In the savings and investment environment, Tax-Free Savings Accounts (TFSAs) stand out as both a beacon of potential and a puzzle of misconceptions.

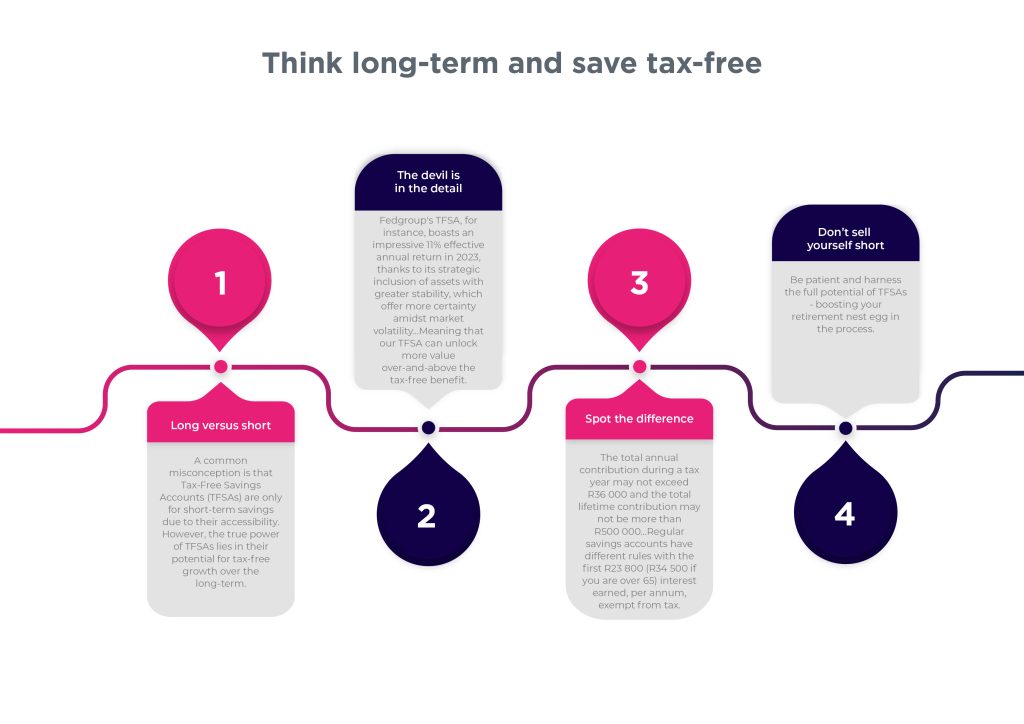

Introduced in 2015 with the noble aim of fostering long-term savings habits among South Africans, TFSAs have sparked debate about their effectiveness and strategic positioning. A common misconception is that TFSAs are only for short-term savings due to their accessibility. However, the true power of TFSAs lies in their potential for tax-free growth over the long-term.

Nomzamo Manqele, an astute investment specialist and wealth advisor at Fedgroup, makes a pertinent point by saying: “Access to funds in long-term savings products are usually restricted until retirement age, but with TFSAs, people have access to their savings within seven days. This might create an impression that TFSAs are short-term savings products when in fact, they should be grouped with long-term savings.”

The devil is in the detail

Come to think of it, the performance and trajectory of a TFSA hinges on its underlying structure. Herein lies both the beauty and the challenge; different providers offer distinct approaches, resulting in varying returns. Fedgroup’s TFSA, for instance, boasts an impressive 11% effective annual return in 2023, thanks to its strategic inclusion of assets with greater stability, which offer more certainty amidst market volatility. In other words, we found the sweet spot between low fixed returns offered by banks versus TFSAs linked to volatile markets. Meaning that our TFSA can unlock more value over-and-above the tax-free benefit.

Yet, beyond the allure of returns lies the essential consideration of fees. A zero-fee approach, as championed by Fedgroup underscores the commitment to maximise long-term growth potential, transcending the limitations posed by inflation.

Spot the difference

But, as with all regulated financial products, TFSAs have specific rules. The total annual contribution during a tax year may not exceed R36 000 and the total lifetime contribution may not be more than R500 000. The beauty of this product is that all interest or returns earned is tax free! Regular savings accounts have different rules with the first R23 800 (R34 500 if you are over 65) interest earned, per annum, exempt from tax. As soon as the amounts increase, you will be taxed.

When looking at the above comparison, regular savings accounts might seem like the way to go because you are allowed to invest a larger amount per year compared to a TFSA, but if you look a little closer, you might change your mind.

Yes, at first a regular savings account might look more attractive because of the higher amount allowed per annum, which could earn more interest. And let’s assume your bank offers an interest rate of 6.5% on your regular savings, and inflation stands at 5.1%, it means your real return is only 1.4%. Not a great long-term savings solution. In sharp contrast, with a TFSA from Fedgroup you could earn 11% effective annual return, meaning if inflation stands at 5.1%, your real returns could be 5.9%; much higher compared to a regular savings account. And it’s all tax free over the long-term! Then, add the gift that keeps on giving – compound interest on top of this – also tax free.

If you save R36 000 per year in a TFSA, it will take almost 14 years to reach your lifetime limit of R500 000. So, start saving today and imagine the interest you could earn, not to mention compound interest, to be enjoyed when you eventually withdraw these funds during retirement. Excellent reasons why a TFSA should be grouped with your long-term investment products.

Don’t sell yourself short

Nomzamo cautions against short-term withdrawals from your TFSA since it reduces the lifetime limit allowance of R500 000 and reminds of the long-term benefits at stake. By exercising patience and foresight, you can harness the full potential of TFSAs, bolstering your retirement nest egg in the process.

She concludes by saying, “Don’t sell yourself short by underestimating the value that TFSAs hold. Embrace the journey, seize the opportunities, and let your TFSA pave the way to a brighter financial future.”

About Fedgroup

Established in 1990, as a specialist South African financial services provider, Fedgroup has carved a niche for itself by doing things differently. Their unique approach prioritises people and long-term sustainability ahead of short-term profit. With over R20 billion in assets under management, the Group offers various financial products including investments, long-term insurance, lending, and fiduciary services.

As innovators in the impact investment space, Fedgroup has the experience and expertise to confidently guide investment decisions by incorporating stable and profitable alternative investment offerings into investment portfolios. With specific reference to their Impact Farming offering, the Group boasts more than seven years of experience within the renewable space, managing multiple agricultural and impact investment sites and technology-empowered companies to ensure the smooth and continued operations of projects. Fedgroup remains committed to age-old values of honesty, integrity, dignity, and people first and embraces a strong governance framework that is supported by people, processes, and technology. 4

Download Fedgroup’s corporate profile here