4Sight carried on where the interim period left off (JSE: 4SI)

And yet the market is largely ignoring this small cap

4Sight’s website might be drowning in a soup of tech buzzwords, but the underlying corporate story is becoming increasingly interesting to follow. They are doing some smart stuff, like the cleverly structured B-BBEE deal that was announced in May this year. I appreciate it when small caps behave like larger companies, as it shows that the foundations are there for growth.

And growth is certainly the order of the day, with a trading statement for the year ended February 2025 suggesting an increase of between 27.9% and 38.6% in HEPS. I had a look at the interims to August 2024 and HEPS was up by 35.5%, so they’ve basically carried on where they left off at the halfway mark.

Despite this, the market isn’t paying much attention to the stock, with no obvious direction over the past year apart from the choppy bid-offer spread. To be fair, the suggested HEPS range of 6.932 cents to 7.510 cents vs. the current share price of 70 cents puts it on a pretty full P/E by small cap standards. Still, this is worth keeping an eye on.

A great year for Alexander Forbes (JSE: AFH)

This supports the share price growth over the past 12 months

The Alexander Forbes share price has been volatile, but heading higher in recent times. The 12-month performance is a gain of 38% and the release of results for the year ended March 2025 explains why that has happened.

Normalised HEPS has increased by 23%, boosted by operating income growth of 13% thanks to a combination of organic growth and the benefit of acquisitions made in previous years. Operating expenses were up 11% including the impact of major accounting changes, or 6% if you look through a more business-focused lens on the operations. Profit from operations increased by 14% and cash from operations grew by 15%, so mid-teens growth is probably the correct summary of this performance.

Although the dividend was only 10% higher at 55 cents per share for the full year, there’s a special dividend of 10 cents per share as well to sweeten the deal. Companies use special dividends when they don’t want to create an expectation in the market that higher dividends have been baked in, so this isn’t as strong a signal of growth as would’ve been the case had the ordinary dividend increased in line with earnings. They indicate that part of the special dividend is the receipt of proceeds from successful litigation, but that doesn’t really explain why they were so conservative in the payout ratio for the ordinary dividend in this period.

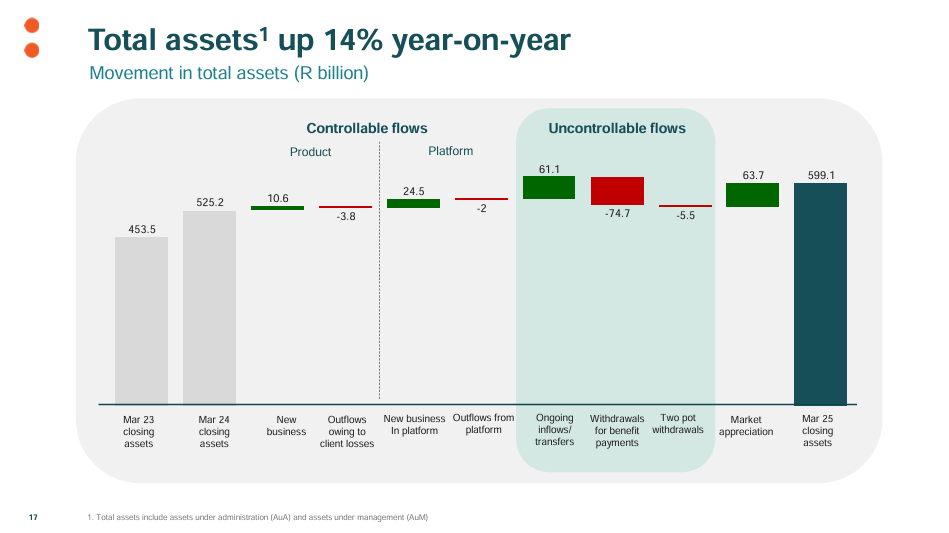

Other metrics that I think are worth highlighting include 4% growth in the number of active retirement members, as well as a 23% jump in umbrella assets under management. There’s also this pretty interesting chart in the analyst presentation that shows how they think about the different types of flows:

No profits at Aveng this year (JSE: AEG)

Construction companies are only as good as their worst projects

Aveng has flagged that they will report a headline loss per share for the year ending June 2025. Quite how bad it will be, we just don’t know yet. Either way, it’s a very ugly swing vs. HEPS of A$29.6 cents in the comparable period.

As is usually the case for construction companies, there are just a couple of projects letting the whole team down. Both of them are in McConnell Dowell, which Aveng is trying to figure out what to do with that business from a strategic perspective. If you’re looking to sell or separately list something, you want to do it when the going is good, not when there are losses.

Within McConnell Dowell, the New Zealand and Pacific Islands operations have grown their profits. The Australian side was break-even in the interim period and deteriorated in the second half, with the Kidston Pumped Hydro project costs running away from them. The weather has been a major factor here, leading to a delay in the work by a number of months. Whether or note they can recover any of these costs through commercial claims and negotiations with the client remains to be seen. Other than the Kidston project, the business is profitable. And finally, in Southeast Asia, the Jurong Region Line project is running in line with the revised project plan and cost.

Outside of the infrastructure segment noted above, Built Environs is profitable and growing. They are light on details for mining business Moolmans, which suggests that they might be having a trickier time there as well. Generally, when companies have a good news story to tell, they tell it.

Moolmans is also up for sale by the way, with negotiations in progress with interested parties. As you can see, there are a lot of moving parts for this group, with a likely outcome being a break up and eventual name change of whatever the listed entity is. At this stage, nothing is certain.

The Aveng share price has cratered this year, having lost half its value year-to-date.

Barloworld gets the green light from the Competition Commission (JSE: BAW)

Subject to conditions, as usual

Barloworld is currently under offer at R120 per share, as you are probably aware. The scheme of arrangement for this deal failed to garner sufficient support, so everything now depends on whether enough shareholders accept the offer to make it viable for the offerors. Recent results at Barloworld (and a sector peer like Bell Equipment) have made me inclined to think that more shareholders might be wiling to accept the offer than before. We will have to wait and see.

In the meantime, Barloworld has been busy getting regulatory approvals in place. The Competition Commission has approved the deal, subject to a 13.5% B-BBEE empowerment transaction being executed in Barloworld after the delisting. This is effectively to replace the empowerment that currently stems from the PIC being a shareholder, as the PIC has agreed to accept the offer.

The Competition Tribunal still needs to sign off on the deal. Although it does sometimes happen that the Tribunal disagrees with the Competition Commission’s recommendation, this is quite rare.

The offer to shareholders is open until 30 June 2025. We will know soon enough whether this thing is going ahead and I suspect that an updated view on the acceptance rate will be released in the next couple of weeks.

Lighthouse had no trouble raising R400 million in equity (JSE: LTE)

The property sector is hot once more

Property funds are popular things on the JSE. There are very deep pools of institutional capital out there, which means that high quality property funds tend to have no trouble in raising hundreds of millions of rands in the space of a morning. This is fine. The problems start when the middle-of-the-road and then low-grade funds start raising without any issues – at that point, we are in bubble territory. I see no evidence of that yet.

Lighthouse Properties is a good example of a solid local property fund, even though their investment story is centred firmly on Europe. On Monday morning, they announced that they wanted to raise R100 million through an accelerated bookbuild process, with the announcement reminding the market that the fund’s acquisitive activity has focused on Portugal and Spain.

Perhaps thanks to Carlos Alcaraz reminding everyone that the Spanish are a tenacious and talented bunch, the market responded positively and Lighthouse announced that the capital raise would up increased to R300 million. By the time the dust settled, they had actually raised R400 million at R8.20 per share – and the book was still oversubscribed at this level.

To give you a sense of pricing, the share price opened at R8.40 on the day, so this raise is at a slight discount to the prevailing market price.

Oceana hurt by fish oil prices (JSE: OCE)

There are just so many variables in this industry

Agriculture and mining are considered to be cyclical, risky businesses as they are so reliant on commodity prices that are completely outside of their control. When it comes to fishing businesses, you can then layer on the additional risks of variable catch rates and all the other challenges that the ocean is capable of dishing up. This is why you can get volatility in the Oceana share price like this:

The six months to March 2025 were rougher than the seas for Oceana. Although revenue increased by 2.9%, HEPS took a horrible knock of 43.9% and the dividend was much the same story, down 43.6%.

The main problem was global fish oil pricing, which fell based on the Peruvian anchovy resource coming back to the market. This hammered the American business from a year-on-year perspective (operating profit down 55.6%), with improved performance in South Africa (Lucky Star as the key segment, with operating profit up 35.9%) unable to offset the impact. Despite margins at Lucky Star improving, group gross profit margin fell from 34.1% to 27.8%.

To add insult to injury, the net interest expense jumped from R93 million to R144 million due to higher borrowing levels. When the operations had a tough time, it obviously only makes things worse if finance costs moved significantly higher. The pressure on the balance sheet came from strategic buying of inventory, ensuring consistent supply in an uncertain trade environment. One would hope that this will normalise in the second half of the year, as cash from operations was just R10 million in this period vs. R634 million in the comparable period.

The net impact of lower profits and higher debt is that net debt to EBITDA increased from 1.2x to 2.2x. Although the group is in compliance with all lender covenant requirements, I don’t think they can realistically run the balance sheet this hot for too long. To be fair, it looks like much of the inventory investment is to support the Lucky Star business, which is where they just can’t afford to miss out on any sales at the moment.

There’s little indication that the second half of the year will provide a significant improvement on the first half, as global fish oil prices are expected to remain under pressure. The US tariff environment is interesting, as it might assist Daybrook in that domestic market. Overall, they’ve done their best at Oceana to position the group for the best possible second half under the circumstances, with shareholders thanking their Lucky Star as usual.

A flat period at Omnia (JSE: OMN)

But not if you look at a share price chart

At first blush, Omnia’s results for the year ended March 2025 just look “boring” – revenue was up 3% and operating profit was essentially flat, while HEPS increased by 1%. This isn’t a story that will be passed down for generations.

And yet here is the share price chart over the past 12 months, with plenty of action:

Market sentiment is an incredible thing, leading to vast differences in the valuation of roughly the same underlying cash flows.

If we dig deeper into Omnia, Agriculture saw a dip in revenue of 2% and an increase in operating profit of 3%, so not much to report there. Mining was stronger, with revenue up 10% and operating profit up by a juicy 13%, with solid growth in some markets outside of South Africa as well. Sadly, Chemicals was a very different story, with a nasty swing into operating losses despite revenue increasing by 2%.

I honestly don’t have a clue how the global chemicals markets work, but perhaps I’m just feeling browbeaten from reading about “chemicals” in Sasol and now these numbers in Omnia.

In summary, the Chemicals segment was a nasty drag on earnings, bringing the group to a flat position overall despite the variance in segmental performance. This is a common situation in corporates. As a further overhang on the story, the fight with SARS still hasn’t been resolved, with Alternative Dispute Resolution proceedings hopefully being finalised soon.

It’s all about the margins at PPC (JSE: PPC)

Profits are what count

PPC has released results for the year ended March 2025. You won’t find the happy news on the revenue line, where group revenue decreased by 1.9%. But as you move down the income statement, you’ll find that HEPS more than doubled from 19 cents to 40 cents! For those who only trust cash earnings growth, you’ll be pleased to note that the ordinary dividend is up 28.5%.

What matters more to you – strong revenue growth and low profits, or muted revenue and great profits? If those are the only two options available, it’s clear that the latter is better. The holy grail is of course great revenue growth and better margins, but have you seen the state of South African infrastructure investment?

Cement volumes in the SA and Botswana segment fell 2.3%, but revenue was up 0.6% due to positive pricing moves. EBITDA jumped 31%, taking EBITDA margin 260 basis points higher to 11.0%. Most importantly, this segment is finally paying a dividend, after such a long period of being at the mercy of the banks.

In Zimbabwe, volumes were down 5.5% and revenue fell 6.7%. Despite this, EBITDA was up 26% and EBITDA margin was up a meaty 700 basis points to 27.2%. Zimbabwe has been a reliable payer of dividends (if you can believe that), up from $11 million to $13 million in this period.

The CEO talks about the Awaken the Giant strategy. Right now, they are certainly a lot more awake when it comes to profits. There is of course a practical limit to how far you can drive profit growth without revenue growth, so investors will want to see revenue increases coming through. PPC knows this, hence the decision to build a new integrated plant in the Western Cape. Although South Africa as a whole may have weak supply-demand dynamics for cement, there’s significant growth in the Western Cape and they see the opportunity there.

As a final note, finance costs were down 19.1% as debt levels dropped significantly. This is a wonderful turnaround story.

Insights from Santova’s latest presentation (JSE: SNV)

Although it deals with February year-end results, there’s much more to it

Santova recently announced the acquisition of Seabourne in the UK, giving the group deeper exposure to the eCommerce sector in Europe through a business that has been built to handle smaller, more frequent packages rather than bulkier items stored for a longer time. This is an interesting play by Santova and one that was followed up by extensive buying of shares by directors, which is always a positive sign.

The group has made the annual results presentation available to the market, with the nuance being that it includes plenty of strategic thinking in the context of the Seabourne deal. In other words, this is far more than just a normal numbers deck.

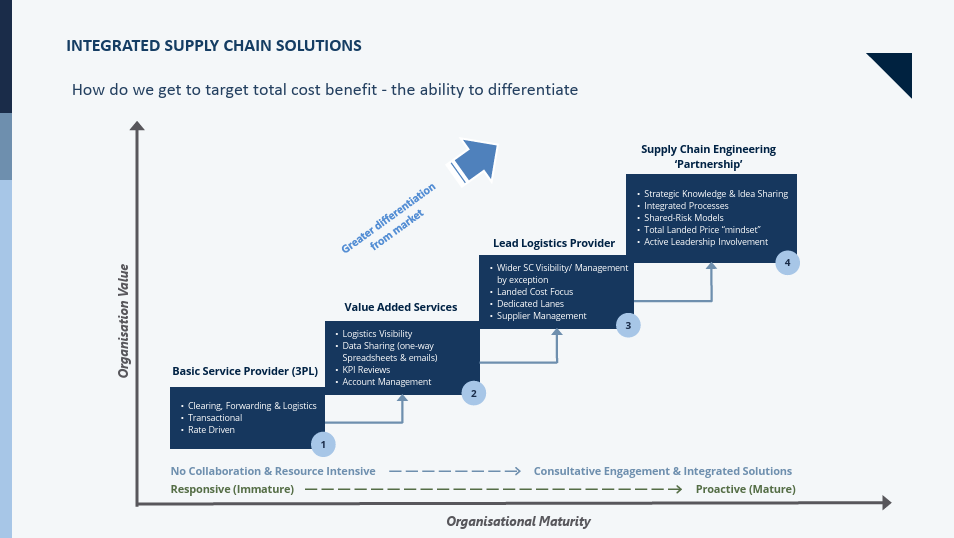

This struck me as a pretty useful slide, as it shows how companies in the logistics sector build a wider moat over time:

Unsurprisingly, the presentation is filled with references to how changeable global conditions are. It’s not just the trade war and associated risks that are relevant – it’s also the kind of wars fought with bullets and missiles that disrupt trade routes. Santova has a truly global business (only 17.1% of new client revenue came from Africa in this period), so they are exposed to the broader geopolitical environment.

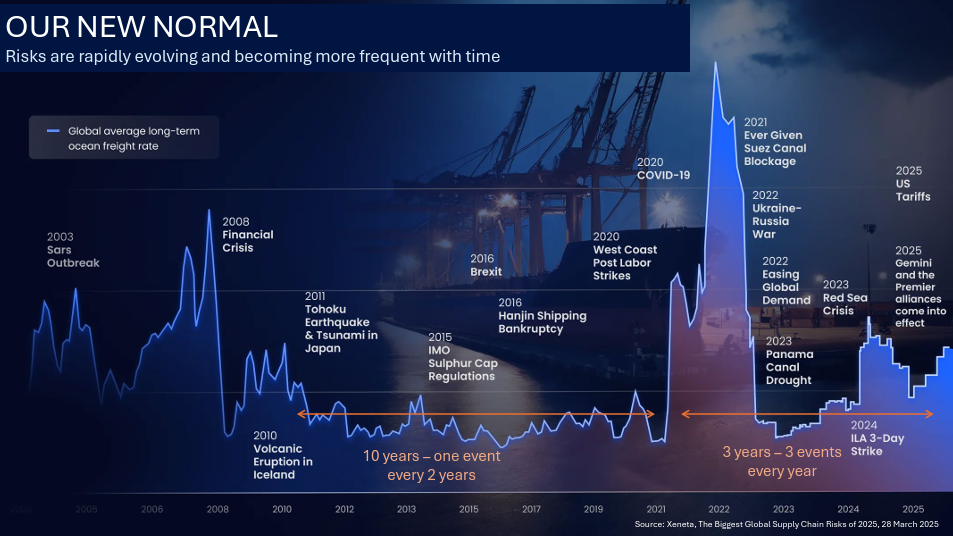

And of course this is before taking into account some of the other disruptions in the sector, shown in this pretty epic slide:

Despite this high-risk backdrop, there are strong growth opportunities. eCommerce is an incredible force at the moment, shifting demand for space from retail into industrial as more orders are fulfilled from warehouses rather than stores. This is changing the game in the sector, with Santova noting that the Netherlands is the “predominant gateway” to Europe. Interesting.

Another trend they reference is “friendshoring and nearshoring” as opposed to just onshoring, which means bringing supply chains into friendlier territories even if this comes at a greater cost. Supply chain security is a higher priority than just cost of production, so that points to a more inflationary environment overall.

The bear case for Santova is ironically also the bull case, with the question being whether Europe can go from being sluggish to exciting. A knock to US exceptionalism doesn’t necessarily mean that Europe will suddenly spring into life. Revenue and profits fell in the region in the latest financial year, with Santova making the brave decision to invest in Seabourne despite the risks. Another angle to the bear case is of course the US trade lane as well, as US government policy is firmly focused on encouraging domestic consumption at this time.

Santova’s share price has climbed nearly 28% in the past month. The market is enjoying the combination of the recently announced deal and the extensive director buying. I also thoroughly enjoyed how detailed the investor presentation is, as it really is helpful in understanding all the pros and cons of the sector at the moment.

Nibbles:

- Director dealings:

- A director of a major subsidiary of KAP (JSE: KAP) – PG Bison, to be exact – sold shares worth R6.5 million.

- The CFO of Sirius Real Estate (JSE: SRE) and his immediate family members bought shares worth R585k.

- An associate of the company secretary of Cashbuild (JSE: CSB) sold shares worth R59k.

- Although there were some directors of Ninety One (JSE: NY1 | JSE: N91) who sold vested shares, there were also a few who kept the entire amount. And of course, there were those who sold only the taxable portion. I’m calling it a draw, with no obvious pattern in the behaviour.

- This is just a reshuffling of chairs, so I haven’t included it in the director dealings section as I don’t want to create the wrong impression that this is a trade that should be interpreted as a signal. It’s just a reminder of the sheer extent of the wealth of the Christo Wiese family that they’ve moved around some Collins Property Group (JSE: CPP) shares between family entities with a total value of around R300 million.

- Oasis Crescent Property Fund (JSE: OAS) announced that holders of 72.5% of units in the fund elected to receive a cash dividend, while holders of the remaining 27.5% opted to receive new units instead.

- I’m glad to see that Mpact’s (JSE: MPT) shareholder impasse regarding non-executive director remuneration has been solved. There was an insane situation for a while where directors were appointed to the board of a subsidiary instead of the holding company as that was the only way for them to be paid. Perhaps the weirdness between Mpact and Caxton (JSE: CAT) is behind us.

- The co-founder and honourary chairman of Mr Price (JSE: MRP), Stewart Cohen, will be retiring from the board in August this year. He co-founded the business in 1985, so it really has been an incredible journey. Cohen turns 80 this year and is ready to step away from formal duties, freeing up more time for for the Mr Price Foundation and other social projects. He will give strategic input to management in a non-remunerated advisory capacity.