Adcock Ingram could delist later this year if the Natco Pharma deal goes through (JSE: AIP)

The latest full-year numbers might be the last ones we see

Adcock Ingram has released results for the year to June 2025. They weren’t exactly a thrilling read, with turnover up 1% as pricing more than made up for a 3.1% decline in volumes. Gross margin suffered a slight dip and operating expenses increased by 2%, so that was enough to drive a 4% decline in trading profit.

The positive impact of equity accounted earnings further down the income statement took HEPS into the green, albeit with growth of just 1%. The dividend increased by 2% to 280 cents, a modest payout ratio in the context of HEPS at 626 cents.

If you dig deeper, the Prescription segment is where things really went wrong. Turnover was down 3% and trading profit fell by a nasty 25%, showing just how much operating leverage you’ll find in that part of the business. The best performing segment was Consumer, with both turnover and trading profit up 6% – and thus no operating leverage in sight.

The circular for the Natco Pharma deal will be posted in September and if all goes well, Adcock Ingram expects to delist by November this year. In case you’re wondering why Natco pulled the trigger on this uninspiring set of numbers, it’s worth highlighting that HEPS in the second half of the year was a whopping 36% higher than in the first half, driven by a 7% increase in turnover and 30% jump in trading profit.

The full-year numbers may have been weak, but the momentum is strong.

Gold Fields is a gold mine in every sense of the words (JSE: GFI)

Production increased at exactly the right time

The gold price has been very kind to the gold sector in recent times, boosted by global monetary policy that is seen by the market as highly inflationary. That’s happy news for gold bugs, but the mines can only take full advantage of this environment if they get the basics right: in other words, if they get the stuff out the ground efficiently.

In the six months to June, Gold Fields increased its production by 24% and they are on track to meet guidance for the year. So, they’ve kept up their side of the bargain with investors. The swing in free cash flow is quite something to behold, from an outflow of $58 million in the comparable period to an inflow of $952 million!

The dividend isn’t as volatile as free cash flow, as the latter is impacted by the exact timing of capex and the former is deliberately smoothed out. This is why the dividend is up by “only” 133% – still a fantastic outcome for investors.

Although all-in sustaining costs (AISC) fell by 4% year-on-year, Gold Fields expects to do better and they believe that they can meet full-year guidance on this key metric. They came in at $1,682/oz for the interim period vs. full-year guidance of $1,500/oz – $1,650/oz.

With net debt to EBITDA of 0.37x, the balance sheet is in exceptional shape. They just need to keep delivering on the opportunity that the gold market is presenting them.

The Port and Terminals segment boosted Grindrod’s interim earnings (JSE: GND)

Can they unlock better numbers in Logistics going forwards?

Grindrod has released interim earnings for the six months to June. The period got off to a dicey start, with weak volumes at the terminals in the first quarter. There was substantial improvement in the second quarter, which did enough to move the overall performance into the green.

You need to be quite careful in interpreting Grindrod’s numbers. There were major corporate actions in this period, like the acquisition of the remaining 35% in the Matola terminal in May and the exit of the KZN property and Marine Fuels businesses. This is why Grindrod reports headline earnings from core operations, which came in flat year-on-year.

Once you include the non-core stuff, you get to a 23% increase in HEPS. I would focus on the core earnings instead, as further evidenced by the interim dividend being flat year-on-year (and therefore in line with core HEPS).

Shareholders are at least being rewarded for the disposals though, with Grindrod declaring a special dividend of 32.3 cents per share. For context, that’s bigger than the interim dividend at 23 cents per share!

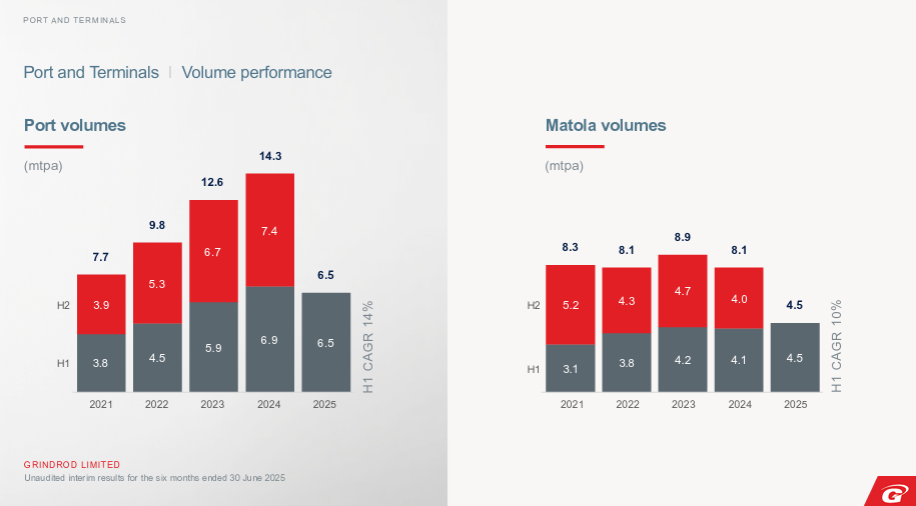

If we look deeper into the numbers, we find that port volumes had their first wobbly in recent years, with the pressure coming from the ports other than Matola:

Despite the drop in volumes and the 5% decrease in revenue in Port and Terminals, EBITDA jumped by 13% as EBITDA margin improved from 33% to 40%. Although normalisation adjustments blunt that move to an improvement from 33% to 36%, the point is that the business was more profitable and grew its headline earnings by 12.6%. Return on equity fell from 26% to 18% though, so keep an eye on that.

Logistics, on the other hand, suffered an 11% drop in revenue and a 19% decrease in EBITDA. Normalised EBITDA margin dipped from 27% to 26%. Headline earnings fell by over 21% and return on equity suffered a substantial drop from 21% to 9%.

Grindrod has some major projects to bed down, with the Matola terminal acquisition as the obvious area of focus. On the Logistics side, they are working to improve the rail business that experienced low utilisation of rolling stock, accompanied by a decrease in margins in road transportation where competition is heavy.

CEO Xolani Mbambo’s time with the group is drawing to a close, with the interesting choice to move across to Kumba Iron Ore (JSE: KIO) as CFO. Although that may sound like a step backwards, Kumba’s market cap is around 9x higher than Grindrod, so the size of the prize is much larger. Grindrod is still searching for a successor for Mbambo, with his time at the company due to end in December 2025.

Hulamin’s latest numbers are awful (JSE: HLM)

The share price has lost nearly a third of its value this year

Hulamin is having a tough time out there. The benefit of higher sales volumes in the first half of the year was more than offset by the impact of pricing pressure in the local market, a stronger rand (which hurts our exporters) and higher energy costs.

The company is making significant changes, like the wind-down of the Containers division and the plans to sell the Extrusions business, with negotiations currently in progress for that disposal. The silver lining at the moment is the successful commissioning of the wide canbody expansion project, although the returns from that project will ultimately depend on market forces.

For the six months to June 2025, HEPS is down by between 78% and 82% – a nasty outcome indeed. If you accept Hulamin’s view of normalised HEPS, which adjusts for the metal price lag (which can swing wildly year-on-year), then the expected drop is between 42% and 54%.

In other words, whichever way you cut it, it’s been a really rough period. This explains why Hulamin’s share price is down 31% this year and 34% over 12 months. If anything, I’m surprised that the drop isn’t worse.

MTN Zakhele Futhi has fully exited its MTN position (JSE: MTNZF)

The residual net asset value per share is estimated to be R4.00

MTN Zakhele Futhi has been quite the story over the past 12 months. A year ago, the directors were staring down the barrel of a scheme that was set to mature with close to zero value in it, thanks to the immense pressure on the MTN (JSE: MTN) share price. But since then, the MTN share price has been on a trip to the moon, driven by vastly improved circumstances in Africa.

Thankfully, MTN stepped in last year and restructured things at MTN Zakhele Futhi in such a way that the scheme could continue for long enough to realise decent value. I’m not sure that anyone expected things to happen quite so quickly thereafter, as it only took a few months before the winding up began!

Thanks to the latest disposal of shares that raised R391 million after costs, MTN Zakhele Futhi is officially out of MTN. They are now just sitting on cash and they will need to go through the process of winding up the scheme. The estimated residual value per share is R4.00 and the current share price is R3.10, with the gap representing the time value of money (to some extent) and the lack of liquidity available to close the gap (the real reason, I think).

This comes after the payment of a R20 per share special distribution that was funded by the sale of most of the shares in early June via an accelerated bookbuild offering in the market at R128 per share. The current MTN share price is R156, showing just how much momentum the MTN share price has enjoyed this year – and how much was left on the table!

Yes, MTN Zakhele Futhi shareholders would’ve been better off if the directors had been more patient, but hindsight is always perfect. If you go back 12 months, I doubt anyone would’ve believed that they would eventually get roughly R24 per share out of MTN Zakhele Futhi, particularly as it was trading at around R9 per share at that stage!

Nibbles:

- Director dealings:

- RMB Holdings (JSE: RMH) released more details on the change of directors in Atterbury Property, which saw RMB Holdings CEO Brian Roberts removed from the board of the operating company in that group. The backstory to this is that RMB Holdings is trying to realise value from that asset, a strategy which is at odds with the wishes of the controlling shareholders in Atterbury. This seems to be the reason why Roberts was removed. This entire situation is a cautionary tale about the danger of having a lot of money tied up in non-controlling stakes – it’s all fun and games while everyone agrees, but there’s no guarantee of that being the case forever. If you would like to the read the rather interesting transcript of Roberts’ presentation to Atterbury Property shareholders, you’ll find it here.

- There’s an unexpected change to the board at RH Bophelo (JSE: RHB), with Bojane Segooa stepping down as director and chairperson of the audit and risk committee. The reason I know this was a surprise is that the announcement was made on the day of the AGM and the resolutions dealing with her reappointment were therefore withdrawn.

Note: Ghost Bites is my journal of each day’s news on SENS. It reflects my own opinions and analysis and should only be one part of your research process. Nothing you read here is financial advice. E&OE. Disclaimer.