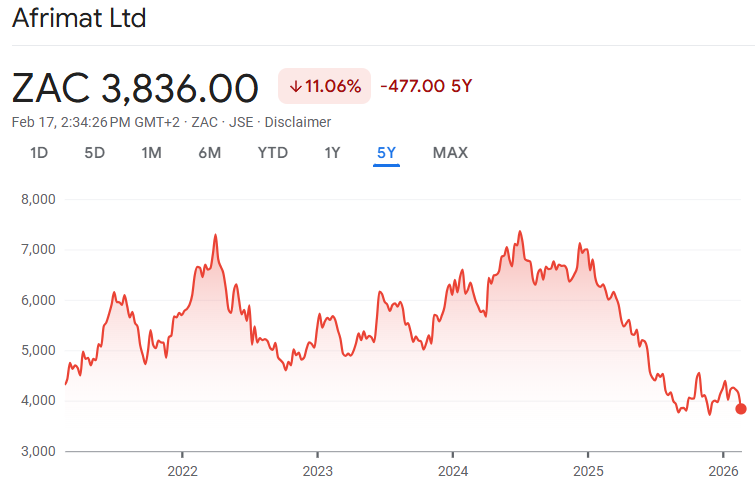

Can Afrimat stop the slide in the share price? (JSE: AFT)

They took a big risk on Lafarge – and the environment hasn’t been kind to them

Businesses go through good times and bad. This is simply a reality of the world that we operate in. This is why investing in shares is a risk, as growth is by no means guaranteed and things can go wrong. The reward for that risk is that you could earn high returns.

Some investors prefer to operate with highly concentrated portfolios that chase the highest possible returns (for the most risk), while others (like me) prefer to spread the risk across many names.

The Afrimat share price chart is a perfect example of why I believe strongly in diversification:

This is a good time to point out that Afrimat is actually a very good company with a strong management team. But if you keep rolling the dice on acquisitions, sooner or later you’re going to roll a 1 instead of a 6.

The share price has lost more than a third of its value in the past year because the timing of the high-risk Lafarge acquisition happened to coincide with several other things going wrong. Perfect storms can happen to the best of us.

Naturally, this means that the market is looking for the bottom in this share price chart. Much like Donkey in Shrek 2, we continuously find ourselves asking: “Are we there yet?”

The answer isn’t easy to figure out.

In a pre-close business update, Afrimat has given plenty of narrative and only a handful of detailed numbers to work with. At least we know that the debt/equity ratio is consistent with previously reported levels, so the balance sheet isn’t getting worse – and also isn’t getting any better. This should improve going forward thanks to asset disposals and the related proceeds being used to reduce debt. They are also in the process of refinancing debt to have a longer-term profile.

Digging into the underlying businesses, we begin with the Construction Materials segment and specifically the aggregates business, where Afrimat expects margin in FY26 to improve slightly, provided you take out the non-core businesses that have been disposed of. They’ve been focused on delivering numerous improvement projects aimed at enhancing margin in the continuing operations. Time will tell what that really means for the numbers.

In the cement business, sales volumes are expected to be up vs. the prior period. The business is sadly still in a loss-making position, but the losses did at least reduce in the second half of the year.

Moving on to the Bulk Commodities business, the significant underlying risk for the iron ore operations is the exposure to ArcelorMittal (JSE: ACL), a business in crisis. Government has been in negotiations with ArcelorMittal for ages now, but there’s still no resolution to the situation that will impact thousands of jobs. At least offtake to the Flats business in Vanderbijlpark increased, but even that part of the ArcelorMittal group isn’t safe in the current environment of massive disruption to the South African industrial base.

The natural response to a lack of domestic demand would be to export the surplus iron ore and tap into the export market. But this isn’t so easy, as volumes are only expected to be flat year-on-year thanks to shipment capacity being 16% lower than the committed rail allocation. The infrastructure in South Africa just keeps letting our companies down. To add insult to injury, international iron ore pricing has dipped from $105 to $101 – and that’s even worse in rand.

In anthracite, the domestic business is suffering with a decline in volumes thanks to the shutdown of the ferrochrome smelters. The Nkomati Anthracite Mine was closed from November 2025 to January 2026 based on the disastrous state of the ferrochrome industry in South Africa. Afrimat had skeleton staff in place this month in anticipation of a restart date for the smelters, but such a date has not been confirmed.

This is one of the places where Afrimat does give specific numbers: local volumes of anthracite are expected to be half of the levels achieved in 2025. Yikes!

In this case, there was a significant boost in exports to try and offset the dramatic decrease in local volumes. They put in a valiant effort, but total volumes for FY26 will still be around 3% less than FY25.

The Glenover project is still important to the long-term plans, but Afrimat has more than enough other things to keep them busy right now. They are assessing different processing methods for this asset and engaging with potential international partners. I can’t imagine that this is getting much headspace from management at the moment. Ditto for Industrial Minerals, which was also impacted by the smelters.

At this stage, it feels like Afrimat is truly between a rock and a hard place – and in a way that even the execs of a quarrying business wouldn’t enjoy. 20 years into their corporate journey, they are dealing with major challenges. I worry about the extent of exposure to major underlying risks like the ferrochrome smelters, and ArcelorMittal, not to mention Transnet in terms of exports. To top it all off, the stronger rand is making exports less attractive for Afrimat and imported alternatives more affordable for its customers.

To answer Donkey’s question: no, I don’t think we are there yet. But what do you think?

BHP is off to a great start in FY26 (JSE: BHG)

There’s a sharp increase in HEPS for the first half of the year

Mining giant BHP has released earnings for the six months to December 2025. With underlying EBITDA margin up by 7 percentage points to 58%, it was a strong period for them. Net operating cash flow increased by 13% and HEPS was up by 30%!

It won’t surprise you that copper features strongly in the story, with an EBITDA margin of 66% and production up 2%. Iron ore isn’t exactly far behind, with an EBITDA margin of 62% (thanks to extensive focus on efficiencies at Western Australia Iron Ore) and production growth also sitting at 2%.

Steelmaking coal is far less lucrative, with an EBITDA margin of only 15%. Production was up 2% in that commodity as well.

BHP certainly knows how to play the game from an investor relations perspective, with the presentation including striking references like “world’s highest margin major iron ore business” and “world’s largest copper producer and resource” – it’s nice to sit at the top of the pile!

And the top is where BHP will remain, now that we know that Glencore (JSE: GLN) and Rio Tinto abandoned talks to create the world’s largest mining company.

With copper production guidance for FY26 increased, BHP is on track for a great year. This is why the share price is up 21% over 12 months.

In a separate announcement, BHP confirmed that they have entered into a streaming agreement with Wheaton Precious Metals International. This has nothing to do with Netflix and everything to do with obtaining upfront funding of $4.3 billion for the delivery of silver from the Antamina mine.

Interestingly, BHP is only a 33.75% shareholder in CMA, the company that owns the Antamina mine. CMA is not a party to this streaming agreement. There’s clearly some fancy financial and legal footwork here, as the streaming deal also doesn’t come through as debt on BHP’s balance sheet, even though it strikes me as an obligation to deliver silver.

The core of the deal is that BHP will deliver 33.75% of the silver produced by Antamina to Wheaton until they have delivered 100 million ounces. After that milestone is reached, BHP will deliver 22.5% of Antamina’s silver to Wheaton. In addition to the upfront payment, Wheaton will pay BHP 20% of the spot silver price at the time of delivery.

MTN is moving ahead with the deal for IHS (JSE: MTN)

But they only want the African towers, not the LatAm footprint

MTN recently confirmed that it was in discussions regarding the potential acquisition of the 75.3% in IHS that it doesn’t already own. IHS has over 28,700 towers across five key markets in Africa, including in South Africa. They serve 10 out of the 13 mobile network operators in Africa.

This deal is an unusual approach to capital allocation, as the industry has been focused on separating the tower infrastructure from the telco operators. With this transaction, MTN is effectively undoing that.

IHS has already announced the disposal of its Latin American (LatAm) business, with MTN very happy to see that go. MTN is only interested in the African tower portfolio, giving it control over much of its infrastructure footprint in Africa. IHS derives around 70% of its revenue from MTN.

This is a chunky deal, with cash of $2.2 billion changing hands. Cleverly, they are using $1.1 billion of cash on IHS’ balance sheet and $1.1 billion from MTN, funded by available liquidity and debt. MTN doesn’t need to do an equity raise for this deal.

The offer price to IHS shareholders is a premium of 9.7% to the 30-day volume-weighted average price (VWAP) of IHS. Once you adjust for the disposal of the LatAm assets, the African tower portfolio has an enterprise value of around $4.8 billion.

Will that be a high enough price to convince shareholders to say yes? Thanks to engagement with other shareholders, MTN has support for the transaction from holders of 40% of the voting shares. They need to achieve two-thirds approval, so there’s still a way to go.

At least they don’t need approval from MTN shareholders as well, as this is only a Category 2 transaction.

IHS generated interim profit of around $106 million for the six months to June 2025. The LatAm assets would be in those numbers I’m sure, so that’s not a pure indication of the earnings that MTN is acquiring. Still, annualising this number shows that they are paying a modest Price/Earnings multiple. This is exactly why MTN’s management sees this as an accretive deal.

Naturally, IHS will still continue to serve all customers, including MTN’s competitors. This is key to the economics of the towers themselves. And even if there was an economic way to squeeze competitors out, I’m quite sure that regulators would be sitting on MTN’s head immediately.

Sirius Real Estate had no trouble raising nearly R1.7 billion in just a few hours (JSE: SRE)

This is the power of the market for successful property funds

You’ll often hear people complain about the pain of being a listed company and how the juice just isn’t worth the squeeze. The property sector is an exception, with Real Estate Investment Trusts (REITs) capable of raising hundreds of millions (and sometimes a few billion) in the space of a morning.

Sirius Real Estate is just the latest example, with the company kicking things off on Tuesday by announcing a raise of approximately £77 million. This was structured as a non-pre-emptive placing of £75 million and a retail raise of £2 million.

They had no struggles in securing this capital, with an announcement just a few hours later confirming that they raised £77 million at a premium of 1% to the closing share price on 16 February 2026.

This means they raised nearly R1.7 billion without even offering a discount to investors. If you can believe it, they managed this at a premium of 1.4% to the 30-day volume-weighted average price (VWAP). Impressive!

To be fair, the company confirmed that they spoke to certain shareholders before the time, so they had lined up their institutional supporters. They will also allow new institutional shareholders onto the register as part of this raise. Another important point to raise is that certain directors and executives will participate in this raise to the extent of £100k. That’s small in the context of the total raise, but still a large number for individuals to be adding to the pot.

The management of the capital raise certainly contributed to the success, but the real story is the underlying strategy and the track record in deployment of capital. Sirius Real Estate is focused on the property market in the UK and Germany, with a particular tilt at the moment towards the defence theme that is playing out in Europe. This means industrial assets in strategically important locations that can attract defence tenants.

This raise will be used for two acquisition opportunities in Germany. The company is in exclusive negotiations and they expect to notarise the properties in the second quarter of 2026, subject to being happy with the due diligence. One of the properties is a long-term sale and leaseback in southwest Germany, while the other is a multi-tenanted site in northern Germany.

The total value for the two acquisitions is £113 million. In case you’re wondering about the gap between the £77 million equity raise and the value of the deals, remember that property funds make extensive use of debt to help achieve the right return on equity. Sirius Real Estate targets a loan-to-value ratio of 40% for the group, although they can obviously tweak that on a deal-by-deal basis if needed.

To give you a sense of pricing, the properties have a net initial yield of 7.6%. As always, Sirius Real Estate sees the potential for value-add strategies aimed at improving the returns over time. The company talks about a “window of opportunity” to do deals at this point in the cycle, which speaks directly to capital discipline.

Keen to learn more about the strategy, especially elements like the defence sector in Germany? Listen to this podcast from December 2025 with the CEO, CFO and CIO of Sirius Real Estate (and you can access the transcript here):

Nibbles:

- Director dealings:

- As mentioned above in the Sirius Real Estate (JSE: SRE) update, directors subscribed for around £100k (almost R2.2 million) in new shares. The CEO was good for half this amount, with the rest spread across a few executives.

- PBT Holdings (JSE: PBT) announced that Spalding Investments, the B-BBEE investment vehicle that holds just over 26% in the company, sold some shares to directors of PBT Holdings and subsidiaries. Various directors bought shares worth almost R1.5 million in aggregate at R6.50 per share. This is small in the greater scheme of things, with Spalding’s stake reducing from 26.61% to 26.39%.

- ASP Isotopes (JSE: ISO) announced that the headquarters of Quantum Leap Energy will be established in Austin, Texas. The choice of Texas makes sense based on the recent corporate trends in the US and the customer base that Quantum Leap Energy is looking to reach. In rather colourful language, the CEO of Quantum Leap Energy refers to Texas as the “epicentre of the American nuclear renaissance” – nice! Jokes aside, with all the power demand of data centres and the seemingly endless investment in that space, this feels like the right time to really get the hammer down on accessing the US market.

- Tsogo Sun (JSE: TSG) confirmed that over the period since the authority was granted at the AGM in August 2025, they have repurchased 3.12% of shares that were in issue at that date. This has been done at an average price of R6.95 per share, which is slightly lower than the current price of R7.10.

- Sibanye-Stillwater (JSE: SSW) released a Mineral Sources and Mineral Reserves declaration. A lot of work goes into these estimates each year. Aside from the obvious reduction from ongoing mining activities, there are other changes to the reserves based on geotechnical considerations. The one that sticks out is Kloof, where the economic viability of the operation was impacted by the removal of isolated blocks of ground. The majority of the Mineral Reserves were written down at that operation. On the plus side, the completion of feasibility studies at various mines helps to increase the reported mineral reserve.

- Oando (JSE: OAO) is not a name that comes up very often, yet the company has announced that it plans to issue a whopping 4.4 billion shares in a rights issue. They’ve indicated a price of 50 naira each, which is roughly R0.60 per share. The current share price is only R0.18. I’m not sure where they are going to find over R2.6 billion in support for their rights offer, but I look forward to seeing the circular for this raise. The current market cap is R2.2 billion.

- Barloworld (JSE: BAW) had a busy day. One of the final steps in the take-private dance for this group is the redemption of the listed preference shares. The first announcement on the day was that the redemption will be delayed, as approval hasn’t been received yet from the South African Reserve Bank (SARB). They clearly tempted fate here, as the approval came through later in the morning and Barloworld then released a finalisation announcement. The preference shares will be delisted on 3rd March.

- Caxton and CTP Publishers and Printers (JSE: CAT) is another company that is waiting for approval from the SARB, although they need the approval to pay special dividends rather than to redeem shares. Caxton has had to push out this special dividend to an unknown date, as they are not sure when the approval will come through. You really have to wonder why we find ourselves in a situation where companies cannot do something as basic as pay a special dividend without waiting for approval from a regulatory body that seems to regularly miss the deadline.