The gold sector has been a source of great disappointment for me. Most irritatingly, when I bought a basket of gold shares at the beginning of 2021 without spending enough time researching the sector, I managed to leave Pan African Resources out of the portfolio. That was a mistake.

Pan African has just wrapped up the financial year ended June 2022. With full reporting only due in September, the group has released an operational update that kicks off with an exciting headline:

“Record annual gold production and significant reduction in net senior debt.”

Every CEO dreams of being able to tell a story like that to the market, especially when competitors have either had major production hiccups or are busy chasing huge international deals.

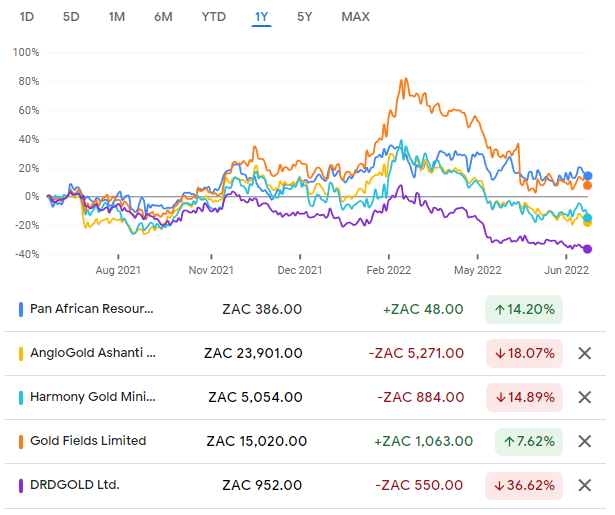

Over the past year, Pan African has been the top performer in the sector:

More gold

Production is only up by 2% vs. FY21, so don’t get carried here with expecting tech company growth rates. Still, that’s a move in the right direction. Pan African didn’t expect such a favourable result this year, as actual production of 205,459oz of gold is around 5% higher than initial guidance.

There are five major mining operations in the group and four of them performed better than last year. The Sheba and Consort underground operations saw a disappointing drop of nearly 30% in production. This is thankfully the second smallest operation in the group.

Pan African has given conservative guidance for FY23, with a plan to maintain production at FY22 levels.

Less debt

The gold price hasn’t been terribly exciting over the last year, but it has been at a level that allows Pan African to make money. When coupled with strong production numbers, that means a year of debt reduction and value creation for shareholders.

The extent of the reduction is astonishing. Debt is down 71.5% year-on-year or 59.8% since the end of December 2021. Pan African Resources reports in US dollars and so these numbers are subject to the wildly volatile dollar movements. I checked in the integrated report and it looks like the debt is with local banks and denominated in rand, so I would prefer to consider the percentages based on the change in the rand value. In that case, debt is down 68% year-on-year, which is still excellent of course.

More energy

Pan African has commissioned a 10MW solar PV renewable energy plant at Evander, the first of this scale in the South African mining industry. The Barberton 8MW solar PV renewable energy plant site establishment has also commenced.

Fewer injuries

Pan African has a strong safety record. There were improvements in the recordable injury frequency rate (RIFR) and the lost time injury frequency rate (LTIFR). Far more impressively, Barberton Mines achieved 2 million fatality free shifts on 10 May 2022 and the Evander / Elikhulu operations achieved 2.5 million fatality free shifts on 19 January 2022.

More blueberries

I just couldn’t help but highlight an unusual ESG update. At Barberton, the commercial harvesting of blueberries has commenced.

Frankly, based on how the gold price is behaving at a time in the world when it should be doing well, perhaps blueberries would be the most profitable route forward.

As a shareholder of Pan African Resources I’m over the moon 🌙 with the performance and congratulations to management 👏. Keep up the excellent work.

Glad I’m holding a small bag of this. Thank you for the great article.