Hyprop holds onto Hyde Park Corner (JSE: HYP)

I don’t think that’s a bad thing

In July 2025, Hyprop announced the sale of a 50% undivided share in Hyde Park Corner, along with the option to dispose of the remaining 50%. The proposed purchaser was a wholly owned subsidiary of Millennium Equity Partners.

In my opinion at least, Hyde Park Corner is one of the more interesting and unusual retail spaces in Joburg. Genuinely iconic and with great positioning, the centre includes a solid mix of upmarket offerings. Perhaps I’m just biased because there’s an impressive bookstore. Either way, I think it’s a solid property to own that was made even better by the recent opening of a Checkers FreshX store.

That positive view on the centre is just as well, as the deal to sell the share in the property has fallen through due to lack of fulfilment of conditions precedent. The announcement doesn’t specify which conditions weren’t met. This means that Hyprop shareholders will continue to have exposure to this mall in the absence of any other offers coming through.

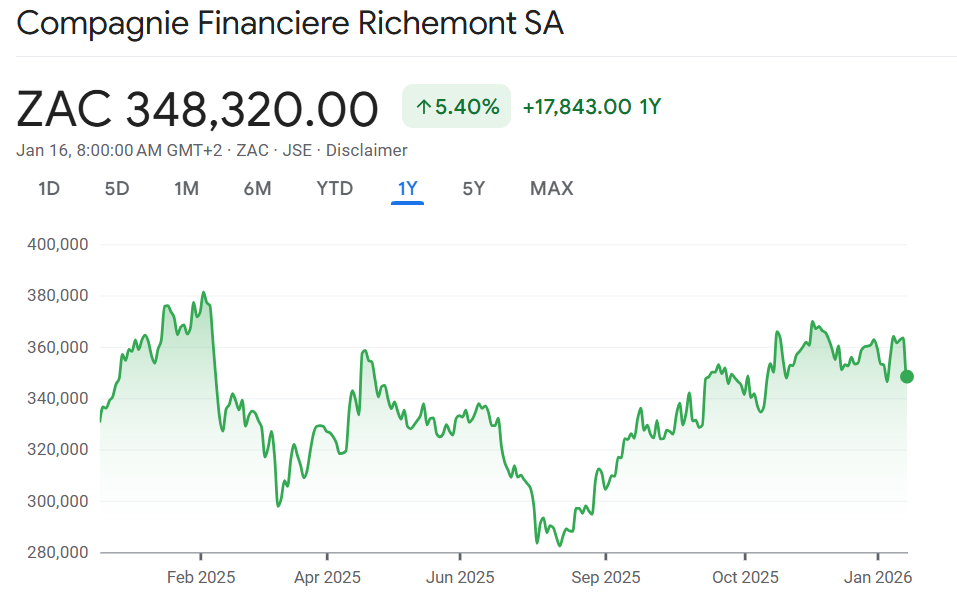

Currencies are having a huge effect on Richemont (JSE: CFR)

The dollar and yen are the worst offenders

Richemont released a sales update for the three months to December 2025, which is of course the all-important festive period. Sales were strong on a constant currency basis (up 11%), but this was diluted down to just 4% growth as reported in euros. Global geopolitical strain is having a serious effect on Richemont’s numbers.

Before we get to the currency effects, let’s deal with the momentum through the year. This quarter was slightly stronger than the nine-month results on a constant currency basis (11% Q3 vs. 10% YTD) and slightly lower as reported (4% Q3 vs. 5% YTD). This tells us that the the business itself is getting better, yet the geopolitical impacts are getting worse.

Breaking it down by region really tells the story. Asia Pacific remains the biggest region with sales of €1.87 billion, up 6% in constant currency but down 2% as reported. Within this region, it’s important to note that China, Hong Kong and Macau on a combined basis grew 2% in constant currencies. Seeing a positive growth trend in that part of the world is important to the investment case and a critical read-through for the entire luxury sector.

Next up is the Americas at €1.74 billion, up 14% in constant currency (a terrific result) but only up 6% as reported due to the weakened dollar. Europe is the third largest region at €1.55 billion, up 8% in constant currency and 6% as reported (part of the difference is the UK, which they say performed well).

Japan is much smaller (€632 million) and grew 17% in constant currency, or 7% as reported due to the pressure on the yen. Just to finish the regional summary, Middle East & Africa (€607 million) was up 20% in constant rates and 12% as reported.

The other popular way to slice and dice Richemont is by product segment. Jewellery Maisons (by far the largest at €4.8 billion) achieved sales growth of 14% in constant currency and 6% as reported. That’s a particularly impressive performance against a strong base. Specialist Watchmakers (€872 million) grew 7% in constant currency and 1% as reported. The Other bucket (a meaty €742 million that includes fashion and accessories) was flat in constant currency and down 5% as reported.

Finally, we can view the group through a distribution lens. Retail is the biggest (€4.6 billion) with a constant currency move of 12% and reported results up 5%. Wholesale and royalty income (€1.4 billion) grew 9% in constant currency and 3% as reported. Finally, online retail (€413 million) was up 5% in constant currency and down 1% as reported.

This deals with the sales story, but what about profits?

There’s a most unfortunate note in the announcement that I’ll repeat verbatim:

“Consistent investment to nurture Maisons’ growth prospects in a complex macroeconomic environment marked by weaker main trading currencies and rising material costs continuing to weigh on margins.”

Or, in simple terms, they have to keep spending money to stay competitive, but they are struggling to maintain margins. Combined with the currency concerns, this is why the share price fell over 4% on the day.

This is an interesting chart:

Nibbles:

- If you’re keen to get up the curve on Southern Palladium’s (JSE: SDL) investment story, then a good way to do it would be to refer to the latest presentation delivered by the executive chairman at the Future Minerals Forum in Saudi Arabia. You’ll find it here.