South Africa’s listed debt market presents an intriguing blend of opportunities and challenges. Characterised by its unique structure, participant dynamics, and liquidity constraints, this is a space worth examining for institutional and retail investors alike. Understanding the nuances of this market provides insight into how investment strategies are shaped and how market participants operate within the boundaries of the South African economy. This overview is brought to you by Intengo Market.

South African Debt Market Structure and Dynamics

Our local debt market is considered a “buy-to-hold” market, with minimal trading activity in the secondary market. Institutional investors, such as life insurers and asset managers, dominate the primary market, accounting for a significant portion of activity within this space, and these institutions generally prefer to hold assets to their maturity.

Participants are drawn to the listed (or public) debt market because of its potential for steady yields and minimal volatility, aligning well with the conservative fixed income investment mandates of insurers and large asset managers.

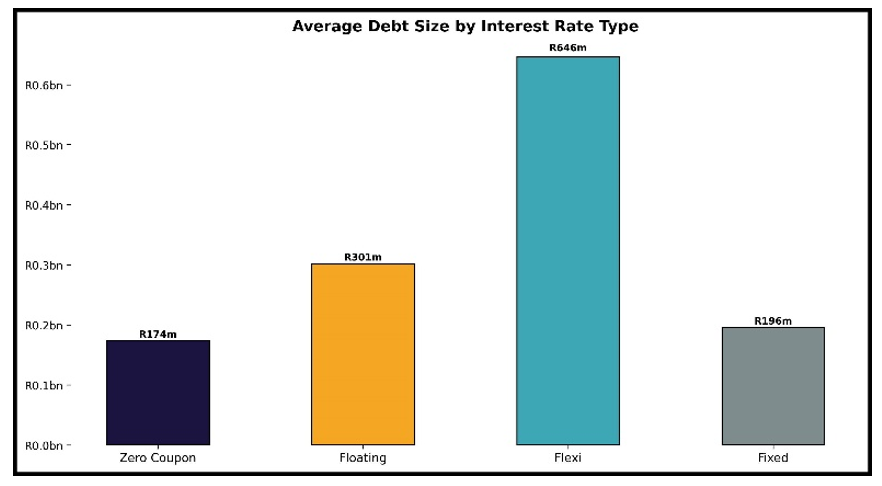

A large majority of the non-government issued fixed income instruments in our local market are also issued as floating rate notes. These generally reset their reference interest rate every 90 days and this mitigates a significant amount of interest rate risk for the issuer and investor.

Key Market Participants

The primary issuers in local listed debt market include the government, state-owned enterprises (SOEs), financial institutions and large corporates. Each year, only around 25 entities (excluding the Government) come to market to issue debt instruments, providing significant opportunities for investors. Of these, 19 issuers have been relatively consistent participants, issuing debt annually, while the remainder alternate every other year or two. This rotation provides a measure of diversity in the market, although the dominant presence of consistent issuers underscores the predictability of the debt issuance landscape.

The opportunity for private credit is, however, is much broader than that in the listed space in terms of number of issuers, as there are almost 300 listed companies in South Africa and most of them require debt funding in some shape or form (we will dive deeper into the private credit market in a future article, as it deserves much more focused attention).

Around 100 institutional investors are regularly active in this market. In addition to institutional investors, it includes five major local banks and several smaller banks. Among the five, three are relatively active in the secondary credit market, offering pricing to the market for most of the high-quality corporate credit issuances. These participants are often referred to as the “sell-side” as they are generally distributing (i.e. selling) products or instruments to the broader market. Their role in providing pricing mechanisms contributes to some level of market efficiency; however, even this active pricing is insufficient to foster a liquid secondary market in bank and corporate credit. Then there are also debt brokers, who act much like real estate agents in the property market – using their networks and skills to bring buyers and sellers together at a price that leads to a deal.

The ”buy-side” would traditionally encompass the institutional asset managers and life insurers. They are generally buying debt directly from the issuers (in the primary market) or from the sell-side (in the secondary market) into their portfolios.

Recent developments (supported by regulatory changes) have seen hedge funds entering the local fixed-income space. These funds are beginning to carve out niches through innovative strategies and risk management approaches. This emerging presence hints at potential shifts in market dynamics, although the impact of hedge funds remains relatively nascent and limited in scope at this early stage.

Illiquidity as a Defining Feature

One of the most notable characteristics of South Africa’s listed debt market is its illiquidity. The lack of a robust secondary market means that once debt instruments are issued and purchased, they rarely trade hands. This illiquidity is rooted in several structural factors, including the dominance of buy-to-hold strategies among institutional investors and the limited number of banks prepared to take on the other side of any potential trade.

For example, if the entire buy-side was looking to sell the same instrument, you could theoretically have 100 sellers. The sell-side, on the other hand, is at most five large banks and a few debt brokers. As a result, while the local banks play an essential role in pricing corporate debt, their efforts do not translate into active trading volumes.

The scarcity of buyers and sellers of the same instrument at the same time in the secondary market perpetuates the cycle of illiquidity, limiting the market’s attractiveness for those investors seeking flexibility and exit opportunities.

Opportunities and Constraints

For investors who align with the buy-to-hold approach, the South African listed debt market offers distinct advantages. These include relatively predictable income streams and relatively stable portfolio performance. However, the constraints posed by illiquidity cannot be overlooked, as they restrict the ability to rapidly reallocate assets or respond to evolving market conditions. Ignoring market crises, like the sell-off during COVID, this can be most observed during times of negative issuer news when asset pricing can fall substantially in very short spaces of time – far beyond what might be expected in a more liquid market.

Institutional investors often navigate these constraints by adopting rigorous due diligence frameworks and focusing on diversified credit portfolios. The emphasis is placed on selecting high-quality corporate credit names that deliver consistent returns while mitigating credit risk.

Another important factor in investor behaviour is that the yield on longer term South African government bonds (“SAGBs”), more often than not, makes it relatively unattractive for any conservative asset manager to purchase anything else. Some investors might take the view that a 10-year SAGB offers significantly better liquidity than even a 1-year high quality corporate bond. The return on the SAGB thus becomes far more attractive and many institutions find themselves reluctant to diversify away from this risk-return-liquidity combination.

Market Statistics

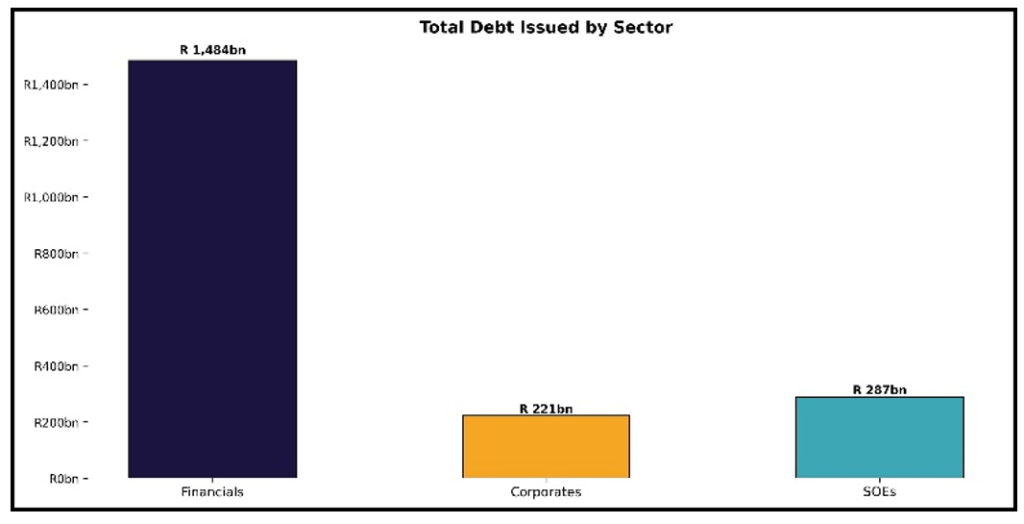

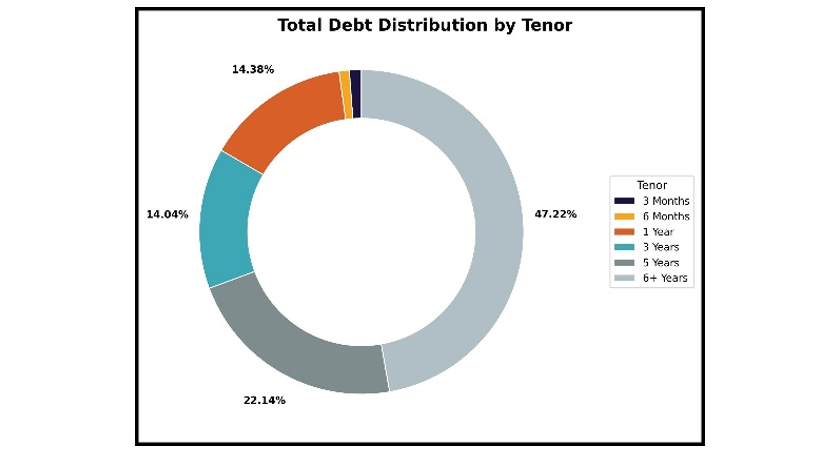

The South African listed debt market is a significant component of the country’s financial ecosystem, supported by a diverse range of participants and instrument types. The market, as at time of writing, has around 7,000 instruments totaling R6.7 trillion which settle through public market infrastructure. Not all of these are listed instruments, but these still constitute the public domain (in contrast to private credit instruments like loans). Around R1.2 trillion of this is bank and financial institution debt and only around R220bn is corporate debt. As a result of the large proportion being SA government debt, we exclude them from the below graphics as they tend to distort the scale of the graphs:

Note: all charts are based on data from Intengo Market’s platform

Emerging Trends and Future Outlook

Despite the prevailing illiquidity, the South African debt market shows signs of gradual evolution. The entry of hedge funds into fixed-income strategies introduces a layer of innovation and potential liquidity enhancement. While hedge funds are currently a minor presence, their growth could pave the way for more active trading and secondary market participation.

Further progress may depend on structural reforms, such as efforts to digitise interactions and find ways to incentivise secondary market activity. Initiatives to enhance transparency, streamline pricing mechanisms, and facilitate the introduction of new participants (foreign investors, retailers, or the newer banks, for example) could play a pivotal role in addressing liquidity and other systemic market challenges.

Understanding the intricacies of this market remains essential for informed investment decision-making and strategic portfolio management. Intengo Intuition offers its institutional users powerful analytical tools to better understand the market and the relative value of available instruments. In addition, the Intengo Platform is looking to address some of the structural reforms required to remove friction costs and democratise the playing field.

To find out more about how Intengo is addressing these issues, please visit www.intengomarket.com or connect with Ian Norden on LinkedIn. You can also contact Intengo Market here.

Get more insights by listening to Episode 60 of Ghost Stories, in which Ian Norden went into more details on the structure of the debt market and the role played by Intengo: