It is no wonder that activity in the South African mergers and acquisitions (M&A) space has been subdued; there has been so much noise, both locally and internationally, that investors have opted to take a cautious approach – for now, anyway.

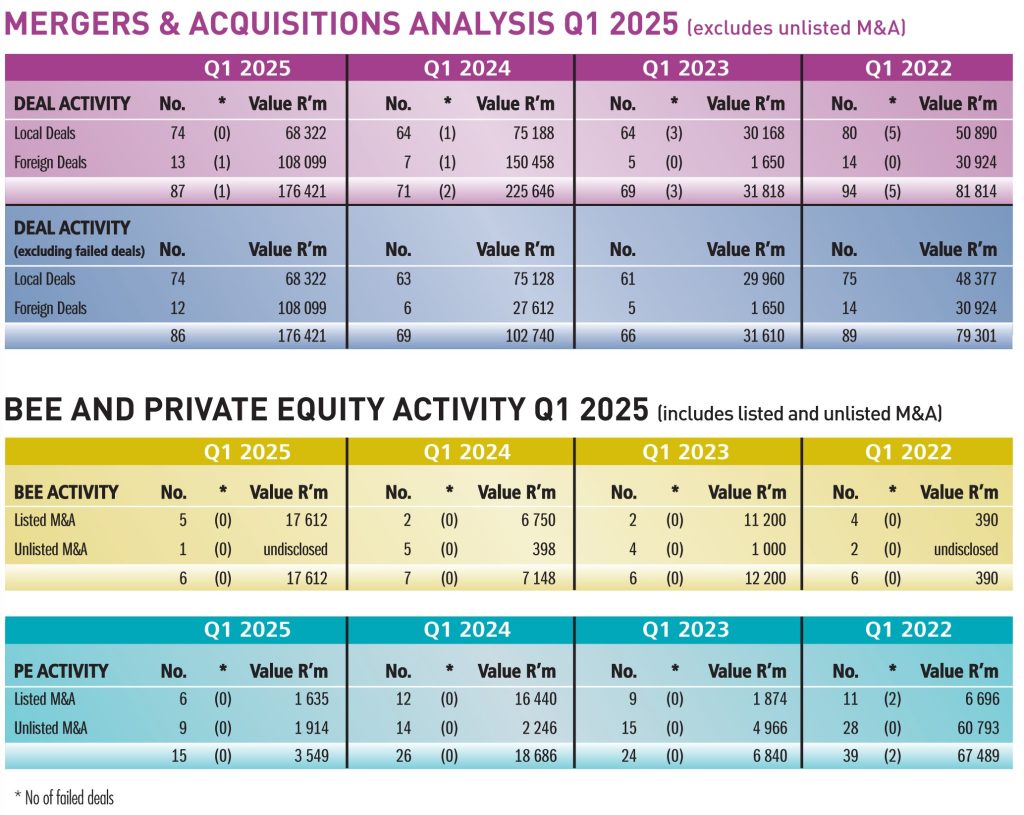

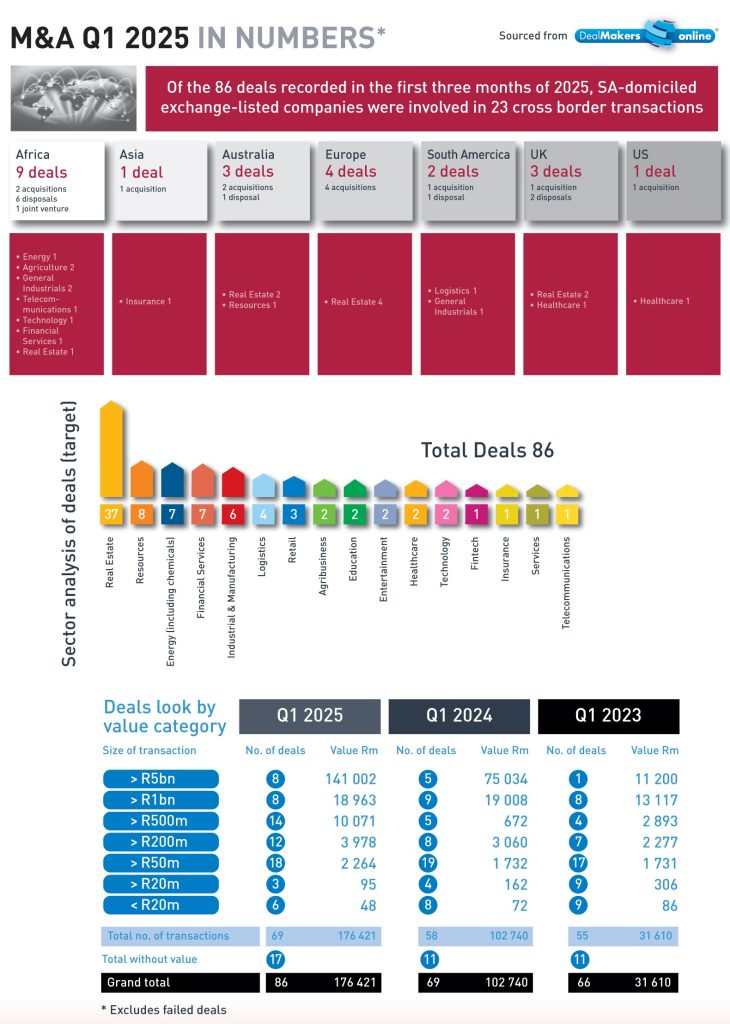

DealMakers recorded a total of 87 deals for the quarter, valued at R176,4bn. Sector analysis for the quarter shows real estate transactions taking the major share in activity reported, followed by deals in energy, financial services and the industrial and manufacturing sectors. Companies in Africa were the partners of choice for cross border activities by SA-domiciled exchange-listed companies – with nine deals announced of the 23 recorded for the quarter. These deals were across a broad spectrum of sectors, with no trend evident.

The number of private equity deals recorded (both by exchange listed and unlisted companies) continued to decline to 15 (2024: 26 deals). At six, the number of BEE deals for the quarter remained constant, with Exxaro’s extension of its BEE ownership scheme (valued at R16,7bn) making the top 10 deals by value for the quarter.

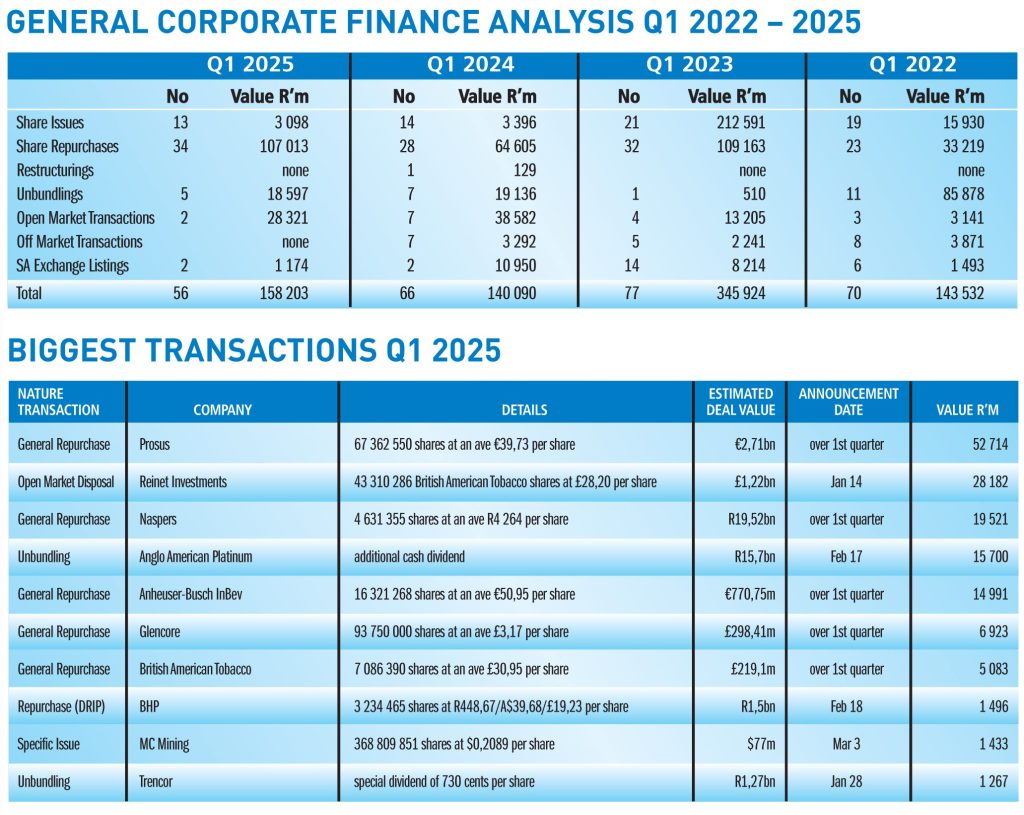

Behind the scenes, in what DealMakers classifies as general corporate finance, activity was also subdued. Only repurchases showed an uptick as companies took advantage of the turmoil in global markets to repurchase shares at discounted values. R107bn worth of shares were repurchased – against R64,6bn during the same period in the previous year.

Sectors on the investment radar for 2025 include: renewable energy – South Africa has attracted significant international funding to support its push towards sustainable energy solutions; digital infrastructure, as acquisitions and strategic partnerships are sought to enhance connectivity, particularly in underserved areas; and mining, with the likes of Anglo American pursuing strategies involving restructuring, and broader consolidation efforts ongoing in the mining sector.

Trump’s ‘Liberation Day’ tariffs, although now on a 90-day pause, showed the current US administration’s ability to potentially alter the global economic landscape – with South Africa facing the prospect, with some exceptions, of a 30% blanket tariff on exports to the US.

Challenges often provide an opportunity for self-reflection, and for South Africa, there is a unique opportunity to reposition itself as a leader in African trade by strengthening regional trade networks within AfCFTA and beyond, and to leverage public-private partnerships and public sector investment.

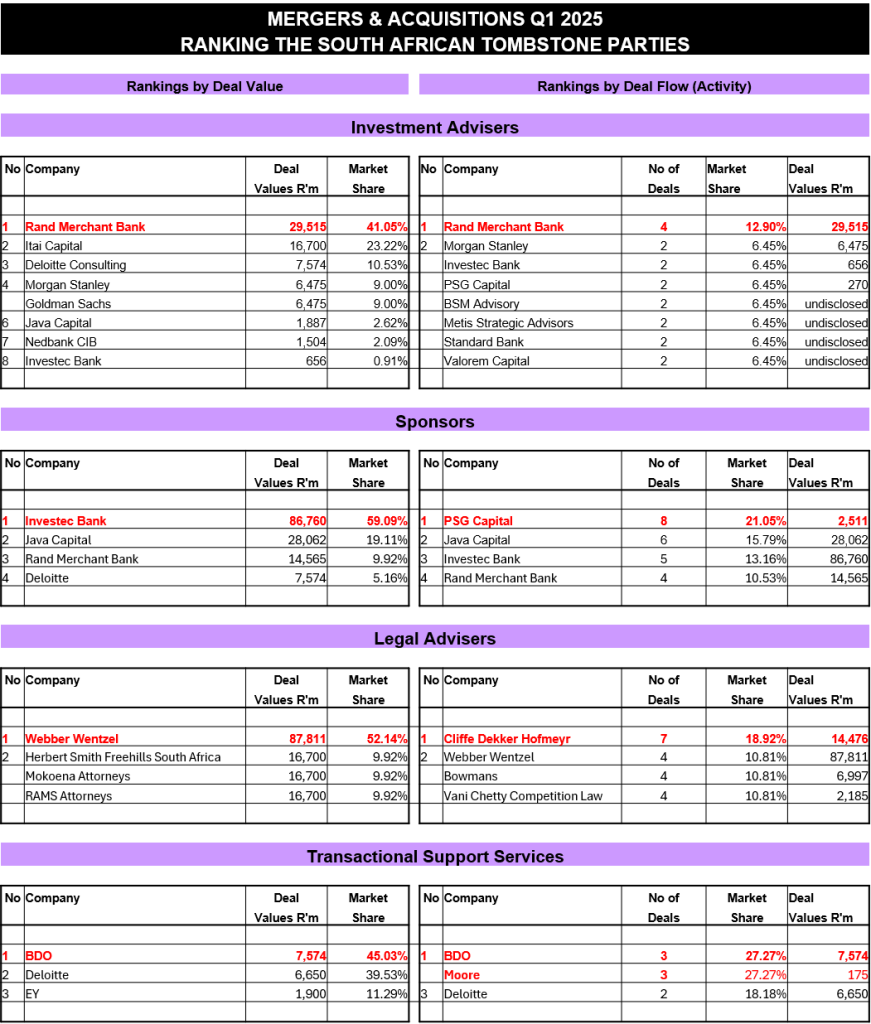

DealMakers Q1 2025 League Table – M&A activity by the top South African advisory firms (in relation to exchange-listed companies).

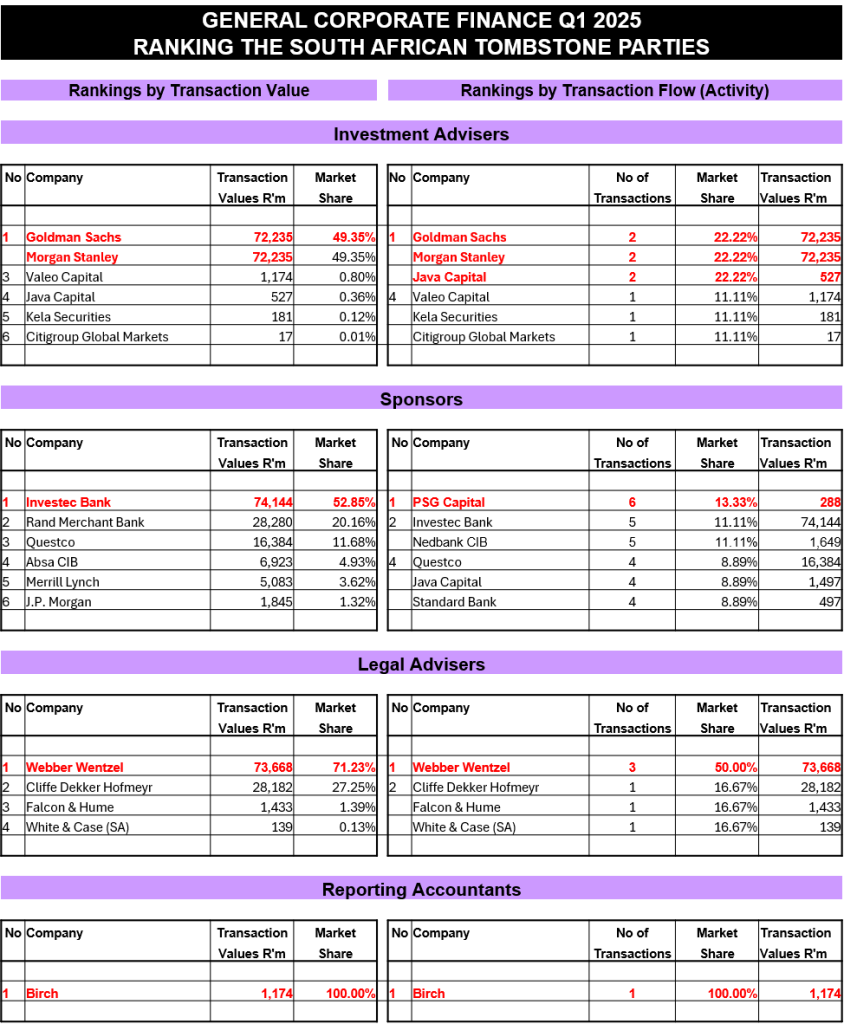

DealMakers Q1 2025 League Table – General Corporate Finance activity by the top South African advisory firms (in relation to exchange-listed companies).

DealMakers is SA’s M&A publication.

The latest magazine can be accessed as a free-to-read publication on the DealMakers’ website