Choppies puts some concerns around Botswana to rest (JSE: CHP)

HEPS has moved in the right direction

Choppies released a trading statement for the year ended June 2025. Full results are due for release next Monday, so they’ve given investors only a few days of warning here. At least the results are in a different week to the trading statement, so there’s time for investors to digest it before the full results come out. It would still be good to see more daylight between the trading statement and the release of results.

The numbers are full of distortions related to the sale of the Zimbabwe business, forex impacts and other once-offs. There’s even a significant change to the effective tax rate due to losses in Namibia for which they haven’t raised deferred tax.

This is why profit after tax from total operations will drop by between 25% and 35%, while HEPS from total operations will increase by between 15% and 24%!

It’s encouraging that adjusted EBITDA from continuing operations was up by between 6% and 16%, as that’s about the closest we can get to a view on the core operations right now. Given all the concerns around the economy in Botswana at the moment, it’s good to see this. It will be important to wait for the full details before reaching any strong conclusions though.

At long last, Metrofile shareholders receive an offer (JSE: MFL)

And the market liked the price

Metrofile has been trading under cautionary for several months now. That doesn’t tell the whole story, as the market has been hearing about potential offers and take-privates for years now.

Finally, there’s an actual offer on the table from Mango Holding Corp (a Delaware company held by WndrCo LLC, James Simmons and his family) at R3.25 per share. We are talking about a stock with a 52-week low of R1.17 around February this year! To make it happen, the offeror has had to furnish a bank guarantee of almost R1.4 billion to show that they can afford the deal.

The deal takes the form of a scheme of arrangement, which means the acquirer wants to get their hands on all the shares in Metrofile. This also explains the premium of 99% to the 30-day VWAP to 25 March (the date before the first cautionary) and the premium of 25% to the 30-day VWAP to 16 September.

Unsurprisingly, this premium is enough to get strong support from a number of major shareholders who have given irrevocable undertakings to say yes to the Mango Holding dress. Holders of 52.81% of shares will support the offer, including MIC Investment (39.2%) and another name you’ll recognise: Sabvest (JSE: SBP) with a stake of 4.97%. The scheme will need 75% approval to be binding on all shareholders.

The circular will be distributed to shareholders in due course, including the independent expert opinion and the recommendation by the independent board. I think the extent of irrevocable undertakings already obtained tells you that the price is good.

Immense growth at Momentum (JSE: MTM)

The company has had a spectacular year

Momentum’s share price is up 19% in the past 12 months. Strong as that is, it doesn’t seem to tell the full story of a company that grew HEPS by 50% and the dividend per share by 40%.

But here’s the metric that it probably does reflect: diluted embedded value per share grew by 15%. I suspect that this anchored the share price performance in the same way that net asset value per share does it for banks.

It’s not surprising at all to see that one of the contributors to the positive result was a better underwriting result at Momentum Insure. This is in line with the narrative we’ve seen across the short-term insurance sector, although Momentum Insure’s normalised headline earnings more than doubled and thus put in a particularly great performance.

The largest segment is Momentum Corporate, which achieved 37% growth in normalised headline earnings. Momentum Retail is the second largest and posted growth of 22%. When your two largest segments are growing like that, it’s hard for the group results to go wrong. Notably, operating losses in India decreased significantly.

Interestingly, the present value of new business premiums (PVNBP) dipped 3% and the value of new business fell 20%. Momentum explains this as being partially due to a focus on quality rather than overall volumes, but they also acknowledge that the value of new business needs to be addressed.

In a group this size, there’s always something to work towards improving. But with return on equity up to 21.2% from 15.5% in the prior year, shareholders aren’t complaining.

Mustek’s earnings will be slightly up (JSE: MST)

Here’s another trading statement released too close to results

In case you haven’t noticed, I’m now making a point of highlighting companies that release trading statements at the last minute before releasing full results. Trading statements should be an early warning system for shareholders and the market at large, not merely a tick-box exercise just before the numbers come out.

Mustek is the latest culprit, releasing a trading statement for the year ended June 2025 on Wednesday, with full financials due to be released just two days later. That’s not good enough.

HEPS will move by between 0% and 10%, so that implies mid-single digit growth at the midpoint. A trading statement is triggered by a move of at least 20%, but not just in HEPS – the test is also applied to Earnings Per Share (EPS) which doesn’t make adjustments for large once-offs in the same way that HEPS does. This is why EPS is expected to be between 85% and 95% higher.

HEPS is the right measure of performance, so it was a period of modest growth for Mustek. But more importantly, it’s time that listed companies stopped treating trading statements as a joke. I find it hard to believe that clarity on such a huge increase in EPS (vs. the test of 20%) was achieved in the same week that a fully baked set of results will be presented to the market.

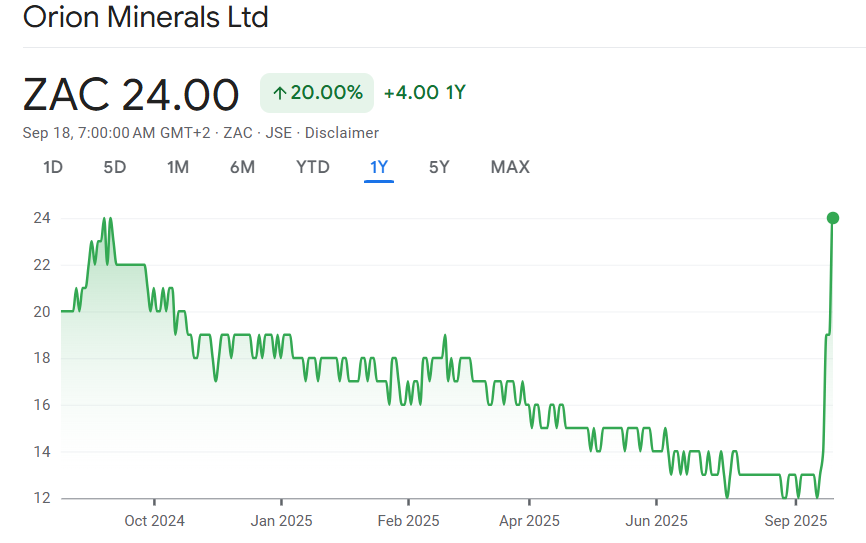

Orion Minerals’ share price shoots for the stars (JSE: ORN)

Nothing like a 26% jump in a single day!

Orion Minerals announced the news of a non-binding term sheet for a financing deal with a subsidiary of Glencore (JSE: GLN) and the market showed its appreciation, with a 26% increase in the share price. Worryingly, the share price is up 85% over 5 days. I get the argument around momentum traders and how they can amplify a move as they chase unusual volumes, but this is one of those classic cases where I hope the JSE will examine the trades before this announcement to make sure that there wasn’t any nonsense of someone trading based on a whisper they heard at a golf course. Sigh.

Back to the deal: provided that all goes well in the deal conditions, Orion has locked in financing of between $200 million and $250 million for the Prieska Copper Zinc Mine. They’ve also secured concentrate offtake as part of the deal.

The funding comes in two tranches. Tranche A is worth $40 million and will be used for the “Uppers” at Prieska. The remaining funding comes in Tranche B and will be used for the “Deeps” – descriptions that do what they say on the tin. As for the offtake, Glencore will take 100% of the bulk concentrates from the Uppers for 5 years, along with 100% of the copper concentrates and 100% of the zinc concentrates from the Deeps for 10 years.

Glencore still needs to complete a due diligence, so the funding isn’t guaranteed yet. These funding facilities will bear interest at “market rates” and will become cheaper once commercial production is declared. Glencore has some of the sharpest minds in the sector, so I have no doubt that they pushed Orion hard on the funding cost. The new management at Orion have done well here though, as the company desperately needed to show the market some meaningful progress in obtaining funding.

They hope to reach binding agreements over the next four to six weeks.

As share price charts go, you can add this to the “might inspire contemporary art” bucket:

Supermarket Income REIT managed only the slightest growth in the dividend (JSE: SRI)

The UK market isn’t a land of milk and honey right now

Most of what I read about the UK economy at the moment isn’t particularly encouraging. I’ve also heard reports from the ground on how difficult it is to grow businesses there. If I look at the results for Supermarket Income REIT, it once again looks like achieving meaningful growth in the UK market is difficult.

Net rental income may have been up 6% for the 12 months to June 2025, but EPRA earnings per share dipped by 2% and the dividend per share is up just 1%. The portfolio valuation increased by 1.9% on a like-for-like basis and the net asset value (NAV) per share was down 1% on an IFRS basis. The highlight is the improvement to the loan-to-value ratio, which decreased from 37% to 31%.

The company talks about the effect of cash drag on the earnings, as they recycled quite a bit of capital in this period. This, along with the effect of other initiatives (like the internalisation of the management company), creates the potential for more growth going forwards.

But here’s the problem: the FY26 target dividend is at least 6.18 pence per share. I’m afraid that’s only 1% higher than the FY25 dividend, which isn’t encouraging when the company is talking about how they are poised for growth.

Nibbles:

- Director dealings:

- The CEO of Argent Industrial (JSE: ART) sold shares worth R764k.

- An associate of a director of a subsidiary of eMedia Holdings (JSE: EMH | JSE: EMN) bought N ordinary shares worth R47k.

- Castleview Property Fund (JSE: CVW) has further increased its stake in SA Corporate Real Estate (JSE: SAC). They now hold 21.1% of the shares in issue thanks to selling derivatives worth R95 million and then buying shares worth R351 million (a significant net investment).

- Omnia (JSE: OMN) is presenting at the RMB Morgan Stanley Off Piste Conference this week. They’ve taken the opportunity to make their presentation available, giving a handy overview of the company and the outlook. They are aiming for a compound annual growth rate (CAGR) in earnings of 12% to 17% over the next 3 years. That’s a brave target!

- Frontier Transport Holdings (JSE: FTH) announced that Ulandy Gribble will be the new CFO with effect from 1st October. This is an internal promotion, which is always good to see.

Note: Ghost Bites is my journal of each day’s news on SENS. It reflects my own opinions and analysis and should only be one part of your research process. Nothing you read here is financial advice. E&OE. Disclaimer.