Mr Price pushes ahead with the NKD deal (JSE: MRP)

The investor presentation on 17 March is going to have a spicy Q&A session

Despite considerable criticism in the market from major institutional and retail investors alike, Mr Price is pushing ahead with the acquisition of NKD in Europe.

At this stage, the major outstanding condition is approval under the European Commission’s Foreign Subsidies Regulation. Hilariously, if that condition fails, it would probably be the best near-term catalyst for the share price!

It’s unlikely to fall through though, as I can’t see why there would be any sensitive regulatory hurdles for Mr Price in this deal. This means that investors will grill management at the investor presentation scheduled for 17th March. I sincerely hope the webcast will allow for a proper Q&A, otherwise the entire thing really is a farce.

Reinet’s NAV fell 1% in the past quarter (JSE: RNI)

The bigger questions are around the plans once Pension Insurance Corporation is sold

Reinet has been taking transformative steps in recent times. They sold their stake in British American Tobacco (JSE: BTI) in early 2025. Then, in mid-2025, they agreed to sell the stake in Pension Insurance Corporation to Athora Holding. This deal is expected to close in 2026.

What will be left, you ask? If you can imagine a bag of Liquorice Allsorts, you’re on the right track.

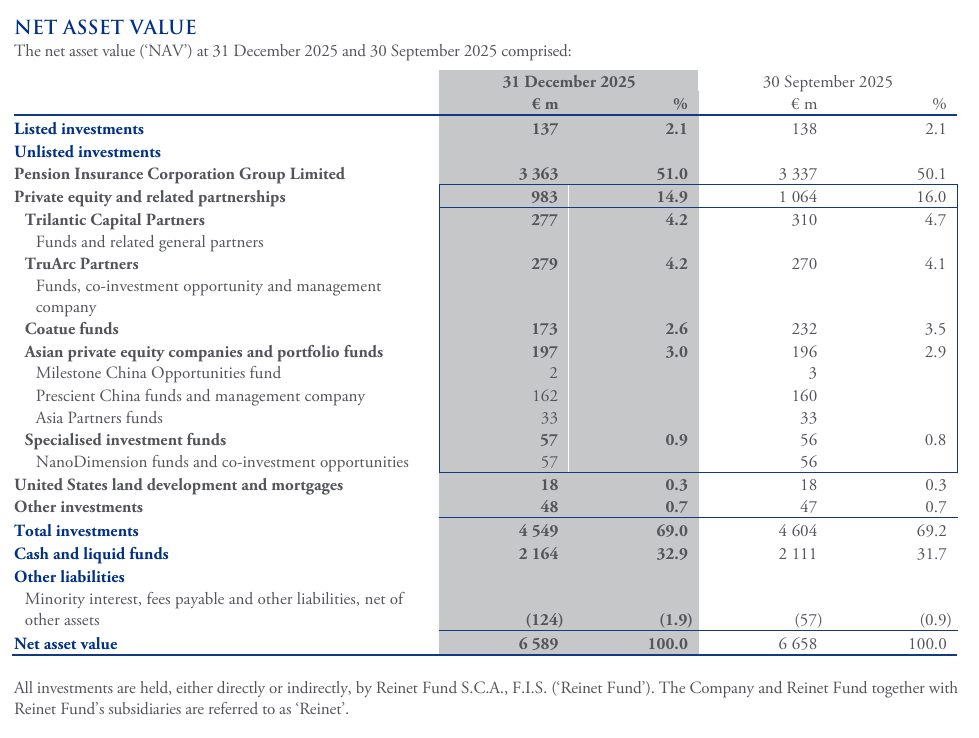

Based on the latest accounts, Pension Insurance Corporation is 51% of the group NAV. A whopping 32.9% of the group NAV is sitting in cash and liquid funds. Your eyes are not deceiving you – just over 16% of the group NAV is sitting in other investments (net of small liabilities and minority interests). And within that bag of sweeties, you really will find all shapes and sizes.

It’s easiest to just show you the extent of diversification by pulling this table from the latest report:

Nobody in the market is going to queue up to pay a premium valuation for such a diversified basket of random investment funds, so the real question is around Reinet’s plans for the extensive cash on the balance sheet – especially once Pension Insurance Corporation is sold.

Surprisingly (and perhaps disappointingly), there is no share buyback programme in progress. The lack of buybacks suggests that they have earmarked other uses for the cash in 2026. I hope that it will be a large acquisition that becomes the new cornerstone asset in the group.

The NAV per share of €36.24 (around R691) is significantly higher than the share price of R570. The discount to NAV of 17.5% is less than you’ll see in most investment holding companies, but that’s because such a big chunk of the NAV is sitting in cash. This discount gives further support to the argument that they should already be doing share buybacks, hence they must have something important planned for the cash as they aren’t taking that route.

Speaking of the NAV, we were given a clue earlier in the week as to the direction of travel. Reinet releases the underlying fund NAV before they release the group NAV. It’s therefore not a surprise to see a decline of 1% in the NAV per share from September 2025 to December 2025.

Valterra Platinum had a truly spectacular second half (JSE: VAL)

This is why share prices have been running so hard

All share prices are forward-looking by nature, but none more so than mining stocks. Daily moves are based on commodity prices, with financial reporting only catching up way down the line and showing us why the share price moved several months ago.

When PGM stocks started rallying in 2025, they were still releasing very uninspiring results for the first part of 2025. PGM prices were moving sharply higher, so the market knew that results in the second half of 2025 would be much better. At last, we’ve reached a stage where we are starting to see confirmation of that performance through the release of financial results.

In a trading statement covering the year ended December 2025, Valterra Platinum has flagged a jump in HEPS of between 85% and 105%. Yes, at the mid-point, that means they nearly doubled their earnings! This is for the full year, not just the second half, so it shows you how exciting the second half was. For context to just how nutty the year was, HEPS in the first half was down by 81%!

What does that look like in absolute terms? Headline earnings was R1.2 billion in the first half. In the second half, it was between R14.4 billion and R16.1 billion. Even when you think you’re numb to the effect of PGM cycles, it’s still wild to see numbers like these.

There’s an important nuance here, as the trend cannot be entirely attributed to PGM prices. In the first half of the year, flooding at Amandelbult had a significant impact on output. Although insurance proceeds of R2.5 billion were received (yet another skew to the timing), this still resulted in lower sales volumes in FY25 vs. FY24. The significant increase in PGM basket prices essentially rescued the period.

In case you’re wondering, the share price is up 178% in the past year!

Nibbles:

- Director dealings:

- There’s a reshuffling of the Wiese family exposure in Invicta (JSE: IVT). Adv JD Wiese’s Mayborn Investments sold R5.3 million in shares to Titan Premier Investments (a Christo Wiese entity of which JD Wiese is also a director). Some families pass the tomato sauce to each other around the table; others pass millions of rands worth of shares.

- A trust linked to the CEO of Sirius Real Estate (JSE: SRE) received shares worth around R350k in lieu of cash dividends. This is part of the Dividend Reinvestment Plan (DRIP) offered by the company.

- Farewell, Barloworld (JSE: BAW) – the iconic name will be delisted from the JSE on 27 January after the acquiring company utilised the squeeze-out mechanic to acquire all the remaining shares in issue.