There’s finally a succession plan at CMH (JSE: CMH)

The gives the market some certainty

To say that the CMH directors have been around for a while would be an understatement. CEO Jebb McIntosh has been on the board since 1976 (12 years longer than I’ve been alive) and financial director Stuart Jackson has been on the board since 1986 (when my parents were no doubt starting to have conversations about bringing a little ghost into this world).

We can therefore agree that it’s time for a succession plan. Charles Webber, the CEO of the group’s motor retail and distribution division, will be appointed to the board and is clearly being prepared to take over as CEO. For now, McIntosh remains CEO.

Priya Govind has been nominated to take over as financial director from Stuart Jackson, having been with the group since 2023. The announcement doesn’t give a specific date for the handover, but rather talks about an “orderly transition” in the role.

It’s hard to let go after that many years. At least the process is finally happening.

Double-digit earnings growth at Invicta (JSE: IVT)

As always, HEPS is the metric to look at

Invicta has released a trading statement dealing with the year ended March. They seem to have done well, with expected HEPS growth of between 11% and 17%. This takes them to a HEPS range of 520 cents to 548 cents. The mid-point of that range is a Price/Earnings multiple of 6.3x.

There’s a big difference between Headline Earnings Per Share (HEPS) and Earnings Per Share (EPS) in this update due to a profit on disposal of the main warehouse in Singapore by Kian Ann Engineering. EPS growth of between 54% and 60% therefore isn’t reflective of the maintainable underlying growth in the group.

The market enjoyed what it saw, with Invicta trading over 5% higher by afternoon trade.

Ninety One had a much better second half to the year (JSE: N91 | JSE: NY1)

But not enough to fully offset the first half

Ninety One has reported results for the year ended March 2025. It was very much a tale of two halves, as the financial cliché goes.

In the first half of the year, they suffered net outflows of £5.3 billion. In the second half, they managed net inflows of £0.4 billion. That’s quite a swing! Thanks to overall market returns, assets under management (AUM) increased by 4% for the year to £130.8 billion.

It’s interesting to see where the growth was. The alternatives asset class was a star performer, with AUM up 21% to £5.2 billion. They note the alternative credit strategies as a particular highlight here. The South African fund platform was even better, up 19% off a larger base to finish at £13.2 billion. A modest 3% increase in equities to £60.1 billion also contributed. Fixed income was a drag on growth, ending slightly down at £31.8 billion. The final category is multi-asset, up 1% to £20.5 billion.

It’s interesting to note that AUM from UK clients fell by a pretty nasty 13% to £21.1 billion, due to large clients “rebalancing their portfolios” with reduced allocations to certain strategies. Meanwhile, clients in Africa (including SA) contributed 9% growth in AUM to £55.6 billion. Asia Pacific was a bright spot, up 14% to £23.6 billion.

Another way to slice and dice the business is institutional vs. advisor AUM, with the former up 6% to £85.5 billion and the latter down 1% to £45.2 billion. Having a primarily institutional business does open the group up to significant flow decisions by large clients, as evidenced by the UK business in this period.

Despite the 4% increase in AUM, adjusted operating revenue grew by just 1.1%. Adjusted operating expenses increased by 2.3%, hence adjusted operating profit fell by 1.4%. Adjusted operating margin dipped by 80 basis points to 31.2%. Finally, HEPS was down by 7%.

So, on the whole, a poor start to the year made it difficult for them to try and save the year. The market certainly appreciated the second half momentum though, as well as the total dividend per share for the year being down just 1%. Ninety One was trading over 6% higher in afternoon trade.

SPAR has tons of work to do (JSE: SPP)

Even continuing operations are under plenty of pressure

SPAR has released results for the 26 weeks to 28 March 2025. They are pretty rough I’m afraid, so buckle up.

After learning very hard lessons in Poland, they are being more decisive with getting out of difficult offshore businesses. It’s certainly better to sell something while it still has some value, rather than waiting to pay someone to drag the carcass away. SPAR Switzerland and AWG in England have been recognised as discontinued operations, which means they were impaired by R4.2 billion in the process. Ouch! The post-tax losses in those operations (including the impairment) come to R4.4 billion. Of course, merely determining that something is held for sale and actually selling it are two different things.

If we then focus on continuing operations, we see that turnover dipped by 0.2%. Under the circumstances, it’s not a bad outcome that operating profit was up 1.6%. HEPS fell by 0.4% to 450.1 cents.

The Southern Africa business is dealing with low food inflation, just like everyone else in the sector. This makes them reliant on growth in volumes, which is tough when the rise of on-demand shopping has cast serious doubt on the competitive advantage of SPAR’s convenience locations in strip malls, where you can park and run in quickly to get something. The parking and running is being done by a scooter driver these days, often to the soundtrack during delivery of an over-excited toddler who thinks that every Sixty60 driver is a superhero.

So, competition has come to SPAR and in a big way. They managed like-for-like retail revenue growth of just 1.6%. Remember, the owners of your local SPAR aren’t obligated to buy from the holding company listed on the JSE, so there’s a difference between retail revenue growth and wholesale revenue growth. Grocery and liquor wholesale revenue was up just 1.1%. Interestingly, they believe that growth was better among lower-income segments vs. middle- and upper-income segments. I have to believe that this is the Sixty60 / Dash effect, with Pick n Pay’s ASAP offering gaining traction as well. SPAR2U might be up 174% in delivery volumes, but I can still count on my fingers the number of times I’ve seen one of those vehicles on the road.

Build it was actually a highlight in this period, which isn’t something that we’ve seen for a while. Like-for-like sales were up 5.4% and gross margins went higher. The DIY sector is finally seeing some love!

SPAR Health is also doing well, with revenue up 13.7%. Loyalty (the way they measure the extent to which franchisees procure from the holding company) increased significantly from 53.2% to 58.0%. SPAR is up against other major wholesalers in the market, including those operated by Clicks and Dis-Chem.

The business in Ireland is significantly smaller than in Southern Africa, contributing around a third of operating profit. Local currency revenue fell by 0.6%, with the opposite issue on that side of the bond in terms of higher inflation putting pressure on volumes.

With net borrowings at R6.6 billion and net debt / EBITDA in continuing operations sitting at roughly 2x, the balance sheet is in decent shape overall. It’s going to come down to how efficiently they can sell the businesses in Switzerland and England. Negotiations are already in progress with interested groups.

There are a number of management initiatives in both Southern Africa and Ireland. I expect that focusing on just two regions will improve the situation in both of them, with the group expecting to see margin improvement in the second half of the year. The market seemed to like this, with SPAR closing 3.3% higher on the day.

Nibbles:

- Director dealings:

- An executive at Richemont (JSE: CFR) sold shares in the company worth R69 million. This individual can certainly afford to buy the company’s watches!

- Oando (JSE: OAO) finally released results for the year ended December 2024. They include roughly four months’ worth of numbers from Nigerian Agip Oil Company, which was acquired in August 2024. This contributed to a 44% increase in revenue. Profit after tax was up 267% off a small base. And in good news for the balance sheet, they are enjoying the support of lenders, as evidenced by an upsizing of the reserve-based lending facility to $375 million. There’s very little liquidity in this stock, so you would have to be very excited at the thought of the Nigerian oil sector to spend much time on this.

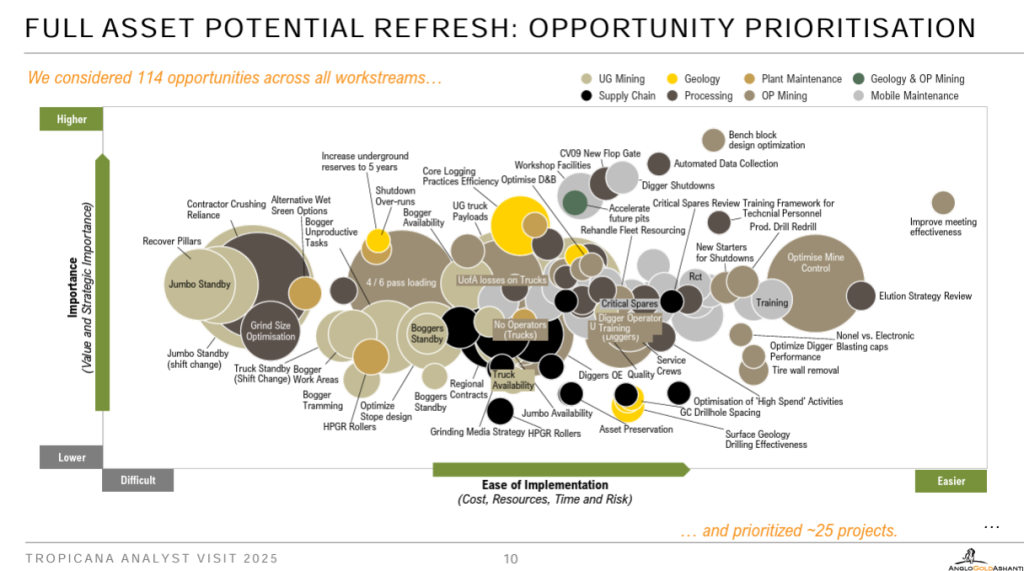

- If for some reason you would like to learn more about AngloGold Ashanti’s (JSE: ANG) exotically named Tropicana mine in Australia, then the company has made a presentation available. I’ve seen some wild slides in my life, but this surely takes the cake:

- Datatec (JSE: DTC) has released the circular for the scrip distribution alternative. This gives shareholders the ability to receive more shares in lieu of a cash dividend. If you’re a shareholder, I suggest that you check it out.

- Gemfields (JSE: GML) likes to report something called the G-Factor, which it came up with in 2021. Essentially, it measures the percentage of natural resource revenue paid to governments of countries from which the resource is derived. When you’re doing business in frontier markets, you need to extra steps to make sure that government is happy – and even then, they had issues like the Zambian government slapping an export tax on them out of nowhere (and subsequently removing it). For the 10 years from 2015 to 2024, the G-Factor is 20% for the Kagem emerald mine in Zambia and 25% for the Montepuez ruby mine in Mozambique. Perhaps the Zambian government is just jealous.

- Shuka Minerals (JSE: SKA) has received interim approval from the Competition and Consumer Protection Commission (CCPC) for the acquisition of a 100% interest in Leopard Exploration and Mining in Zambia. They still need to get a final approval, but they can now continue as though that approval will come.

- UK-based property fund Hammerson (JSE: HMN) announced that CEO Rita-Rose Gagné intends to retire as CEO in 2026. This gives them time to find a suitable successor. This hasn’t been the longest stint around, as she only took the top job in 2020.

- Acsion (JSE: ACS) has renewed the cautionary announcement related to a potential acquisition. There’s no further insight at this stage into exactly what they are up to.

- Harmony Gold (JSE: HAR) announced a loss-of-life incident at the Joel mine in the Free State. It’s another tragic reminder that mining in a dangerous industry, even though so much effort is put into safety.