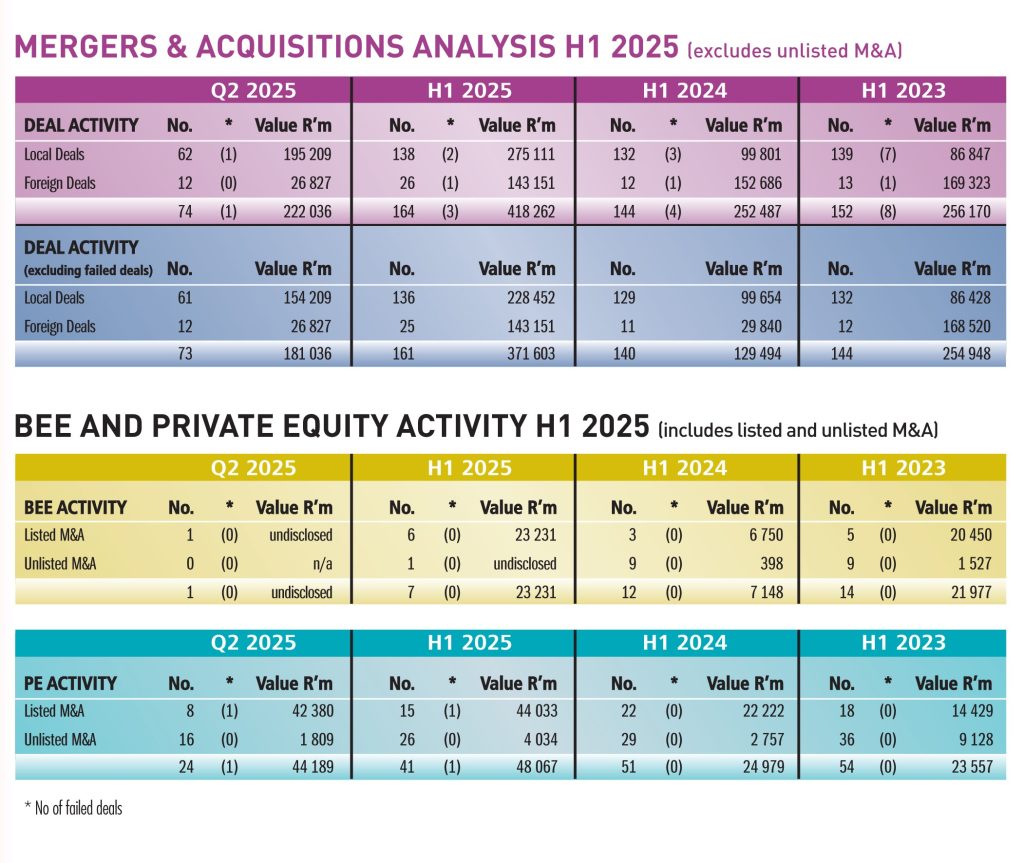

Global uncertainty and local budget-related wrangles still weigh on confidence and demand in South Africa. Yet, higher commodity prices and market volatility created opportunities. M&A activity by value of SA-listed companies rose 66% in H1 2025 compared with the prior year, and DealMakers recorded 164 deals worth R418,3bn.

Excluding failed transactions, the real estate sector led activity (37%), followed by resources (13%), technology (7%), and industrial and manufacturing (7%) – broadly mirroring last year’s trends.

The top 10 deals by value reflected this pattern, with resources and real estate dominating. Highlights included Gold Fields’ acquisition of Gold Road Resources (A$3,7bn|R43,7bn) and Primary Health Properties’ acquisition of Assura (£1,79bn|R43,3bn).

Excluding deals by foreign companies with secondary listings in South Africa, deal value for H1 2025 more than doubled to R228,5bn. SA-domiciled, exchange-listed companies were involved in 31 cross-border transactions during the period, with Africa, Australia and Europe the most active destinations. Once again, real estate deals topped the list, followed by technology.

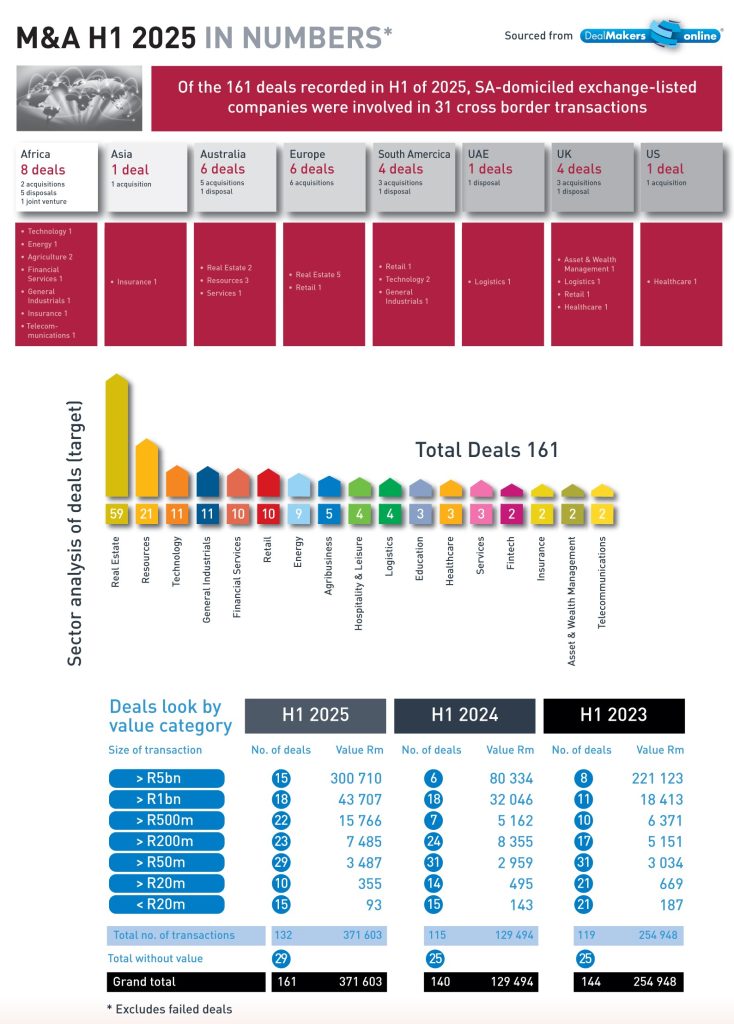

Despite increased opportunities, many companies remain cautious, holding cash yet to be deployed. Instead, firms have turned to multi-billion rand share buyback programmes and special distributions to reward shareholders.

The scale of this shift is striking:

- In H1 2010, repurchases accounted for 10% of General Corporate Finance (GCF) activity and just 2% of aggregate transaction value.

- By H1 2020, in the midst of the COVID-19 pandemic, they had risen to 33% of activity and 10% of value.

- Fast forward to H1 2025, repurchases dominated, representing 50% of GCF transactions and value (R227,5bn). Together with special and capital reduction distributions (R30,4bn), companies returned R258bn to shareholders in the period.

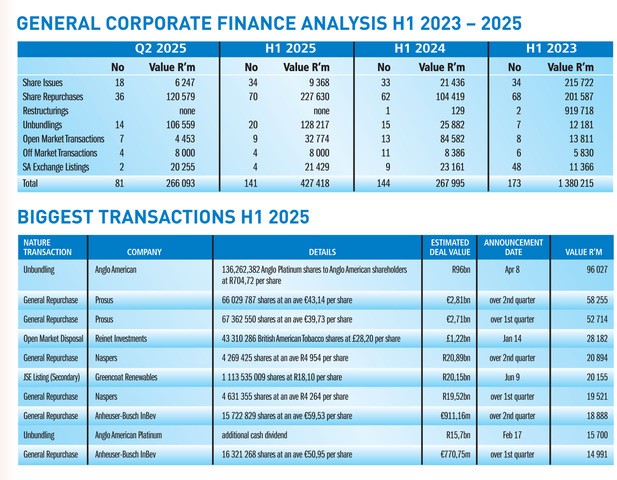

DealMakers H1 2025 League Table – M&A activity by the top South African advisory firms (in relation to exchange-listed companies).

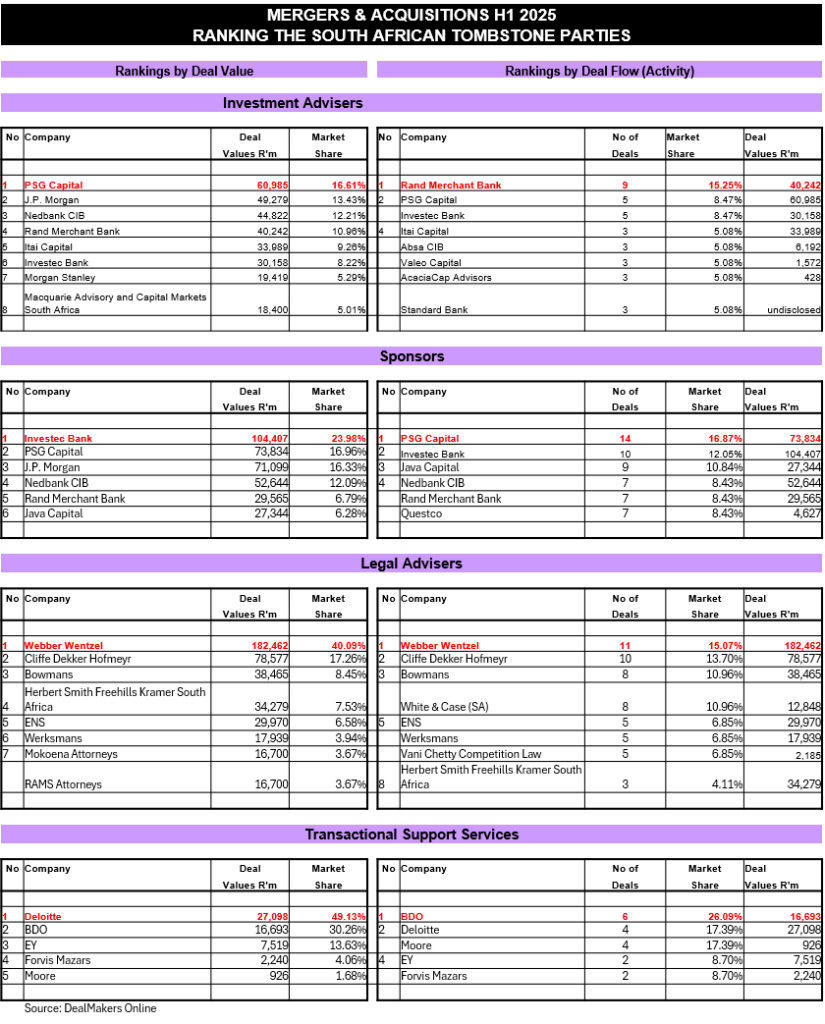

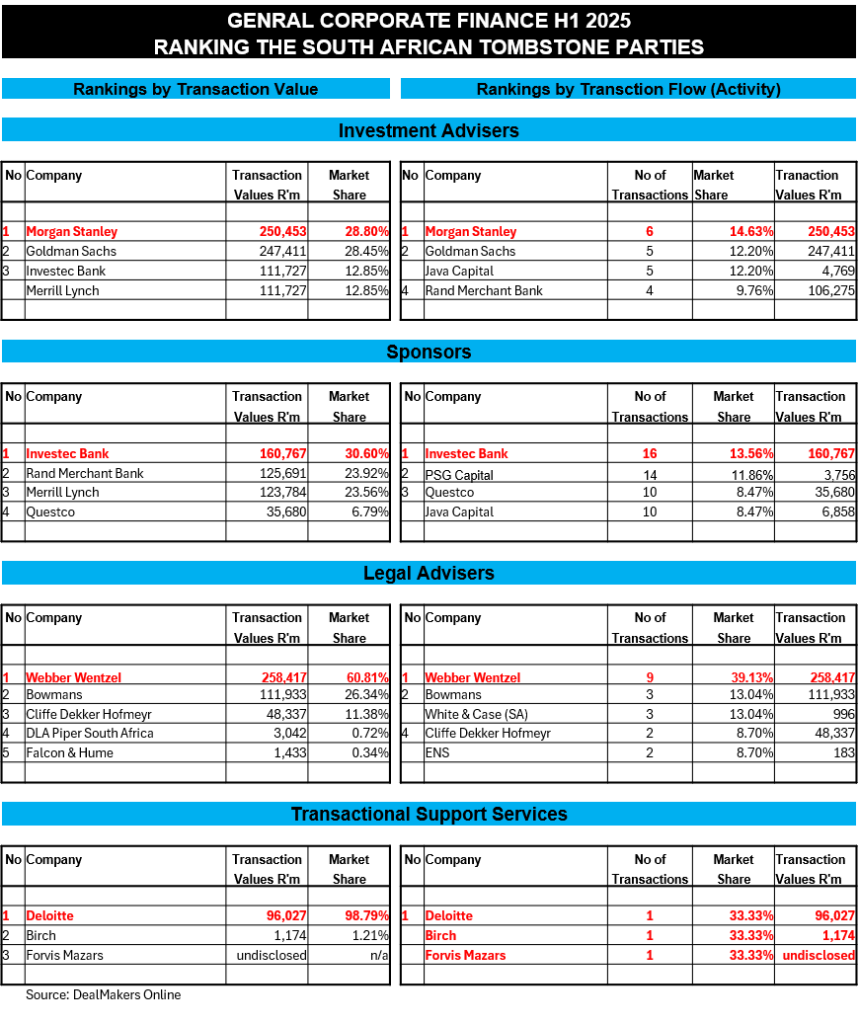

DealMakers H1 2025 League Table – General Corporate Finance activity by the top South African advisory firms (in relation to exchange-listed companies).

DealMakers is SA’s M&A publication.

The latest magazine can be accessed as a free-to-read publication on the DealMakers’ website www.dealmakerssouthafrica.com