DRDGOLD is loving the higher gold price (JSE: DRD)

But watch those costs

DRDGOLD is a tailings business. This means that they take previously mined material and process it again using modern technology, extracting the last bit of gold that can be economically obtained at this time.

This is a little bit like the old “picking up pennies in front of a steamroller” joke, unless the gold price is doing extremely well and thus the steamroller is taking a break from trying to squash the management team.

This was certainly the case in the year ended June, with group revenue up 26% despite a 3% decrease in gold sales. The gold price clearly did the heavy lifting here, up 31% in rand. This was good for an increase in HEPS of between 64% and 74%.

Far West Gold Recoveries contributed revenue of R2.2 billion and enjoyed a 0.5% improvement in the gold yield, which speaks to operational efficiencies and the quality of the material being processed. Over at Ergo Mining, which is significantly larger with revenue of R5.7 billion, the gold yield fell by 21% and throughput was up 21%, so they have to work much harder there to extract the gold.

Or do they? Costs at Ergo were only up 4%, so the substantial increase in throughput isn’t driving a similar increase in costs due to having fewer, hydraulically mined sites. At Far West Gold Recoveries, costs were up 8% despite the stronger yields, as the recovery process seems to be less efficient there. Thanks to the technology involved in processing the materials, the level of throughput isn’t necessarily the best predictor of costs.

Free cash flow was given a boost by capital expenditure coming in R731 million lower vs. the prior year, a drop of 24%. This was thanks to the completion of major projects. The overall swing in free cash flow was rather breathtaking, from an outflow of R1.2 billion to an inflow of R1.2 billion!

The share price is up 56% this year.

Growthpoint has fully exited NewRiver REIT (JSE: GRT)

The strategy to have a more focused group continues

You may recall that Growthpoint sold its shares in Capital & Regional in a deal announced back in 2024, with shares in NewRiver REIT as part of the settlement for that transaction.

Growthpoint has now sold off all of those shares for gross proceeds of £50.5 million. Most of the shares were acquired by NewRiver in a share buyback and the rest were placed in the market through an accelerated bookbuild.

Growthpoint gives only generic guidance around the use of the cash proceeds, but the recent narrative from the company is one of following a more focused strategy right here at home. In a country where the macro picture remains tough, having broad property exposure all over the show isn’t the right approach. Although NewRiver was offshore exposure rather than South African, there’s a push at Growthpoint to have fewer distractions for management. It will be interesting to see what Growthpoint’s next move is.

Master Drilling’s earnings might be up – and they also might be down (JSE: MDI)

Welcome to the frustrating world of wide earnings guidance

Master Drilling released a trading statement for the 6 months to June 2025. The company gives earnings guidance in both ZAR and USD, as they operate a global business where my understanding is that many of the contracts are denominated in USD.

For the period, HEPS reported in ZAR will be between 5.4% lower and 14.6% higher than the comparable period. Although the midpoint of that is in the green, it’s still a wide range that could include flat or even negative earnings. And in USD, earnings will be between 3.5% lower and 16.5% higher.

Although it doesn’t affect HEPS, there’s happy news about the Mobile Tunnel Boring Machine that was previously impaired. The group managed to finalise a contract to operate this machine, so they’ve partially reversed the impairment to the tune of $4.7 million (the total impairment in the prior year was $7.8 million).

Although you would expect the market to be happy with this, the share price fell 4.9% on the day – admittedly on thin volumes.

MTN Rwanda’s margin moved much higher (JSE: MTN)

The performance in Africa is looking better for MTN across the board

MTN Rwanda can now add its name to the list of African telecoms companies that are doing well. This is a further boost to the MTN story, one which has enjoyed considerable support on the market this year.

During a period in which the inflation rate was 5.7% in the country, total revenue grew by 11.4% – this means that they grew at double the rate of inflation. To add to that happy news, EBITDA grew by an excellent 43.7%. This boosted EBITDA margin by 9.1 percentage points to 40.4%.

As the icing on this cake, capital expenditure excluding leases fell by 61.7%, which means that free cash flow increased by a rather daft 1,804%. It’s better to just look at the numbers than the percentage in a case like that, with free cash flow of 18,913 million RWF vs. just 993 million RWF in the prior period!

Rwanda is an appealing growth market, with projected GDP growth of 7.1% for the full year. MTN shareholders certainly aren’t complaining about being exposed to it.

Things look bleak for Mozam Aluminium at South32 (JSE: S32)

Electricity is a pretty important ingredient in this recipe

In mid-July, South32 alerted the market to a significant issue at Mozal Aluminium in Mozambique. It’s pretty simple, really: no electricity means no operations. The current agreement for the supply of electricity ends in March 2026 and things aren’t looking good in the negotiations.

The counterparties are Eskom and Hidroeléctrica de Cahora Bassa (HCB). I’m not close to the details of this, but I assume that both those parties (certainly the former) could sell their electricity elsewhere, so they don’t need South32. But South32 certainly needs them, creating a clear imbalance of power in the negotiation. I can also only assume that the deal South32 was hoping to get doesn’t provide a sufficient economic return to the electricity companies, otherwise there wouldn’t be an issue in getting this deal done.

For now, South32 will start to wind down Mozal Aluminium with the expectation of it being placed on care and maintenance from March 2026. They are recognising a massive $372 million impairment in the FY25 financials, reducing the carrying value to $68 million.

South32’s share price fell 6.3% on the day, which means it is down 17% year-to-date.

Resilient shareholders are being rewarded this year (JSE: RES)

The focus on retail properties is working

Resilient released results for the six months to June. They are a good reminder of why I far prefer listed property exposure to having any buy-to-let headaches, as Resilient is a highly liquid stock that just achieved growth in the dividend of 12.2%. I would much rather deal with a stockbroker than tenant, personally.

Aside from the benefit of a dip in interest rates in South Africa that does wonders for the profits of property funds, the South African portfolio managed net property income growth of 8.6% on a like-for-like basis. This talks directly to Resilient’s energy investments that have helped reduce exposure to ongoing increases from Eskom. When combined with a decent period of growth for retail tenants, the net result is strong.

The potential for positive reversions when there’s a change in tenant is incredible, with Resilient bringing in 79 new tenants at an average rental that was 19.5% higher than the outgoing tenants. The total base of lease renewals (including existing tenants) was for 287 renewals at rentals on average 2.2% higher than the expired leases.

Resilient’s stake in Lighthouse enjoyed a 7.9% increase in the dividend. Resilient also has direct property investments in Spain and France, in both cases in partnership with Lighthouse. Resilient now owns 27.6% of Lighthouse, having recently sold off some shares to fund other direct property opportunities.

The net asset value per share is R69.83 and the current share price is R65.38, so that’s a modest discount to NAV by REIT standards.

Double-digit growth at Standard Bank (JSE: SBK)

As a reminder, South Africa contributes roughly half of group earnings

If you’re bullish on Africa as a whole, then Standard Bank is the name among local banks that you would probably want to consider. For context, South Africa contributed earnings of R11.6 billion in the latest period and the rest of Africa was good for R9.7 billion. Offshore contributed R1.6 billion and the 40% stake in ICBC Standard Bank generated R0.8 billion. In other words, South Africa was only 49% of group earnings.

Despite a flurry of selling by directors earlier this year for whatever reason, the bank has continued to put in a solid performance. Director sales aren’t always a sign of trouble, but you should always consider them as part of your risk factors – especially when the sales are by more than one director. Some of those execs might be kicking themselves this year, depending on what they did with the money!

The strength of the recovery in Africa this year (MTN’s subsidiaries are another great example) has driven double-digit growth in both HEPS and the interim dividend for the six months to June 2025, both up 10%. Return on Equity (ROE), a key metric for banks, increased from 18.5% to 19.1%.

It all looks strong, boosted by elements like a favourable impairment environment for credit that we’ve seen across the banks. When combined with demand for credit (which is what is lacking in South Africa vs. other regions), banks make money. Standard Bank can also boast a record period for investment banking origination, with Energy and Infrastructure opportunities as the major driver.

It’s just as well that Standard Bank has such extensive operations beyond South Africa, as their macro outlook for real GDP growth in South Africa has dipped for 2025 and 2026 vs. the expectations back in March. Despite this, Standard Bank has reaffirmed its medium-term targets that reflect HEPS growth of 8% to 12%, along with ROE in the range of 18% to 22%.

The media headlines were filled with reports of Standard Bank’s CEO and CFO both planning to retire by 2027. The succession plan will be interesting to keep an eye on.

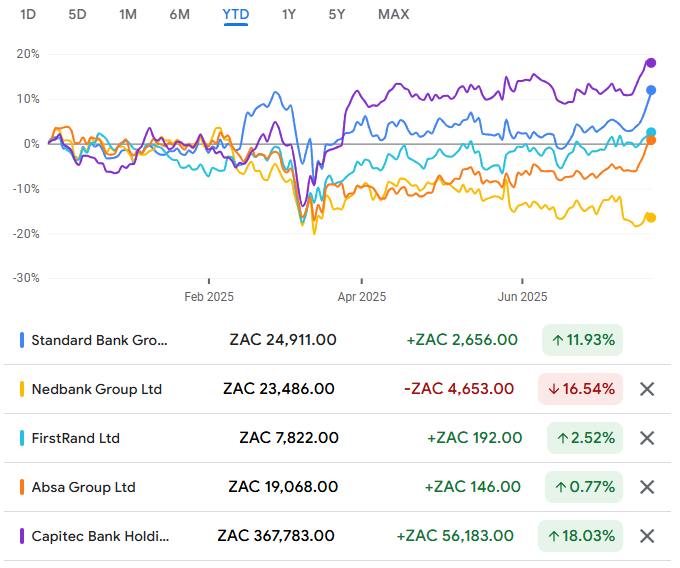

A chart of the banking Big 5 reveals that Standard Bank is second only to Capitec this year, with Nedbank as the clear laggard thanks to its SA focus. Notably, a Satrix Top 40 ETF would’ve returned 24% year-to-date, beating all of these banks:

Nibbles:

- Director dealings:

- Astonishingly, the day before Nedbank (JSE: NED) announced the acquisition of iKhokha, the managing executive of that division (Ciko Thomas) sold shares worth R1.6 million. In my opinion, this sails very close to the wind from a governance perspective. But more than that, it’s a poor signal around their belief in the SME strategy. Nedbank is pretty light on pockets of growth right now and it doesn’t look good when the executive in charge of an area where Nedbank is allocating capital is out there selling shares.

- Despite the Renergen (JSE: REN) and ASP Isotopes (JSE: ISO – coming later this month) deal still needing to meet some conditions, the approval from the Competition Commission means that the companies can already start planning their integration. They expect to achieve the fulfulment of outstanding conditions soon.

- Not that there are exactly many Deutsche Konsum (JSE: DKR) shareholders running around, but in case you somehow fall into that category, be aware that the third quarter report has been released. The loan-to-value improved slightly but is still very high at 55.8%. The portfolio valuation suffered a negative move once again.