A focus on margins has paid off at Adcorp (JSE: ADR)

The market loved this news

Adcorp tends to have a wide bid-offer spread, but that’s not the reason why the share price was trading 34% higher by the late afternoon. Volumes were almost 5x the average daily volume and all the action came after the release of an exciting trading statement.

For the year ended February 2024, Adcorp expects HEPS to come in between 51.6% and 71.6% higher. This means a range of 127.0 to 143.8 cents, so it’s not a surprise that the share rallied in response. It was trading at R4.10 at the start of the day, which suddenly became a modest P/E ratio even by Adcorp’s standards. Even at the closing price of R5.50 per share, that’s a P/E of just over 4x.

The low P/E is a function of the lack of growth in this space, with Adcorp’s resourcing businesses dealing with a tough economy and a bunch of other factors, like the impact of AI on white-collar jobs. This has forced the group to focus on costs and margins, with clearly visible results.

Full results are due for release on 29th May.

Profits more than halve at Astral Foods (JSE: ARL)

Aah, the joys of poultry margins

The margins in chicken farming are the stuff of legend. It takes just a few changes further up the income statement to cause huge swings in net profit and thus profit margin. This is evidenced by results at Astral Foods for the six months to March 2025, where revenue was up 3.5% but operating profit fell by a nasty 50.7%. This took net margin down from 5.3% to 2.5%. Ouch!

At least the balance sheet is a lot stronger these days, supporting an interim dividend of R2.20 per share (a decent payout ratio vs. HEPS of R4.09). For context, the share price is over R186, so you definitely aren’t buying this for the dividend.

Trying to guess how the broader industry will perform truly is a game of chicken. For example, with SAFEX yellow maize prices up 28%, you would expect there to have been margin pressure in the Feed division. But instead, thanks to a significant drop in soymeal prices (and chickens presumably having more flexible tastes than the average toddler), they managed to not just maintain margins in the Feed division, but improve them by 10 basis points to 5.6%.

The same can’t be said for the Poultry division, where revenue was up just 1.5% and Astral was on the wrong side of the increase in feed costs. Once again, Astral is subsidising the cost of producing chicken, with a loss of R26 million for this division in the period. To add insult to injury, a cybersecurity incident cost the division R20 million.

The outlook statement by the company is essentially a laundry list of risks. And yet, the Astral share price is up 20.7% in the past 12 months. I genuinely don’t understand how anyone can do a reasonable valuation of the companies in this industry, hence I avoid it entirely.

Famous Brands: a scrappy set of numbers, but margins went up at least (JSE: FBR)

And margins are what really matter right now

The year ended February 2025 saw an acceleration in the second half by Famous Brands, as they took advantage of a period that saw practically no load shedding. HEPS for the six months to August was up 9.5% and the full-year result was an increase of 11.9%, so that’s encouraging momentum for the group.

This was firmly a story of margin rather than revenue, as revenue was up just 3.2% and operating profit increased by 12.6%. That’s a 90 basis point improvement in operating profit margin, from 10.1% to 11.0%. This has driven an improvement to the balance sheet, with net debt to EBITDA down from 1.13x to 0.89x.

We begin with the Brands part of the business, which means the franchised restaurants that you know and possibly love. There are various sub-categories here.

Leading Brands, the part of the business with the takeaway businesses that have been the foundation of the group, increased its revenue by 1.6% and operating profit by 7.5%. That’s not exciting on the revenue line, but it’s a lot better than Signature Brands (the fancy restaurants) where revenue fell by 4.4% and the operating loss margin worsened from -1.9% to -5.7%. Looking beyond the South African business, the SADC region grew revenue by 10.0% but suffered a slightly dip in operating profit and thus a contraction in margin from 13.4% to 11.2%. The Africa and Middle East business may have grown revenue by 27.7%, but their operating loss jumped from R14 million to R43 million, a nasty margin of -60.5%. And finally, Wimpy UK had a horrible time, with revenue down 18.5% and the operating margin more than halving from 11.4% to 5.4%.

The Manufacturing side of the business only increased revenue by 2.5%, yet they increased operating profit by 25% and improved the margin from 9.0% to 11.0%. This was the star of the show for Famous Brands in this period.

In the Logistics business, revenue may have been up 4.1%, but operating profit margin declined from 1.9% to 1.4%. Those are paper-thin margins.

As for the Retail division, the margins are even worse. Revenue dipped by 6.6% to R344 million and operating profit fell from R6 million to R1 million. That is a truly horrible return on capital, as the working capital required to support those sales to retailers is substantial.

The group expects a low growth year in 2026. Trading on a P/E of 11.3x, I’m just not sure that there’s enough in this story to keep the multiple at that level.

Margins on the up at Netcare (JSE: NTC)

And a 20% increase in the dividend

Netcare released results for the six months to March 2025. Although revenue was up just 5.3%, they managed to convert this into operating profit growth of 11.5% and a jump in HEPS of 20.9% (or 20% on an adjusted basis). Cash quality of earnings is strong, with the interim dividend also up 20%.

This means that Return on Invested Capital (ROIC) has improved from 10.9% to 11.9%. It’s still too low of course, with hospital groups having quite the reputation for earning sub-par return on capital. At least this metric is trending in the right direction. The group has followed a sensible approach of executing share buybacks, which is what you want to see in terms of capital allocation discipline.

And in line with the recent trend, maternity cases continue to decline. Humanity just isn’t in a particularly great space right now when it comes to making more humans. I always contrast this trend to mental health, where demand is “robust” – another indication of how people are doing at the moment.

Prosus launches the all-cash offer for Just Eat Takeaway.com (JSE: PRX | JSE: NPN)

Bloisi’s growth strategy continues

News of this transaction first broke in March this year. I went into it in some detail at the time in my weekly Moneyweb podcast (you’ll find that episode here and I would love it if you became a regular listener).

Food delivery is one of the verticals that Prosus / Naspers really likes. It’s a familiar space for CEO Fabricio Bloisi, as he cut his teeth by scaling a food business in South America. Europe is certainly not the same place as South America, hence it will need a strategy around efficiencies rather than outright growth. Of course, being able to deliver a product with more efficiency is also a way to drive growth, as it can become more cost competitive.

The offer price of EUR 20.30 per share is a 63% premium to the closing share price on 21 February 2025. It has been unanimously recommended to shareholders by Just Eat Takeaway.com’s board. Top executives including the CEO have agreed to accept the offer.

The timing is clever, as Just Eat Takeaway.com has been through a tough period in which they made mistakes and eventually got out of the US market. This makes it perfect for the Prosus / Naspers crew, as it means that (1) it fits the strategy of building a non-US platform and (2) they can get it for a good price.

The deal is worth EUR 4.1 billion. Revenue over the last twelve months was EUR 3.6 billion. That’s a price/sales multiple of just over 1.1x, which is a bit of a joke for a platform business like this (in a good way). It’s not surprising that some minority shareholders have launched a public campaign to discredit the offer price, calling it far too cheap.

This is how markets work – successful companies get to buy unsuccessful ones and fix them. Here’s a share price chart of Prosus vs. Just Eat Takeaway.com based on their European listings (and thus in comparable currency):

Unlike his predecessor who loved deploying as much capital as possible at the very top of the cycle, Bloisi is able to execute opportunistic deals that take advantage of the broken growth stories in a post-pandemic environment. This is one of the reasons why I’m now long Prosus.

Pressure on Renergen after the release of financials (JSE: REN)

The share price fell 5% on strong volumes

Renergen’s financial performance for the year ended February 2025 wasn’t exactly a secret. The company had previously published a preliminary report that gave a strong indication of what was coming. Despite this, there was a strongly negative market reaction to the detailed financials.

Renergen’s revenue may have increased by 79.7%, but that’s off a tiny base relative to the expenses in the company. This is why the headline loss per share jumped from 75.07 cents to 159.15 cents.

LNG production may have increased by 70% for the year, but that’s not really what the market is interested in. The value lies in helium, which only achieved its first delivery in March 2025 (after the end of this period). This makes the 2026 financial year absolutely critical, as any missteps in the helium story could literally sink the company.

Why is that the case? Well, Renergen is burning through cash and is reliant on ongoing support from funders and investors. That support is based entirely on the expectation of helium successfully being produced and sold. This is why 2026 is the make-or-break year, as I can’t see the market having any further patience.

And here’s the kicker that the market may have particularly hated: as of February 2025, Renergen is in default with the United States Development Finance Corporation. This paragraph from the results should make the risks pretty clear to you:

Tharisa has suffered a huge drop in earnings (JSE: THA)

Chrome prices and the weather were major negative impacts

Tharisa released a trading statement dealing with the six months to March 2025. There’s no good news here I’m afraid, with HEPS expected to drop by between 76.6% to 84.3%. As a reminder, the company reports in US dollars.

This substantial decrease has been attributed to weather-related operational challenges and weakness in chrome prices. Although PGM prices have at least stopped sliding, they also haven’t exactly been on the up. The combination means that operating conditions remain tough in the sector.

With interim HEPS of between 2 and 3 US cents, that share price of R14.50 looks very high.

Vodacom: stretching the term “normalised” as far as possible (JSE: VOD)

This kind of reporting is nonsense

There are many companies out there that distinguish between “reported” and “constant currency” numbers. There are good reasons for this, as it helps investors distinguish between underlying, in-country growth vs. the impact of converting the results into the reporting currency.

It’s also not unusual to see “normalised” numbers, as companies have often undertaken large corporate actions that introduced additional costs into the system.

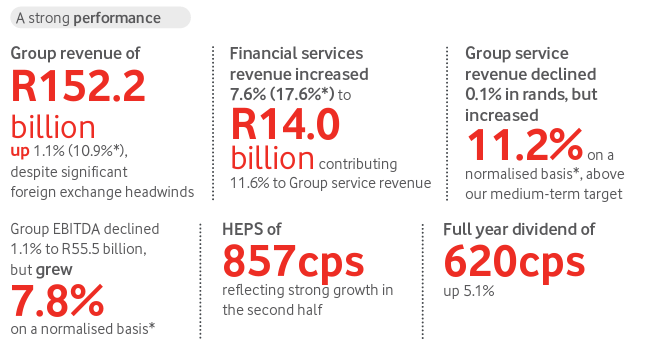

But I can’t recall another example of seeing constant currency numbers presented as being normalised, particularly when I know that the currency impact is significant. For the year ended March 2025, Vodacom has reported revenue growth of 1.1% and operating profit growth of 1.3%, yet these magically turn into 10.9% (both of them) on a “normalised” basis.

If you are deeply invested in Africa, you cannot tell me that the constant currency basis is “normalised” in the way that most people would understand that term. They shouldn’t be allowed to report numbers like this. I fully understand that companies will try and put the best story forward, but just look at this example of where they are putting the emphasis:

Every small percentage increase is in black. Every large one is in red. Skim readers, beware.

The South African business achieved revenue and EBITDA growth of 2.3%, so margins have been consistent locally. Egypt grew very strongly in constant currency, up 45.2% in revenue and 70.4% in EBITDA. This is where the currency really plays a role, as the numbers reported in rand reflect an 8.2% decrease in service revenue and just 2.9% growth in EBITDA.

The rest of the African business (Tanzania / DRC / Mozambique / Lesotho) saw a 10.4% increase in reported revenue, yet a 13.8% drop in EBITDA. Finally, Safaricom in East Africa grew revenue by 21% as reported and EBITDA by 15.3% on the same basis, making it the genuine standout result.

Credit where credit is due: the fintech business is growing solidly, including in Egypt where it was up 14.1% as reported or 80.1% on a constant currency basis.

There are actually some good news stories in Vodacom. It’s just a pity that they are wrapped up in such a clumsy attempt to gloss over the currency risks that the group faces. How different our continent would look if the macroeconomic situation just needed to “normalise”…

WeBuyCars impacted by the listing structure, but the core business is growing (JSE: WBC)

All the important metrics are going the right way

I have a long position in WeBuyCars for two reasons. The first is that I was a Transaction Capital shareholder at the time when it blew up, so my resultant WeBuyCars stake is essentially the corporate equivalent of a PS: I’m Sorry chocolate bar. The second is that WeBuyCars is a really good business that is consistently winning market share in South Africa. I would much rather be exposed to churn of the existing national car parc than rely on selling new cars to local consumers.

My theory is working out just fine, with revenue for the six months to March up by 15.2%. Growth companies always have to be careful of their working capital, so it’s encouraging to see that cash generated from operating activities was up 6.4%. The growth mindset also comes through in the target dividend payout ratio of just 25% to 33% of headline earnings per share, resulting in an interim dividend of 30 cents. They are hanging onto plenty of capital for growth purposes.

The comparable dividend is of no help, as it reflects the huge pre-IPO dividend that was payable as part of WeBuyCars being separated from its toxic host. This process also significantly impacted the number of shares in issue, which is why HEPS is up by just 1.6% despite core headline earnings being 26.4% higher.

The group remains firmly on a growth path. The impact of the additional number of shares will normalise soon and although the impact on HEPS is frustrating, I’m certainly not complaining about the share price being up roughly 125% since listing in April last year.

Nibbles:

- Back in September 2024, Grindrod (JSE: GND) announced an intention to acquire the remaining 35% in Terminal de Carvão da Matola Limitada (TCM), the Maputo dry bulk terminal that has been taking advantage of South Africa’s infrastructure failings. All conditions precedent to the deal have been met and they will now move to closing. A deal is never done until all the conditions have been met, so this is important.

- Gemfields (JSE: GML) achieved strong support at its Extraordinary General Meeting for the fully underwritten rights issue. This isn’t a surprise, as they are in somewhat desperate need of the capital. Interestingly, although 94.41% of votes were cast in favour of the issuance of shares, only 86.33% were in favour of the underwriting issue. That’s still an approval, but it does show some discomfort among shareholders.

- AYO Technology (JSE: AYO) announced that a potential offeror (at this stage unnamed) has expressed a firm intention to make an offer for all the shares in the company not already held by that offeror. The announcement is currently under review by the Takeover Regulation Panel (TRP) and will be released in due course.

- MTN (JSE: MTN) announced that Moody’s has affirmed its credit rating with a stable outlook. This gives further support to the overall narrative of how well things have stabilised there.