An interesting segmental story at Argent Industrial (JSE: ART)

And a strong group performance overall

Argent Industrial released results for the six months to September 2025. They look solid to say the least, with revenue up 12.4%, EBITDA up 13.2% and HEPS increasing by 13.3%. That’s quite an unusual shape, as there isn’t much margin expansion despite a strong top-line performance.

The segmental story is rather interesting. In South Africa, revenue was down 3.1% and profit increased by 9.6%. In the Rest of World segment, which contributed over two-thirds of group profit in this period, revenue was up 38% and profit only increased by 13.5%. It’s amazing how the group margin can look so steady, yet the underlying segments experienced significant changes. This is true for so many companies out there, particularly when they are making acquisitions and bringing in businesses that have structurally different margins.

City Lodge: I’m very happily in the green (JSE: CLH)

And all you needed to do was read the previous announcement (or Ghost Bites)

When I wrote about City Lodge in early September based on earnings for the year ended June 2025, I included this paragraph:

“We now get to the particularly good news: July and August 2025 saw an uptick in occupancy of 400 basis points year-on-year. Food and beverage revenues jumped by 16% and 14% for July and August respectively. To add to this, the group is now debt free. Perhaps it’s time for that share price chart to start heading back into the green?”

I thought about it for a bit, tested the thesis with a few people and then decided to go long myself. The market just wasn’t picking up on this uptick in occupancy, so it struck me as an opportunity.

I’m now up 25% thanks to the market taking its sweet time to catch onto what the company was saying. That’s exactly why investors talk about the opportunity to generate alpha (returns in excess of the market) in local stocks, particularly among mid-caps that are big enough to matter and small enough to fly under the radar of most investors.

The latest operational update at City Lodge only adds to the good news, with the company noting a 460 basis points uptick in occupancy for the four months to October 2025. Combined with an inflationary increase of 3% in average room rates, things are looking good. November month-to-date is even better, with occupancy up by a whopping 800 basis points year-on-year to 65%!

You won’t find a more up-to-date view than this: the announcement notes that group occupancy “last night” was 90.7%. That’s fantastic at this relatively early stage in the holiday season.

The good news continues in the food and beverage business, where the first four months were up 16%. In November, they are up 32% thus far!

Looking beyond our borders, Botswana is struggling due to diamond industry pressures among other reasons, but they have seen some recent improvement. Namibia is doing well. Mozambique seems to be on the up.

To add to the happiness, City Lodge repurchased 6.1% of shares in issue (measured at at the beginning of the 2026 financial year) at an average price of R4.00 per share. The share price is now trading above R5.

There are some great companies on the local market that get ignored by investors until all the best returns have been made. Sometimes, all you need to do is read and pick up the bread crumbs that management is leaving for you.

A reminder from Crookes Brothers that agriculture is really hard (JSE: CKS)

There are just so many exogenous factors in this industry

Business is hard enough when you’re able to control most of the things that affect your profitability. In some sectors, the biggest drivers of earnings are external, which means that management focuses on “controlling the controllables” while asking the deity of their choice for help with the rest.

A trading statement from Crookes Brothers for the six months to September lays bare the difficulties in the agriculture sector. HEPS is expected to drop by between 42% and 46%, driven mostly by softer commodity prices (beyond their control) and extreme weather events that hit the banana and macadamia segments (also beyond their control).

It’s hard to think of a tougher industry!

Steady funds from operations at Delta Property (JSE: DLT)

This is quite the achievement for this group

If you’ve ever watched a movie where somebody is digging their way out of a jail cell with a spoon, then you’ll have some idea of how hard things have been for Delta. With a loan-to-value ratio that is too high and a property portfolio that is filled with difficult buildings, they’ve had to chip away at the debt by selling off properties as often as they can.

Kudos to management: persistence has paid off. The share price is up nearly 70% year-to-date as this speculative play has paid off for those who took a punt. The main reason for the upswing is that the company has stabilised, with funds from operations per share actually increasing from 8.1 cents to 9.2 cents. Combined with a loan-to-value ratio that has improved from 59.5% to 58.4%, it seems that the worst is behind them.

They still have plenty of vacancies to try and fill, with the vacancy rate improving from 31.9% to 29.7%. They are achieving this through new leases and the disposal of properties that they can’t fill.

With a 100% rental collection rate (!) and now a decrease in interest rates in South Africa, it feels like things will start to get easier for Delta.

Kore Potash has raised capital to cover the next 12 months (JSE: KP2)

This removes the near-term pressure and allows them to properly consider any offers

Based on recent announcements, we know that Kore Potash has attracted some potential suitors. This isn’t a surprise, as the company has gotten through some major hurdles related to the Kola Project in the Republic of Congo. This puts it at an interesting point on the risk/reward curve.

My concern was that the balance sheet would force Kore Potash to act too quickly on these negotiations, as they need capital to move forward with the project. The company has addressed this issue by raising $12.2 million with existing shareholders and new institutional and other investors.

They need $2.2 million for the final payment to PowerChina International Group, as well as $3 million for advisory and legal costs. The rest is going on other costs and general working capital.

They might be able to raise more, as the two largest shareholders (the Oman Investment Authority and Sociedad Química y Minera) each have the opportunity to invest in more shares to avoid being diluted. Such an investment would be in addition to this $12.2 million raised elsewhere.

Return on Equity has dipped at Investec (JSE: INL | JSE: INP)

Earnings might have grown modestly, but ROE matters more

Investec’s share price fell 5.2% on Thursday in response to the release of results for the six months to September 2025. The banking group grew revenue by 2.4%, adjusted operating profit by 1.5% and HEPS by 3.4% (all measured in ZAR).

The currency plays a big role here due to the extent of UK business interests. Expressing those numbers in GBP leads to negative growth in revenue and adjusted operating profit, with just 0.3% growth in HEPS.

ROE is where the rubber hits the road in banking. Investors care about the returns that the bank can achieve with their capital, so ROE tends to be a major driver of the valuation multiple for a banking group. Investec’s ROE has unfortunately dipped from 13.9% to 13.6%. Combined with low growth, this would’ve contributed to the drop in the share price as the market digested the numbers. The mitigating factor from a valuation perspective is that the tangible NAV per share increased by 7.9% in ZAR.

Net core loans increased by 8%, but declining interest rates and lower income in the SA investments portfolio led to pre-provision adjusted operating profit decreasing by 2.6%. The credit loss ratio on core loans was 35 basis points, an improvement vs. 42 basis points in the comparable period and well within the target range. The reason for the decline in earnings is more to do with pricing rather than concerns around credit quality.

An interesting nugget is that trading and investment income is down in SA, as the base period included the sharp upswing in sentiment from the formation of the GNU.

Investec expects second-half performance to be broadly in line with the interim period, so there isn’t much for investors to feel excited about there. The group needs to show some progress on moving ROE higher despite the interest rate decreases that will impact margins.

Excellent numbers at Lewis (JSE: LEW)

Margins are up and the footprint has expanded rapidly

Lewis has released results for the six months to September 2025. The group has a strong reputation for turning difficult operating conditions into great numbers. And in this period, they took a more bullish view on the environment by opening more new stores in a six-month period than ever before.

Revenue was up 11.3% overall, including solid contributions from value-added lines like insurance revenue. If we focus purely on merchandise sales, we find total growth of 6.7% and comparable store sales of 2.3%.

Notably, cash sales were up 3.7% and credit sales were up 8.0%. It’s not a surprise seeing this, particularly as the furniture sector has always been reliant on credit sales. At Lewis, credit sales are 70.3% of total merchandise sales.

Cost growth of 10% was impacted by the store rollout programme, so it would be best to compare this number to total revenue growth rather than comparable store sales.

Operating profit was up by a juicy 21.4% as the operating margin moved 250 basis points higher to 20.7%. HEPS came in 16% higher, with a jump in net finance costs blunting the story between operating profit and HEPS.

The interim dividend increased by 12.3%. When you consider the rapid expansion and capex investment as the backdrop to this story, double-digit growth in the dividend is impressive.

For the remainder of the year, the expansion in store footprint will focus on specialist bedding brands. And although management doesn’t explicitly say it, it’s worth remembering that the second half of the year is up against a base period that includes the two-pot boost.

Mr Price: an earnings rally, but can it break out of the current range? (JSE: MRP)

This is my long position in the sector

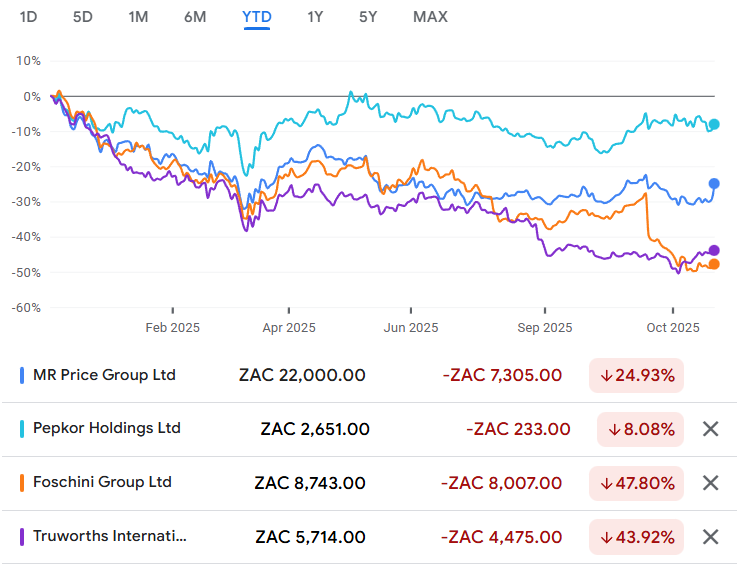

The apparel retail sector has been a fascinating story to follow this year. Just take a look at the year-to-date chart:

The only position I hold of these four names is Mr Price. I bought at an in-price of R203.05, as my view is that it was the baby thrown out with with the bathwater – The Foschini Group (JSE: TFG) and Truworths (JSE: TRU).

It’s been a sideways story for a couple of months, with my position now 8% in the green thanks to a 7% rally on the day of results at Mr Price. I’m certainly hoping for more obviously, with the idea being that Mr Price closes some of the gap to Pepkor (JSE: PPH).

So, what do the numbers at Mr Price for the 26 weeks to 27 September tell us?

Firstly, total revenue is up 5.4% and gross margin expanded by 30 basis points to 40.0%, so that’s an encouraging start. Operating margin was up 10 basis points to 11.5%. This means there was some margin expansion, but not as much as I would’ve liked to see based on that gross margin expansion. By the time we reach the bottom of the income statement, diluted HEPS was up 6.4%.

In-store sales were up 5.4% and online sales were up 9.7%, so Mr Price is responding to the omnichannel opportunity rather than playing any kind of leading role in it. They increased their weighted average trading space by 3.5%.

Mr Price is primarily a cash model, which is one of the things I like most about it. Cash sales were 88.2% of retail sales and increased 5.6%, while credit sales grew by just 4.3%.

Looking deeper into the business, the Telecoms segment was the best performer with retail sales up by 12.4%. It only contributes 3.8% to group sales though, so it won’t move the dial by itself.

The Home segment contributes 17.7% and is thus more important than Telecoms, with growth of 5.1%. Within that segment, Yuppiechef has continued its excellent performance with double-digit growth.

The Apparel segment is 78.5% of group sales and grew by 5.3%, with the expanded gross margin being particularly impressive when you compare this to the numbers we’ve seen elsewhere in the SA apparel sector.

The balance sheet is in excellent shape, with no debt and cash of around R3 billion to fund capex and other growth opportunities.

Mr Price has flagged a tougher second half in terms of year-on-year comparison, as the prior period included the boost from two-pot withdrawals. On the plus side, operational improvements at the Durban port have positively impacted the inventory position. For the first 7 weeks of the new period, retail sales are up 3.3% against a base period that grew 12.3%, so that’s an acceptable two-year stack.

I’m happy with this. Mr Price is strongly outperforming The Foschini Group and Truworths. It might be lagging behind Pepkor, but it’s doing so with cash sales rather than meaningful credit exposure. I feel like I bought at the right time (more or less).

A juicy jump in earnings at Netcare (JSE: NTC)

They’ve carried on where they left off in the interim period

Netcare has had a fantastic year. In a trading statement for the year ended September 2025, they’ve highlighted a jump in adjusted HEPS of between 19% and 22%. This is a lovely continuation from the interim period, where adjusted HEPS was up 20%.

In case you’re wondering, HEPS (without adjustments) is up by between 17% and 20%, so don’t let the adjustments scare you. It’s been a great year for them.

There are a number of drivers of these earnings, ranging from better activity through to cost efficiencies, lower interest rates and the benefit of share buybacks.

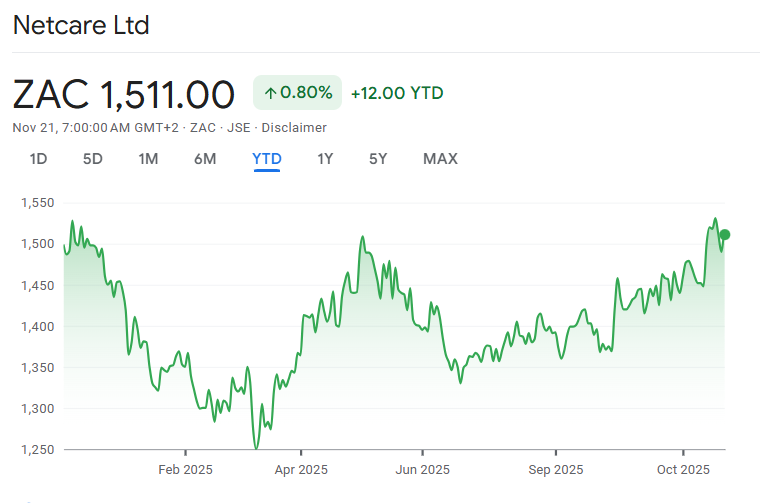

Despite this, the share price is basically flat year-to-date, having been on a wild journey that looks like the side profile of a pre-G20 Sandton pavement:

Full details will be released on 24 November. I look forward to understanding more about the performance.

A vastly better second half at Reunert (JSE: RLO)

Can they capitalise on this momentum?

Reunert has released results for the year ended September. Revenue from continuing operations was down 2% and operating profit fell 8%, while HEPS was down 5%. That’s not great.

But here’s the thing: compared to the interim results, these numbers look fantastic. Reunert was down 5% in revenue and 20% in HEPS at the halfway mark. With a 6% improvement in HEPS in the second half of the year, they’ve managed to stem the bleeding. They will hope to carry that momentum into the new year.

Another positive element to these numbers is the cash flow. The final dividend was up 6% and net cash jumped by 39%, so this is very much a story of cash generation in a difficult environment. I guess that’s better than poor cash flow in a strong environment, but it’s still not exactly what shareholders want to see.

With all to play for in a new financial year, Reunert will hope for improvement in the Electrical Engineering segment in particular. Revenue was down 3% and operating profit tanked 31% in this part of the business, with the double whammy of weak infrastructure investment in South Africa and the impact of tariffs on exports to the US.

The ICT sector also had a tough time, with flat revenue and a 9% reduction in operating profit. In Applied Electronics, revenue was down by 7%, but operating profit jumped by 21% as they focused on margins. The Defence business has a strongly positive narrative and the Renewable Energy business grew EBITDA year-on-year.

The share price is showing strong momentum now, with a long way to go to get back to where it started this year:

Supermarket Income REIT buys more “omnichannel stores” (JSE: SRI)

This shows you how entrenched the omnichannel model is in Europe

South African online shopping penetration is still way below what you’ll see in markets like the UK. It is growing rapidly though, with companies like Shoprite (JSE: SHP) and The Foschini Group (JSE: TFG) leading the way in their respective sectors, while competitors hustle to try and catch up. As a sign of where we might get to in South Africa, we can look to Supermarket Income REIT in the UK.

This company recently announced the acquisition of a portfolio of Carrefour supermarkets in France that were seen as “omnichannel stores” – the rents are affordable and the catchment area is lucrative.

This language has come through once more in the latest announcement for an acquisition of 10 Asda supermarkets in the Blue Owl Capital joint venture. Much like the Carrefour deal, this is also a sale and leaseback transaction. The Asda supermarkets have 25-year leases and annual CPI-linked rent reviews with a cap of 4% and a floor of 1%. They are described as stores that support online fulfilment and click-and-collect services. In modern retail, stores are just an extension of the distribution network.

Supermarket Income REIT is also transferring five of its assets into the joint venture to help it achieve scale. The assets are being transferred at a 3% premium to book value and the company will receive an annual management fee.

Nibbles:

- Director dealings:

- ASP Isotopes (JSE: ISO) released its quarterly numbers for the period ended September. The company is putting in place the route to market for its products and is preparing Quantum Leap Energy for a distinct listing, so the market value and the investment thesis aren’t really based on current numbers. Still, bulls will need to be comfortable with a net loss for the quarter of $12.9 million vs. a loss of $7.3 million in the comparable quarter. The year-to-date comparison is even more severe, with a loss of $96.4 million vs. $23.2 million.

- Here are some interesting numbers at Deneb (JSE: DNB): a trading statement for the period ended September 2025 reflects an expected jump in HEPS of between 91% and 111%. This means that earnings have roughly doubled! I look forward to seeing the detailed results on 27 November.

- Renewable energy may be a lovely asset class for people to feel good about the world, but it’s by no means a licence to print money. Power generation is variable based on Mother Nature herself, plus there are all of the usual maintenance and other issues to think about. Mahube Infrastructure (JSE: MHB) demonstrates this with a trading statement for the six months to August, where negative fair value movements have made them swing from positive HEPS of 67.58 cents to a headline loss of between 30.77 cents and 34.01 cents. They also flagged lower dividend income from underlying investments due to operational challenges at one of the wind assets. Full details should become available on 28 November.

- It might be time to get the popcorn out for Trustco (JSE: TTO), as the company has announced that Riskowitz Value Fund has demanded a shareholders’ meeting to consider the appointment of a new board of directors. The company is considering the validity of the demand and will make a further announcement in due course.

- Here’s an interesting one for you: Brait (JSE: BAT) has hedged part of its stake in Premier (JSE: PMR), giving them protection (on that portion) from the Premier share price dropping below R166.69. They also give away any upside above R186.16. Premier is currently trading at just over R167, so they are locking in some of the recent gains. This structure reduces Brait’s economic interest in Premier from 32.3% to 28.7%.

- In case you’ve been wondering, Orion Minerals (JSE: ORN) has updated the market on the financing and offtake agreement with Glencore (JSE: GLN). Glencore is in the final stages of its technical and financial due diligence, while the legal due diligence has been largely completed. The parties are working towards binding terms for the deal. They expect to sign docs by the middle of December.

- Spear REIT (JSE: SEA) announced that the acquisition of Berg River Business Park in Paarl for just over R182 million has been completed. Their loan-to-value ratio after the deal is sitting on between 21% and 22%. For context around the relative size of this deal, the gross portfolio value is now R6.39 billion.

- Labat Africa (JSE: LAB) announced that the Classic Transaction has been completed and all profit warranty conditions have been met. The 116.5 million shares related to this acquisition have been issued and listed at an issue price of R0.07. The share price is currently around R0.05.

- Africa Bitcoin Corporation (JSE: BAC) announced that Forvis Mazars South Africa has been appointed as the group’s external auditor. This doesn’t surprise me at all, as Wiehann Olivier (the audit partner) has particular interest in crypto. Look out for a podcast with him coming soon on the topic of blockchain and regulation in that space!

- Efora Energy (JSE: EEL) has released a bland cautionary about “various negotiations” that could affect the company’s securities. The company is suspended from trading anyway.