China offers an exciting emerging markets opportunity, driven by the country’s vast manufacturing base and the progress made in areas like artificial technology. But geopolitical risks and the volatility that plagues emerging markets is also present, making it more difficult for investors to add exposure to this market.

With the launch of two new structured products that reference the Shanghai Shenzhen CSI 300 index, Investec has sculpted two payoff profiles that could appeal to investors of varying risk tolerances. With a combination of mechanisms that create capital protection and enhanced upside under certain outcomes, these products aim to take advantage of the opportunity in China, while reducing the overall risks.

Brian McMillan and James Cook of Investec joined me to talk through not just the appeal of China, but also the way in which the two products work. There’s a wealth of information in this discussion on the Investec ZAR CSI 300 Digital Plus and the Investec USD CSI 300 Geared Growth products.

Applications close on 13 August, so you must move quickly if you are interested in investing. As always, it is recommended that you discuss any such investment with your financial advisor.

You can find all the information you need on the Investec website at this link.

Listen to the podcast here:

Transcript:

The Finance Ghost: Welcome to the Ghost Stories podcast. I’m really looking forward to digging into the latest structured product offerings from the team at Investec. We have Brian McMillan joining us today – the voice that you will certainly recognise if you’ve been listening to a lot of these podcasts from the team at Investec. And we have a new face and a new name and therefore a new voice on the show as well, and that is James Cook. James, Brian, thank you for joining me on the show. I’m really looking forward to talking about, actually, two different product launches and unusually with two different payoff profiles. So looking forward to getting into the details of that – but both of which at the end of the day point to China, so I’m excited to also understand more about the Chinese investment thesis.

Let me say hello to the two of you first, Brian, James, welcome to the show.

Brian McMillan: Thanks very much. Ghost.

James Cook: Thank you.

The Finance Ghost: So let’s start with just understanding the relevance of China, I think, to any kind of global markets discussion. And this has been a particularly interesting year, right? A lot of people are looking for opportunities beyond the US and that’s a bigger debate around whether or not you can find good stuff in Europe, etc. But certainly people are looking at emerging markets. They’re asking all kinds of questions. And what’s happening out there is this rift. It’s just getting wider and wider between East and West. At least that seems to be what’s going on out there. And there’s certainly a school of thought that perhaps this will force China to actually focus more on domestic consumption, growth in technology, developing their own AI, for example, their own supply chains, the whole story.

Is that one of the reasons why maybe investors should be paying attention to what’s going on in China. And then what are some of the other factors that you think make China interesting at the moment? Because I think the important context here for listeners is that Investec chooses where to do these new structured products based on markets that you think are interesting at a point in time. So, the fact that the new products are referencing China, is actually interesting in and of itself.

Brian McMillan: Yeah. Ghost, that’s something that we do take into account. We go out into the market, we speak to our clients when we’re putting a new product out, but we’re also receiving information back from them, from our clients and where their interest is.

And I think over the last few years, one of the interesting things about structured products is that it really allows you to enter into these new types of markets with a bit of confidence because you’ve got that capital protection. You can take on a new theme. As you mentioned, we’ve got two – one is in rand and one’s in dollars. We give you multiple ways to get access to this market. But it’s also nice to try new and different indices when you’ve got that capital protection.

Not a lot of people have direct access to China in their portfolios. Obviously there’s some through the JSE, through Naspers and Prosus, but for the Greater China Index, which we’re doing, it makes sense to try and capture some exposure to what is essentially the second largest economy in the world. And this allows us to do that. I’ll let James explain some of the reasoning, why specifically at this time we went for China.

James Cook: Yeah, sure. China’s been in the news a lot recently, specifically around tariffs and trade negotiations. And I think if we go back to when Trump first came into term, it really highlighted the importance for China to start diversifying their trade relationships, to start really focusing on internal consumption, as you mentioned, and highlighting the importance of becoming independent from a technology point of view.

We’ve seen from a trade relationships point of view, decreasing exposure to exports to the US, increasing it to other countries. There’s been quite a lot of change from that point of view. In terms of the internal consumers, you have a very large economy, you’ve got 1.4 billion people. And unfortunately, there’s just a consumer sentiment issue at the moment where there’s just this depression that’s happening.

I think that the government is very aware of this and focusing quite heavily on creating policies and government stimulus to try and rectify that situation to get people to start spending again. And we are starting to see that coming through. As an example, if you go back to September 2024, there was a stimulus package that was released. The results of that was met quite favourably by the market. We saw a 32% increase in the CSI 300 Index over a two-week period. I guess at the moment things are just very in the air, we don’t really know what’s going to happen in terms of negotiations with the US. The sentiment seems to be that they’re kind of holding back, seeing how things evolve and they will then decide how much more to go in on that front.

Then lastly, just on the technology front, I think the fact that there are these restrictions around technology exports is forcing China to innovate and invest heavily into these – AI, renewable energy, the energy to promote or to allow for AI to develop. And I think that drives innovation and hopefully we’ll see that coming through.

Brian McMillan: It’s interesting that there are two centres of AI knowledge building up in the world. The US obviously leads the way, but China has obviously taken the view that they need to go it alone. The launch of Deep Seek on Trump’s inauguration date, I think that was timed. And they’re obviously drawing in a lot of knowledge workers into China, like America is. And I think there’s going to be two clear winners in terms of AI throughout the world and that’s going to be the US and China. So to get exposure to that market through a structured product is a good way to do so.

The Finance Ghost: Yeah. And it’s not actually easy to do through buying Western companies. So you referenced Naspers / Prosus there and then obviously the look-through is Tencent. But another great example we saw with Nvidia this year, they had a bit of a wobbly in their earnings because they were actually blocked from selling a specific product into China. And people almost forget that Nvidia is actually an American company. It’s easy to just get confused and bundle the stuff together as being “somewhat Taiwan related” – but Nvidia is as American as anything and that means you’re not necessarily getting that uptick of what’s happening in China if you own a company like Nvidia. It is quite interesting, it’s quite difficult to be able to get some of this direct exposure.

You’ve referenced the index there already, but it’s the Shanghai Shenzhen CSI300 index, not necessarily one that will roll off the tongue for most people or that they might have heard of before. I think before we maybe talk about relative valuation, let’s just quickly touch on: this index seems to track a basket of companies across two different exchanges. Is that correct?

James Cook: Yes, that’s correct. It’s the Shanghai Stock Exchange and the Shenzhen Stock Exchange and It’s the top 300 companies based on market cap and liquidity from those two exchanges.

The Finance Ghost: Yeah, so this is not some look through…

Brian McMillan: No, yeah, yeah, it’s very much China focused. So obviously a lot of the internet and tech stocks are listed on the Hong Kong exchange. This particular index is really looking at China as – manufacturing base, finance base, banking, consumer discretionary – and really focusing on the economy of China rather than the internet stocks of China.

The Finance Ghost: That’s a really important nuance. Thank you for confirming that. And I guess that explains as well why from a valuation perspective it looks quite appealing at the moment, because that would include a lot of sectors that have somewhat been left behind by the big boom in technology and where market sentiment has been. Of course, any investment return is a function of not just what you buy, but also how much you paid for it.

We look at a market like India, which of course is the other gigantic emerging market that everyone talks about. That market has been red hot, basically. Investors have been loving the combination of the more services driven economy rather than manufacturing, the world’s biggest democracy, essentially. People love that as well. So, from a China perspective, and particularly this index, which then references life on the ground in China, essentially, what are the catalysts for a potential valuation uplift there? Or do you think it’s a case that there’s enough growth in the underlying companies to drive the returns here, even if you don’t see much of a structural improvement in valuations?

James Cook: Sure. Well, maybe just to touch on what that valuation looks like, you have the CSI 300, which is the index that we are referencing. Since its high in February 2021, it’s now down 31% from that point. Whereas if you compare that to other major indices around the world, they’ve gone up quite significantly over that same period. That’s been driven by factors like quite hectic lockdowns around Covid, supply chain disruptions, initial trade disruptions in terms of the negotiations with Trump in his first term, there were factors like that property market was quite a big catalyst for that downturn as well. That’s resulted in a lot of negative sentiment that has been priced into the market. And you see this through the price/earnings ratio being 13.8x compared to America, or the S&P 500, at 23.5x. So it’s significantly – not undervalued, but looks like a relatively attractive valuation from that point of view. On that basis it seems to be a fairly decent point to get into the market.

If we see things as we discussed earlier, like a boost in internal consumption and the results of the innovation investment and technology coming through, which would boost earnings and result in an increase in the index, those kind of things could start seeing the index rise.

The Finance Ghost: Yes, there are a few levers to pull here. And the nice thing, it’s almost the “every dog has its day” trade. But of course, when you’re doing it as a structured product and you’ve got some capital downside protection, those trades become a lot more interesting, particularly when you’re going into indices that have maybe had a bit of a tough time. It’s not clear that they’re ready to actually start firing and it’s nice to have some protection in case they don’t. But obviously we’ll get into some of those specifics when we talk to the payoff profile.

Before we get there, I said at the beginning of the podcast that you’ve got two different structured products on offer. This time around, both of them are tracking that index, the Shanghai Shenzhen CSI300. One is in ZAR, one is in US dollars. Now I was kind of expecting that that’s where the differences would end, but definitely not this time around. The payoff profiles are actually very different and we’ll get into those payoff profiles shortly. But I guess just to set the scene, why two such different payoff profiles this time around? It’s not just a currency difference.

Brian McMillan: Yeah, so as you say, it’s not just the currency difference. We often offer a rand listed one which goes on the JSE and then our offshore ones which we have Dublin listings for. As I mentioned earlier, we speak to a lot of clients, we get a lot of feedback and there is a base of client out there that is very conservative. They want exposure to certain markets but they want the full hundred capital protection. They don’t want to risk downside. In this particular case, when we priced it up in rands, we could get a decent return on a rand basis with capital protection. When we went offshore into the US, the pricing is not as attractive and so that’s why we have a downside barrier. So it’s not 100% capital protected in all cases. It does mean that if the index is down more than 40% in three and a half years that you do have capital at risk, but at the same time, we’re offering more upside.

There are two views in the market. One wants to be very conservative and then other people want the exposure to China and are willing to take gearing on it. So that’s why we have two different kinds of products in two different kinds of currencies.

The Finance Ghost: Yeah, it’s interesting. This is the magic of being able to do some financial structuring, right? As you can basically carve out these payoff profiles to match what clients are asking for.

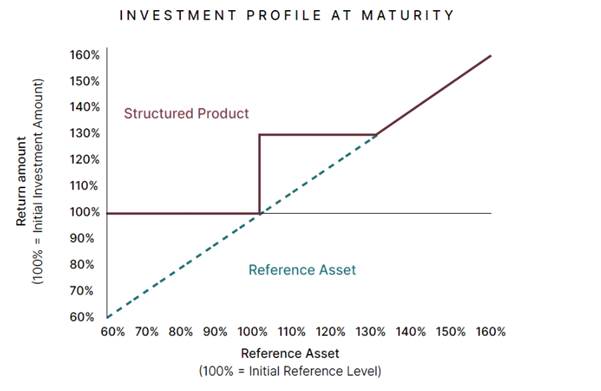

I think let’s dig into that because that’s where it gets very interesting. And to anyone listening to this who maybe doesn’t have the transcript in front of them, if you’d like to see a chart of what these payoff profiles look like, I’ll include that in the show notes. And obviously you can find that on the Investec website as well, just in case the payoff profile is not the easiest thing to follow as you’re listening to it, because it is a little bit complicated. But let’s start with the rand note, which is the Investec ZAR CSI 300 Digital Plus. And those who have gained some familiarity here with Investec’s structured products will probably be happy to see that this is where the capital protection is when the asset closes below 100% of its starting value at maturity, which is three and a half years later. I was mildly horrified when I read the brochure to see that three and a half years is in 2029. That was a slight shock. I saw 2029 and thought, wow, that’s far away, and then realized it is in fact three and a half years away! But that’s where we are.

And so this is the one that’s got all of the downside protection. This is the one that therefore probably has less upside. I’ll let you speak to that now. I’m also curious to exactly what a digital return is – does that just mean that you’re not delivering the money yourself, Brian, James, to someone at the end of the three and a half years? They’re getting it in a bank account.

James Cook: The term “digital” comes from coding, where it’s either a yes or no, it’s a 0 or 1. So in this case, what it means is that how the payoff profile works is that at maturity, if the index level is either the same or higher than it was when we started, then the condition is met and you’re going to jump straight up to a digital return. In this case it’s 30%, but if it ends below where it was, then you don’t get your 30%.

The payoff profile for this one says if markets drop, you get your money back because it has 100% capital protection. If it’s flat or positive, you’ll get 30% and that 30% is equivalent to 7.8% in rand compounded each year. If the market does more than 30%, then you also get the upside. So it’s almost like you’re keeping your options open. If the market really does recover, then you have unlimited upside potential, if it does more than 30.

Source: Investec brochure

The Finance Ghost: Okay, fantastic. So that is something that I’ve learned today, is the concept of a digital return. I didn’t think it was a toggle between the carrier pigeons and an EFT, but it’s good to understand that it’s basically binary, it’s 1 or 0. That’s essentially what it is. In this case it’s just 30% or nil for any close between 100 and 130, right? And then above that you’ve got your upside. So actually, you’re not giving away much upside at all for this downside protection, are you?

James Cook: The product is designed more on the conservative side because you have 100% capital protection. And it also does fairly well if markets just move sideways. But what’s really nice is that, that you’re not introducing a cap, so you’re keeping your options open. And given the fact that the market seems to present a fairly decent entry point, if any of the things that we discussed earlier play out, it could be quite a nice upside potential.

The Finance Ghost: Yeah. The big difference here is that what you’re not getting is a geared return, right? As you say, if the markets kind of go sideways, you do quite well. If they go above 30%, you probably get what you essentially would have gotten otherwise. But you’re not getting a geared, accelerated, supercharged upside that you’re getting in some of the products, one of which will be that USD product which we’ll get to soon.

I think let’s just finish off on the ZAR product while we can. This is a flexible investment note that is listed on the JSE as I understand it. I think let’s just touch on the advantages of that and the liquidity. And then also does that mean that this note, because it’s ZAR-denominated, it’s listed here, does this not count then towards the offshore investment allowance that everyone gets annually?

Brian McMillan: As you mentioned, the rand note will be listed on the JSE. The advantage of us listing it on the JSE is it will be inward listed, so investors can invest in it without using any of their offshore allowance because essentially it’s inward listed. So they have full access to it, investors don’t have to use their allowance.

And it’s a little bit different from what we were doing two years ago in that we call this a flexible investment note. Now what we’ve done is that we’ve listed a note for 20 years. We list this note for the next 20 years and what we then do is we place this particular structured product in it. So this is called investment profile number one of this 20-year note. It will last three and a half years. Hopefully the index is up, you get a 30% return, let’s say you get the digital return and at that point you will be able to as an investor roll this forward without getting paid out.

So what used to happen is would pay everybody out their 30% return plus their capital and then we would say we have a new product, would you like to invest in that? Everyone would give us back their R130 and they would start a new one. With this one, it allows us to roll it forward, which has some benefits because obviously it’s a bit quicker as well. So we’re not paying everybody out then a week later asking them for the money back, we’re just going to roll it forward. And then of course their capital protection – and let’s say we did a product over the EURO STOXX that had a digital of 40%, it can change index, it can change currency, it can change a whole lot of different features, but your capital protection is now on 130. You’re able to roll up that capital protection as you go along over time, which has some benefits down the line because you’re constantly stepping up and locking in as your investment goes along. And we’ve seen that in a number of – one of the disadvantages of things like an ETF is client will invest in it, they’ve been in it for five, 10 years, they’ve had good returns, they don’t want to divest from it because you have a tax event at that point. But of course you have the full downside. Whereas every time you lock into one of these on our products, within the flexible investment note, you’re locking in all the gains that you’ve made and that should have some benefits over the 20-year period.

The Finance Ghost: Yeah, that sounds very clever. It’s basically for those looking and saying, well, we want this interesting offshore exposure, we’re quite happy to lock up a sum of money for a period of time and then let it roll, let it compound, see what Investec brings to the table each time.

And I guess if they want to, at the point of rolling, they can cash out, right? From a liquidity perspective, I know liquidity along the way maybe comes with some limitations and I think let’s just deal with that quickly. But there is a liquidity event if they want at the end of the three and a half years, right?

Brian McMillan: Yes, absolutely. They can exit at that point and that’s frictionless. There’s no fees or anything at that point, no brokerage. But they can also at any time – because we list this on the exchange, we actually provide a market on a daily basis.

So let’s say the index does go up and let’s say it goes up on day one by 10% and stays 10% up over the next three and a half years. Our product will actually grow over those three and a half years up to that 30% digital return. But if you were two years into the product and you wanted to exit, you needed the money, you can at any time by just selling that note on the exchange. We will make a daily market in that and it’ll reflect the price of that structured product at that point in time.

The Finance Ghost: Yup, so there’d be a spread on that obviously which people should take into account. But at least there is some liquidity along the way, just in case. But I think what’s always come through in everything you’ve ever put out to the market really is for people to understand – treat this as a three-and-a-half year thing at least. Don’t even think about putting money in there that you’re going to need in less time than that. Then you are not understanding the product. And again this is where working through an advisor is very important. But for advisors listening to this, also make sure that you realise that this is at least a three-and-a-half-year commitment.

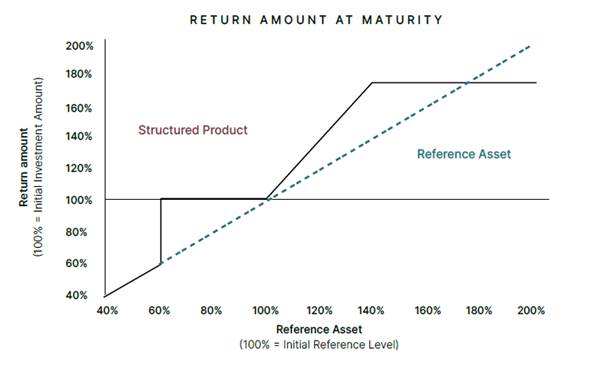

I think let’s move on then, with the liquidity out the way. We’ve done the ZAR note, let’s talk about the USD one. And again, it’s not just the currency that’s different here, it’s a lot of things that are different. The payoff profile is particularly interesting. James, I’m excited to hear how you plan to describe this particular shape. It looks like a nice art project and I’ll make sure that it’s in the show notes.

How do these levels work on this particular product? What does it mean that it’s geared? Just give us a sense of why it’s been structured this way and how it actually works.

James Cook: Sure. I think let’s just break it down into what happens if the market goes down and then what happens if it goes up.

So starting off with what happens if it goes down at the end of the term, you have capital protection like you do with the rand version, but this time the capital protection is conditional on where that index level ends up. There’s a barrier at 60% of the initial index level. And what that means is that if the index at maturity hasn’t breached that barrier, then you get all your money back. So, for example, if it’s dropped by 30%, it hasn’t gone below that 60% barrier. So now you’re going to get all your money back. But if it drops more than that, so say 45% down, now you have live exposure to the market, so you’d have a 45% loss.

On the upside, instead of it being a digital, this time you’re going to have what we call geared growth. So whatever the market does, you’re going to get a gearing factor applied to that growth. The gearing in this case is 190%. So if the market grows by 10%, you’ll get back 19%. With this particular one, though, there’s a cap, meaning that your upside potential is capped. So the index growth is capped at 40%, but you still get your gearing on that 40%. Your maximum return would be 40% times by 190% gearing, is 76% in dollars on the upside. If the market does more than that, unfortunately, you don’t participate. That’s still a fairly high return potential in dollars. So that’s equivalent to 17.5% compounded each year in dollars.

The Finance Ghost: So what’s interesting is it almost looks as though someone going into this note would say, okay, I think that this market might do up to 40% over the three and a half years, and I don’t think it’s going to do worse than 40% down. So I want to get geared upside in the 40% up situation, and I want some protection, if it drops by as much as 40%, I mean, that’s where this thing works, right? Anything more than a 40% drop, you may as well have just bought an ETF, because you’re going to be in the same basic position in terms of you’re going to wear that loss. But to your point, you’re getting a geared return, which works out to a very nice CAGR compound annual growth rate. That’s kind of the view on this, right?

James Cook: Yeah. So maybe just an interesting point on that. We did some backtesting where we went back to the start of this index in 2005. And we said if we simulate a product for every single day since the start of the index, how many of those simulated returns would have breached that 60% barrier? And the answer is 2.2%

So while the risk is there, based on historical data, it’s 2.2% of the time. I guess going forward that’s not necessarily predictive, but it gives us an idea of that risk profile. And then this would be considered a bit more of a bullish case. If you have a bit more of a bullish view, you need the index to actually do well before the gearing actually means anything. Whereas with the ZAR version, even if it’s flat, you still get a nice return.

The Finance Ghost: Yeah, that makes sense. And 2.2% outcomes don’t happen too often unless you’re an amateur golfer, in which case truly anything is possible. I’ve seen some crazy things with much lower probabilities than 2.2%. Luckily the markets are a little bit less wild than amateur golf, at least most of the time!

In terms of the structure of this USD product. This is now part of Investec’s note issuance program which sounds like a nuance on what we talked about earlier. So how does this one’s actual plumbing work in terms of where it sits, what it means in terms of risk, liquidity and then also those foreign investment allowances once again.

Brian McMillan: This particular one is the same in terms of it’s a note issued by Investec Bank Ltd. The only difference is that it is in hard currency and that the listing is then in Dublin.

So we list this note in Dublin. The difference there is that Dublin doesn’t have live trading of these particular notes. Investors would have to come to us and we market make we’d be able to do that. Essentially what the investor is buying is a dollar-denominated note from Investec bank that says we promise to pay you, at the end of three and a half years, the return as calculated. So very much the same as the rand one, just in US dollars. And the issue here is Investec bank limited in both cases.

The Finance Ghost: And so then just to be clear, foreign investment allowance you are going to use here versus the ZAR one where you aren’t going to?

Brian McMillan: Yes, exactly. So you can use your foreign investment allowance money that you have over there and also asset swap. Some people have access, some asset managers, stockbrokers have access to asset swap and they may allow you to use that to access our products.

The Finance Ghost: Okay, brilliant. And then in terms of minimum investment amounts, so we’ve talked about the minimum time, you need to be thinking about this, which is three and a half years. But in terms of the minimum amount, there are rules around minimums. So what are those rules for each product? And do investors always need to go through a financial advisor or can they come to you directly?

James Cook: Sure. The minimum investment for the rand version is R100,000 and for the dollar version it’s $6,000. In terms of how you can go about investing, you can’t go directly through Investec. You can either work through a financial advisor if you have one, or if you have an online trading account, then you can invest via that online trading account.

The Finance Ghost: Perfect. And then I think last question just to bring it home, because this has been really interesting in terms of again, two products, underlying index is the same, you’ve got to have a view on China here – but actually, the entire risk and payoff profile is so different. For someone who just thinks hmmm, I heard some really interesting stuff on this show. I want to go and look at this again. If you could summarise the difference between the two, just as an elevator pitch, what would you like investors to just remember from this podcast about these two products?

James Cook: I think the starting point is to say that if you believe that there’s an opportunity in China, then perhaps this type of investment might be a good way to go about making that investment. You have two different options. You would take into account your view on currency – if you have a view on the rand, you might have dollars or not, you might not want to use your discretionary allowance or not. So that would be the starting point.

And from a risk point of view, you could say that the rand could be considered less risky because it has 100% capital protection with no barriers and it does fairly well in the sideways market. But you’re also keeping your options open. If the market does really well, you have uncapped upside.

The dollar version is, I guess, more of a bullish case where you’re saying that you do have capital protection provided the market doesn’t go down more than 40% at maturity. And then on the upside, you’re going to get your 190% geared exposure to whatever the index does, up to a maximum return of 76%.

The Finance Ghost: Got it. And where I’d like to just finish off well done to you as the team because I did see that Investec Structured Products has been recognized for the second year in a row now at the International Structured Products Intelligence Awards, winning the Best South African Issuer award and that’s 2024 and 2025 now. So, well done to you guys and also to the team.

And to anyone who’s listening to this and thinks, wow, these structured products are interesting. They’re not always open all the time. They do have a deadline effectively, and we need to just finish off with that, I guess. But you can go back and listen to a number of the Ghost Stories podcasts featuring various team members from Investec Structured Products if you want to learn more, if you’re really hungry for knowledge. I mean, I distinctly remember one with Japie where I think we spent 45 minutes going through all the derivatives that are underneath all of these structures and the way the thing is actually put together. So if this has really grabbed you, go and listen to that. I think you’ll really enjoy it from a financial engineering perspective.

But certainly from an investment perspective, we’ve covered off, I think, everything we needed to cover off here, apart from perhaps most important thing: closing date. For those who are interested in this, on both the ZAR and the USD instrument, by when do they need to have parted with their money and sent it across to you guys to go and do some interesting investments?

James Cook: Sure. So both of them have the same closing date. It’s going to be the 13th of August. By that stage the investor would have had to submit their application form and funded their trading account with the funds for the investment.

The Finance Ghost: Perfect. So those who like this one will need to move quickly. But to be honest, if structured products are going to be part of your plan, then you probably do need to be sitting with the kind of liquidity that lets you do something like this relatively quickly.

Always speak to your financial advisor and just understand how it fits in as part of your broader financial plan.

Brian, James, thank you for your time. Thanks for returning to Ghost Stories. Great to have you back and I look forward to seeing how this one goes and seeing what you cook up next as a structured product, it’s always very interesting to see what you guys get up to.

James Cook: Thanks very much. Thanks for having us.