Astral: a terrific example of operating leverage (JSE: ARL)

Just a 6% increase in revenue makes all the difference

Astral has released results for the year ended September. They reflect exactly why the poultry sector is anything but a low-stress way to make a living. Revenue increased by just 6%, yet this was enough to drive a massive swing from a headline loss per share of R13.24 to HEPS of R19.20!

To understand this, you have to look at how the additional revenue drops to the bottom line. Astral generated additional revenue of R1.23 million and additional operating profit of R1.75 million! That sounds a bit daft of course, but it shows how a business with very high operating leverage benefits from a modest uptick in revenue and a decent period of cost containment – not least of all thanks to the disappearance of load shedding costs. When profitability has been marginal (or negative), you can end up with wild percentage swings at net profit level despite modest moves in revenue.

The lesson here is to be cautious of businesses with very thin profit margins. They can deliver a wild ride, thanks to an operating margin of just 3.4% in the key poultry division. It doesn’t take much volatility further up the income statement to cause chaos by the time you reach the bottom.

As a sign of just how much better things are, there’s a dividend of 520 cents per share. For now at least, the sun is shining on the poultry industry once more. Given its importance to South Africa, I’m very glad to see this!

Fairvest increases its stake in Dipula Income Fund (JSE: FTA | JSE: DIB)

Coronation is swapping Dipula exposure for Fairvest

Fairvest’s strategy is to become a retail-only REIT focusing on low-income communities in South Africa. This is a really lucrative growth segment of the market, so I don’t blame them. This means selling off properties that don’t fit that strategy and reinvesting in properties that do.

Dipula Income Fund also happens to be listed and has a portfolio of assets that fit what Fairvest is looking for. Fairvest has been invested in the group since 2014 and will now increase its shareholding to 26.3%, making it the largest shareholder in Dipula.

Is this part of a broader pathway to control? Maybe. It certainly wouldn’t be the first time that a listed fund has gobbled up another one. For now at least, they remain a non-controlling shareholder, albeit the largest individual one.

To achieve this, one of Coronation’s funds is selling a chunk of shares in Dipula to Fairvest in exchange for new shares being issued by Fairvest. Just in case Fairvest pulls the trigger on a bigger deal, Coronation has protected itself with an agterskot structure (future payment) if Fairvest makes a takeover offer before 19 November 2025 on more favourable terms than this deal.

Goldrush has released its first consolidated accounts (JSE: GRSP)

They are now long accounted for as an investment entity

A change in accounting approach at Goldrush means that the financials look very different to before. Instead of focusing on investment holding company metrics like net asset value per share, the market is likely to pay more attention to the ratios typically applied to an operating company, like earnings multiples.

As this is the first period of consolidation accounting, the income statement and balance sheet aren’t comparable to the previous period. To assess performance, you instead have to refer to management commentary, with notes like Gross Gaming Revenue up 5% for the year. Gross profit was up only 2%, so it’s been a difficult period for the group despite the reduced load shedding.

As we are seeing in a number of local businesses, the small interest rate cut hasn’t had much of an impact yet on consumer discretionary spending.

The one exception is online gaming, which saw revenue more than double year-on-year. All the gaming groups are fighting hard for market share in this space.

A reduction of debt in the group will go a long way towards driving growth for shareholders. Interim operating profit was R101 million and the interest expense was just below R70 million. The silly lease accounting standard means that lease costs are in finance costs as well (around R16 million), but even then the banks are getting a significant slice of the pie before shareholders.

The market seemed to like the change in accounting and the additional disclosure that it brings, with the share price up 17.4% on the day!

Earnings have roughly doubled at Naspers – Prosus (JSE: NPN | JSE: PRX)

The focus on profitability is paying off – literally

Naspers and Prosus have released a trading statement for the six months to September. To give you an idea of just how much things have improved, eCommerce profitability was higher in this six months than in the preceding 12 months! This is what happens when these platform businesses finally reach an inflection point where the contribution margin from additional revenue is very high. In other words, thanks to all the fixed costs, much of the additional revenue drops to the bottom line.

For this period, Naspers expects core HEPS from continuing operations to increase by between 87.2% and 93.8%. For total operations, the increase is between 99.0% and 106.0%.

The percentage is a bit different as Prosus, as the underlying exposure of Prosus excludes a couple of other assets that are further up in the structure in Naspers. At Prosus, core HEPS from continuing operations will be between 84% and 93% higher, whilst core HEPS from total operations will be between 94% and 104% higher.

Whichever way you cut it, this is excellent.

PPC wants to “awaken the giant” – but that giant is struggling to get out of bed (JSE: PPC)

Above all, they need a major boost in infrastructure spend

With new management in place for the next stage in PPC’s turnaround, the theme is “awaken the giant” – and with revenue from continuing operations down 4.2% for the six months to September, this giant is in hibernation mode. That’s because the South African economy has been sleeping for years in terms of infrastructure investment, while imported cement takes market share and causes even bigger problems for local manufacturers with loads of excess capacity.

If this giant does indeed awaken, then the rewards for shareholders could be immense. In a manufacturing business like this, even modest improvements in revenue can do wonders for net profit.

At least there are signs of strong cost management even if the revenue growth isn’t there, with EBITDA up 5.9% in South Africa and Botswana despite revenue down 0.6%. This means that EBITDA margin improved from 9.9% to 10.6%. Even better, there was a decent cash inflow and debt has reduced from R855 million to R502 million in the past 12 months.

PPC Zimbabwe struggled though, with imports driving a drop in revenue of 11.6%. EBITDA fell 6.3%, so at least the pain was mitigated through cost control. EBITDA margin has dropped from 26.1% to 24.6% in that segment, but it’s still a far more lucrative business than the South African and Botswana operations in terms of margin.

With EBITDA in Zimbabwe of R402 million vs. R394 million in South Africa and Botswana, the two geographical segments are of similar size these days.

With all said and done, group HEPS ticked up by 10% to 22 cents. They have had to survive some really tough times. If things can improve for them and if they can maintain discipline, there’s a good chance of decent returns here.

The share price is up just 3% year-to-date, although the volatility has been extreme with a 52-week high of R4.34 and a 52-week low of R2.92.

Sanlam completes the acquisition of 60% of MultiChoice’s insurance business (JSE: SLM | JSE: MCG)

Here’s something unusual: good news for MultiChoice!

Sanlam and MultiChoice couldn’t look more different right now. The former is growing beautifully, with various deals to grow its reach in emerging markets. The latter is hanging on by a thread, hoping for the Canal+ deal to close so that the (very costly) strategy of building out Showmax can be delivered.

It therefore made sense back in June when the companies announced that Sanlam would acquire a 60% stake in MultiChoice’s insurance business and enter into a long-term commercial arrangement to expand insurance and related financial service offerings into the subscriber base in Africa.

For Sanlam, this gives them further reach into important markets. For MultiChoice, this gives them R1.2 billion in cash and potentially another R1.5 billion based on earn-outs measured at 31 December 2026. It’s quite rare for deals to achieve a full earn-out, so just manage your expectations there.

Watch the dilution at Sirius Real Estate (JSE: SRE)

The timing of equity raises vs. deployment of capital makes a difference

Sirius Real Estate managed to grow funds from operations by 14.5% for the six months to September. That’s clearly a great outcome. The trouble is that funds from operations per share fell by 5.5%, thanks to many more shares being in issue after capital raises in November 2023 and July 2024.

This is what happens when there’s a lag between raising and deployment of capital, which is why it’s quite rare to see funds raising capital for a future acquisition strategy rather than specified deals that will only close when the capital raise is completed.

It’s less of an issue over a longer time period, but it does cause near-term irritations like an increase of just 2% in the dividend per share.

With a loan-to-value ratio of 30.5% (down from 33.9% at March 2024) and a free cash balance of nearly €300 million, Sirius has to manage the cash drag here – the negative impact on shareholder returns of sitting on a lazy balance sheet. The solution of course is to deploy capital into the right opportunities.

Telkom’s cost initiatives are paying off (JSE: TKG)

In this case, adjusted EBITDA is the right metric to look at

I’m always wary of management teams using “adjusted EBITDA” to tell their story. This metric gets heavily abused by US tech companies who like to hide loads of stock-based compensation in the adjustments, pretending that paying employees with shares isn’t a real cost. Thankfully, South African management teams haven’t adopted a culture of nonsense around adjusted EBITDA, but you still have to be careful.

In the case of Telkom’s numbers for the six months to September, the use of adjusted EBITDA is more than reasonable. They’ve incurred R160 million in restructuring costs and a massive R618 million in derecognition losses for the Telkom Retirement Fund. Without adjusting for these once-offs, group EBITDA is just 2.1% higher and in line with revenue growth. With adjustments, group EBITDA is actually up 18.3%, thanks to the benefits of Telkom’s cost control coming to the fore.

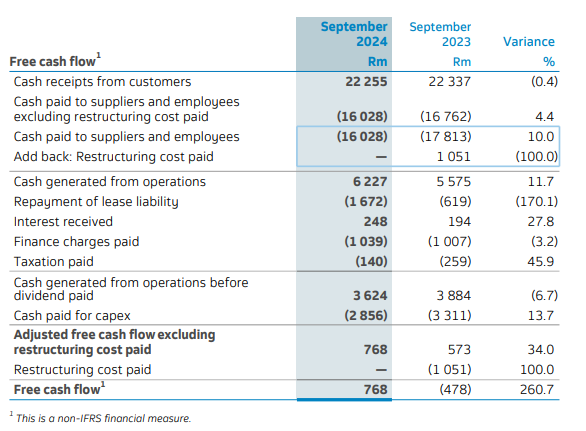

The gap between adjusted EBITDA and free cash flow is huge though, so that’s something to be careful of. Adjusted EBITDA was R5.6 billion, but free cash flow was only R768 million. The telco sector is incredibly good at eating up cash flow for capex, which is part of why returns haven’t been great historically. It’s worth highlighting that capex from continuing operations fell 17.9% year-on-year, so the conversion of revenue into free cash flow is improving. This becomes even clearer when you consider that the comparable period was negative free cash flow of R478 million, so there’s a R1.25 billion positive swing at play here!

The free cash flow statement does a great job of showing the improvement:

WeBuyCars signs off on a year full of accounting distortions – and decent growth in sales (JSE: WBC)

With the listing and share issue out the way, next year should be simpler

WeBuyCars has released results for the year ended September. They come with important adjustments, as you can’t judge the performance of the underlying business by including things like R45 million in listing costs and a loss on a call option derivative of R426.5 million after those call options were cancelled.

Instead, the focus should be on revenue growth (16.5%) and core headline earnings, up 23.4%. The core HEPS metric is less exciting at 9.9% growth, as many new shares were issued as part of the listing. The group hasn’t been able to deploy the capital in a meaningful way yet. To be fair to management, the capital raising plan was driven more by Transaction Capital’s needs than the exact timing of cash requirements at WeBuyCars.

In my view, the area that does deserve some attention from shareholders (like me) is working capital. The number of cars bought increased by 17.8% and cars sold increased by 16.4%, so the expansion of the footprint naturally led to more cars on the book and thus the absorption of working capital i.e. investment in inventory. Net cash generated from operating activities increased by only 1.6%.

During a period of expansion, expecting the group to be a cash cow is unreasonable. Still, it’s worth keeping an eye on this metric, along with comments related to concepts like inventory turn – how quickly the inventory is sold. Inventory turn improved year-on-year and gross margins were maintained, so that’s good enough for me.

A successful expansion should hopefully improve the HEPS view as well, as the cash raised in the listing can be deployed in such a way as to drive additional earnings.

Despite the investment in the footprint, a final dividend of 25 cents per share (25% of earnings for the second half of the year) has been declared.

Although I’m nervous about how hard the share price has run this year, I also believe in the long-term story of this business and hence I’m not selling.

Nibbles:

- Director dealings:

- Christo Wiese hasn’t wasted any time in buying up Brait (JSE: BAT) shares after the release of results, with purchases worth R14.6 million.

- A director of a major subsidiary of Woolworths (JSE: WHL) sold shares worth just over R2 million.

- The CFO of Exemplar REITail (JSE: EXP) bought shares worth R854k and the company secretary bought shares worth R196k.

- A director of BHP (JSE: BHG) has bought shares worth A$40.38k.

- A director of Brimstone (JSE: BRT) bought shares worth R51.5k.

- Crookes Brothers (JSE: CKS) isn’t the most liquid stock around, so their trading statement only gets mentioned in the Nibbles on an otherwise busy day. HEPS is down 30% for the six months to September, attributable to the discontinuation of the deciduous segment and the timing of certain agricultural expenses this year vs. the previous season.

- Afine Investments (JSE: AFI) is also firmly in the illiquid bucket, so the release of results for the six months to August only gets a passing mention. Distributable earnings increased 8% and HEPS was up 7.2%, yet the dividend per share fell 0.5%.

- Efora Energy (JSE: EEL) released a trading statement dealing with the six months ended August. The company expects a headline loss per share of between 1.47 cents and 1.61 cents, significantly worse than the loss of 0.74 cents in the comparable period.

- Sable Exploration and Mining (JSE: SXM) released results for the six months to August. The company doesn’t make a cent of revenue as they are in the exploration phase. The loss for the period was R5 million and the cash balance is just R600k. With a lack of funding from joint venture partner IPace, there are major question marks around whether Sable is a going concern.

- If you are a BHP (JSE: BHG) shareholder or you are interested in copper, then you’ll want to check out the presentation that has been made available from a site tour for investors. You can find it here in all its 141 page glory.

- In the extremely unlikely event that you are a shareholder in obscure property group Globe Trade Centre (JSE: GTC), be aware that they have entered into a deal to acquire a residential portfolio in Germany for EUR 448 million.