In the interests of transparency and keeping investors informed, Prime Kapital has opted to publish this letter in Ghost Mail for a market-related placement fee. It is published as sent to shareholders (i.e. without amendment) and does not represent the opinions or views of The Finance Ghost (such views are indicated in Ghost Bites on an ongoing basis, informed by SENS releases by MAS and my own analysis). This letter is included for research and information purposes only. Please consult your financial advisor regarding the various activities around MAS.

Part of the Second Floor

Exchange House

54-62 Athol Street

Douglas

Isle of Man IM1 1JD

(“Prime Kapital”)

Dear Fellow Shareholder:

Re: Response to the Purported “Voluntary Bid” by Hyprop Investments Limited and Related Shareholder Developments

We are writing to you in light of recent developments regarding MAS and the unsolicited actions of certain MAS shareholders and external parties, which we believe require your careful and immediate attention and consideration.

We also address the purported “Voluntary Bid” by Hyprop Investments Limited (“Hyprop”) (the “Hyprop Free Option”), outline our concerns with its structure and implications, and explain why we believe it is not in the best interests of independent MAS shareholders to grant Hyprop such an option over their MAS shares.

1 Reasons to Reject the Hyprop Free Option

1.1 The Hyprop Free Option is not a genuine, bona fide binding offer, but rather a thinly veiled scheme to induce uninformed independent MAS shareholders to grant Hyprop free options to acquire MAS shares at its discretion at a future date, and at a substantial discount to the current depressed market price,

1.1.1 The Hyprop Free Option opened for acceptances on Friday, 18 July 2025, and is scheduled to close on Friday, 25 July 2025 (subject to indefinite extensions by Hyprop).

1.1.2 Hyprop essentially proposes that MAS shareholders grant it a free of charge option valid for at least 3 months to 31 October 2025 (or an undefined later period if Hyprop extends the long stop date in its discretion) for a share swap at a ratio very unfavourable to MAS shareholders, valuing MAS at just R18.03, or €0.88 per share — far below Friday’s market close (22% discount) as well as MAS’s IFRS NAV (48% discount).

1.1.3 The cash component of the offer is a “smoke and mirrors” exercise, designed to distract from the deeply unattractive pricing of the proposed equity swap. The cash offer covers just 5% of MAS’s market capitalisation, represents only a 4% premium to the current share price for control of the business, and is a 31% discount to MAS’ IFRS NAV. The Hyprop Free Option remains subject to numerous conditions precedent, several of which are subjective or entirely within Hyprop’s control. These are only required to be fulfilled or waived (where permitted) by 31 October 2025, or such later date as Hyprop may elect in its sole discretion, any number of times.

1.1.4 Critically, Hyprop indicates that MAS shareholders must accept the Hyprop Free Option now, before 25 July 2025, without knowing whether it will become

unconditional. There is no ability for shareholders to accept the offer after it has

become unconditional.

1.1.5 This structure is inconsistent with the JSE Listings Requirements governing

corporate actions, which require that an offer remain open for at least 12 business

days after the announcement that it has become unconditional (the “finalisation

date”).

1.1.6 Rather than providing MAS shareholders with the opportunity to make an informed decision once the offer is capable of being implemented, the Hyprop Free Option demands irrevocable acceptance upfront. This confers on Hyprop the effective right, but not the obligation, to acquire shares at a later date, depending solely on whether it elects to fulfil or waive the outstanding conditions. In substance and effect, this constitutes an option granted to Hyprop, not a binding offer accepted by MAS shareholders.

1.1.7 The rationale for this thinly veiled scheme of Hyprop to obtain free options from MAS shareholders is in our view, objectionable. Hyprop remains months away from being in a position to make a genuine offer, wishes to prevent real

competition, and wishes to profit from a low MAS share price that it may have

potentially contributed to depress. If MAS shareholders were afforded the JSE

Listings Requirements’ required acceptance period following the finalisation date,

it is likely they would only consider to accept an offer once it is certain that Hyprop is actually required to acquire their shares (consistent with market practice). The current option structure deprives MAS shareholders of this choice.

1.1.8 If the voluntary offer initiated by PK Investments Limited (“PKI”) to acquire all shares in MAS not already held by PKI (the “PKI Voluntary Bid”), or any other

competing bid, is launched before the Hyprop Free Option becomes unconditional,

MAS shareholders would have a meaningful opportunity to compare and choose

between alternative offers.

1.1.9 Instead, by requiring early irrevocable acceptances, the Hyprop Free Option

removes those MAS shareholders from the market, regardless of whether the offer

becomes capable of implementation, frustrating genuine, bona fide and superior

bids. In substance, MAS shareholders are providing Hyprop with free options over

their shares under the guise of a so-called “Voluntary Bid”. This is materially

prejudicial to MAS shareholders.

1.1.10 What is particularly concerning is that the structure of the Hyprop Free Option allows Hyprop to initially set a one-week acceptance period, and then to extend the closing date repeatedly, including by very short periods, as many times as it chooses. This creates a mechanism whereby Hyprop can monitor acceptances in real time and close the offer the moment it has secured just enough support to gain control of MAS, all while the offer remains subject to numerous conditions. In this way, Hyprop is never required to re-open the offer to all MAS shareholders once it is capable of implementation, depriving the broader MAS shareholder base of a fair opportunity to assess the offer with the benefit of full information and certainty. This tactic enables Hyprop to manufacture urgency, exert pressure on MAS shareholders to commit early, and engineer control through rolling short extensions, without providing any binding obligation to proceed with the Hyprop Free Option. Not only may this call into question whether the Hyprop Free Option satisfies the requirements for a valid Voluntary Bid under the MAS Articles of Association (“MAS Articles”), which would exempt Hyprop from making a mandatory bid upon acquiring control, but it also, in our view, amounts to a request for MAS shareholders to give up their rights without any certainty of value being returned. MAS Shareholders are pressured, through short timeframes, into granting free options for Hyprop to buy their shares by accepting an offer that may never materialise, under the fear of being left behind in a diminished minority position.

1.1.11 It is particularly noteworthy that a condition of the Hyprop Free Option is that the MAS board of directors (“MAS Board”) must confirm in writing that Hyprop will not be obliged to make a mandatory bid in terms of the MAS Articles or must grant an exemption. Such confirmation would be unnecessary if the Hyprop Free Option were truly a Voluntary Bid. For the reasons explained above and in paragraph 1.2 below, it is Prime Kapital’s considered view that the Hyprop Free Option does not constitute a “Voluntary Bid” in terms of the MAS Articles, and that absent the exemption requested by Hyprop from the MAS Board mentioned above, Hyprop would be required to make a mandatory bid to MAS shareholders should it acquire control following the exercise of the Hyprop Free Options.

1.1.12 What should concern independent MAS shareholders even more is that a group of shareholders who generally have outsized economic interests in Hyprop, and potential alignment with Hyprop, have called on MAS shareholders, ostensibly

under the guise of promoting good governance, to appoint a majority of so-called

“independent” non-executive directors to the MAS Board (see paragraph 2 below).

In our view, it is not unreasonable to suspect that this may be part of a broader

strategy to ensure the MAS Board grants the exemption or confirmation Hyprop

requires, despite doubts as to whether the Hyprop Free Option qualifies as a

Voluntary Bid, and Hyprop and any parties acting in concert with Hyprop potentially being required to make a mandatory bid should Hyprop acquire control of MAS pursuant to the Hyprop Free Option.

1.1.13 Prime Kapital intends to write to the JSE to formally request that the JSE require Hyprop to revise the offer via SENS announcement and a supplementary circular to:

1.1.13.1 permit shareholder acceptances for a period of at least 12 business days after the offer becomes unconditional; and

1.1.13.2 allow any shareholder who previously accepted the Hyprop Free Option to withdraw their acceptance prior to the revised closing date.

1.1.14 Prime Kapital has communicated to MAS its firm position that no lawful basis exists to grant the requested exemption or confirmation. If the offer genuinely qualifies as a Voluntary Bid, such exemption would be redundant.

1.2 Hyprop retains the right to reduce the Cash Consideration per Share, Cash

Consideration Cap and/or Share Consideration

1.2.1 Hyprop retains unilateral discretion to reduce the Cash Consideration, the Cash Consideration Cap and the Share Consideration.

1.2.2 The announced Share Consideration of 0.42224 Hyprop shares, which values MAS on Hyprop’s closing price on Friday at a low R18.03 per share (or

approximately 88eurocents) per MAS share is not fixed. Hyprop may amend this

ratio, upwards or downwards, at any time by SENS announcement prior to the

closing date. The same applies to the R24.00 per share Cash Consideration and

the R800 million Cash Consideration Cap (the latter amounts to less than 5% of the total price paid if all MAS shareholders accept to grant Hyprop the requested

options over their shares and Hyprop follows through and exercises such options).

1.2.3 Hyprop may also extend the closing date indefinitely. As a result, MAS

shareholders who accept the offer may find themselves bound to a transaction

under terms materially less favourable than those initially presented.

1.2.4 Although the Hyprop circular states that changes to consideration will be disclosed and that accepting MAS shareholders will be advised of the action to take if there is a change to the consideration, the offer structure enables Hyprop to:

1.2.4.1 lock MAS shareholders into the Hyprop Free Option on current terms;

1.2.4.2 subsequently reduce the price once competing offers are no longer available;

1.2.4.3 even if MAS shareholders at the time have the right to withdraw their

acceptances, this will leave such shareholders who accepted the Hyprop Free

Option with inferior consideration and no remaining options.

1.2.5 The absence of a fixed minimum consideration undermines the Hyprop Free

Option’s enforceability and may render it invalid under basic contractual principles

due to lack of consensus on essential terms.

1.2.6 For this reason, we also question whether the Hyprop Free Option satisfies the definition of a valid Voluntary Bid under the MAS Articles, which we believe

requires a binding offer with a fixed or determinable minimum price.

1.3 The Hyprop Free Option is materially inferior to the PKI Voluntary Bid, uncertain and serves the interests of MAS shareholders with oversized positions in Hyprop

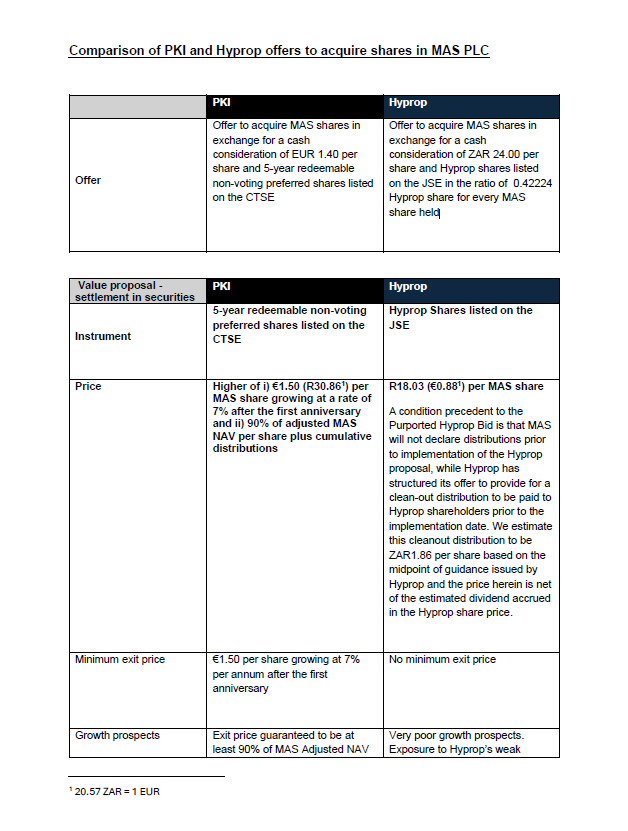

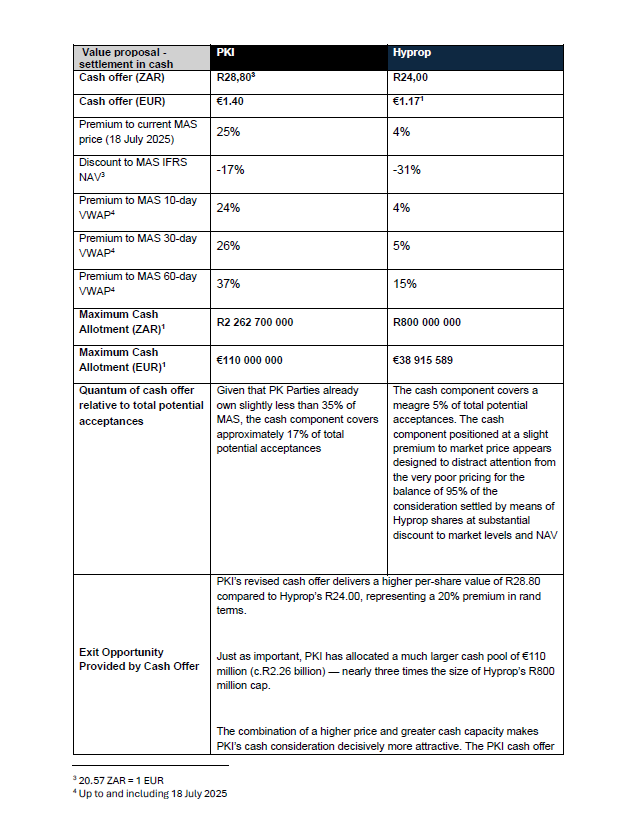

1.3.1 We refer you to the comparison between the PKI Voluntary Bid and the Hyprop Free Option which accompanies this letter, and which explains that –

1.3.1.1 the feasibility and timing of the implementation of the Hyprop Free Option is highly uncertain. In comparison, the PKI Voluntary Bid offers MAS

shareholders a high degree of transaction certainty;

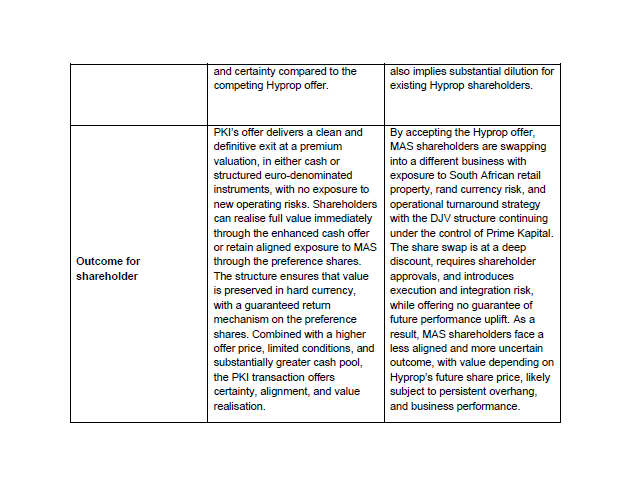

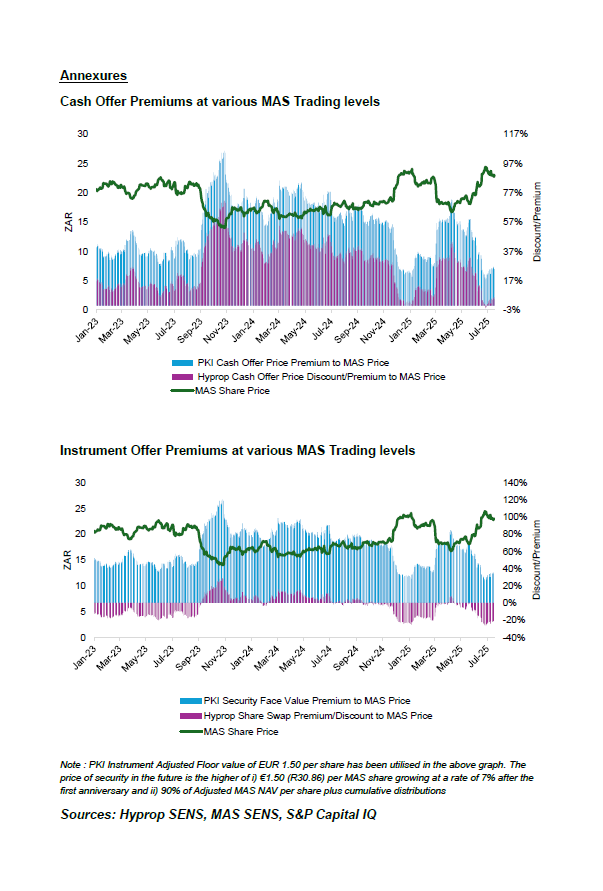

1.3.1.2 from a pure upfront economic standpoint, both PKI’s cash offer and cash

capacity makes PKI’s cash consideration decisively more attractive than the

cash consideration offered in terms of the Hyprop Free Option. Hyprop, which

currently holds no MAS shares, has allocated a cash pool of approximately €40

million, an amount that would cover less than 5% of total MAS shares in issue.

By contrast, the PK Parties already hold approximately 35% of MAS, meaning

that PKI’s cash component, if not increased, would be sufficient to cover at

least 17% of the remaining MAS shares held by other shareholders. Hyprop’s

limited cash offering, while superficially more attractive than the low implied

value of its share consideration, is in reality a smokescreen designed to

obscure the underlying weakness of the equity swap it proposes. The real

substance of the Hyprop bid lies in the share exchange, which offers poor

value, particularly in comparison to the alternative available under the PKI

Voluntary Bid. PKI’s preferred shares, by contrast, offer materially superior

value. These instruments are backed by a floor price that is significantly higher

than the value implied by Hyprop’s share ratio, and provide MAS shareholders

with a far more secure, euro-denominated return profile than a forced

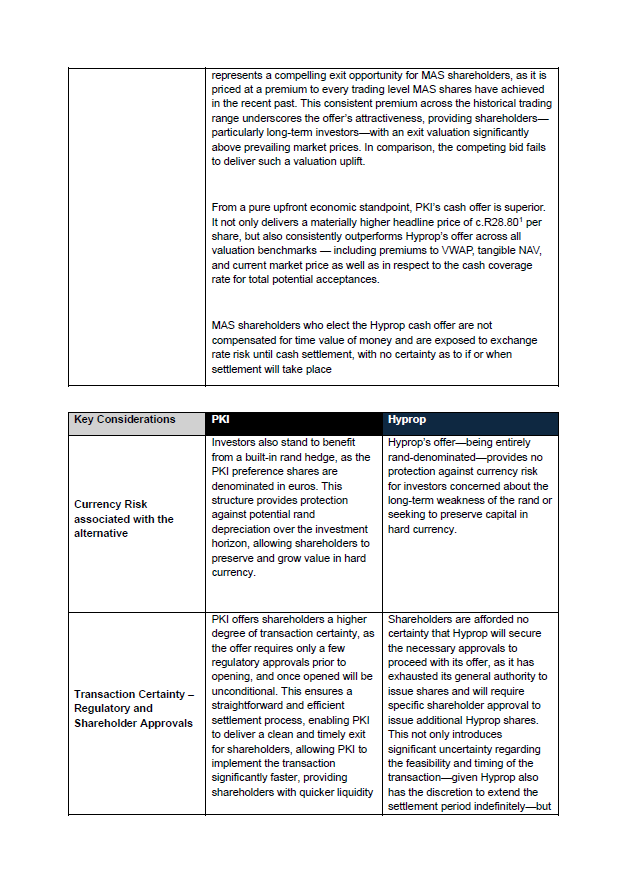

conversion into rand-based Hyprop equity (see paragraph 1.3.1.3 below);

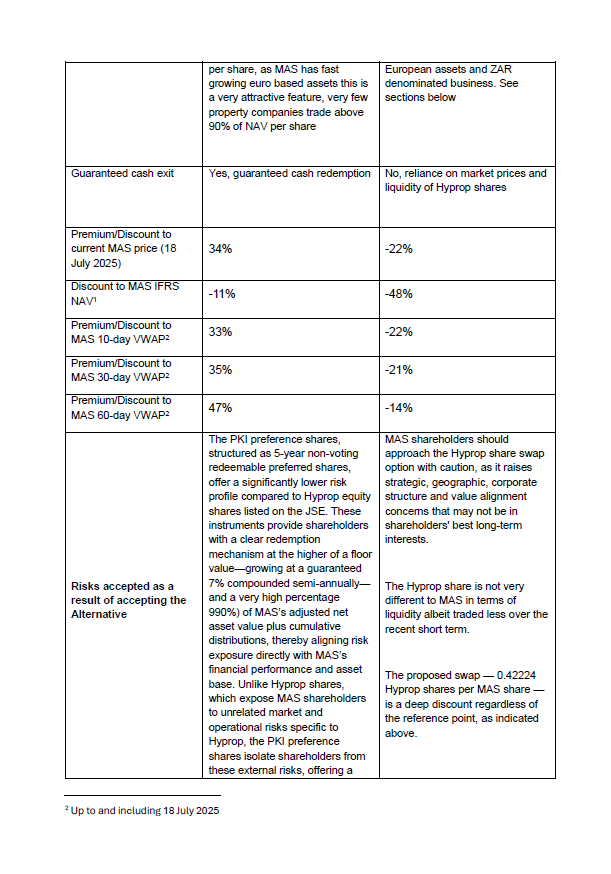

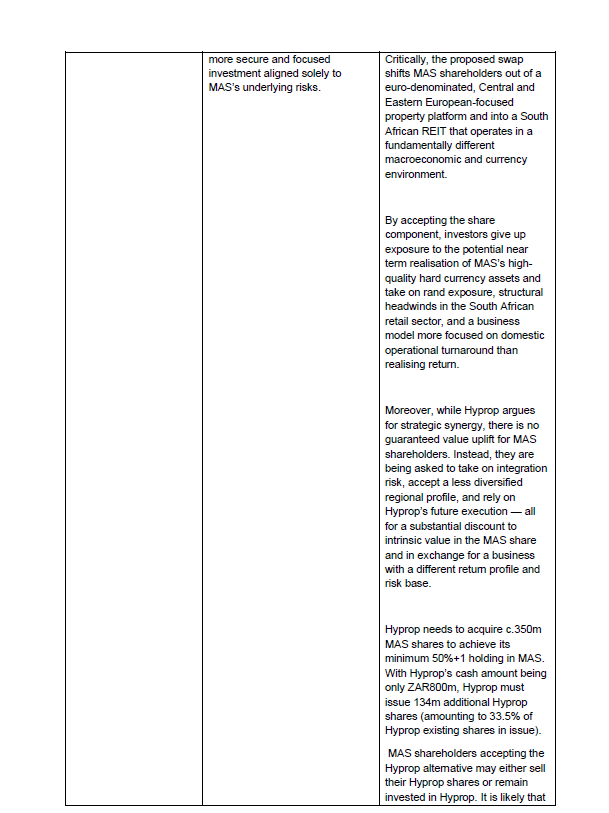

1.3.1.3 the PKI preferred shares offered as consideration under the PKI Voluntary Bid, structured as 5-year non-voting redeemable preferred shares, offer a

considerably higher value and a significantly lower risk profile compared to

Hyprop equity shares listed on the JSE –

1.3.1.3.1 whereas the preferred shares pay out 90% of adjusted MAS NAV per share, subject to a minimum price of €1.50 per share adjusting at 7% per year,

Hyprop’s equivalent price amounts to €0.88 per share (i.e. 42% lower than

PKI’s minimum price and 22% below the closing price for MAS on the day

when the Hyprop Free Option was made)

1.3.1.3.2 whereas MAS NAV and thus the preferred share redemption value is

expected to grow in euro terms, given historic trends, the opposite seems

to be likely for Hyprop’s shares;

1.3.1.3.3 whereas shareholders holding PKI preferred shares benefit from a certain cash exit, Hyprop shares offer no such certainty. MAS Shareholders

receiving Hyprop shares would need to realise value by selling them in the

open market, which may prove challenging given the limited liquidity of

Hyprop’s shares and the potential for adverse price movements; and

1.3.1.3.4 whereas the PKI Voluntary Bid afford MAS shareholders with the benefit of a built-in rand hedge, as the PKI preferred shares are denominated in euros,

the Hyprop Free Option, being entirely rand-denominated provides no

protection against currency risk for investors concerned about the long-term

weakness of the rand or seeking to preserve capital in hard currency.

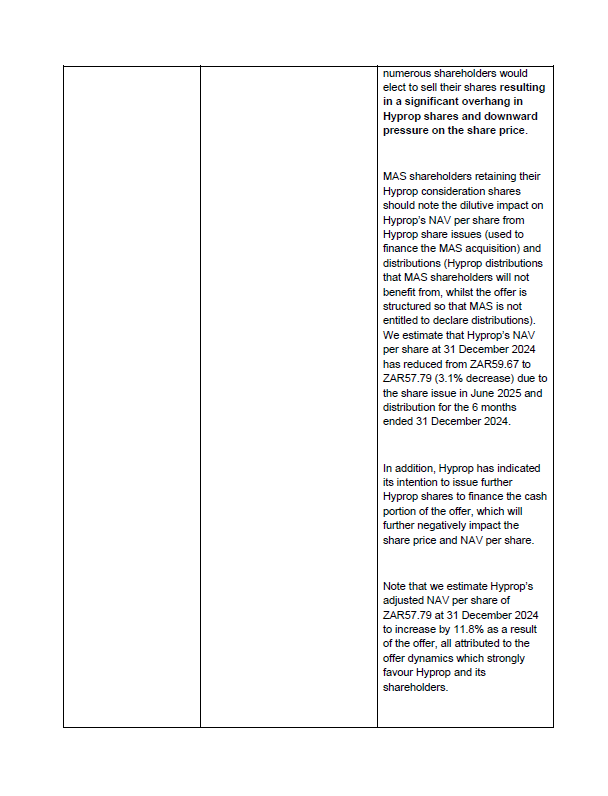

1.3.2 As MAS shareholders will note from this comparison, the Hyprop Free Option only benefits MAS shareholders with oversized positions in Hyprop, and if

implemented, is expected to be highly prejudicial to MAS shareholders who are

not in a similar position.

2 Actions by a group of MAS shareholders holding oversized positions in Hyprop

2.1 On 9 July 2025, a group of MAS shareholders requisitioned a shareholder meeting (“EGM”) proposing, among others (i) an advisory resolution mandating a board committee to investigate the PKM Development Ltd (“DJV”) arrangements; (ii) the removal of Mihail Vasilescu and Dan Pascariu as MAS directors and (iii) the

appointment of four new directors (including Des de Beer of Resilient Real Estate

Investment Trust and Lighthouse).

2.2 The advisory resolution appears to have been designed to compel the immediate public disclosure of questions posed to MAS before MAS could formulate any response. In addition, some of the questions seemed to be aimed at creating the impression of malfeasance and impropriety whilst ignoring well known facts and circumstances. This approach, in Prime Kapital’s view, is not conducive to the orderly dissemination of information to the market. In parallel, Prime Kapital and certain of its executives have been the subject of repeated and often highly critical, and defamatory press coverage. This media reporting has contained numerous inaccurate, misleading, and, in some instances, plainly false assertions.

2.3 Furthermore, if the resolutions proposed at the EGM regarding board appointments are passed, the majority of MAS’s independent non-executive directors would have been nominated by shareholders with outsized economic interests in Hyprop in circumstances where their independence is questionable, at the very same time that the MAS Board will be required to assess and respond to Hyprop’s request for an exemption from the mandatory bid requirement in the MAS Articles or for a formal confirmation that no such obligation applies (refer to paragraph 1.1.12 above).

2.4 Prime Kapital has also taken note of the identities of the institutional shareholders who have requisitioned the EGM. Based on publicly available disclosures and Prime Kapital’s own analysis, it appears that these shareholders generally hold a substantially larger economic interest in Hyprop than in MAS. From an economic perspective, an opportunistic acquisition of MAS by Hyprop at a depressed valuation would be accretive to these shareholders and other shareholders with an oversized position in Hyprop, on a net basis. What they may forgo in value on their MAS holdings could be more than offset by the corresponding gains in their larger Hyprop positions.

2.5 This cumulative pattern of conduct raises legitimate questions as to whether the requisitioned EGM and public commentary (including certain press articles and

opinion pieces) are not in fact a concerted strategy by certain stakeholders,

alternative bidders and their advisers to –

2.5.1 delay, frustrate or otherwise obstruct the implementation of the PKI Voluntary Bid;

2.5.2 enable the advancement of competing proposals by alternative bidders on

potentially less favourable terms, without the need to compete directly with PKI’s

superior value proposition; and

2.5.3 appoint a sufficient number of representatives to the MAS Board to acquire control of the MAS Board to implement their strategy, and ensure that the MAS Board provides Hyprop with the exemption required from the obligation to make a

mandatory bid in terms of the MAS Articles following implementation of the Hyprop Option.

2.6 In Prime Kapital’s respectful view, the commercial incentives at play are clear. Any upward movement in the MAS share price attributable to an attractive offer by PKI may render alternative proposals such as the Hyprop Free Option comparatively less attractive. It follows that the lower MAS’s share price remains, and the more distrust and suspicion created regarding the PKI Voluntary Bid, the more likely that nonaligned MAS shareholders will accept offers that undervalue MAS, creating a strong incentive to delay or undermine the PKI Voluntary Bid and the credibility of Prime Kapital, the DJV arrangements and MAS’ current board of directors.

2.7 In addition, where such MAS shareholders cooperate with Hyprop for the purpose of enabling Hyprop to acquire control of MAS, such MAS shareholders may also be acting in concert with each other and Hyprop, and if such MAS shareholders’ collective shareholdings exceed 30% of the MAS shares in issue (excluding treasury shares), such MAS shareholders may be required to themselves make a mandatory bid to the remaining MAS shareholders to acquire all of their MAS shares.

3 Insufficient Support Without Independent Shareholder Consent

3.1 The current structure of the Hyprop Free Option has the effect of precluding MAS shareholders from evaluating and accepting competing offers on an equal and informed basis before the Hyprop Free Option becomes unconditional. By forcing early irrevocable commitments under uncertain terms, the Hyprop Option frustrates the operation of a fair and competitive process.

3.2 Importantly, Hyprop and the MAS shareholders with oversized positions in Hyprop do not currently have the shareholder support required to pursue these actions without the cooperation of independent MAS shareholders. Their strategy cannot succeed without additional acceptances. We therefore urge all independent shareholders to assess the fairness and legality of the proposal carefully before taking any action.

4 Required Action and Next Steps

4.1 In light of the concerns raised above, we urge MAS shareholders not to accept the Hyprop Free Option. To do so would be to cede control of your MAS shares to Hyprop on vague and contingent terms, with no guarantee of execution and for extremely poor value.

4.2 We encourage all MAS shareholders to remain informed, to consider the implications of the competing bids carefully, and to take such steps necessary to promote longterm value for MAS and its stakeholders.

We believe this is a defining moment for MAS. Preserving value, fairness, and governance standards requires unity among independent shareholders and a firm stance against coordinated and self-serving tactics. We remain fully committed to pursuing an outcome that delivers real and equitable value to all MAS shareholders.

Yours sincerely,

I’m amazed that you got a fee for it. Very lucky! They hired a PR team to send a release about it across SA.