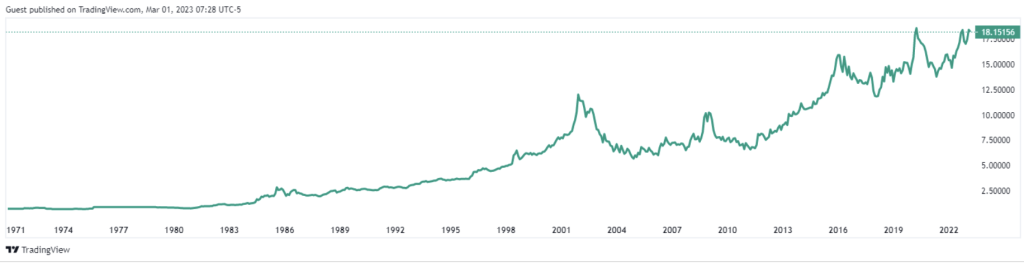

The Rand has gone from bad to worse over the last month, but is it really a surprise? The R/$ has been especially volatile of late, but it’s been a story of one step forward and two steps back. We only have to look at the history of this relationship to understand that while there may be strong rallies from time to time, ultimately the rand has continued to deteriorate against the dollar, and that doesn’t look like it’s changing anytime soon.

History of the R/$

| Year | 1995 | 2000 | 2005 | 2010 | 2015 | 2020 | 2023 |

| Rates on March 1st | R3.58/$ | R6.55/$ | R6.22/$ | R7.34/$ | R12.11/$ | R17.86/$ | R18.44/$ |

In between the dates shown above, there have been massive fluctuations due to different reasons; 9/11, the 2008 Recession, and Covid. But the overarching theme here is that while the rand may firm against the dollar on occasion, it looks set to keep its current trajectory.

Factors Affecting the Rand/$

We have now officially been placed on the grey list, which is going to have major consequences for the country, especially in terms of foreign investment. Essentially the Financial Action Task Force (FATF) concluded that South Africa has compliance issues, and the country is not doing enough to combat terrorist funding and money laundering. Countries placed on the grey list tend to see a decline in foreign investment into the country, as pointed out by Webber Wentzel attorneys. However, being on the grey list means you are committed to addressing the issues and SA has already made big strides from where it initially was.

As Mauritius has proven, it is possible to be removed from the grey list within 2 years. But even if South Africa achieves that in such a short space of time, the damage that will have been done will have ripple effects that will take a while to stabilize. Added to this is that our country is still at the hands of inept and corrupt government officials. Local South Africans are leaving the country in droves and taking their money and skills with them.

The country is also facing a major power problem, with reports saying SA should expect Stage 8 load shedding in winter. This will greatly impact our economy and have a debilitating effect on business, GDP, and the unemployment rate.

While Q4 2022 unemployment results show that SA created 169,000 jobs, 167,000 of those were created by the Western Cape. That’s 2000 jobs in the other 8 provinces over a space of 3 months. According to World Economic Forum, the outlook for unemployment shows SA with the highest unemployment rate in the world at 35%. These results may be skewed as there are a lot of countries that do not have enough data to analyze, but regardless of where we rank in the world, a 35% unemployment rate is impossible to ignore. Due to these reasons, there will most likely be a sharp decline in foreign investment, weakening the rand even further.

On the other side of the pond, while it seemed inflation was under control based on previous CPI results, it is still stubbornly high. ISM manufacturing data released recently also suggests that the Fed is going to continue rate hikes, with a 25-basis point hike expected in March and May, with many betting on an additional hike in June. With these higher interest rates, one can only expect the dollar to get stronger as foreign investors look to take advantage of the higher yields in US bonds and interest-rate products.

Looking at the history of the Rand/$, over time the rand keeps devaluing against the dollar. In the last 10 years, the rand has devalued by almost 7% per year against the $. That is a staggering statistic but a useful one. Hindsight is an exact science and while the rate may seem too high now to change your rands into dollars, the other alternative is you never do and your rands are worth less and less as the years go on. It’s extremely difficult trying to time the rate, and even the best get it wrong. One of the better options we’ve noticed is dollar cost averaging, popular when investing in markets. Buying a fixed amount on a regular basis so that your total price paid is less affected by your timing. In such a volatile market, this seems a logical choice. Magnus Heystek says the rand at this rate could still very well be a bargain compared to where it could be going and we wouldn’t bet against him.

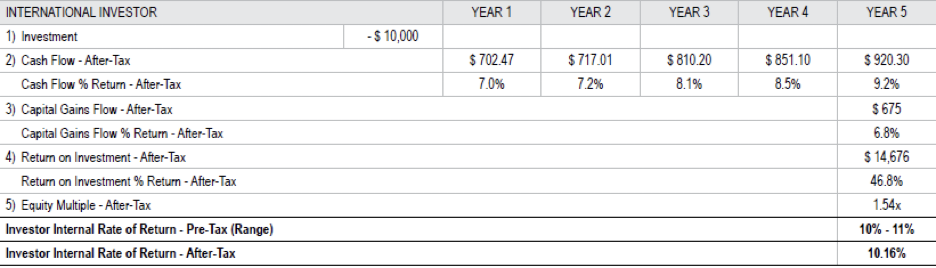

If you are looking at buying dollars, you’ll want somewhere to invest them. Orbvest has the solution. Orbvest has just launched a new project, the Lakeside Professional Centre, in Atlanta.

This well-maintained Class A medical office property is located in the Northeastern part of the rapidly growing Atlanta MSA. The property totals 23,555 SF and is 100% occupied by all medical tenants. OrbVest believes this is a great opportunity to acquire a core medical office asset in a top-growing MSA in the US. Forecasted quarterly dividends between 7%-8% annualized with a targeted IRR of 11%-12%. A no-frills no fuss building, long-term NNN leases in place, this is a great option to preserve your capital with a reliable income stream.

To find out more, contact OrbVest at www.orbvest.com or email support@orbvest.com

Authored by Devon Thomson, an experienced Senior Investment Consultant with Orbvest and a licensed representative.

OrbVest SA (Pty) Ltd is an authorized Financial Services Provider. The content and information herein contained and being distributed by OrbVest is for information purposes only and should not be construed, under any circumstances, by implication or otherwise, as advice of any kind or nature, or as an offer to sell or a solicitation to buy or sell or to invest in any securities. Past performance does not guarantee future performance.

Returns are taxable and will be taxed as dividends from a foreign source, ordinary income, or capital gains, depending on your tax residency. OrbVest is not a tax and/or legal advisor. Owing to the complex tax reporting requirements associated with private equity and private real estate investments, investors should consult with their financial or tax advisor or attorney before investing.

For members investing via www.orbvest.com the particulars of the investment are outlined in the property supplement, a private placement memorandum, or subscription agreement, which should be read in their entirety by the proposed investor prior to investing and having obtained independent advice.