One of the things I really like about Sibanye-Stillwater is that the company keeps investors informed about the operations and the strategy. There are regular, detailed presentations made available to investors.

There are two presentations that have been made available in the past week. Sibanye attended the Bank of America Sun City Conference and us plebs who didn’t crack an invite can at least read the presentations.

You’ll find a useful presentation here (company overview) and the Sun City Conference presentation here (SA PGM operations) if you want to read the entire things.

In this article, I’ll pull out some of the most interesting facts about the company.

The company categorises its operations into SA Platinum Group Metals (PGM), US PGM, SA Gold, Battery Metals and Circular Economy Operations (tailings operations like the controlling stake in DRDGOLD). The acquisition strategy is focused on battery or green metals, like lithium and nickel, as part of preparing Sibanye for future demand.

Sibanye has made a name for itself through risky but ultimately highly rewarding acquisitions. When nobody wanted to touch platinum businesses a few years ago, Sibanye ran around mopping them up. R44.4 billion was invested over a three-year period. Net of capex, the cumulative adjusted EBITDA contribution from the investments is R90.1 billion. The payback on investment is thus just over 2x in a matter of a few years. Lonmin is particularly incredible, with a 6x payback achieved over just two years.

Capital allocation is the name of the game in this industry (as it should be in all industries). Off the back of record profits, Sibanye reduced and refinanced debt to reduce the interest burden. In 2021, Sibanye bought back 5% of shares in issue and the dividend yield was 9.8%.

The Sun City Conference focused on the PGM operations, perhaps because the resort sits at the heart of the local industry near Rustenburg. We’ve already discussed that Sibanye achieved great payback returns on recent acquisitions. If you focus on just the SA PGM operations, the total investment was R18.2 billion and the payback is 4.96x since 2016.

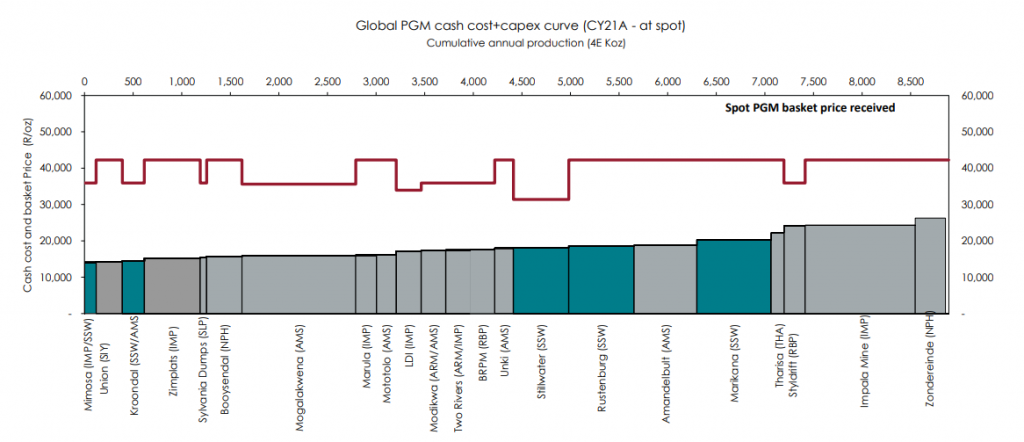

The focus in mining (once capital has been allocated) is to move down the cost curve. For various reasons, different platinum mines have different cash costs to get the platinum (and related metals) out of the ground. Here’s the chart from the presentation to give you some idea of how this works:

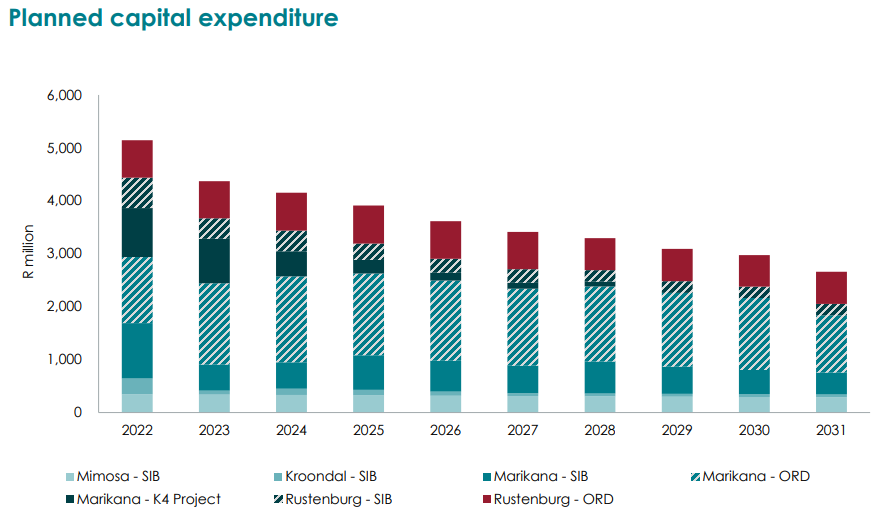

Another important chart is planned capital expenditure, which is expected to decrease in the PGM business over the next decade:

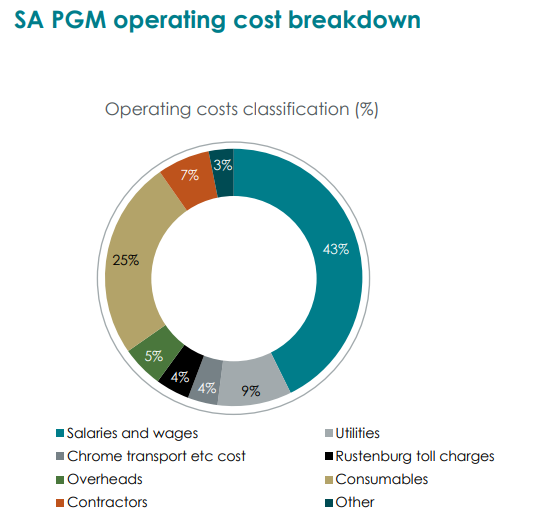

I’ve pulled one more chart to increase your curiosity about this industry. Salaries and wages are 43% of operating costs, which is why Sibanye (and other mines) are so sensitive to wage demands in the industry:

If you want to learn more about the company and the sector, I highly recommend flicking through the presentations that I gave you the links to earlier.

Disclaimer: the author holds shares in Sibanye-Stillwater