also structured the offer – we will structure in such a way that if shareholders don’t want to take the preference shares, they can only take the cash portion. And so they don’t have to take both. They can take one or the other and they don’t have to take their preference share either. They can stay invested as MAS shareholders.

What we were trying to do, which is offering an exit for those shareholders that don’t share our vision for the future of the company, which perhaps is different from other shareholders’ vision, we’re not as dividend focused, for example, as some of the shareholders in MAS are.

But going to the preference share, we don’t know that it will or won’t be liquid. I take your point that perhaps there are some preferences listed that are not liquid and maybe the majority of them are not liquid. But there are some differences between a preference share structure and normal equity. And one of those things are that these preference shares are redeemed for cash. So you’re not totally reliant on selling your share in the market. The listed feature of the preference share is kind of a bonus, because you know that you’re going to get a cash exit.

And secondly, I think the preference share that we put forward is very generous in terms of its payout, because it will pay out to you a minimum price – there’s a floor price of €1.50 per MAS share, that translates to about R31 per MAS share, and that floor escalates at 7% per annum. So there’s a floor that grows in euro terms at 7% per annum and it pays the higher of the floor – it redeems at the higher of the floor or 90% of the underlying NAV per MAS share. Now, not many property companies are trading at 90% of NAV. So we think it is a pretty generous offer. And it does tell shareholders that we have a very strong conviction about the net asset value of MAS as a company.

I haven’t lived in South Africa for many years, but I do understand that a lot of the property companies there perhaps publish net asset values which are not achievable in reality if you should sell the assets. But we’re pretty comfortable as to what the value of those assets are because we’ve developed and acquired almost all of MAS’ assets with the exception of one shopping centre that they own in Germany.

Going back to the original point, we’re not going to force our ideas onto shareholders. If shareholders are very uncomfortable with the idea of us becoming a majority shareholder, we will not proceed with the offer and we will then rather take the cash that we’ve been raising and these are substantial amounts and we will distribute that to the shareholders so that MAS can start paying dividends again and operate as normal. So very much I think a going concern, status quo position is possible. Shareholders don’t have to accept any offer that they’re not comfortable with and the company should return to dividends pretty soon. I think that’s evident to anybody that’s been looking at the company’s results. It doesn’t have high gearing levels, it has raised a lot of money. I think it’s well positioned to repay the bond in full when that date comes early next year.

The Finance Ghost: Thank you. Yeah look, it was a mouthful. I’m sorry for that. We are trying to obviously fit in a lot in the time we have and I think let’s maybe get to the last question while we have time and that is: let’s assume this Hyprop offer works and they do in fact reach a controlling stake and they do manage to close all the conditions and it all happens over the next few months and there’s a big change in the shareholder register of MAS.

Now you’re probably, I’m guessing, not going to accept the offer at that price as Prime Kapital of your shares in MAS. I’m not even sure if you can really comment on that, but maybe what you can comment on is the shares holding the joint venture. Who’s actually going to make the decision about accepting that offer from Hyprop, because the joint venture itself has shares in MAS? And then looking ahead, I know this is very sensitive issue and maybe it’s not something you can comment on easily, but what does this world look like in which potentially you’ve got Hyprop now as a controlling shareholder? You guys haven’t had the best relationship right now given the competing corporate actions. What are your thoughts on that to the extent you can and are willing to comment?

Martin Slabbert: Well, obviously the development joint venture’s board will take a decision as to whether it accepts the offer or not. I don’t think it will, because the offer is so poor, and I certainly don’t think the family interests of my fellow partners will accept the offer either. So 35% of the of the register is definitely not going to, is likely not to accept the offer. Definitely, very, very close to definite.

So in order for Hyprop to achieve control, they need to get 50% out of 65% of the shareholders. Basically I think that’s a very, very challenging target. So given the time frame, given the issues with the optionality that Hyprop is looking for, given that only 65% of shares are available and they need to get to 50%, I think it’s highly unlikely that this will succeed on Friday.

Now Hyprop may decide to extend the time frame – they have that flexibility. They may decide to increase the pricing, we don’t know. So I think it’s a bit early for us to start thinking about those scenarios as to what happens if Hyprop does manage to get options over 50% of the shares and then three or four months from now decides to proceed after all the conditions are fulfilled.

The company will remain listed, so it will be under the management control, I guess, of a different group. But the assets are solid, they’re very good assets. I think that you could stuff up any business if you don’t make good decisions, but we’re fairly confident with the assets that we are invested in, so we’re not too concerned.

The Finance Ghost: Interesting. Well, Martin, thank you for your time. All the focus right now very much on this Hyprop offer because that’s the thing that is happening literally this week. We’ll see what happens with it and then I guess after that there’s going to be more focus on, if that offer doesn’t go through, what kind of competing bid might Prime Kapital actually bring to the table or not, as the case may be. We’ll have to see what happens. The next extraordinary general meeting has been scheduled for August based on what I saw on SENS this week. That’s the one at which there are various resolutions around changes to the board of directors, potential appointments of new non-executive directors. A lot of the backstory there is all the allegations around disclosure shortcomings, etc.

So, there are a lot of moving parts here. As I said earlier, you’ve got major shareholders on both sides, you’ve got the board in the middle, you’ve got some big questions being asked. It is the sharp end of corporate finance for me as a casual observer with a small, very small stake in Hyprop, as a percentage of my wealth. I get to just enjoy seeing corporate finance play out. You obviously have a very big horse in this race.

So thank you for taking the time to do this with me. Thank you for, I think, just valuing the Ghost Mail audience and the retail investors and the instos who will listen to this as well, because I know they’re out there and I know they’re listening. So, Martin, thank you very much. And I look forward to seeing how all of this unfolds. Good luck.

Martin Slabbert: Thank you, Ghost.