September retail sales data still doesn’t reflect the shopper distress that is reasonably expected in this environment. Chris Gilmour wonders when the bad numbers will come.

It’s becoming increasingly difficult to rationalise what’s happening to retail sales growth, especially in this high interest rate environment. The latest print (September) is admittedly something of a lagging indicator, but nevertheless it is not as yet showing the kind of shopper distress that might reasonably be expected as interest rates rise. And it may just be that when the full impact is finally felt, it will be quick and severe, along the lines so eloquently described by Ernest Hemingway when he went bankrupt.

In “The Sun Also Rises,” Hemingway describes the bankruptcy process as being gradual and then sudden.

Already in the really big-ticket areas of housing and automobiles, there are plenty of examples of distressed sales. And as always happens in economic cycles, the largest areas of consumer outlay take the biggest hits early on.

Retail has thus far proven to be incredibly resilient, even without the benefit of enhanced consumer credit, but that surely can’t last much longer. The recent decision by the SA Reserve Bank’s MPC to hike the repo rate by 75 basis points rather than 50 basis points came as something of a surprise.

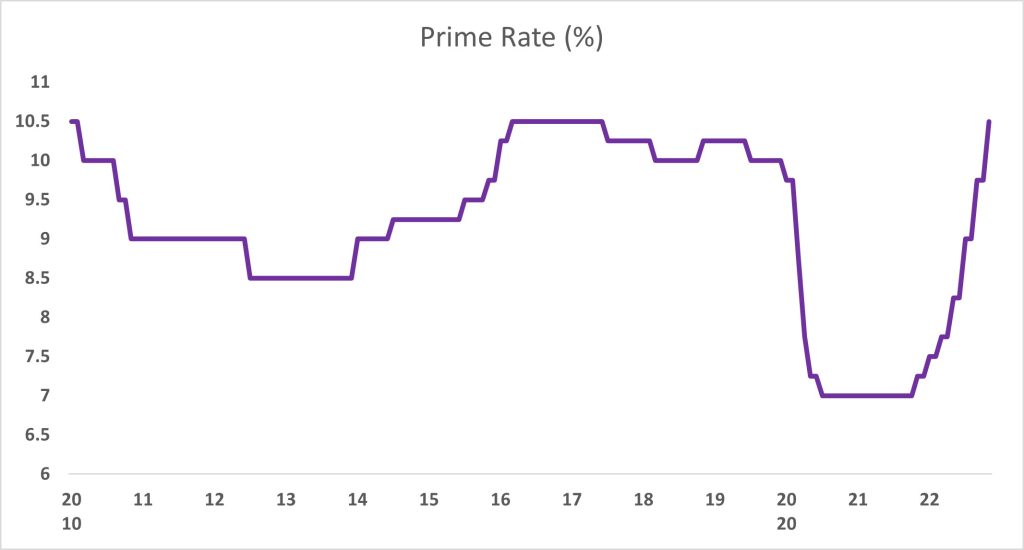

All of the narrative from the governor, Lesetja Kganyago, leading up to the MPC meeting on November 24 suggested that interest rates had peaked and that a 50 basis point rise rather than 75 basis points should be expected. Two members of the MPC indicated a preference for a 50 basis points rise rather than 75 basis points. The repo rate is now above the rate prevailing before the start of the pandemic:

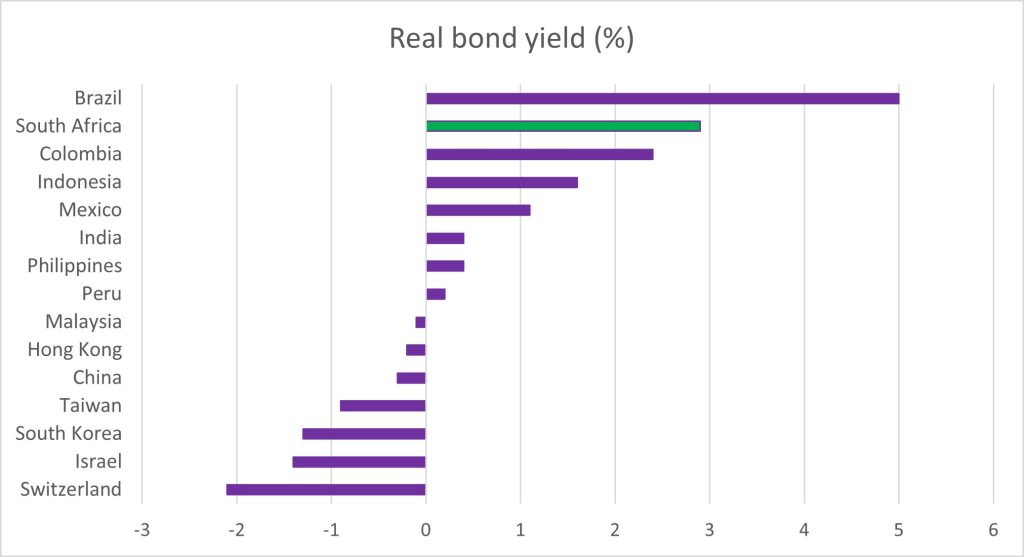

It’s becoming quite apparent that the main reason for the continued hiking of interest rates in SA is to ensure that the country keeps attracting flows of foreign money, thereby underpinning the level of the rand, rather than attempting to choke off any locally-induced inflation.

Only Brazil has a higher real bond yield than SA and there are a number of other countries vying for attention in this regard. For as long as SA offers juicy real yields to foreigners, the money will continue to come in. As the US takes the lead in hiking interest rates, expect SA and other countries to do the same.

The difficulty with the StatsSA figures in recent months has been that favourable base effects have often clouded the situation, making retail sales growth appear artificially better than it otherwise might be.

Compounding this conundrum is a host of seemingly good results from many JSE-listed retailers. One retailer in particular, The Foschini Group (TFG), stands out in this regard. It’s taking big market share away from virtually all of its competitors, especially among lower income consumers. Thanks to highly visionary quick response manufacturing capability, TFG is gradually producing more and more product in SA and away from China and the far east. Its acquisitions appear to be better than any other group, even including those of Mr Price, and its excellent performance in Australia is proving to be a natural rand hedge. Even its operations in the UK, which lagged badly thanks to major coronavirus lockdowns in the UK, appears to have turned around.

And yet, the TFG share price is still languishing at around 50% of its peak from over four years ago.

The September retail sales figures threw up a veritable potpourri of data, much of which was difficult to rationalise. This was especially true of the food retail categories, one of which showed a large slump in sales, admittedly from a very high base in July. Clothing, footwear, textiles and leather (CFTL) continues to show strength, notwithstanding that this is definitely a discretionary category. However, both CFTL and furniture & household (F&H) are showing signs that they may be running out of steam.

Home improvement or DIY, as proxied by StatsSA’s hardware, paint & glass category, continues its dismal decline, deep in negative territory. For a brief period in July, it appeared as if some sort of recovery was underway but that was merely the base effect of July 2021 making itself felt.

We need to watch retail sales growth over the next few months, especially during the critically-important months of November (Black Friday) and December (Christmas). With the consumer coming under further sustained pressure, it’s difficult to see how these periods can be anything other than muted.

Great column as usual, Chris.