Anglo’s production is boosted by Quellaveco (JSE: AGL)

This copper ramp-up was the major positive news in Q1

Anglo American is a huge beast, so a 9% increase in production that is mainly attributable to a single project tells you how big that project really is. Of the 178,100 tonnes of copper produced in this quarter, 59,500 tonnes was attributable to Quellaveco. There was no production from Quellaveco in the base period.

Aside from Quellaveco, there was good news at the steel and iron ore operations as well. These benefits were partially offset by lower copper grades in Chile, a drop in PGM production and the transition of De Beers’ Venetia mine from open pit to the new underground section.

2023 production and unit cost guidance has been reaffirmed across all business units.

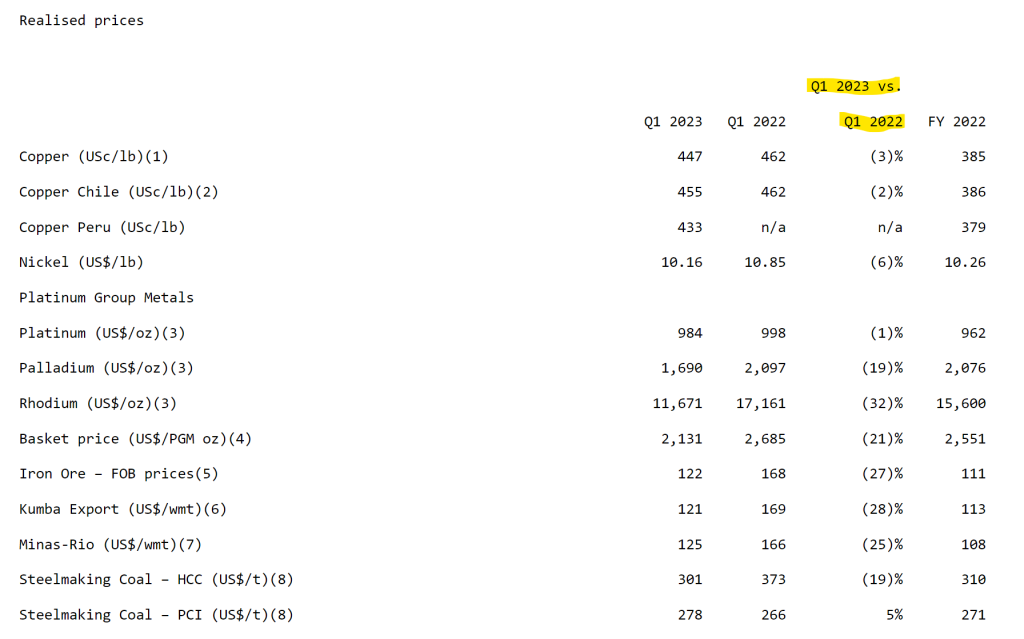

In terms of realised prices, I’ve decided to include the entire table from the announcement to show you how significantly commodity prices have dropped off year-on-year when measured in US dollars:

Production fell at Anglo American Platinum in Q1 (JSE: AMS)

The decrease is in line with guidance, which has been reaffirmed for the full year

In its own-managed mines, Anglo American Platinum (or Amplats) anticipated a drop in production because of lower predicted grade at one of the mines and infrastructure closures at another. Refined PGM production was impacted by smelter availability, which in turn was impacted by Eskom load curtailment.

Due to lower refined production, PGM sales volumes decreased by 17%.

Despite this, there is no change to 2023 guidance across production and unit cost guidance.

Astoria holds its portfolio valuations steady in Q1 (JSE: ARA)

Detailed valuations of unlisted assets are only performed at the end of the interim and annual periods

Astoria holds a portfolio of listed and unlisted assets. The unlisted assets are valued by the directors based on maintainable earnings and reasonable valuation multiples. The listed assets need to be marked to market, which led to a write-down in value this quarter.

There’s not a whole lot that you can read into the quarterly results, particularly because the major driver has been market volatility and its impact on the listed portion of the portfolio. If you want to understand more about the group, you would be better served by watching the recording of the recent appearance on Unlock the Stock:

A smokin’ fine for British American Tobacco (JSE: BTI)

The US scored a payday here for BAT’s activity in North Korea over a decade

This isn’t a political platform and never will be. Still, I can’t help but stare in awe at a fine payable to the US authorities of a whopping $635 million (plus interest) by British American Tobacco for activities in North Korea from 2007 to 2017. Sanctions are clearly a profitable business model for the Americans.

British American Tobacco ceased all operations in North Korea in 2017, so this investigation related to the decade before that.

In its interim report, the company had raised a provision of roughly $540 million for this settlement. Perhaps the most incredible thing of all is that despite the obvious shortfall, full-year guidance for the company is unchanged.

Hammerson’s property values are going sideways (JSE: HMN)

Improvements in property income are being offset by adjustments to yields

Because of the way property is valued, it’s entirely possible for the rental income to improve and the value to stay flat or even move lower. It all comes down to the required rate of return for investors, which is higher as the cost of capital in a market increases. This is why a rising rate environment can hurt property values even when property is thought of as an inflation hedge.

In line with what I’ve seen from other European funds, Hammerson’s portfolio value went sideways this quarter despite improvements in rental income and footfall.

Importantly, balance sheet metrics have also improved. The company can’t do much about property values but it can certainly reduce debt. You may recall seeing headlines about anger at Hammerson for the lack of a dividend. Perhaps the improved property metrics will be supportive of a return to dividends sooner rather than later.

Kumba reports higher production and flat sales (JSE: KIO)

The base period was significantly impacted by rainfall

After some positive commentary on Transnet by Afrimat and Sasol, I’ve been waiting to see whether Kumba is also having a better experience. Although ore railed to port by Transnet increased by 3% year-on-year, it was still below Kumba’s expectations.

Looking at this quarter specifically, production increased by 14% because of difficulties in the base period including the weather. Sales volumes were flat year-on-year (hence inventory stockpiles increased). Compared to Q4 2022, which was a disaster with the Transnet strike, sales are up 38%.

Guidance for full year 2023 has been reaffirmed subject to Transnet performance.

Prosus has further reduced its Tencent stake (JSE: PRX)

The buybacks continue to be funded by the sale of Tencent shares

In my next life, I’m coming back as a Prosus executive. After putting in place a convoluted structure to try to reduce the inherent discount to the valuation in the holding structure with Naspers, the management team is now being paid eyewatering sums of money to sell Tencent shares on one side and repurchase Prosus and Naspers shares on the other. The worst part is that this is what should’ve happened in the first place, instead of the ridiculous cross-holding structure that we have today.

Sigh.

After a further sale of shares in Tencent, Prosus’ stake has now decreased to 25.99% in the company.

Quilter reflects improved investor sentiment in 2023 (JSE: QLT)

Flows in Q1 2023 are significantly higher than in Q4 2022

Quilter reported a modest 2% gain in assets under management and administration as at 31 March 2023 vs. 31 December 2022. That’s not earth shattering, but not bad for a three-month period either. The gain was mostly attributable to net inflows, which is the good news in this story.

Although net inflows were lower year-on-year, the comparable period was before the conflict in Ukraine really took off. If we look at Q4 2022 for comparative purposes instead, the momentum in flows is positive. This is especially true in the Affluent channel.

Quilter (and its shareholders) will hope that this momentum can be sustained throughout 2023.

This capital raise is at the Finnish line (JSE: SSW)

Sibanye’s lithium project in Finland is enjoying local government support

In its efforts to secure the outstanding equity funding for the Keliber Lithium project in Finland, Sibanye has announced that the Finish Minerals Group (the manager of the Finnish State’s mining industry shareholdings) will increase its holding in the Keliber project from 14% to 20%.

This will be effected through the rights issue by the project’s holding company, with the state obviously taking up an outsized proportion of rights in order to increase its stake. Of the total raise of €104 million, a substantial €53.9 million is coming from the Finnish State.

Sibanye will retain 79% in the project, with minority shareholdings holding the remaining 1%.

Laying of earthworks for the project commenced in March and the project is progressing well. The remaining capital for the project will be raised in the form of debt.

Steinhoff creditors say WHOA – mostly (JSE: SNH)

Major shareholders are trying to extract some value here

I really do love the fact that Steinhoff’s Dutch Law restructuring plan is called the WHOA Restructuring Plan. Whoa, indeed.

After the plan was published at the end of March, shareholders were allowed to make representations that were also shared with the court-appointed observers.

Unsurprisingly, the shareholders pushed for a material change to the terms. Equally unsurprisingly, the creditors said whoa. There will not be any material changes.

The important update is that contingent value rights (CVRs) to be issued to creditors and shareholders in the new “topco” will carry identical terms and conditions. Creditors will hold 80% and shareholders will hold 20%.

In other words, once the creditors are settled and this exceptionally complicated scenario plays out, the current shareholders would hold 20% of whatever is left via an unlisted instrument. For retail shareholders who have a tiny stake in Steinhoff, holding such an insignificant amount in the unlisted space is literally worthless.

I maintain that the fundamental value of a listed Steinhoff share is close to zero.

Little Bites:

- Director dealings:

- A director and prescribed officer of Sabvest (JSE: SBP) collectively bought shares worth R765k.

- Oasis Crescent Property Fund (JSE: OAS) has very little liquidity, so it only earns a mention in Little Bites on an otherwise busy day of news. With no leverage in order to be Shari’ah compliant, this property fund has a highly conservative business model. Despite the lack of debt, an improvement in conditions drove a 14.6% increase in distributable income in the year ended March 2023.

- Eastern Platinum (JSE: EPS) has some unusual drama on its hands, having received unproven whistleblower allegations related to undisclosed related party transactions involving the sale of chrome at discounted prices. Two independent directors will oversee an investigation into this.

- With approval from the SARB now obtained, PBT Group (JSE: PBG) will pay its special dividend on 15 May.