Double-digit earnings growth at FirstRand (JSE: FSR)

The credit loss ratio led to better-than-expected earnings

FirstRand has released results for the six months to December 2024. With return on equity of 20.8% and normalised earnings up 10%, shareholders have once again been rewarded by this successful financial services group. The dividend is also up 10%, so cash quality of earnings is solid.

The performance is ahead of FirstRand’s expectations, mainly thanks to a better credit performance in both South Africa and particularly the UK. They also did a great job of controlling costs.

At segmental level, you’ll find that the biggest jump in earnings was at the centre, which is where you’ll see loads of technical concepts linked to capital management. At business unit level, the UK operations grew earnings by 16% and Wesbank was next highest at 12%. FNB, which contributes 60% of group earnings, could only grow by 6%. RMB wasn’t much better at 7%. Aside from South Africans and their absolute love of borrowing money to buy expensive cars, the rest of the South African business didn’t grow by much more than inflation.

Notably, RMB did have a strong year on the advisory side, with what they call “knowledge-based fee income” jumping by 55%.

That was a tough year at Grindrod (JSE: GND)

Border disruptions were a significant drag on profits

Grindrod released results for the year ended December 2024. The company is focused on moving things from A to B, whether by rail or through the ports. This means that border disruptions are very expensive for them, with an estimated negative impact on headline earnings of between R180 million and R200 million.

Grindrod is also exposed to prevailing commodity prices. Higher prices would encourage more exports, which is exactly what drives volumes at Grindrod.

The model has tons of operating leverage (fixed costs), evidenced by continuing operations suffering a minor decrease in revenue of 2% that was enough to drive a drop in headline earnings of 26%.

In the non-core business, there were some major negative moves. The sale of the property-backed loans for R500 million is still waiting for conditions to be fulfilled, with Grindrod having recognised fair value and credit losses of R522.9 million. The other major negative was a provision of R165.5 million raised to cover warranties on loans disposed of as part of the Grindrod Bank disposal.

Sadly, this means that the total group saw HEPS plunge by 69% to just 46.7 cents. The final dividend was 55% lower. The market clearly didn’t love this, with the share price down 5.5% on the day.

Surprisingly, it’s only down 4.6% over 12 months!

Lesaka has completed the Recharger acquisition (JSE: LSK)

The deal was first announced at the end of 2024

Lesaka Technologies is in the process of building a particularly interesting fintech and payments ecosystem. If you enjoy the Nasdaq-style tech companies that you’ll find in the US, then Lesaka is one of the closest things you’ll find to that on the JSE. Of course, this means that the focus is on “adjusted EBITDA” at the moment rather than HEPS.

Scale comes through acquisitions in this space, with the latest example being the R507 million deal for Recharger. This is a South African prepaid electricity submetering and payments business that boasts a base of over 460,000 registered prepaid electricity meters. That’s a lot of users!

The purchase price is settled partly in cash (R332 million) and partly through the issue of shares (R175 million). There’s also a loan of R43 million from Lesaka to Recharger to enable the repayment of a shareholder loan from the existing owner. The total purchase price is payable in two annual tranches, with the second one due in March 2026.

Above all else, this is an entry into the private utilities space in South Africa and a source of further bulk in the fintech space. One does have to be very careful of scale for the sake of scale, with Lesaka doing a lot of work on synergies in the background.

Lighthouse buys another property in Spain (JSE: LTE)

The popularity of Iberia continues for local property funds

After years of focusing mainly on Eastern Europe, South African property funds in search of offshore exposure have turned their gaze to Spain and Portugal. The Iberian Peninsula offers a similar cocktail to Eastern Europe I guess: a developed market flavour with growth rates that are closer to emerging markets. It’s a happy medium that works.

Lighthouse Properties has announced the acquisition of a mall in Spain for €96.3 million. Located in the greater Madrid area, Alcala Magna was refurbished in 2019. It has the usual assortment of tenants, including key clothing retailers that have been driving footfall.

The mall is fully let and located in a high growth area, as is often the case on the outskirts of the world’s most important cities. The purchase price is a yield of 7.6%. When you consider what the underlying exposure is, that’s surely far more attractive than buying something like SA residential property on a 9.5% yield!

Lighthouse certainly thinks so, which is why the Iberian exposure is now 84% of the value of their directly held properties. It makes a lot of sense to me.

MTN Uganda is another success story in Africa (JSE: MTN)

Add it to the list of what investors wish Nigeria could be

MTN Uganda has released results for the year ended December 2024. Whichever way you cut them, the numbers are excellent.

Total subscribers grew by 13.2%. The traditional side of the business still has plenty of growth, with service revenue up 19.5%. The fintech side also has a fun story to tell, with the value of MoMo transactions up 19.1%. And yes, all of this is being converted into profits, with EBITDA margin actually improving by 80 basis points to a lucrative 52.2%.

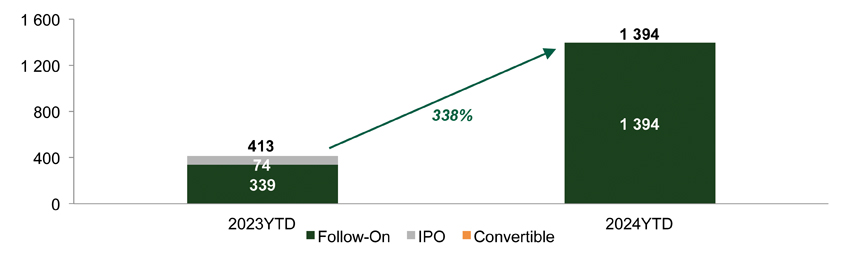

It’s therefore little surprise that when MTN Uganda made more shares available to the public in June 2024, the offering was strongly oversubscribed. By all accounts, it’s a solid business.

Here’s perhaps the biggest shock: the Uganda shilling appreciated against the US dollar by 2.7% in 2024. This is why you aren’t reading about terrible forex losses and all the other issues that plague Nigeria. With headline inflation of just 3.3%, it also shows just how impressive the MTN Uganda growth rates actually are.

From a free cash flow perspective, capex is always the thing to look at in detail when it comes to telecoms. MTN Uganda’s capex (excluding leases) increased by 18.3%. That’s below EBITDA growth of 20.7%, so no concerns here in terms of whether cash is eventually finding its way to shareholders.

The medium-term guidance is service revenue growth in the high teens, with EBITDA margins staying above 50%. This is probably the best business in the MTN stable. It’s just a pity that Uganda is too small a country to really move the dial vs. the likes of Nigeria, South Africa and Ghana.

Mustek’s earnings were awful, but the balance sheet has come a long way (JSE: MST)

Full focus has been on cash generation

First off, let me just say that Mustek’s annual report looks pretty epic on the cover page. You would think that you’re holding a report from one of the hottest companies on the Nasdaq. Alas, the numbers aren’t even remotely as exciting as the design work.

For the six months to December 2024, revenue fell by 14%. Despite gross margin improving slightly and the group working to control costs (operating expenses were down 5.2%), headline earnings never really stood a chance with that kind of top-line pressure. HEPS took a nasty 74% knock.

Mustek is primarily a hardware business and that’s where the pain was felt, with hardware sales down more than 15%. Software sales were flat and services revenue was substantially higher, which is probably why the mix effect saw gross margin ticking up. Generally, IT hardware margins are skinnier than a pro tennis player.

The highlight, other than the fancy cover art, is to be found on the balance sheet. They managed to unlock R637 million in net working capital, partially thanks to lower sales of course. They therefore smashed the overdraft down from R600 million to practically zero, a rather spectacular achievement against a backdrop of horrible earnings.

Is the balance sheet the opportunity that Novus sees in the group? Even with a healthier balance sheet, I’m really not sure that Mustek is a lucrative business. Although the hope is for a stronger cycle of IT spending, it does feel as though spending on hardware is largely tied to economic growth (companies growing their headcount etc.) and there isn’t too much of that going around in South Africa.

The release of earnings also allowed Novus to release details of the pro forma earnings and asset value per Mustek share, as required as part of the mandatory offer process. In case you’re keeping track, now that DK Trust has been determined to be a concert party of Novus, the offers and its related / concert parties hold 55.36% of the shares in Mustek.

Another great set of numbers at Sanlam (JSE: SLM)

This section is also relevant to Ninety One (JSE: N91 | JSE: NY1) shareholders

The year ended December 2024 was an excellent time for Sanlam. The net result from financial services grew by 14%, or 25% including the reinsurance capture fee. It’s obviously quite hard for things to go wrong in the rest of the financials when it starts like that! Sure enough, HEPS was up 37% – a fantastic growth rate.

This result was driven by 6% growth in new business volumes, a 2% increase in life insurance value of new covered business and a 52% jump in net client cash flows, with that particular metric driven by excellent asset and wealth management numbers.

Return on group equity value per share was 20.3%, so life insurance and adjacent services remains a more lucrative model than the average bank. This is also why Sanlam trades at a premium to the group equity value per share of R81.23. The premium isn’t as large as one would expect though, with the current share price at R85.17. It feels like it should be higher, given that the returns are so far in excess of the cost of equity.

The dividend per share was 11% higher for the year at 445 cents, so the rate of growth in HEPS wasn’t repeated in the dividend.

Separately, Sanlam and Ninety One released a joint announcement dealing with the long-term active asset management relationship between the companies. The market was first alerted to this in November 2024, with the idea being that Sanlam would appoint Ninety One as its primary active asset manager for single-managed local and global products. Of course, this gives Ninety One preferred to access to the distribution juggernaut that is Sanlam.

The structure is that Sanlam will sell Sanlam Investment Management to Ninety One. First, they will strip out anything that isn’t an active management business. The UK active management business will also be transferred to Ninety One. The parties will enter into a 15-year strategic relationship. As consideration for this, Sanlam will receive shares in Ninety One representing a 12.3% stake in the company. Once you allow for minority investors in the Sanlam structures, Sanlam shareholders will have an effective 8.9% stake in Ninety One.

Sanlam expects the deal to be margin dilutive in the first year, with transaction implementation costs as a factor, with the deal expected to become earnings and dividend accretive from year three.

Surprisingly, the UK and South African transactions are not inter-conditional. In other words, one or both could go ahead and at different times. I guess they are making allowance for the different risks of regulatory approvals in each country. The UK transaction has a long stop date of 15 March 2025 and the South African transaction has a long stop date of 31 March 2026. Spot the more difficult set of regulatory conditions!

To get the ball rolling, Ninety One has released the circular for the general meeting seeking approval to issue shares.

Nibbles:

- Director dealings:

- Prepare to feel poor: the company secretary of Naspers (JSE: NPN) disposed of shares worth R26.4 million, related to share option awards from back in 2020. I don’t think there’s another company on the JSE that could possibly make its company secretary this wealthy!

- A director of Metrofile (JSE: MFL) bought shares worth R107k.

- Bidvest (JSE: BVT) is a step closer to completing the acquisition of Citron in the UK. This is a services business focused on washroom hygiene products, with the head office in Canada. This type of business (facilities and services) is core to the DNA of Bidvest and is where recent results have been strongest, so the deal makes sense in the context of the recent strategy. The UK Competition and Markets Authority approved the deal, so the parties can now work towards closing.

- For those who are interested in debt markets and how money gets priced, Sappi (JSE: SAP) announced the pricing of its €300 million sustainability-linked bond. The notes are due in 2032 and the coupon is 4.5% per annum. This gives you a great indication of how much it costs for a corporate to borrow in euros for seven years.

- Sable Exploration and Mining (JSE: SXM) has breathed life into the term sheet with Ironveld Holdings that goes back to an announcement that first came out in September 2023. This relates to the Lapon Plant, with Ironveld committed to funding the completion of the beneficiation plant. Commissioning is expected in the next few weeks (talk about a quick turnaround!) and the plant will focus on DMS-grade magnetite. This is structured as a 50/50 partnership between Ironveld and Sable.