Altvest’s trading statement deals with each share class (JSE: ALV | JSE: ALVA | JSE: ALVB | JSE: ALVC)

The credit opportunities fund seems to be the pick of the litter

When you look at Altvest’s trading statement, you may feel overwhelmed by the number of different share classes. This is because the company’s model is to list a separate preference share instrument for each underlying investment, with the Altvest holding company’s ordinary shares being listed as well.

The trading statement for the year ended February 2024 deals with each share class separately. They base the disclosure on NAV per ordinary share, as is the market norm for an investment holding company. I do think that Altvest is somewhat of a hybrid though, as what they are doing (which is very startup in nature) is different to how I would view a standard investment holding company.

The net asset value per share for the ordinary shares will be between 44% and 64% higher, which is significant. Moving into the preference shares and starting with the A shares, which reference Umganu Lodge, the NAV per share will be between 3% lower and 17% higher. The B share references the Bambanani Family Group restaurants, where things are going wrong and restructuring is under way, evidenced by the NAV per share plummeting by between 50% and 70%. I remember that there were nasty losses in that business in the interim period. As for the C shares, which related to the credit opportunities fund, there’s a useful uptick of between 11% and 31% in the NAV per share.

Altvest is still early in its journey. The credit opportunities fund seems to be the best opportunity at the moment.

Bidcorp has grown off a demanding base (JSE: BID)

This really is one of our best exports

Regular readers will know that most management teams on the JSE have a pretty sketchy track record when it comes to offshore expansion. Bidcorp is an exception of note, with over 90% of revenue sourced outside of South Africa. Through a consistent strategy of bolt-on acquisitions rather than betting the farm on any one particular deal, they’ve grown beautifully.

The latest trading update reflects the year-to-date numbers for the 10 months to April 2025. They are up against a strong base, as the FY24 results were solid and there has been little in the way of food inflation this year to boost revenue. Despite this, trading profit growth is around 10% for the period under review and HEPS is also up by 10% on a constant currency basis.

The rand has been stronger recently, so that’s actually had a negative impact on Bidcorp of around 3.8% year-to-date. You win some and you lose some when it comes to currencies, so I agree with management’s view that constant currency numbers are the best choice for assessing performance.

Revenue is up 6.7% in constant currency, of which 4.6% is due to organic growth and 2.1% is from acquisitions. EBITDA margin improved by 20 basis points to 5.8%.

Bidvest has achieved these numbers against a backdrop of significant pressures on consumer budgets, resulting in a dangerous cocktail of weak demand from consumers and a need for ongoing inflationary increases for staff. This hurts margins, with Bidvest having to swallow this issue in some markets to protect volumes. This makes the group margin performance even more impressive.

It’s interesting to note that emerging markets have had a relatively stronger period than developed markets. The major exception to this is China, where they note that conditions remain challenging. Discretionary consumer spending in China has been a headache for so many companies in recent times. The major headache on the developed market side is Australasia, where Bidcorp is dealing with a market that is suffering from weak consumer demand and pressure on hospitality in New Zealand. I don’t think it helps that New Zealand is about 3 – 5 business days away from basically anywhere that isn’t Australia or China.

The group has invested a net R5.6 billion over the period, split equally between maintenance and expansion capex. They aren’t exactly slowing down with acquisitions either, with a total of 10 bolt-on deals year-to-date at a cost of R1.1 billion.

The share price is up 13% over the past year. Given the relative strength of the rand, that speaks volumes about the strength of the underlying business.

British American Tobacco is reducing its stake in ITC (JSE: BTI)

They already did something similar last year

In 2024, British American Tobacco sold part of its stake in Indian company ITC for around $2 billion, which Reuters notes was India’s third-largest block deal ever. These are serious numbers.

On Tuesday afternoon, the company responded to press speculation regarding another sell-down of the stake. A couple of hours later, full details were released.

Through its Indian subsidiary that holds the stake, British American Tobacco will sell a 2.3% stake in ITC via an accelerated bookbuild. This will help the group reach its target for net debt to adjusted EBITDA of between 2x and 2.5x. They will also use the proceeds to increase the current share buyback programme by £200 million to £1.1 billion.

After the sale, British American Tobacco will be left with a 23.1% stake in ITC, an investment that goes back to the early 1900s!

I would rather work at Coronation than own the shares over the long term (JSE: CML)

A 7% increase in operating costs isn’t “tight expense management”

Coronation is struggling to grow. Although they keep blaming the South African savings culture, I also see little evidence of them doing anything about their business model. If the assets aren’t coming to you, then shouldn’t you be going out there to find them?

At least this period saw a decent financial performance, with average AUM up 9% and revenue up 8%. Total operating expenses increased by 7%, which is below revenue but still above inflation. My worry is that they describe this as “tight expense management” based on underlying people costs. This immediately tells me that Coronation is a business with slow growth and expensive human capital, a combination that they seem quite happy to live with. There’s nothing tight about above-inflation cost increases.

If this sounds more like a fixed income investment profile than an equity investment to you, then you aren’t alone in that thinking. The market values Coronation in such a way that the dividend is usually the bulk of the return. The interim dividend increased by 8% to 200 cents per share and if we annualise that, then Coronation is trading on a forward yield of 10%.

Combined with the share price growth in the past year, it’s been a great return over 12 months. I just can’t help but wonder what they might achieve if they put in a serious focus on growing assets, particularly as they are so proud of their track record of fund performance. Over 5 years, the share price is slightly in the red and shareholders have been fully reliant on dividends for their returns.

Datatec had a pretty spectacular year (JSE: DTC)

Revenue growth is the last metric to look at here

Revenue growth is usually the right place to start when assessing company performance. At Datatec though, it doesn’t tell the right picture for the year ended February. A change in accounting policy has impacted the way that revenue and cost of sales are recognised, with no net impact on gross profit. Thus, gross profit is the metric that will help you understand the numbers.

It really was a great year for the group, with gross profit up 5.6% and EBITDA up 24.6% – both measured in US dollars. HEPS jumped by 79.6 cents! The dividend per share is measured in rand and increased by 53.8% to 200 cents. This is why the share price is up 60% in the past year.

There are several drivers of this growth, including the AI boom and how it is driving a need for “generational” change in infrastructure.

Looking at the underlying segments, Westcon International grew adjusted EBITDA by 24.7%, with particularly strong growth in Asia-Pacific. Logicalis International achieved adjusted EBITDA growth of 26.8%, while Logicalis Latin America saw a jump of 59.5% in adjusted EBITDA.

The trend in margins is expected to remain positive, with a greater proportion of revenue coming from software sales and annuity services. Along with the benefit of more cash sitting at the centre of the group, this has inspired management to increase the dividend payout ratio from 33.3% to 50% of underlying earnings.

Harmony makes a giant leap in copper (JSE: HAR)

Everyone wants a piece of this metal

When it comes to commodities, copper is firmly in vogue at the moment. Harmony Gold has already diversified into this metal and they certainly aren’t playing around, announcing the acquisition of MAC Copper for a meaty $1.03 billion (over R18 billion).

The underlying asset is the CSA Copper Mine in New South Wales, Australia. This mine is a high-grade copper asset and is obviously in a stable jurisdiction where the infrastructure works. The operating free cash flow margin is 36%, so this is a profitable and lucrative mine. With a reserve life of 12 years and exploration potential, the hope is that the cash will continue for a long time. This is a complementary asset for Harmony, as they have other assets in the region including Eva Copper in North-West Queensland.

Despite the size of the deal, Harmony’s net debt to EBITDA is expected to stay within the target range of below 1x. They will finance the transaction with a $1.25 billion bridge facility and existing cash reserves. They will refinance the bridge funding in due course.

MAC is listed on the New York Stock Exchange and the Australian Stock Exchange. The offer price is a 32.1% premium to the 30-day VWAP, so Harmony is paying up for the asset. This isn’t an unusual control premium, but the market does tend to get nervous of swashbuckling deals in the mining space. Harmony closed 4.6% lower on the day.

The MAC board is unanimously in favour of the deal and will propose it to shareholders as a scheme of arrangement. Holders of roughly 22.5% of shares outstanding (directors and key shareholders) have indicated that they will vote in favour of the scheme.

A number of large mining groups have positioned themselves around copper. I hope that the supply-demand dynamics will work out the way they expect them to.

Insimbi Industrial Holdings is having a tough time (JSE: ISB)

There are nasty losses and they seem to be in breach of covenants

Insimbi Industrial Holdings has released an updated trading statement for the year ended 28 February 2025. It tells a sad and sorry tale, with a headline loss for the period that could be as bad as -7.75 cents per share. That’s significant when the share price is R0.61 (having closed 11.6% lower in response to the news).

The loss per share (rather than the headline loss per share) is much worse than that, driven by impairments. This tells you that the underlying business is struggling. The far more worrying note in the update is around covenants, with Absa agreeing to relax covenants up to February 2027.

Although we will only know for sure when detailed results come out on 30 May, bankers don’t generally relax covenants unless a company is already in breach. It’s obviously great to see that the banks are giving them some breathing space, but that’s still an unpleasant situation to be in.

Novus has had a decent financial year (JSE: NVS)

Investors must be patient for a couple more weeks for detailed results

Novus released a trading statement for the year ended March 2025. HEPS is expected to be between 6.1% and 18.1% higher. That’s a wide range at the moment, as the group is still finalising the results for release on 13 June 2025.

The reason for the trading statement (which is triggered by a difference of at least 20%) is that Earnings Per Share (EPS) will be between 40.1% and 52.1%. This gets skewed by all kinds of once-off adjustments, hence the market generally focuses on HEPS.

Strong growth and margin expansion at Pepkor (JSE: PPH)

But keep an eye on Avenida

Pepkor has released interim results for the six months to March. At group level, they tell a great story – revenue growth was up 12.8% from continuing operations and gross margin expanded by 110 basis points to 39.2%. HEPS was good for 12.4% growth. If you adjust for the normalised tax rate, then HEPS was up 18.9% – a solid outcome indeed.

If you include discontinued operations and you don’t normalise for the tax impact, then HEPS was only up by 8.5%. I don’t like brushing over these things, but that’s not a great indication of how well the core business is performing.

Like-for-like sales growth is my preferred metric in the retail world. PEP was a highlight here, up 11.9%, with Ackermans putting in a solid 9.6% performance. Speciality was good for 4.2% and Lifestyle managed 6.3%. As for the non-SA businesses, PEP Africa was up 21.3% in constant currency, while Avenida was down 1.8% in constant currency. As you can see, Avenida is the only blemish on this period, with the Brazilian retailer slowing down its store expansion programme in order to refine the business model.

Credit sales growth continued to outpace cash sales growth, with the proportion of credit sales increasing from 13% to 15% of total revenue. This has driven a 67.3% increase in revenue from financial services, while Pepkor continues to beat the drum of its “credit interoperability” strategy. They also have cellular and insurance businesses that are helpful contributors. In the informal business, which rolls up into the broader fintech play, the Flash business achieved a 23.6% increase in throughput.

They aren’t sitting on their hands. Pepkor is looking for new areas of growth, like through the recent acquisition of Choice Clothing that gives them an off-price business. They are also looking forward to having Shoprite’s furniture business in the group, with that acquisition having been announced in September 2024. But most of all, Pepkor wants to improve its market share in adult wear categories, including a rebrand of Ackermans womenswear stores to the Ayana brand and of course the recently announced acquisition of Legit and other businesses from Retailability.

Aside from the headaches in Brazil, this was a great set of numbers that sets them up strongly for the rest of the year.

Reinet’s NAV and dividend have increased (JSE: RNI)

The group is firmly in a new era

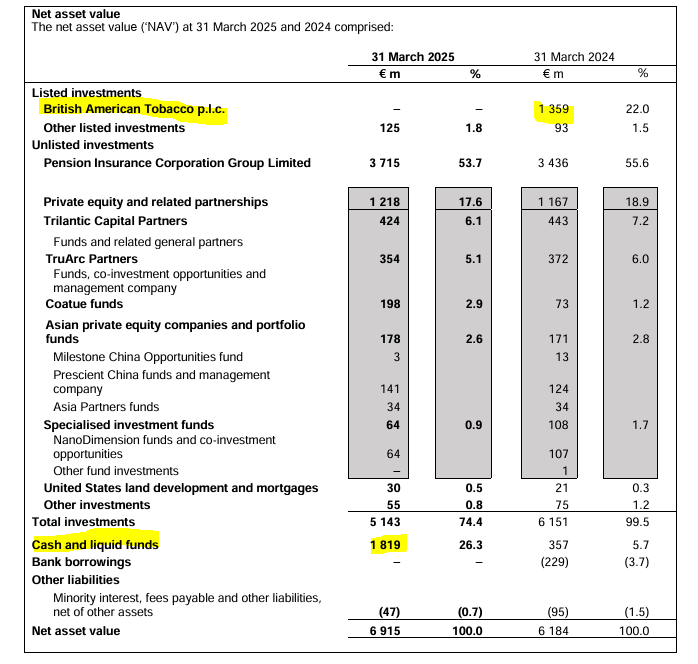

In a major step, Reinet recently sold its entire stake in British American Tobacco. They held this asset since being spun-off from Richemont in 2009 and received a whopping €2 billion in dividends over the years before finally letting it go. By their calculations, the annualised return from this investment was in excess of 11%.

As was recently pointed out to me by a well-respected local investment professional, this means that British American Tobacco was a stronger performer than the rest of the Reinet portfolio. Since 2009, the total portfolio only grew its net asset value by 9% per year including dividends. In other words, with British American Tobacco no longer part of the Reinet story, they will need to improve their capital allocation in other assets.

The other major asset is Pension Corporation, which has had a strong year. This has been the primary driver of the 11.8% increase in Reinet’s net asset value from March 2024 to March 2025. It’s also worth noting that the Reinet dividend is 5.7% higher vs. last year.

The group has also been allocating capital to other institutional managers, with a variety of specialist offshore funds that have caught the eye of Reinet over the years. As the group inherited the British American Tobacco asset from a previous life, the management team’s track record will be measured based on what they achieve beyond that asset.

It’s worth looking at this net asset value summary, as it represents a new era in which the British American Tobacco stake was transformed into a huge cash pile instead:

Stefanutti Stocks remains speculative, but profits have moved much higher (JSE: SSK)

The balance sheet is still on a knife’s edge

Stefanutti Stocks is quite a wild thing. The share price is up nearly 300% in the past 12 months, which is a wonderful example of the potential rewards at play when you’re willing to gamble on an absolute basket case of a company. It looks better than it did a year ago, but remains a high-risk punt.

An 8% increase in contract revenue from continuing operations was good enough to drive a rather daft 700% increase in profit from continuing operations. There was an equally daft deterioration of 656% in the loss from discontinued operations, but thankfully the relative size of continued and discontinued operations means that profit from total operations jumped from R15.9 million to R131.5 million (up 727%, in case you were wondering).

HEPS improved from a loss of 55.73 cents to positive earnings of 109.36 cents, which explains why the share price rose so sharply from R1.15 a year ago to close at R4.27 on the day of these results.

To make this rollercoaster ride even more interesting, the group’s current liabilities exceed its current assets by R1.3 billion. This is why there’s a restructuring plan in place that includes various elements, one of which is a potential equity raise.

For now, lenders have extended the loan to June 2026. Priced at prime plus 5.1%, the bankers are making a delightful amount of money while watching this story play out. This has allowed the group to prepare its accounts on a going concern basis, with the bankers taking a juicy first bite of this partially rotten cherry and shareholders getting the rest.

As great as the return has been over the past 12 months, they aren’t out of the woods yet. The restructuring plan includes some difficult elements that aren’t all within the company’s control, ranging from the disposal of the Mozambique business through to legal disputes.

Zeda pulled a margin rabbit out of the hat (JSE: ZZD)

As a shareholder, I’m pretty happy with this

My local automotive sector exposure is a combination of WeBuyCars and Zeda. WeBuyCars gives me a focused play on car sales (only used, not new) and Zeda delivers exposure to the rental market, with used sales as part of their business but not their core focus.

I believe that WeBuyCars is the better quality business. When it comes to Zeda, a big part of the appeal for me is the low multiple that the share is trading on. Over the past year, Zeda has all the makings of a value trap vs. WeBuyCars which has been a wonderful position for me:

I’m pleased to say that WeBuyCars has been the higher conviction position for me and sized accordingly. It’s much bigger in my portfolio than it used to be, thanks to that share price performance!

“Cheap” stocks like Zeda can take a long time to blossom, as they need to achieve consistent enough results that the market takes notice. For the six months to March, a top-line performance of a 1.6% drop in revenue isn’t going to attract too many growth investors. Used vehicle sales were the source of the pressure, with Zeda managing to sustain performance in their rental business.

But here’s the good news: thanks to the changing mix and management’s overall efforts, gross profit margin improved by 200 basis points to 43% and gross profit was up 4.6%. Operating profit was up 5.4% and margin improved by 100 basis points to 16%. Sure, there are some iffy line items like a dip in EBITDA, but what I really care about is HEPS – and that was up by a lovely 11.2%.

This puts interim HEPS on 184.1 cents. Now, in a business as seasonal as car rental, you can’t just annualise the interim number. Instead, a last-twelve-months basis is appropriate, which you calculate by taking the second half of the previous year and adding it to this interim period. They made full-year HEPS of 312 cents last year and interim HEPS of 165.5 cents. This means that the second half of the year (which isn’t the peak tourist season) was a contribution of 146.5 cents.

Adding that to the latest interim number gives us HEPS over the last-twelve months of 330.6 cents. Zeda closed 3.7% higher on Tuesday to trade at R12, which puts it on a Price/Earnings multiple of 3.6x. Yes, multiples can stay “cheap” for a long time, but not if underlying HEPS growth continues. I’m also quite happy to bank an interim dividend of 55 cents per share along the way.

In the second half, I would like to see a normalisation of the balance sheet. They took on debt and increased the fleet size right near the end of the interim period, so the earnings related to that increased capacity haven’t come through yet. This spiked the net debt to EBITDA ratio to 1.9x (from 1.5x) and took return on equity down from 28.5% to 21.8%.

Nibbles:

- Director dealings:

- A2 Investment Partners, the activist shareholder and associate of Andre van der Veen who is the chairman of Nampak (JSE: NPK), bought shares worth almost R13 million in the company.

- Gerrie Fourie (who is retiring as CEO) sold R8.9 million worth of shares in Capitec (JSE: CPI).

- An associate of the COO of Afrimat (JSE: AFT) bought shares worth R74k.

- Copper 360 (JSE: CPR) has appointed Graham Briggs as the new CEO, with effect from 1 June 2025. Controlling shareholder and current CEO Shirley Hayes appears to have spearheaded this appointment.