AngloGold bids Côte d’Ivoire farewell (JSE: BAT)

They want to focus on other markets

AngloGold Ashanti announced that it will sell its stake in two gold projects in Côte d’Ivoire to Resolute Mining, a company with experience in West Africa. These projects were part of the Centamin plc acquisition in November 2024. AngloGold has been assessing what to do with them and the decision has obviously been made to let them go, specifically because of the need to focus capital and time elsewhere.

There are no conditions to the sale, so this is a done deal.

Interestingly, part of the deal will see AngloGold acquiring Toro Gold Guinée Sarlu, which owns the Mansala Project in Guinea. This project is adjacent to an existing AngloGold mine in Guinea and they expect to develop it over time. This acquisition does have conditions though, even though the abovementioned sales don’t.

The selling price for the main Côte d’Ivoire asset (the Doropo Project) is $175 million, of which at least $150 million is payable in cash. The remaining $25 million is settled either through the Toro Gold Guinée Sarlu deal, provided it can be completed within 18 months, or through a further payment of cash. The payments are made in three tranches over 30 months.

The ABC Project, which is the other Côte d’Ivoire asset, is being sold for $10 million in cash plus a 2% net smelter royalty. The cash payment is triggered by the declaration of a mineral reserve.

Brait’s update was met with market approval (JSE: BAT)

Solid performance at Virgin Active and capital discipline were the themes

Brait’s share price is up 65% in the past 12 months, so this is a good example of where speculative plays can work out pretty well. And thanks to a positive 10% move in response to a trading update, the share price is slightly in the green year-to-date as well – a pretty resilient performance in a market with so much volatility.

In the latest update, Brait noted that Virgin Active is growing revenue at 13% year-on-year, with annualised March trading suggesting run rate EBITDA of £119 million. They neglected to give a comparison in the update, so I had to go digging for the run-rate EBITDA at the time of the interim results (September 2024). It was just £85 million, so that’s a great example of operating leverage (the benefit of additional revenue at the gyms without a major increase in costs).

Brait still has a stake in Premier, but the results of Premier aren’t a surprise because that company is separately listed these days. Premier is expecting HEPS growth of between 20% and 30% for the year ended March 2025, so that’s certainly helping the story.

And as a cherry on top, Brait decided not to participate in New Look’s £30 million capital raise to accelerate its digital strategy. Historically, New Look has been such a headache that investors are thrilled to see that Brait isn’t throwing good money after bad. Instead, they did things like repurchase convertible bonds at a discount to par value – and that’s what investors want to see from a capital allocation perspective.

A brief additional note on CMH (JSE: CMH)

The analyst presentation caught my eye

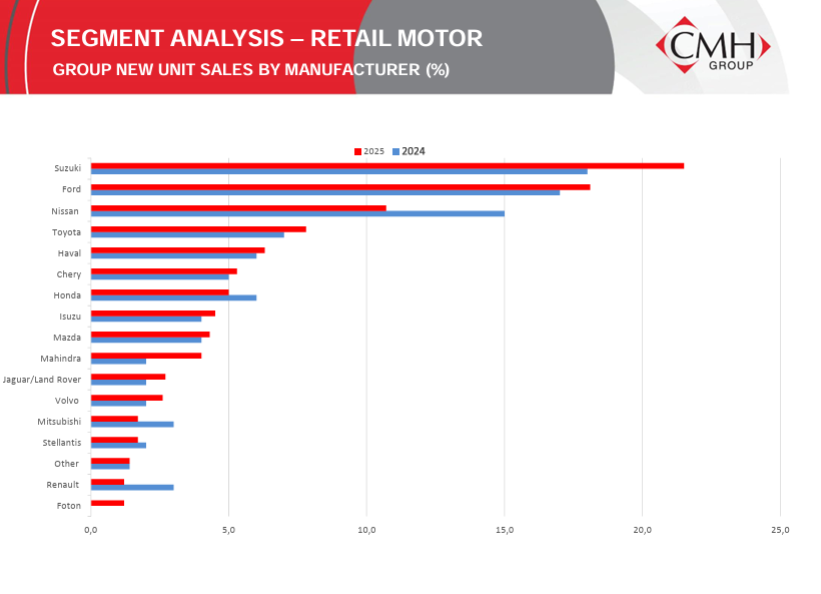

Although I already wrote about CMH’s results in detail when they were released, the company subsequently made an analyst presentation available. It’s worth a read if you’re interested in all the details.

There’s one particular chart that I felt was worth highlighting, as it shows how severe the drop in sales was at Nissan and Honda in 2025. It also shows how important Suzuki is to the group story and how this is their best defence against the Chinese onslaught in passenger vehicles:

Although Ford did well, their focus is on the light commercial market. If quality Chinese bakkies make a mark, then those sales are also at risk.

More auction results from Gemfields, this time for emeralds (JSE: GML)

And once again, comparability is difficult

As we saw earlier in the week with the results of a rubies auction, Gemfields has released numbers that aren’t easy to interpret. At least this wasn’t a mini-auction, with total revenue of $16.4 million comparing favourably to the auction in November 2024 that raised $16.1 million.

The average price was $6.97/carat, which is once again a million miles below the recent results that varied from $15.90/carat to $167.51/carat. The mix of emeralds in any given auction can vary dramatically, leading to this range of prices and making it really hard to figure out whether this is good or bad news.

This means we have to rely on management commentary, with the company calling this a “notable improvement” on the November auction. They have all the details on how pricing played out for this specific mix of stones, so I have to assume that this is an accurate reflection of what happened.

The market didn’t like Glencore’s production update (JSE: GLN)

An 8.6% drop in the share price on the day took the year-to-date move to -29%

Glencore has released a production update for the first quarter of the year. At this stage, energy coal’s guided production range for the full year has been reduced by 5%, while other guidance is unchanged. So, not a fantastic start.

Copper is also causing some stress for investors, as it had a slow start to the year with Q1 production down 30% year-on-year. Although Q1 is a seasonally slower period for copper production, it does put pressure on the rest of the year and of course this heightens the risk of anything going wrong. They expect a 42/58 split for H1 vs. H2 copper production this year, so there’s a lot of uncertainty heading into the rest of 2025.

To add to the uncertainty, the Marketing side of the business is of course dealing with all the complexity created by the tariff environment and the recessions risks in the global economy. Volatility can also represent opportunity and you would probably back the smart people at Glencore to figure that out, as the company has quite the reputation. For now, they are taking a safe approach with their guidance, with an expectation for Marketing Adjusted EBIT to be in the middle of the long-term guided range of $2.2 – $3.2 billion for the year.

Glencore’s share price is down 44% in the past 12 months. Commodity cycles can be brutal things. There is a risk-off flavour to the market, which is why a disappointing Q1 production number caused this kind of sell-off.

The Gold Fields deal to acquire Gold Road may still have legs (JSE: GFI)

After an initial rebuttal by the Gold Road board, the parties are talking

On 24 March, Gold Fields announced that it had put in a non-binding, indicative proposal for Gold Road Resources. They want to acquire 100% of the company through a scheme, which is why the Gold Road board would need to be happy with the terms and would need to agree to propose them to shareholders.

The underlying asset that is driving the deal is Gruyere, a low-cost gold mine in Western Australia. Gold Fields is already operating the mine and Gold Road owns it, so the parties are joint venture partners.

The Gold Road board initially rejected the proposal, which isn’t unusual in an effort to get the price up. In response to press speculation, Gold Fields has confirmed that active discussions with Gold Road are underway, so the parties are clearly back at the negotiating table.

Again, this isn’t unusual and it doesn’t give any guarantees that a deal will go ahead.

Much, much better numbers at MTN Nigeria (JSE: MTN)

This compounds the good news story out of MTN Ghana

It feels good to be reading about better numbers from MTN’s African subsidiaries. MTN’s share price is up 32% this year, with the market putting a lot more belief in the growth story.

Thankfully, the numbers seem to be supporting that view. After releasing solid numbers from MTN Ghana, the group has now followed it up with a far more positive performance than I can recall seeing at MTN Nigeria.

Naturally, the macroeconomics are playing a major role here, just as they did when things were really tough. The exchange rate was fairly stable vs. the US$ and inflation was “only” 24.2% – you can’t apply developed and even emerging market standards to frontier markets like Nigeria. The trick is to compare revenue growth to inflation, with the goal always being to achieve meaningful real growth.

Sure enough, with service revenue growth of 40.5% and EBITDA up by 65.9%, there’s plenty of real growth. And because of the improved forex picture, they swung wildly from a loss of N392.7 billion to profit of N133.7 billion. There was positive free cash flow of N209.9 billion, despite a 159% increase in capex.

A source of uncertainty in the coming quarter is the implementation of the new tariff structure. Most of the adjustments only took place in March, so the full impact wasn’t in these numbers. For now, MTN Nigeria is seeing resilience among customers in response to the pricing change, so that’s encouraging.

With EBITDA margin up 720 basis points to 46.6%, there’s a lot more to smile about at MTN Nigeria – especially as they made plenty of progress in reducing their foreign debt exposure. With only 23% of total debt denominated in foreign currency and with the business currently generating free cash flow, they have a real chance of getting things on track here.

Oceana has given tighter earnings guidance (JSE: OCE)

Things certainly could’ve been worse

In February 2025, Oceana noted that HEPS for the six months ending 31 March 2025 would be at least 40% lower than in the comparable period. One of the reasons was the previous record-breaking production by Daybrook that created an incredibly tough base for comparison.

Now, as any experienced investor will know, the words “at least” sometimes work very hard in trading statements. The subsequent move can be much worse than initially guided, so be careful whenever you see that wording. Thankfully, Oceana’s initial guidance was on point, as the updated guidance is for a decrease in HEPS of between 40% and 48%.

Although fish oil prices didn’t do Daybrook any favours in this period, there were other positives to help offset the impact. This included the performance in segments like Lucky Star and Wild Caught Seafood, with full details to be included when the group releases interim earnings.

The fishing sector depends on a large number of external factors, so variability in earnings is a feature rather than a bug. The share price is down 23% in the past 12 months.

Renergen is on a cash flow treadmill (JSE: REN)

Litigation costs aren’t helping

Renergen has released its financials for the year ended February 2025. As I’ve written before, there’s no expectation of profits at this stage in the company’s journey. Still, seeing the loss increase from R110.3 million to R236.1 million is rather scary.

LNG sales volumes and prices both moved higher, so revenue was R52.1 million. Although that obviously helped, the reality is that they are still firmly in cash burn phase. Getting liquid helium production off the ground cost a fortune and there were many delays. On top of this, they had significant increases in interest costs (up from R22.7 million to R81.1 million) and operating costs, including cash and non-cash costs. Seeing a high depreciation expense is one thing, but noting negative cash from operations of R150.6 million is quite another.

Cash on the balance sheet fell from R471 million to R28.3 million. To help support the next phase of cash burn, AIRSOL subscribed for a second tranche of convertible debentures to the value of $4 million in March. That won’t get them far at the current level of expenses, so I’m quite sure we will see more share issuances in the coming year.

It also doesn’t help that Renergen has been involved in a great deal of litigation, with legal and professional fees of R12.1 million for the year. Although they landed a blow against Springbok Solar through a challenge to the Section 53 consent, the court still hasn’t delivered its ruling. There are other fights underway as well, including a claim and counterclaim situation with the contractor for the process plant, as well as Molopo’s attempt to cancel the loan agreement for alleged breach of a condition. Renergen notes that the soonest hearing date in the High Court in Gauteng is 4 years and 9 months away, which is absolutely ridiculous and a reflection of how bad things have gotten in our courts. Molopo will have to be patient, it seems.

Renergen’s share price is down 46% over 12 months. Although it more than doubled from the recent 52-week low, it remains a highly speculative stock.

Supermarket Income REIT refinanced £90m in debt (JSE: SRI)

This is a useful indicator of UK funding costs

Property funds operate with a targeted loan-to-value (LTV) ratio, or at least a range. This debt is needed to juice up the returns from the properties, as these funds can access debt at attractive rates. Unlike most companies where debt comes and goes, the concept of having debt is baked into the REIT model. This is why you will frequently see them refinancing debt that is about to mature.

The latest such example is Supermarket Income REIT, which refinanced £90 million in debt through a new unsecured debt facility with Barclays. This will refinance existing facilities with Wells Fargo and Bayerische Landesbank of £30 million and £55.4 million respectively, which were due to mature in the next 12 months.

The new facility is an interest-only facility, which means that the capital is only repayable when it matures after three years. The lender has the discretion to extend it by two years. The loan is priced at a margin of 1.55% above SONIA. At current rates, SONIA is 4.46% and thus the current floating rate is 6.01%.

But here’s the good news: there are existing interest rate hedges on the maturing facilities that will cap the rate at 5% at no additional cost to the company. This gives them certainty over the cost of debt, with the potential for it to move lower if SONIA drops significantly.

The company’s expected pro-forma LTV after the refinancing is 31%, which is a healthy level.

Nibbles:

- Director dealings:

- A non-executive director of Dis-Chem (JSE: DCP) sold shares worth R38.6 million.

- Gerrie Fourie is retiring as the CEO of Capitec (JSE: CPI) in July this year. In such a case, it’s not uncommon to see a sale of shares as the outgoing executive looks to diversify exposure. Fourie has sold shares worth R26.2 million.

- Here’s another example of yet more sales of Standard Bank (JSE: SBK) shares, this time by the CFO. He sold shares worth R30 million.

- A director of Italtile (JSE: ITE) sold pledged shares worth R384k.

- Anglo American (JSE: AGL) enjoyed strong shareholder support for the demerger of Anglo American Platinum (JSE: AMS), with 99.94% of votes being in support of the deal. There are still some conditions precedent to be met, with the demerger expected to become effective on 31 May. At the AGM for Anglo, the address to shareholders also included this nugget about De Beers that I felt was worth including in full (and you can decide for yourself if the challenges are only in the “near-term” market):

- MTN (JSE: MTN) is still dealing with the aftermath of its decision to operate in Iran. Turkcell is suing MTN in the South African courts, claiming damages related to allegations of impropriety in how the private licence was awarded in Iran. This goes back more than a decade, when an MTN special committee investigated this and found that MTN was not in the wrong. The latest court development is that the Supreme Court of Appeal has upheld an appeal by Turkcell regarding court jurisdiction. There are also some elements of Iranian Law that apply to the dispute. This has no bearing at all on the merits of Turkcell’s case, but it does mean that the legal process can move forwards.

- MC Mining (JSE: MCZ) released a quarterly update that reflects a 13% drop in run-of-mine production at Uitkomst on a year-on-year basis. This obviously had a significant negative impact on sales volumes. Coal prices were also under pressure. But of course, what really mattered was the approval by shareholders of the next tranche of the Kinetic Development Group deal that will see them holding a 51% interest in MC Mining.

- Jubilee Metals (JSE: JBL) is in the process of finalising the trials of the processing of various high grade copper ores at the Roan Concentrator. This is quite a complex process, as they need to adjust the circuit at Roan for each material. The results have therefore been delayed, with further trials expected over the next couple of weeks.

- enX (JSE: ENX) recently announced a deal with Trichem South Africa for West African International Proprietary Limited (WAI). This business is in South Africa by the way, not in West Africa! The deal sees Trichem subscribe for 25% in WAI, with an option to acquire the remaining 75%. The subscription step has been completed, with gross proceeds of R107.3 million flowing into WAI.

- Remgro (JSE: REM) and Vodacom (JSE: VOD) have received the reasons for the Competition Tribunal’s decision to prohibit the fibre deal. They tend to submit an updated notice of intention to appeal on 2nd May, with the Competition Appeal Court having reserved 22 to 24 July 2025 for the hearing. Although the transaction long-stop date has now been extended to 23 May 2025, they will clearly need to extend it several more times if they hope to get the deal done.

- Super Group (JSE: SPG) announced that the SG Fleet scheme of arrangement in Australia has been implemented. This deal couldn’t have come at a better time for the group, as they are wrestling with the broader disruption to the automotive industry.

- Southern Palladium (JSE: SDL) is still in exploration phase, so the quarterly update just gets a mention down here in the Nibbles as it serves of more of a reminder of progress than anything else. The company’s pre-feasibility study for the Bengwenyama PGM project has an expected IRR of 28%, which is solid. Looking ahead, they expect a decision by the DMRE on their mining right application in the coming quarter.

- At Kore Potash (JSE: KP2), the quarterly report doesn’t give us much in the way of new information. They expect an 18% IRR from the Kola Project on an ungeared post-tax basis, which will hopefully be enough to get investors across the line. The funding structure is going to be crucial, as any funding sources that come in at a lower cost than the ungeared IRR would significantly boost the geared IRR (i.e. the returns to equity holders). The quarterly update didn’t have any additional information on the Summit Consortium proposal. A separate announcement about the suspension of trading did have reference to the proposal though, with the ASX now imposing a suspension and the JSE lifting its trading halt. This is a really complex situation in which there are multiple exchanges involved that have different rules. Kore Potash is sticking to their guns about not disclosing any details of the funding proposal while they are negotiating it, which seems perfectly reasonable to me. If that leads to short-term trading suspensions, then so be it.

- Stefanutti Stocks (JSE: SSK) announced that the timeline for fulfilment of the conditions precedent for the disposal of SS-Construções (Moçambique) Limitada has been extended out to 31 May 2025. Also, the lenders have agreed to extend the capital repayment profile of the loan as well as its duration out to 30 June 2026. It’s all about creating breathing room on the balance sheet as part of the broader capital restructuring.

- In an effort to get more international investors, Datatec (JSE: DTC) is now trading on the OTCQX platform. This is focused on giving US investors a way to buy the shares quoted in US dollars. This isn’t the same as having a listing on one of the major US exchanges, but it is a step in that direction for many companies.

- Kibo Energy (JSE: KBO) announced that its financials for the period ended December 2024 are unlikely to be published by June 2025, which means that they will miss the deadline under AIM rules (the development board on the London Stock Exchange). This is because they are looking at potential acquisitions under a reverse takeover transaction. If they can’t find one, then I suspect that it would affect whether the audit is conducted on a going concern basis.

- London Finance & Investment Group (JSE: LNF) has confirmed that the suspension of its shares from trading will be from 7 May, with the delisting scheduled for 9 May.

- I don’t usually comment on non-executive director appointments, but I thought it was worth noting the appointment of Lisa Seftel to the board of Frontier Transport Holdings (JSE: FTH). What caught my eye is that she has loads of experience in various spheres of the South African government. Given Frontier’s business model and the level of collaboration required with government around transport systems, this seems like a sensible appointment to me.

- Here’s another interesting director appointment for you: KAP (JSE: KAP) has appointed Samara Totaram to the board as an independent non-executive director. Her most recent role was as STADIO’s CFO. She brings loads of corporate finance experience, which will be helpful to KAP from a dealmaking perspective. Is the company preparing for corporate activity?

- Absa sent out a circular to its preference shareholders (JSE: ABSP) regarding the repurchase of the shares at 930 cents per share. Be sure to read it if you are a preference shareholder.