Glencore investor update

The mining giant is reminding investors what it offers

In a slide deck of 36 pages, Glencore has laid out what investors should be focusing on. The company picked a great day on the market to release it, as there were very few noteworthy updates.

Of course, it doesn’t take long before the presentation talks about the journey to net zero emissions and the energy sources required to achieve that. The mining industry is full focused on this.

Glencore has no shortage of coal assets, with the company talking about a “responsible decline” of the coal portfolio and 12 mine closures by 2035.

The company believes that there is a substantial supply deficit in copper over the next decade, driven by demand for renewable energy and electric vehicles, alongside the difficulties of bringing on more supply and the extent of investment required. Of course, Glencore points this out because the group owns major copper projects.

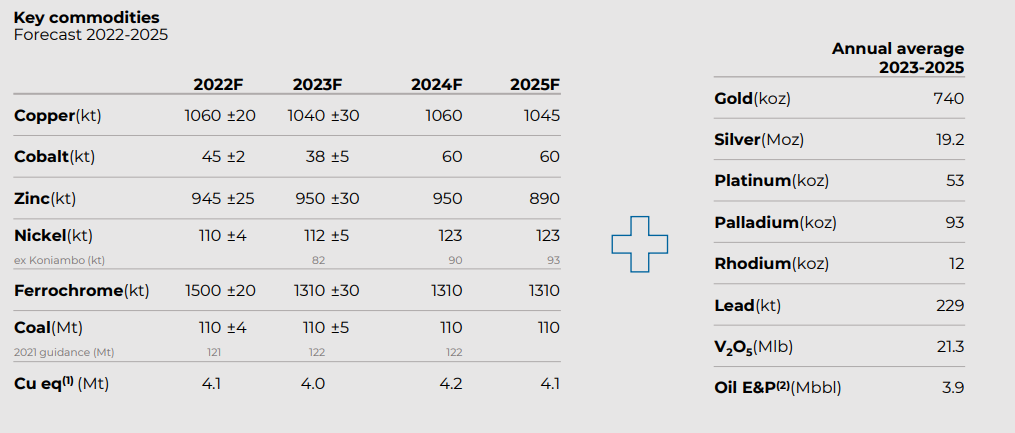

To help you understand just how big this group is, I thought this extract from the presentation would help:

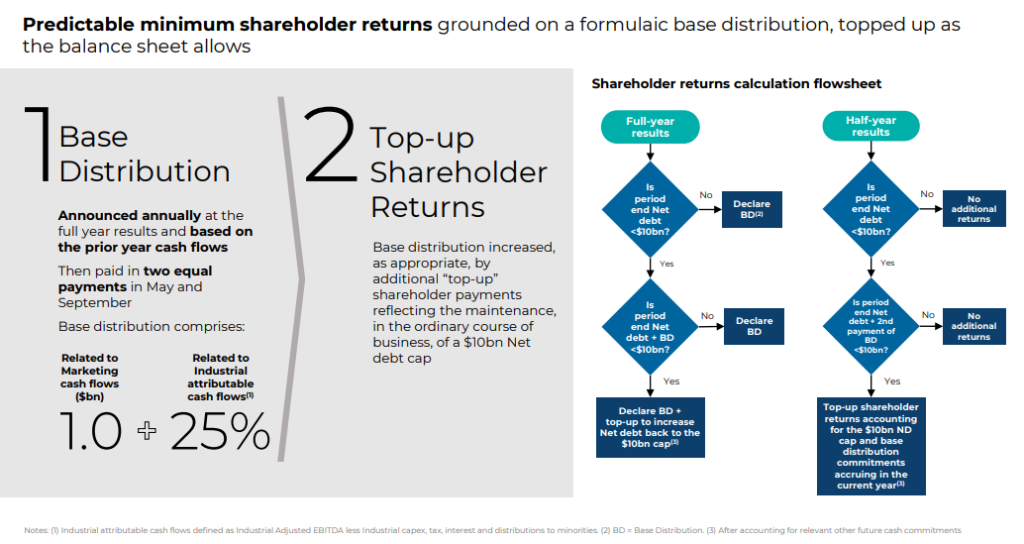

Net debt is managed around a $10bn cap and the ceiling is $16bn, so there is room for using debt for acquisitions. To manage return on equity, a decrease in leverage is rectified through special dividends and share buybacks.

Finally, I couldn’t resist sharing this slide that gives the rules that Glencore applies in determining distributions to shareholders and the use of special dividends or buybacks:

To read the entire investor presentation, follow this link.

Schroder European Real Estate looks good on key metrics

Keep an eye on debt expiry in 2023, despite the low LTV in this fund

In its full year results for the period ended September, Schroder European Real Estate Investment Trust kicked off the results by pointing out that quarterly dividends have reached pre-Covid levels. That’s a big deal, when you consider what the world has been through. To sweeten the deal, there was also a significant special dividend linked to the asset management profits achieved at Paris Boulogne-Billancourt.

With a property portfolio focused on European cities, the net asset value return of 7.3% is particularly impressive in this environment. The major drivers are valuation uplifts in the industrial and DIY portfolio, along with the German office portfolio. The direct portfolio valuation has registered a like-for-like increase of 3%.

The net asset value is a lot lower than it would’ve been without the special dividend, which shows that the management team keeps shareholder value top of mind when allocating capital.

The balance sheet is strong (hence the dividends), with a loan-to-value (LTV) of 29% gross of cash and 20% net of cash. This is higher than a year ago, but that’s not a bad thing as property funds need debt to generate proper returns to shareholders. The target is actually 35% gearing, so there is room to take on more debt. The average cost of debt is 1.9%.

Around 33% of the net debt expires in 2023 and discussions are underway with lenders. It is likely that finance costs will increase from the current low levels, with the hope being that financing costs will be offset by rental indexation.

Little Bites:

- Director dealings:

- The family trust of the CEO of Altron has bought another R169k worth of shares

- Value Capital Partners is still buying big chunks of shares in ADvTECH, in this case worth just under R30m

- A director of Momentum Metropolitan has acquired shares worth R179k

- The Naspers and Prosus buybacks are always touching on every couple of weeks, simply because they are so huge. Between 28 November and 2 December the group purchased Naspers shares worth R2.2 billion and Prosus shares worth $328 million.

- Pan African Resources announced that the JSE has granted formal approval of its R5 billion medium-term note programme. People tend to forget that the JSE is a great place to raise debt capital, something that doesn’t get the same attention as equity delistings because individual investors can’t participate in the debt raises.