Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Attacq and Hyprop have completed their African deals (JSE: ATT | JSE: HYP)

Time will tell whether being in Africa via Lango Real Estate is a better outcome

Investing in a particular region through another structure or with a partner is mainly a capital allocation decision. Holding assets directly in that region is an operational decision as well as a capital allocation decision, as there is far more risk involved. As for the potential for additional reward, well, it’s not always there despite the higher risk.

Attacq and Hyprop have had enough of holding directly in the rest of Africa, hence why they did the deals to sell the direct exposure in Ghana and Nigeria and accept shares in Lango Real Estate instead. Both deals fulfilled their conditions precedent in the same week, so the story going forward will be one of hoping that the Lango structure turns out to be a better decision than holding properties directly.

It’s go-time for the Capital & Regional deal (JSE: CRP | JSE: GRT)

Growthpoint has thrown its weight behind the deal with NewRiver

At last, after many extensions to the deadline for a firm offer to be made, we have a deal on the table for Capital & Regional, Growthpoint’s listed subsidiary in the UK market.

NewRiver’s bid has found favour with Growthpoint, which means shareholders in Capital & Regional are on their way to receiving 31.25 pence per share in cash and 0.41946 NewRiver shares. This is effectively a premium of 21% to the “undisturbed closing price” of Capital & Regional before news of a potential deal broke.

It’s a fairly light premium because of the share-for-share element, which allows existing shareholders to cash out a portion of their exposure and roll the rest into the merged entity. Capital & Regional shareholders will have 21% in the enlarged entity. The combined group will have a coherent strategy focused on UK shopping centres with anchor tenants having a value-focused strategy and thus making them more defensive (e.g. affordable grocery stores).

Growthpoint will vote in favour of the deal, with an eventual holding of around 14% in the enlarged group if all goes ahead. Growthpoint will receive £50.7 million in cash as part of the deal, which should go a long way towards improving the balance sheet at the property juggernaut.

What worries me is that I couldn’t find any evidence of a commitment to NewRiver listing on the JSE in place of Capital & Regional. This is problematic for many Capital & Regional shareholders who can’t just roll their listed exposure on the JSE into listed exposure in the UK. The announcement notes that further details for South African shareholders will be in the scheme document.

A decent year for Choppies – but not on a per-share basis (JSE: CHP)

The rights issue in mid-2023 means there are many more shares in issue than before

For equity investors, it’s obviously really important to consider a company’s financial performance. It’s even more important to look at that performance on a per-share basis. It’s great having a delicious cake, but not if you only get a crumb or two vs. an entire slice. Similarly, a vast increase in the number of shares without a high enough jump in profits means that profits per share will deteriorate.

This is why the industry standard in South Africa is Headline Earnings Per Share, or HEPS.

The performance for the 12 months to June 2024 at Choppies is a perfect example of why this is so important. Profit for the period was up 9.3%, yet HEPS fell by a nasty 20.7%. The difference here is the number of shares in issue this year vs. the comparable period.

Another important element to the performance is the Kamoso acquisition, which played a major role in group revenue being up 31.7%. Without that acquisition, it would’ve been 12% higher. Excluding acquisitions and looking at performance on a like-for-like basis is important in understanding the true underlying performance.

Other important points to note are that gross profit margin and operating profit margin both deteriorated year-on-year, as you can see by comparing the modest growth in profit to the large increase in revenue. Net finance costs also played a role here, with the acquisition of Kamoso as a driver of higher finance costs.

The good news is that there’s a final dividend of 1.4 Thebe per share vs. nothing in the comparable period.

A far less shiny period for Gemfields (JSE: GML)

Revenue at core operations has dipped

Recent auction results at Gemfields haven’t been fantastic. Those results aren’t even in the numbers for the six months to June though, with a trading statement for that period reflecting a significant decrease in earnings before the recent auction pressures are even seen in the results.

For the six months to June, internal production challenges were a bigger issue than a decrease in market demand. HEPS is down by 21% as reported or 48% on an adjusted basis. The difference between HEPS and adjusted HEPS is the fair value loss on Sedibelo, the PGM asset that Gemfields has now written down to zero. That speaks volumes about the current sentiment towards the PGM sector.

Kagem Mining, the emeralds operation, achieved revenue of $51.9 million vs. $64.6 million in the comparable period. Montepuez Ruby Mining (self-explanatory) saw revenue decrease from $80.4 million to $68.7 million. Combined with inflationary cost pressures at both operations and increased finance costs, this is why earnings are down. It also didn’t help that luxury jewellery business Faberge saw revenue decrease from $8.4 million to $6.6 million.

This isn’t a happy start to the financial year, especially considering the recent dip in demand. All eyes will be on the remaining auctions this year, with management putting forward a cautiously optimistic tone around market conditions.

Vukile’s pre-close presentation sounds bullish (JSE: VKE)

The fund is going from strength to strength

Vukile’s pre-close presentation for the interim period is a great read. You can find the full presentation here.

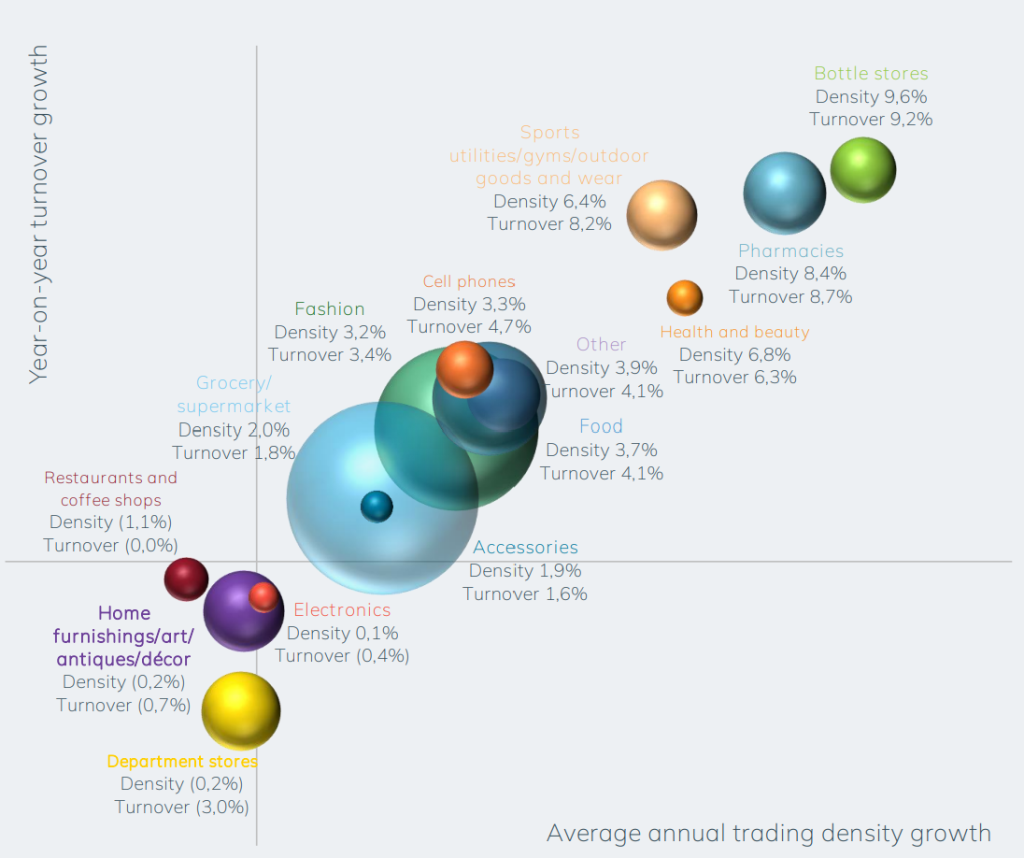

My favourite chart in the deck is from the South African portfolio review, showing the growth in turnover and trading density for major retail categories. Note how strong it looks for pharmacies and health and beauty in particular, with that combo making a strong case for what the current performance at the likes of Clicks and Dis-Chem must be:

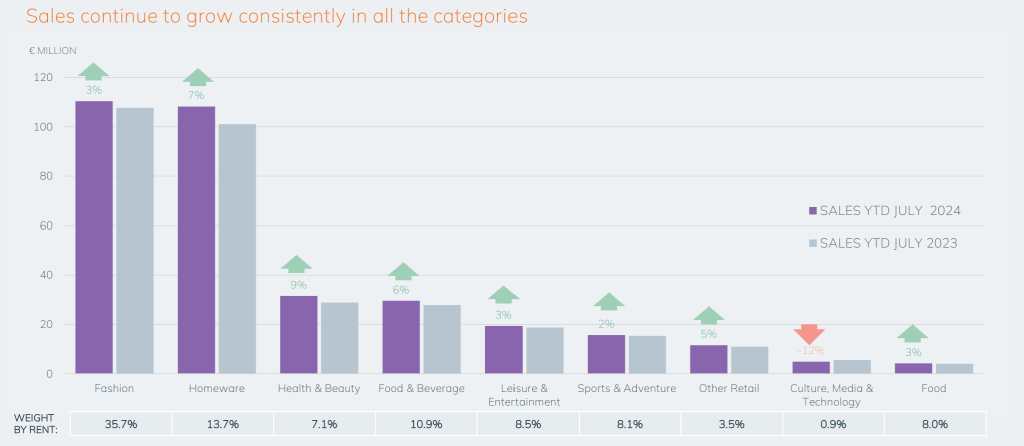

It’s fun to compare this to where the growth is being experienced in the Spanish portfolio, with fashion and homeware as the largest categories but health and beauty once again coming through as the best source of growth:

The great thing about the markets is that you can learn something about retail by reading a presentation by a property fund!

Vukile is on a strong footing for the coming push into Portugal. After a very strong base period, growth in funds from operations per share is expected to be 2% to 4% for the full year and the dividend per share should be 4% to 6% higher. They will give a further update at the interim results.

Nibbles:

- Director dealings:

- An associate of the CEO of Sirius Real Estate (JSE: SRE) sold shares worth over R2.1 million.

- A non-executive director of Anglo American (JSE: AGL) bought shares worth over R580k. Separately, three non-executive directors accepted shares worth over R710k in lieu of fees.

- A director of Bell Equipment (JSE: BEL) and her spouse sold shares worth nearly R40k. A director of a subsidiary sold shares worth R200k and a different director sold shares worth R254k. Unlike the recent selling we’ve seen at Bell, these directors aren’t part of the Bell family.

- A non-executive director of Metrofile (JSE: MFL) bought shares in the company worth R200k. This adds to some of the other recent buying we’ve seen from the CFO.

- An associate of two directors of Astoria (JSE: ARA) entered into a CFD trade worth over R31k.

- The minor children of the founder of WeBuyCars (JSE: WBC) have bought shares in the company worth R9.6k – gotta teach them young!

- Orion Minerals (JSE: ORN) is paying the advisor on the recent capital raising project in shares rather than cash. Although the shares are being issued at quite a discount to the current market price, cash preservation is more important. The amount being settled is around A$10.6k.

- MC Mining (JSE: MCZ) announced that the share options previously granted ex-CEO Godfrey Gomwe have now lapsed. There were 8 million share options, so that makes a difference to shareholder dilution.

- Cilo Cybin (JSE: CCO), the recently listed special purpose acquisition company, is still in negotiations to acquire Cilo Cybin as its first “viable asset” – the technical term for the type of deal that a SPAC needs to do for the listing to become permanent.