Listen to the show using this podcast player:

STADIO Holdings has a growth story to tell. That’s a rare thing on the South African market. The tertiary education space is booming and STADIO is addressing that demand through a combination of contact learning and distance learning offerings.

On this podcast, CEO Chris Vorster and CFO Ishak Kula joined me to talk through the strategy, the growth prospects, the capital allocation strategy and the risks that keep them up at night. If you want to really dig into the STADIO business model, you’re in the right place!

Please note: this podcast has been sponsored by STADIO. Where I work directly with companies, I always craft the questions myself without any influence from the company. My thanks to STADIO for valuing the broader Ghost Mail audience and for stepping into a new era of investor engagement. As always, you must do your own research and treat this podcast as only one part of your research process. You’ll find the most recent financial reports at this link.

Full transcript:

This episode of the Ghost Stories podcast is brought to you by STADIO Holdings. The goal is to give you further insights into the strategy and business model based on recent company announcements. I crafted the questions myself without any influence from the business. Please note that as always, nothing new here is financial advice. And you should not interpret this podcast as an endorsement of the company. Instead, use it as part of your broader research process in in your portfolio and be sure to refer to STADIO’s announcements and reports for more information.

The Finance Ghost: Welcome to this episode of the Ghost Stories podcast. It’s one that I’m particularly excited for because we’re doing something new here. We are taking a step into, I think, a new age of investor engagement. We are doing a podcast with STADIO around their recent annual financial results and the strategy at the company and what they’re busy with. And this is really a wonderful example of the management team at STADIO actually engaging with the market. There are obviously all the fancy conferences that happen and all the discussions with sell-side analysts, and this is a really great opportunity to bring some of those learnings to a broader audience.

So, my thanks to the management team at STADIO. And here today we have exactly who you want to hear from – that’s Chris Vorster and Ishak Kula, so that’s CEO and CFO of STADIO. Thank you so much for your time on this podcast. I’m really looking forward to it. And not only are we going to have some fun, but I think we’re going to learn a lot about STADIO, so thank you.

First question before I get you to say hello, must be of course: do you export anything to the United States? I think we have to start there. I’m just kidding, but welcome to the show – we don’t need to talk about that too much, at least you don’t export anything to the US and that’s happy news this week. You’re not competing with penguin colonies for trying to sell things into America and all the other chaos we’ve seen in the market this week. Luckily you’ve been somewhat immune from that and you can just get on with your core business, right?

Chris Vorster: Good morning. Let me start there and thank you for the opportunity. I actually last night checked in whether we have any students in the US currently studying with STADIO, and we did see that I think there are three students currently registered for distance learning programs, but they are all South Africans. I’m sure at some stage they will come back to the country. But yeah, we will have to look on how imports are going to be affected in that regard!

The Finance Ghost: No, it’s crazy. I mean, the markets are a volatile place and I think it’s always nice to see a company that just does the right stuff over time. I think that’s been a feature of the STADIO story: consistency. At the end of the day, you guys stick to your knitting. You know what it is that you do, you just move forward and make those incremental improvements in the business.

You’ve talked there about distance learning. So in that case, long distance learning, all the way in the US for a couple of students. I’m guessing most of the distance learning students are sitting in maybe smaller towns in South Africa or places not necessarily close to one of your campuses, right? What about students in Africa, for example? Do you have a lot of that?

Chris Vorster: So, yeah, it’s very interesting. If you look at the demographics of our distance learners, I would say 90% of distance learners are actually working adults, people taking up higher education to improve their employability in the workplace as well as positioning themselves for promotions or then also starting their own businesses. So it’s a whole combination.

And for that, you will see that the majority of distance learner students actually reside in city centres where big job opportunities are. Obviously, there are some students also in rural areas, but still the majority would be in our typical urban areas.

Africa, very small for us still. I think over time we will look at that market. For us, up to now, with such a young institution, it was always the strategy to make sure we build the right infrastructure, support structures and quality product to serve the South African market first. We believe that we are not 100% there yet, but we have laid very solid foundations to in future explore more markets outside the borders of the country.

The Finance Ghost: I think it also talks to the specialisation of some of the things you offer, right? There are some really specialist schools within the STADIO group. This would obviously encourage some of the distance learning, right? You can only get it in one place necessarily, or maybe a couple of places. What examples do you have off-hand of some of the really specialist stuff that you offer at STADO? Because I think it really talks to the strategic moat in the business.

Chris Vorster: Yeah, I think if you now just talk distance learning, one of the unique offerings that we have, but which is not really that big, would be our policing qualifications, which I think is quite unique to us and the relationship that we’ve built with the South African Police Services over the last few years. Ishak, you must help me here. I can’t think of something that’s really totally unique to STADIO that our big public universities won’t offer in this space?

Ishak Kula: Morning Finance Ghost. It’s Ishak here. Good to be here. I think latching on to that question around what makes STADIO unique – one of our businesses and one of our pillars in our business is AFDA, which is our film school, which operates predominantly in the creative economy space. I think what makes that offering unique is other than the institution being an award-winning institution on many fronts, it offers students quite a unique experience, a real-life unique experience in the creative economies to become actors or. film producers. To see these productions in real life is quite a proud moment for us as an institution. It’s amazing to see just the technology that’s embedded in those offerings and the actual true life experience that these students get, it’s really amazing. I think that’s one of the value propositions that makes that offering really world class.

The Finance Ghost: And AFDA is an in-person only option, right?

Ishak Kula: Yeah, Finance Ghost, that is purely contact learning. What we term as contact learning in our institution is typically a school leaver that then joins a physical campus. We’ve got a number of campuses across the country there, four predominantly to service those students in the creative economies.

The Finance Ghost: Fantastic. So that’s just a good example of how that police qualification you talked about is pretty much unique. That’s something you can do on a distance basis. And then on a contact basis, something like AFDA. There’s some interesting stuff in STADIO.

I think what always comes up and it’s always made quite clear in your reporting, is putting your contact learning student numbers versus your distance learning student numbers. You’ve made it clear throughout that this really is the overarching way to think about STADIO. And obviously the pandemic made everyone think about, well, just how much can you do online?

And it turns out that it’s a lot more than anyone thought, actually. There’s always going to be a piece of business that gets done in person, but there’s way more online than ever before. We are recording this online right now and it feels very normal because everyone is so used to having video calls. I remember, it was 10 years ago that I was in my corporate advisory career and you would go – sometimes the really big advisors would have a video room and it was a big deal. A whole fancy thing with a special shaped desk. That was where you did your really important, expensive calls.

So the world changes; it changes quickly. I think what’s interesting at STADIO is you are quite well-geared to this omnichannel model. If someone wants to do online, they can. If someone wants to do it in person, they can. What are your sort of broader targets here and how much flexibility does this give you in your business to have both?

Chris Vorster: Yeah, I think we made it very clear in our whole strategy from day one. We want to serve 80% of our student population in our distance learning mode and then put down infrastructure, campuses, bricks and mortar to accommodate 20% of our student population in the contact learning space, on-campus experience.

So just quickly to come back to what you said about COVID – due to all these distance learning capabilities that we have in the group and our experience in distance learning, Covid was a disruptor, but not as big as I think it was for many institutions. We actually adapted very quickly in moving students from the peer contact learning over to the distance learning mode and we could make sure that we support our students. And we lost very little teaching time, teaching and learning time during COVID.

However, that also came with a few challenges because it took time for our contact learning students actually to go back to the campus. If you look at our numbers from ‘20, let’s say ‘21, ‘22, up to where we are today, it was actually only – and Ishak will correct me, he’s the numbers guy – I think it was only in ‘24 where we saw this real big step back to the campus. I believe it had a lot to do with COVID and secondly also with our whole new thinking on what we’re going to offer at our different campuses.

If I might just use some time here, if you look at a pure or traditional private higher education institution, you will see the institution being in an office block where the focus is basically on teaching and learning and not so much creating or offering a full, holistic experience with extracurricular activities as well. So we took the decision in ’22: let’s sell off some of our smaller campuses and let’s really reposition ourselves when we talk contact learning that we put down a full holistic experience for a contact learner, giving the student that sense and feel of a full university experience.

And that led to our two big comprehensive campuses, the one there in Centurion and the other one that we are currently busy constructing here in the Western Cape in the Durbanville area.

The Finance Ghost: Speaking of university experience, I’ll never forget at Wits University – I’m a CA by profession, so you write those really tough exams in the later years. And a lot of the societies had these rooms underneath the one exam hall. It was like the mountaineering society – I’m pretty sure these people maybe went to a mountain once a year and the rest of the year it was basically just a room for them to drink on campus, bluntly. I distinctly recall listening to them having this wild Friday afternoon party downstairs. They were playing 99 Red Balloons, they were going absolutely ballistic. And I was writing like, I don’t know, FinAcc III or FinAcc IV. It’s just funny how you have those really precise memories in your life of that thing that hurt you.

But I guess the point is maybe not encouraging necessarily that kind of behaviuor, but student life is a big part of the tertiary experience and I think it is part of what attracts people to the traditional public institutions. But they come with some other challenges – we’ve had plenty of noise around stuff like “fees must fall” etc. It seems to have calmed down a bit recently, thankfully, there was a time when it was really bad. But there’s clearly space for this because there’s just a lot of people who want to study after school every single year. I see the stories of how there’s way more demand for tertiary education than supply and presumably that’s got to be one of the big drivers for you. Then other trends like semigration, for example, more people living in the Western Cape than at any time before. I imagine that’s also gone into your thinking around this Durbanville campus and just making it a place where students want to be, just giving another option in the Western Cape, essentially. Right?

Chris Vorster: Yes, definitely. We see a big demand currently, not just for STADIO, but I think for the whole private higher education industry with student numbers or matriculants qualifying for higher education increasing every year. And our public institutions just can’t keep up with this demand for higher education. So definitely a big market for us.

But we also want to emphasise: it’s so important that privates also meet the necessary quality offerings that we are going to offer, to make sure that the graduates that we’re going to deliver can actually meet the demands. It’s not just serving the demand, but that we actually produce graduates that will actually be employable and that can contribute to the economic development of the country. That should always be the focus and not just trying to get in more and more numbers, but to ensure that you’re actually contributing to what we actually stand for.

Ishak Kula: I think it’s such a good point, Chris, because I think generally there’s this perception out there with public institutions that somehow the hurdle rate or the barriers or the quality offering is potentially substandard. We always speak about in the eyes of the country or the population, there’s this notion that private schooling is superior to public schooling. But somehow when you get to public universities and let’s call them private higher education institution providers, that the public institutions are superior. So it seems to be the polar opposite. I think that’s one of our things in our institution is people need to realise that the barriers of entry and/or the levels of service and the quality of our offerings are on par with the public institutions. We need to go through the same accreditation processes, the same rigorous oversight mechanisms to make sure our service offering remains relevant and at the right levels. And that’s always this misnomer. It’s quite an interesting thing within the higher education industry.

The Finance Ghost: It’s fascinating actually. You know, you’re so right, you’re absolutely right and I’ve never really thought of it exactly that way around, but you’re right. So that’s obviously the disruption that you can now bring to the story. Tertiary education is particularly close to my heart. So one of the things I hope to do one day, once I’ve maybe built more of a track record, would be something like the opportunity to lecture at a business school, that would be amazing, on stuff like disruption because that’s obviously something I’m busy with as well. It’s a topic that’s very close to my heart, so it’s really great to see this kind of investment in South Africa.

There was something I wanted to ask you later, but I’m actually going to ask you now because I think it’s relevant, which is just to understand how you go about deciding what to offer. The typical kind of curriculum that comes in – this is a for-profit business, so it’s a bit different to a public institution that I think can sometimes offer courses that maybe aren’t as directly linked into employment opportunities. Or maybe I’m thinking about this the wrong way? Maybe you look at it and say: actually, we’re a university, and if someone wants to come and study a humanities degree where there’s no guarantee of a job afterwards, that’s okay.

So how do you actually go about thinking about this kind of stuff and the curriculum and how you offer things and where you offer them?

Chris Vorster: Yes, I think that is a very good question in the sense of, as a private obviously, we can’t offer all the programs that you would see at a big comprehensive public university because we also have to make sure that we look after our shareholders and that the institution remains profitable.

So, although we have a few programs that would typically not make the same profits as your more well-known programs, those programs actually contribute to our whole spread of qualifications, giving us comprehensiveness. So it’s a balance to get that right. But it’s also only fair for us to make that very clear that STADIO would never be in the position to offer all those smaller programs that you would see at a typical, public, well-known, matured university.

How do we do it? Obviously, we have our research that’s continuing in the background every year. But I think where STADIO gets the most traction on what we offer is our links with industry. We’ve made it very clear that part of our DNA is alignment with the world of work. We invite industry into our institution. From when we design a new program, we get them in to evaluate it for us to see whether everything is relevant, whether this is actually what is needed in the workplace. That being said, I must just also make it very clear that we have to meet certain academic standards for a program which is not negotiable, but we invite industry in, make sure that they are part and parcel of how the program looks. Then we invite industry into the classroom, come in and share your experience with our students.

And then thirdly, very important is then to evaluate and give feedback, evaluate the programs, tell us what happens with a STADIO graduate in your business and how are they actually performing? All of that information really gives us the blueprint on how we look at new programs, whether to phase out older programs that are no longer relevant in the workplace, and then to bring in new programs that are actually required by industry.

The Finance Ghost: Ishak, I guess this is where you have to keep everyone honest, right? Some course-level profitability and all that kind of stuff. So maybe I’ll throw this question at you because it’s also just related to the overarching product offering and the way that you guys think about the business.

Just around the growth runway, is it a case of saying, okay, our existing qualifications can just keep ticking over. We can add students every year. The beauty of distance learning is theoretically the number of students is infinite, right? So that’s quite nice. Or do you need to keep adding qualifications in order to achieve your growth targets?

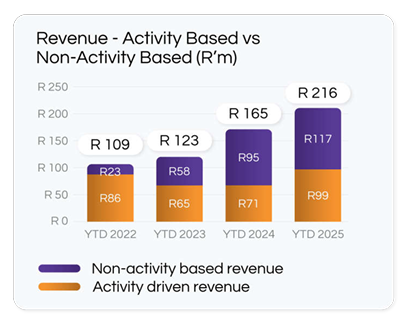

And then anything you can give us around how you think about pricing versus volume, for example, I think it just helps investors understand the levers that you can pull to keep growing revenue at such a strong rate at STADIO. Because I think – well, I don’t think, I know STADIO is a growth stock. Everyone sees it as a growth stock, definitely. And so that’s what’s important, right, is to show ongoing growth?

Ishak Kula: That is exactly right. I think we have been blessed and fortunate with very strong growth. Remember, it’s a fairly young institution listed in 2017, really spun out of Curro at that point, and is now completely independent and separate and distinct. Of course there’s collaboration, but I think for the most part it’s two separate entities managed separately. I think it’s important.

We’ve been very blessed with our growth story, I think particularly in 2024. If you looked at our growth, 14% growth year-on-year. And to your point there, Finance Ghost, I think we’ve been very fortunate. That links directly to our strategies and institution is the bread and butter comes from distance learning, right? So strategically, we’ve positioned the business because that’s where we can pull a lot of leverage. Your incremental cost to serve a student in distance learning, I suppose, is insignificant as you add more students and therefore it allows you many opportunities when it comes to pricing strategies to keep those competitive. That’s how we really look at this business. We want to make sure we provide a high-quality offering at a good and competitive price. Therefore, pricing strategy is always one we want to track inflation or slightly above inflation, but it must remain competitively priced.

We certainly see ourselves from a pricing perspective on par with public universities in the contact learning space. In the distance learning space, no secret that our big competitor is UNISA. And there in the distance learning space in particular, we’re also very well priced against that competitor, certain qualifications probably slightly more expensive, whereas other qualifications slightly less expensive. It’s quite a dynamic thing. But I think it’s important that we stay true to our philosophy of widening access to quality higher education, which means it must also be affordable. That’s always the delicate balance, being a listed environment. I think to Chris’ earlier point, to make sure that we can run a profitable and a sustainable business, but yet serve our community and the dire need within our country.

The Finance Ghost: What’s really interesting and your old friends at Curro, I’m sure something that keeps them up at night is the birth rate. I read it in the hospital results, the maternity cases are dropping. They need children – that’s what they need at Curro. They need more of them! But we’re here to talk about STADIO, and I guess what’s interesting and the reason I raised that trend, is people having fewer kids and having them later – doesn’t that play directly into your business? People are studying for longer, they are putting more energy into their careers. Are there any trends that you’ve seen in terms of the age of students? Is it a little bit older? I’m very curious about what that driver might be because my gut feel is people are studying for longer, investing more in their careers. They understand that they’re on a pretty scary treadmill. There’s AI to worry about, which disrupts entire industries. The fundamentals of your business feel quite strong to me?

Chris Vorster: Yes, I think if we look at our business with the big adult learner component, we definitely see a lot of students coming back and reskilling or doing additional postgraduate qualifications. That’s something that is very noticeable over time, is the number of students taking up postgraduate studies. Now I’m talking about honours, postgraduate diplomas, which is very industry-linked, specific to a specific job. So yes, we do see that happening.

What is interesting though, is in our non-formal business where we look at short learning programs, since after Covid, that business is not really showing any growth. It’s stagnant. It looks like students rather now prefer to do a formal program, get a formal qualification, and even those who want to upskill also go for the formal route of a postgraduate honours, masters or then even a doctorate.

The Finance Ghost: Super interesting. So at the start of this podcast, I said to Chris and Ishak, they have to sit really still when they’re doing this podcast, otherwise the volume does crazy things. Ishak took it so seriously that the light in his office just went off and he had to wave his hands wildly to switch it back on again! You know, these are the joys of me having video on. You can unfortunately only hear this, but it was quite entertaining.

So Ishak, spotlight back on you, literally in this particular case. I want to ask you a financial question, that is around return on equity, which I think is a core metric that investors look at. Investors certainly should look at. If you’re listening to this and you don’t look at return on equity, you need to reevaluate some of your life choices.

This is a key metric when you’ve got stuff like fixed assets and capex. STADIO is interesting because the distance learning is obviously something you wouldn’t associate with capex, but the contact learning you would certainly, when you’re building things like a Durbanville campus, we’re definitely in capex land here now.

Return on equity, I had a look at your latest report, it’s gone up every single year since 2018. So that’s pretty impressive, up from 11.7% in 2023 to 13.6% in 2024, certainly a solid uptick. I think room for improvement there, I would imagine.

What are some of the drivers of that? How do you think about getting ROE up further?

Ishak Kula: Yeah, no, that’s spot on. I think, again, fortunate with the historic growth, but definitely room for improvement there. It speaks predominantly, I suppose, to the “youngness” so to speak. It’s still a young business, basically. I think we’ve been fortunate with really good growth.

When we look at the points you raised around capex, Finance Ghost, it obviously will have an impact going forward, but I think predominantly if we look at our growth trajectory and what we think is going to happen into the future, no one has a crystal ball, right? I think past performance and some good planning I think gives us some headway into what the future looks like. We certainly think that our strategy is, post the construction of Durbanville, which has commenced in October 2024, which is really phase one of our big capex project, we hope to conclude phase one at the end of December 2025 / early January 2026 so that we can open that campus, which will be a big chunk of our capex needs and requirements, that will obviously allow us to have hopefully a good student intake come January 2026 in our Durbanville campus.

I think it’s an important thing because strategically we set ourselves internally that although we want to return more value to our shareholders in the form of dividends, we want to continue to be prudent, we want to make sure that we have a good intake in Durbanville. And post that, certainly from the 1st of January 2026, we see the return on equity even going up more significantly on the back of that capex project being out the way and our capability to sustain a good level of earnings supported by very good dividend growth.

Our internal target is to, by 2030, we believe that we should get an ROE or return on equity of 20%+. I think that will keep us as a management team happy. But I think more so our shareholders.

The Finance Ghost: Yeah, at 20%+, this share is going to be trading at a very nice premium to book, I would imagine, because that’s typically the way it would work on the JSE. Speaking of the share price, I actually just went for fun now and I drew a five-year chart. Obviously that’s back to Covid lows, right, it’s April 2020 as an important reference point, but a casual 400% increase over five years. So well done. That’s pretty good.

I think the other thing that’s interesting to note is year-to-date, you’re actually pretty much flat. So that’s good in a market where there’s been a lot of pain this year, outside of very specific sectors on the JSE, I think that shows that there is support from investors for what you are doing. It’s fun to look at share prices when the market’s tight or difficult and you’re like, okay, what is this thing doing? It really tells you a lot about the resilience that’s baked in.

That brings me, I suppose, to probably my last question on the podcast actually, which would just be around things like a bit more around the dividend policy. You recently went and attended a conference where I think you had some questions around that, around share buybacks. What are investors saying to you? Are they saying, we love the story, take as much of our capital as you can and go bananas? Or are they saying, hey, we want dividends?

This could be a little case study in dividend policy. You can include this in your Durbanville campus commerce course or investment course when you have one. But yeah, it would be good to get some more insights. And maybe just some of the other top of mind stuff that’s coming through from investors and institutional investors? Part of this podcast is to help a broader audience understand what’s going on in the business and what people are thinking about. So that would be good to get a little temperature check on how those meetings went.

Ishak Kula: I think it’s a good opportunity to respond to that. Invariably, many shareholders ask us about our dividends and I think our dividend strategy has been clear and I think we’ve communicated it as such. We certainly want to target 85% of our free cash flow to be declared as a dividend – we want to work towards that post the construction of our Durbanville campus, which is our major capex project. I think that phase one, we estimate it to be around R220 million. We have strategic ideas potentially to accelerate the building, which might increase that phase one cost. But then there’s a future phase two, depending on how our intake looks like next year, phase two, we’ll really look at the timing of that.

But for all intents and purposes, our strategy is to get to 85% free cash flow over the next couple of years, which will increase the dividend substantially. It’s probably the first point I want to make.

The second is invariably our shareholders. I think there was, to be honest, a mixed bag. I think some shareholders liked the dividend on the back of what we declared, whilst others said to us and the feedback has been, we believe so much in the business, we think there’s so much growth opportunity, should you not look to reinvest it into the business? And our response to that is, I think although the dividend has been substantially increased from 10 cents last year to 15.1 cents in 2024, it’s still small relative to what the future state is.

I think the 51% increase, although it’s significant from a percentage perspective, we don’t think it dilutes our growth story at all. We think there’s still lots of runway and that’s how we’ve positioned the business intentionally. We’ve kept it lean, we don’t have any external debt at the end of December ’24. We’ll obviously incur a bit of debt now as we construct the Durbanville campus, but we really want to keep the business lean, which allows us a lot of leeway to move and pounce on opportunities. And that really has been our strategy and it allows us as really good opportunities come our way, we wouldn’t need to do unnecessary capital raises from our shareholders. We could fund it probably very comfortably off our existing balance sheet and/or debt, whatever business we acquire at scale.

To answer your last question, many shareholders ask us whether there isn’t an opportunity to acquire more shares. That’s something I think we as an institution need to look at. Our shares aren’t as liquid, we’re still a small cap. But many of our shareholders ask us, where can they, how can they get more shares? And that is one of our challenges I think that we need to overcome.

The Finance Ghost: It’s a nice question. It’s much better than being asked, please, we want to sell. How do we sell? Do you know anyone who wants to buy them? So you’d much rather be asked that question, that’s for sure.

I remember when you first announced dividends, speaking to institutional investors in the market, I think that South Africans really liked that because I think that South African investors are quite a browbeaten bunch. They’re inherently skeptical. They’ve been suffering for a decade, not a lot of growth stocks on the JSE, I think STADIO is a rare exception.

When they see something like a dividend, they go, oh, not only does it grow, but there’s some capital discipline, they’re not just going and buying whatever they can. Whereas I think American investors almost think the other way around. It’s like, oh, no, why are you paying a dividend? Have you run out of ideas? It’s just the American mindset versus the South African mindset. And I think what you’re doing is right for the South African mindset.

So, last question to bring this to a close. Chris, I’m going to aim it at you. If there was one thing that gets you the most excited about this business, what would that be? And what is the one thing that keeps you up at night?

Chris Vorster: That excites us, very much so, the growth opportunity still in this business. I think we’ve positioned the business extremely well for the future. That really excites us. The runway that’s still ahead – we haven’t even touched further education. There are a lot of opportunities still there.

What keeps us awake at night is, unfortunately, the South African economic situation, in the sense of there is this huge demand for higher education, but unfortunately, funding is lacking and affordability is still a big issue to widen access for more people to get into a higher education. So that’s something that we need to work on. A lot of work goes on behind the scenes to really crack that nut. But I think if we can do that, it would not just be fantastic for our business, but it would be fantastic for the country as a whole.

The Finance Ghost: Yeah, fantastic. I think we’ll leave it there. I just want to congratulate you again on a strong set of results and also just thank you for your support of the Ghost Mail platform and for valuing the Ghost Mail audience, for allowing me to do the work that I do.

Chris, Ishak, thank you so much. And to the listeners, go and dig into STADIO. Go and dig into as many stocks as you can, right? That’s why you read Ghost Mail. But I think STADIO is definitely one of the rare examples of a growth stock on the JSE and a lovely way to go and understand what that means is to go and read the annual report, go and check out the investor relations site, go and engage with the contents thereof and send through questions. It would be interesting – once you’ve listened to this podcast, what do you wish I’d asked? What do you still want to ask? You never know, we might be able to get some answers for you.

Chris, Ishak, thank you so much for your time and I hope we will do another one of these.

Chris Vorster: Thank you very much. We enjoyed it.

Ishak Kula: Thank you. Finance Ghost. Absolute privilege spending the morning with you.